Author: Momir

Translation: Shan Oppa, Golden Finance

Bitcoin

Looking Back at the 2025 Outlook

A year ago, I outlined two divergent paths for Bitcoin: under the "survival perspective," institutional adoption and government interest would drive its development; under the "decline perspective," failure to achieve these milestones would trigger bearish sentiment and potential crises.

As we enter 2026, the reality lies somewhere between these two extremes, but is closer to the pessimistic end.

Bitcoin Cools Down: The Actual Trend of 2025

Government Actions (Mixed Results): The U.S. government's stance has been more passive than expected. While overall support for the crypto industry exists, it has clearly stated that it will not use taxpayer funds to purchase Bitcoin, relying instead on confiscated BTC to build reserves. Trump's re-election brought friendly crypto rhetoric and regulatory optimism, but actual government purchases remain wishful thinking — the promise of "innovative ways to expand reserves" has yet to translate into concrete actions.

Central Banks and Sovereign Wealth Funds (Mixed Results): Major central banks of the top 20 economies have generally taken a wait-and-see approach, with few exceptions; sovereign wealth funds have begun to allocate Bitcoin, but the scale of purchases is difficult to assess.

Corporate Adoption (Mixed Results): MicroStrategy has aggressively increased its holdings for most of 2025, at one point becoming a positive price factor. However, the narrative has completely shifted: MicroStrategy has publicly stated that it would consider selling BTC under certain circumstances, transitioning from pure accumulation to a role akin to "BTC credit instruments." Once a driving force, it is now gradually becoming a potential selling pressure and burden. In contrast, Bitcoin ETFs have performed excellently, with continued inflows in 2025, indicating strong demand from traditional financial institutions and retail investors for compliant Bitcoin exposure, making it one of the most reliable sources of demand for the year.

Bitcoin 2026 Outlook: Dependent on Macro, Lacking Catalysts

Unique Catalysts Exhausted: This cycle has been driven by a series of strong Bitcoin-specific catalysts — the bankruptcy of Silicon Valley Bank and the USDC de-pegging crisis, the 2023 ETF hype, MicroStrategy's continued buying, the early 2024 spot ETF listing, and Trump's victory, each bringing clear directional buying for Bitcoin.

Looking ahead to 2026, there are few positive catalysts specific to Bitcoin: the government has made its position clear and will not become a major buyer in the short term; central banks are unlikely to quickly change their risk assessments of BTC; MicroStrategy has exhausted its capacity for large-scale accumulation and has shifted to potential selling rhetoric; while ETFs have succeeded, the initial wave of adoption has passed.

For Bitcoin to strengthen in 2026, it will almost entirely depend on macro factors, with clear priorities:

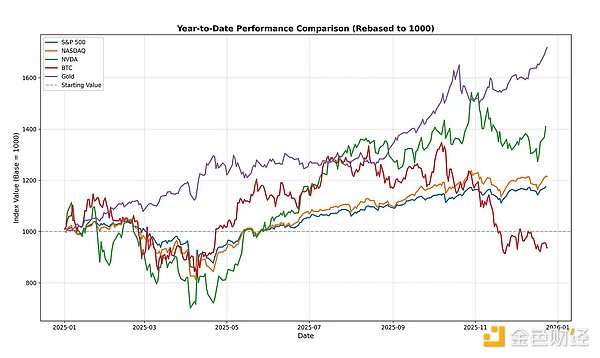

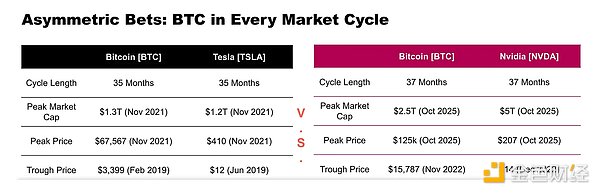

1. AI Stocks and Risk Appetite: Bitcoin increasingly follows the hot assets of each cycle. In the last cycle, it synchronized with the bottom and top timelines of Tesla; this time, it exhibits the same pattern with NVIDIA — its performance is deeply correlated with high-beta tech stocks and AI enthusiasm.

