While spot bitcoin refuses to pick a direction, futures and options markets have stayed busy during the holiday lull, particularly across the world’s most popular crypto derivatives exchanges. Essentially, these instruments combined now offer a clearer window into how professional traders are preparing for the year ahead.

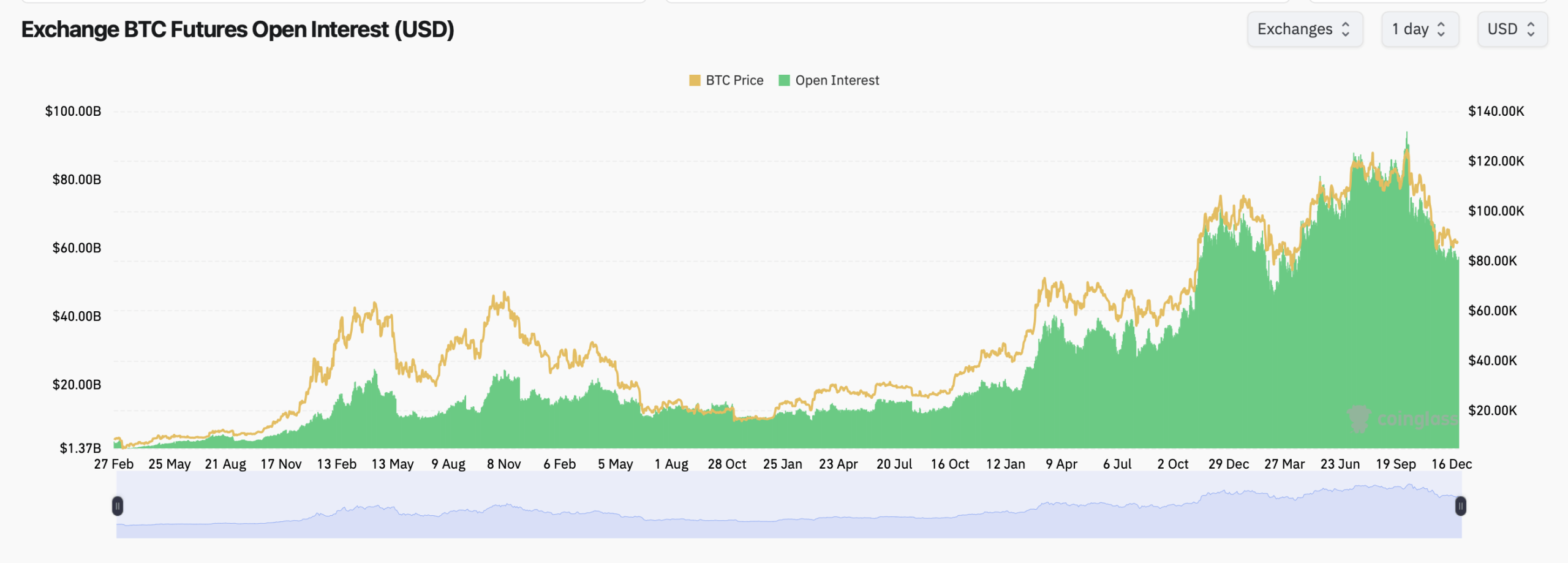

Data logged by coinglass.com shows that aggregate bitcoin futures open interest across exchanges sits at roughly $57.45 billion in active contracts. This level of exposure suggests some traders still maintain conviction rather than rushing for exits. Importantly, the growth appears measured, not frantic, reinforcing the idea that positioning is being built deliberately into year-end.

Among exchanges, CME remains a cornerstone of institutional futures activity, holding about $9.87 billion in open interest (OI), or 112,380 BTC, accounting for 17.18% of the global total. Alternative crypto venues still dominate volume, but CME’s footprint highlights continued institutional participation heading into 2026.