2. Federal Reserve Policy and Liquidity: Whether the Federal Reserve continues its accommodative policy and expands its balance sheet remains key to the overall liquidity environment. Historically, liquidity has been one of the most important factors influencing Bitcoin's price movements. In 2025, the Fed has cut rates three times, and the direction of monetary policy in 2026 will significantly impact whether Bitcoin can attract sustained buying.

Emerging Risks in 2026

While positive exclusive catalysts are scarce, the risks of negative catalysts specific to Bitcoin are more pronounced:

MicroStrategy (also known as Strategy) selling pressure, which once drove Bitcoin's rise, may become a burden in 2026. MicroStrategy's shift from "always holding" to "considering selling under certain circumstances" represents a fundamental change — its defined "specific circumstances" involve selling BTC to repay creditors when the market value net asset value (mNAV) falls below 1. Notably, Strategy's model is beginning to resemble a Ponzi scheme, but the risks are unlikely to materialize in the short term: it has accumulated cash reserves through the high liquidity of its stock, sufficient to cover dividend-related debts for the next three years.

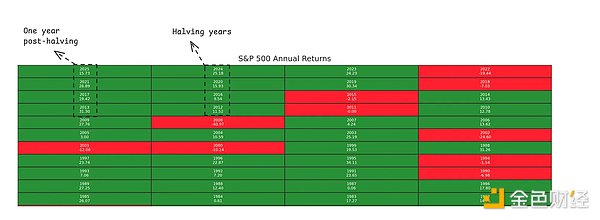

The Paradox of the Four-Year Cycle Theory

According to cycle theory, we may be in a Bitcoin bear market. This theory posits that the Bitcoin market operates on a four-year cycle, with peaks typically occurring in the fourth quarter — the fourth quarter of 2025 should have been the price peak, and Bitcoin did indeed reach $125,000 at that time, which may mark the cycle's top. However, the validity of this theory is increasingly questioned: we believe that cycle theory is more coincidental, overlapping with macro cycles, rather than an inherent law of Bitcoin. Bitcoin's performance in the fourth quarter of 2025 was weak, primarily due to concerns over the AI bubble and risk aversion, with the main reason being long-term holders rebalancing their positions based on cycle theory, leading to continued selling.

Self-Fulfilling Prophecy Risk: Cycle theory has created a dangerous feedback loop

- Long-term holders expect a peak in the fourth quarter and sell

- Selling pressure suppresses prices during what should be the strongest period

- Weak performance "confirms" cycle theory

- More holders adopt this framework, amplifying future selling pressure.

Breaking the Cycle: If the macro environment remains robust, Bitcoin may ultimately break through the cycle constraints and move upward. The first break of the cycle could become an unpriced positive catalyst for the market.

Technical Risks Entering Discussion

Bitcoin faces two long-term challenges: quantum computing vulnerabilities and questions about its economic and security models. The latter has not yet entered mainstream discussion, but quantum risks are gradually gaining public attention — more credible voices are raising concerns about Bitcoin's quantum resistance, which could undermine its narrative of "secure, immutable value storage." However, the BTC community is eager to discuss this early to allow time to find solutions.

Conclusion for Bitcoin in 2026

As Bitcoin enters 2026, it does so not through the unique advantages of crypto-specific narratives, but as an asset sensitive to macro factors, with performance primarily following the overall risk market:

- Catalysts Exhausted: Exclusive positive catalysts are largely depleted or have been realized (government stance clarified, MicroStrategy's capacity peaked, initial ETF adoption wave ended)

- Emerging Selling Pressure: Concerns related to MicroStrategy, cycle theory, and quantum risks entering public discussion may lead to repricing in the mainstream community — but these risks are unlikely to materialize in the next 12 months: Strategy's cash reserves are sufficient to cover three years of debt; if the macro cycle continues, cycle theory will eventually be disproven; the probability of quantum risks affecting mainstream perception is also low.

- Dependent on Macro: Performance will follow AI stocks (especially NVIDIA) and Federal Reserve policy.

Ethereum

Looking Back at the 2025 Outlook

Survival Perspective (Partially Realized):

Looking back at the 2025 outlook, some of Ethereum's potential advantages have begun to manifest, but have not yet fully materialized:

Institutional Viability (Significant Success): This argument has proven correct. The dominance of Ethereum stablecoins (with new issuance reaching $45-50 billion since the implementation of the GENIUS Act) indicates that institutions choosing blockchain infrastructure consistently view Ethereum as the most trusted asset ledger. This is also reflected in the institutional buyer market, where ETH DAT has successfully raised substantial funds from key participants like Bitmine.

Developer Ecosystem and Diverse Leadership Team (Significant Success): Predictions that platforms like Base, Arbitrum, and other L2s would drive Ethereum's adoption have come true. Base, in particular, has become a significant growth driver in the cryptocurrency consumption space, while Arbitrum has made outstanding institutional contributions by integrating Robinhood into the broader Ethereum ecosystem.

ETH as the Sole Alternative to BTC (Timing Misjudgment): The two core long-term unique risks facing BTC — quantum vulnerabilities and security economics — are precisely areas where ETH has advantages and greater future adaptability. ETH remains the only value storage asset that can serve as an alternative to BTC. However, until these concerns are more fully validated in mainstream BTC discussions, the price dynamics of ETH/BTC are unlikely to benefit from this positioning.

Resilience Against Single Entity Risks (Significant Success): With MicroStrategy shifting from an accumulation strategy to one that may burden Bitcoin, the lack of a similar strategy has become a significant advantage. While most DATs may have shorter lifespans, those holding substantial ETH have a more robust ownership structure compared to Strategy, with fewer additional conditions.

Decline Perspective — Essentially Avoided:

The negative scenarios for Ethereum that I previously outlined have not occurred as severely as feared:

Lack of Leadership (Resolved): For a long time, Ethereum lacked sufficiently strong figures to defend its position in the broader cryptocurrency space. Vitalik's attention was spread across many areas, and he was not the type of opportunistic CEO focused on price performance. Until recently, Ethereum had not seen advocates like Michael Saylor, which was one of the main reasons Ethereum's price briefly fell below $1,500 earlier this year. Subsequently, Tom Lee largely filled this gap, becoming a major evangelist and advocate for Ethereum. He meets the necessary criteria: possessing excellent sales skills, a reputable standing in finance, and alignment with Ethereum's price appreciation goals.

Cultural Challenges ("Awakening" vs "Reality-Based") (Improving): Last year, I wrote: "Compared to other ecosystems, Ethereum's culture is often seen as more 'woke,' emphasizing inclusivity, political correctness, and community-driven moral discussions. While these values can foster collaboration and diversity, they can also lead to challenges such as poor communication, moral censorship, and hesitation in taking bold, decisive actions." Fortunately, the Ethereum Foundation has welcomed new leadership that is more performance-oriented and capable of strengthening organizational management to make it more efficient and impactful. Subjectively, I also feel that the atmosphere of the entire community is shifting to better adapt to the current environment.

Ethereum 2026 Outlook: Exclusive Drivers Favor ETH/BTC

Ethereum shares macro risk characteristics with Bitcoin — sensitivity to AI stocks, fiscal policy, and Federal Reserve liquidity. However, in terms of exclusive factors, Ethereum's positioning for 2026 is clearly superior to Bitcoin.

Advantages of Ethereum relative to Bitcoin:

No Major Selling Pressure: Ethereum does not face the structural risks that affect Bitcoin, most importantly, it lacks leveraged entities like MicroStrategy — whose potential sell-off could shake the market. DATs holding large amounts of ETH also have lower leverage than Strategy.

ETH as the Sole Alternative to BTC: Last year we misjudged the timing, but if BTC's exclusive risks (quantum vulnerabilities, economic/security risks) become the focus of discussion, it will be a positive for the ETH/BTC ratio.

Unique Catalysts: The Dominance of Stablecoins and Decentralized Finance (DeFi) Theory

Perhaps most importantly, Ethereum has some unique positive catalysts that are just beginning to emerge. After years of being considered "one of the least favored assets" in the cryptocurrency space — and suffering severe pressure and volatility from 2023 to 2025 — Ethereum's recovery is gradually getting back on track.

Undisputed Stablecoin Leadership: Data clearly shows that Ethereum dominates the stablecoin market. This is reflected in several aspects:

Asset Balances: Ethereum accounts for nearly 60% of the total market cap of stablecoins, demonstrating significant network effects and market preference.

Capital Flow Dynamics: Since the announcement of the GENIUS Act, Ethereum has absorbed $45-50 billion in new stablecoin issuance. This indicates that when new stablecoin demand arises, capital disproportionately flows to Ethereum.

Ten-Year Reliability Validation: Over the past decade, Ethereum has not experienced any major performance issues or outages. This outstanding operational record is irreplaceable and crucial to its status as a cornerstone of global liquidity infrastructure. When traditional finance considers blockchain integration, Ethereum's history of reliably managing billions of dollars in assets provides it with unparalleled credibility.

DeFi as Ethereum's Moat: Ethereum's DeFi ecosystem may be its most significant competitive advantage. Ethereum is the only blockchain capable of efficiently utilizing billions of dollars through proven smart contracts:

Security Tested by Time: Smart contracts like Aave, Morpho, and Uniswap have locked in billions of dollars in total value and have operated stably for years without major security breaches. Although these contracts are like huge "honeypots" for hackers, they have proven to be resilient.

Deep Liquidity, Composability, and Capital Efficiency: The ability to combine different DeFi protocols creates network effects that are difficult for competing chains to replicate. By combining existing foundational components, complex financial products can be built — this capability requires both technical infrastructure and deep liquidity. The composability of Ethena, Aave, and Pendle is a prime example. This makes the Ethereum mainnet the only one capable of supporting capital-intensive application scenarios.

Regulatory Clarity: Positive regulatory policies surrounding the cryptocurrency industry should facilitate further integration of traditional finance and cryptocurrency. Macro timing, regulatory clarity, and institutional adoption convergence make Ethereum the primary beneficiary of traditional finance's entry into the cryptocurrency space. With a strong blockchain development record and mature DeFi infrastructure (capable of securely managing billions of dollars in funds), Ethereum offers institutions security, liquidity, and regulatory transparency that other blockchains cannot match.

After years of poor performance and market skepticism, Ethereum may be on the verge of a sentiment reversal. Once the fundamentals begin to improve significantly, the market often rewards assets that were once considered "on the brink." Ethereum's infrastructure improvements, stablecoin dominance, and efforts to facilitate institutional adoption could drive its valuation reassessment in 2026.

2026 Ethereum Risks: The Battle for Asset Perception

Despite Ethereum's strong fundamental positioning for 2026, there are still risks that could weaken its performance — most notably, the ongoing debate about ETH as an asset.

Asset Classification Dispute

Core Controversy: Bitcoin has been relatively clearly consensus as "digital gold" as a monetary asset, while Ethereum is still in the exploratory phase of market perception. This ambiguity makes it vulnerable to attacks from skeptics and interest groups.

Two Competing Narratives:

Monetary Asset Perspective (Bullish): Supporters in the Ethereum community, including notable figures like Tom Lee, have been promoting the "digital oil" metaphor, positioning ETH as a practical, productive monetary asset. This characterization has gained widespread acceptance, supporting Ethereum's valuation and allowing it to enjoy a monetary premium similar to Bitcoin.

Cash Flow Asset View (Bearish): A significant portion of the market — including Bitcoin advocates and traditional finance skeptics — attempts to fundamentally distinguish Ethereum from Bitcoin. They argue that Ethereum's valuation should be similar to:

BlackRock: Valuation should only represent a small portion of managed assets.

Nasdaq or Exchange Operators: Using cash flow discount (DCF) models based on fee generation rather than monetary premiums.

Cognitive Manipulation: Ethereum is particularly susceptible to narrative attacks because its value proposition is much more complex than Bitcoin's simple "digital gold" story. We have seen from past cycles that skeptics can exert disproportionate influence, negatively impacting the perception of Ethereum as an asset.

Why Ethereum is More Vulnerable to Attack:

Newer Asset: Compared to Bitcoin's over 15-year history, market consensus has not yet fully established.

More Complex Situation: Programmability, decentralized finance (DeFi), stablecoins, Layer 2 — these concepts are harder to distill into simple narratives.

Decentralized Leadership: Multiple voices and intertwined interests make it easier for opponents to spread confusion.

L2 Dispute

With the flourishing of Ethereum's Layer 2 ecosystem (Base, Arbitrum, etc.), questions about value accumulation have also arisen:

Does the L2 layer enhance or weaken Ethereum's value? If most transactions and fees remain on the L2 layer, can Ethereum on the mainnet reflect its value?

Liquidity Fragmentation: Multiple L2 layers may weaken rather than enhance Ethereum's network effects.

Earlier this year, I wrote an article on this topic:

L2 fragmentation can be addressed through two main avenues:

Market dynamics (natural selection) may naturally consolidate the ecosystem, leaving 2-3 dominant general-purpose L2 providers that maintain significant activity, while others either gradually disappear or shift to a stack approach — serving as aggregators for specific use cases.

Establishing strong interoperability standards can reduce friction across the entire integrated ecosystem, thereby lowering the likelihood of any single integration establishing dominance.

Ethereum should actively promote the latter scenario, enforcing interoperability standards while it still has control over the L2 layer. However, this control is increasingly diminishing; the longer Ethereum delays, the less effective this strategy will be. By building a unified L2 ecosystem, Ethereum can regain the composability advantage that once sustained its mainnet, enhancing user experience and strengthening its competitive edge against monolithic blockchains.

Current Assessment: Despite ongoing debates about L2 layer fragmentation, the Ethereum mainnet has successfully maintained its dominance in large capital deployment. Currently, no single L2 layer has enough influence over the mainnet to threaten its value growth. However, if L2 layers continue to develop without sufficient interoperability standards, this risk remains a concern and could intensify.

2026 Ethereum Conclusion

As Ethereum enters 2026, although it shares macro sensitivity with Bitcoin, its exclusive positioning is stronger:

Stablecoin Dominance: Accounting for 60% of the total market cap of stablecoins, with $45-50 billion in new issuance post-GENIUS Act, demonstrating clear institutional preference, likely to benefit the most from further growth in stablecoin market cap.

DeFi Moat: The only blockchain capable of efficiently operating billions of dollars through proven protocols (Aave, Morpho, Uniswap), with a verified safety record over the years.

Institutional Positioning: With regulatory clarity, operational record, and deep liquidity, it is the best choice for traditional financial capital to access crypto.

No Selling Pressure: No entities like MicroStrategy causing potential sell-offs; stronger resilience against single entity risks.

Sentiment Reversal Potential: After years of being the "most criticized asset," significant improvements in fundamentals create conditions for repricing.

Core Risks: Ongoing asset classification debates and attempts at cognitive manipulation remain major threats to valuation.

L2 Monitoring: Fragmentation concerns exist, but the mainnet retains its dominance in large capital — large capital primarily focuses on security; Ethereum's gas costs are disproportionately low compared to transaction sizes, making it very cost-effective for large holders; the DeFi moat is difficult to shake.

Solana

Looking Back at the 2025 Outlook

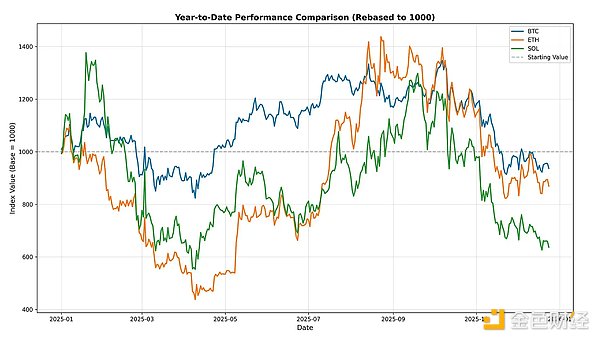

Reflecting on the potential paths outlined for Solana in 2025, the reality is a mix of both scenarios, but leans more towards the negative.

"From Hunter to Prey" (Fully Realized): This trend has fully manifested. The rise of Hyperliquid has dealt a particularly severe blow to the Solana narrative — a chain that spent years claiming to be the most scalable and best suited for Central Limit Order Book (CLOB) exchanges is now completely surpassed in this use case.

Overexposure to MEME Culture (Fully Accurate): This concern has been fully validated. The transience of growth driven by the MEME economy is now evident — in hindsight, the over 98% user attrition rate from MEME casinos was inevitable. Solana's core argument was "buying digital Macau," but many overlooked that the odds of this digital Macau presented a 98% loss probability for users. This could leave a lasting brand stain on Solana, especially as institutions seek more capital-oriented sustainable directions.

DePIN Leadership (Unproven): This argument has not materialized. Although Solana continues to cultivate the DePIN space, it has not translated into the anticipated breakthrough adoption or narrative dominance.

Developer Leadership in Frontier Fields (Mixed): Solana has shown agility, continuously attracting developers (especially in the consumer startup space). However, advancements in wallet and cross-chain infrastructure have made the choice of underlying chains increasingly irrelevant for most consumer applications — users utilizing recent deposit solutions like Privy and Fun.xyz can feel this trend.

Solana 2026 Outlook: Seeking a Sustainable Narrative

Solana shares macro sensitivity with Bitcoin and Ethereum but faces a more complex set of exclusive risks — the outlook for 2026 is more bearish than bullish.

Aftermath of MEME Coins

Solana has experienced one of the most explosive MEME coin cycles in crypto history. While it brought a surge of attention and activity in the short term, it also created several issues:

Unsustainable Dynamics and Brand Risks: The MEME coin frenzy on Solana has exhibited disturbing characteristics:

Extreme User Attrition: A loss rate exceeding 98% — almost all participants lost money, while platforms like Pump.fun, insiders controlling Solana's block space, and many questionable teams behind various projects profited from the trades.

Legal Challenges: Recent lawsuits target Pump.fun and Solana itself, accusing them of facilitating unfair gambling activities.

Brand Risks: Short-term success (high trading volumes, wallet creations, attention) could become a brand liability — the "crypto casino" narrative may hinder institutional adoption and regulatory goodwill. As the MEME coin cycle exhausts, Solana faces the challenge of shedding this label.

Centralization is Inevitable

Solana's integrated high-throughput architecture is designed to support globally scaled applications while minimizing latency. However, this design choice increasingly exposes centralization concerns.

The blockchain industry has gradually clarified: either build integrated centralized solutions optimized for performance or choose a more decentralized modular path. Solana has opted for the former — prioritizing scalability and speed through centralized physical infrastructure. While it has achieved impressive throughput, it fundamentally limits Solana's credibility in applications that require true decentralization and censorship resistance. If the Double Zero project succeeds, it will lead to further concentration of physical infrastructure around a handful of high-bandwidth fiber providers.

Can Solana Maintain "Integration"?

While Solana does not shy away from making trade-offs on centralization, a question remains: to what extent does it defend the premise of an "integrated chain"? At the Solana Breakpoint edge, many discussions revolve around whether Solana can support more complex smart contract logic and heavier computations, or if it is primarily designed to maximize throughput for relatively simple trading logic.

Complex Applications Require Fragmented States: Developers building complex applications on Solana are increasingly moving away from the main state:

Jupiter's Choice: Solana's flagship DeFi protocol Jupiter has decided to launch JupNet (an independent environment competing with Hyperliquid) rather than build on the Solana mainnet. This is akin to acknowledging that Solana's global state cannot adequately support certain application needs.

"Network Expansion": Projects like Neon Labs are building what they call "Solana extensions," but functionally resemble Layer 2 solutions. These solutions fragment Solana's state, allowing developers to control their own block space and execution environment — essentially acknowledging the limitations of a monolithic global state. Their argument is that theoretically, Solana can support any logic, but in practice, heavier computational tasks often require execution across multiple blocks, at which point the platform cannot control the execution order, potentially disrupting the fundamental logic of transactions. Although these "extension" solutions are marketed as expanding Solana's capabilities while maintaining a unified state, the reality is more fragmented — developers need performance-predictable isolated environments, pushing the architecture increasingly towards a modular path similar to Ethereum.

Competitive Positioning Issues

Awkward Middle Ground: Solana now finds itself in an awkward position between two dominant forces. Ethereum, with its proven infrastructure, dominates liquidity, stablecoins, and the DeFi narrative; Hyperliquid has taken the lead in the high-performance order book narrative that Solana has cultivated for years. Solana must demonstrate a competitive advantage in at least one area, or it risks being seen as neither sufficiently decentralized nor maximally scalable.

Before the emergence of Hyperliquid, Solana had a relatively unique positioning — somewhat centralized but highly scalable integrated chain, actively promoting its architecture as suitable for global order books and high-frequency trading applications. Now, this narrative has become awkward: there is no competitive order book on Solana that can match Hyperliquid's trading volume and performance.

Drift may be one of the mainstream protocols for perpetual contracts on Solana, but it still cannot compete with Hyperliquid. Therefore, despite Solana spending five years claiming to be the most scalable chain, the awkward reality is that advanced order books on the Solana blockchain are not even competitive, with activity primarily driven by MEME coins lacking sustainable dynamics.

This places Solana in a situation similar to Ethereum 18 months ago — at that time, Ethereum was caught between Bitcoin and Solana: Solana was gaining activity, while Bitcoin remained the clear value store asset. Now, Solana is caught between Ethereum (liquidity/DeFi/stablecoins) and Hyperliquid (order books/CLOB perpetual exchanges), lacking clear competitive advantages in both directions. If Solana cannot choose one and win the competition, it could severely damage its future narrative.

Path Forward: Proven Adaptability and Survival

Professional Execution: It is commendable that Solana remains one of the most professionally operated blockchain organizations in the industry. The Solana Foundation demonstrates attention to detail and rapid execution capabilities — this cannot be underestimated: Solana has repeatedly proven its ability to identify opportunities and pivot effectively.

Distance from Casinos: Recent initiatives show that Solana is trying to distance itself from the "crypto casino" narrative, seeking more sustainable fundamental use cases. This was very evident at the recent Solana Breakpoint event — the event had a more fintech atmosphere rather than a speculative focus.

Challenges: Solana must successfully expand in at least one of two directions to maintain its competitive positioning:

Capture Liquidity and DeFi: Build a robust DeFi ecosystem that can compete with Ethereum's maturity and liquidity depth. This is a tough battle, considering Ethereum's DeFi moat on the mainnet. However, Solana seems to be taking the right actions, such as attempting to list non-Solana assets on-chain like centralized exchanges, providing more options for Solana traders — I strongly support this initiative, which was also one of the governance proposals I made to Arbitrum over a year ago as a solution to accelerate its DeFi positioning.

Capture Order Book Trading: Develop competitive CLOB perpetual exchanges that can challenge Hyperliquid's dominance. Unfortunately, Solana seems to lack competitive contenders — major competitors to Hyperliquid like Lighter and Aster are outside the Solana ecosystem.

2026 Solana Conclusion

As Solana enters 2026, exclusive risks outweigh opportunities:

MEME Coin Exhaustion: The unsustainable MEME casino cycle driving recent activity is coming to an end, leaving over 98% user attrition and brand damage.

Legal and Brand Challenges: Lawsuits accusing unfair gambling activities threaten regulatory goodwill and institutional adoption prospects.

Competitive Alternatives and Awkward Positioning: Hyperliquid's dominance in CLOB/order books undermines Solana's core narrative as a scalability leader for that use case. Caught between Ethereum (liquidity/DeFi/stablecoins) and Hyperliquid (order books), it lacks clear competitive advantages in both directions.

Integration Issues: Major projects (Jupiter, Neon Labs) shifting towards fragmented state solutions indicate limitations in the global state to support complex applications.

A Ray of Hope: A professionally operated organization has proven adaptability; it can identify new narratives but must succeed in DeFi competition or order book trading to avoid irrelevance in the middle ground.

Summary: The 2026 Crypto Landscape

Macro Dependence Dominates: The three major cryptocurrencies (Bitcoin, Ethereum, Solana) share similar macro sensitivities to AI stocks, Federal Reserve policies, and fiscal spending, but their exclusive positioning differs greatly.

Bitcoin: Entering 2026 as a purely macro beta asset, its exclusive crypto catalysts have been exhausted — but the market's excessive focus on potential negative catalysts may, in itself, yield positive outcomes.

Ethereum: The best positioned among the three, with positive exclusive drivers (stablecoin dominance, DeFi moat, institutional preference), it may outperform even in a neutral macro environment as long as off-chain and on-chain finance continue to converge. The main risk remains the cognitive and consensus issues surrounding ETH's asset classification.

Solana: Facing the most challenging exclusive landscape, with the MEME cycle exhausting, brand concerns, and competitive alternatives — despite strong organizational execution capabilities, it must successfully capture the DeFi or order book market to avoid irrelevance in the middle ground.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。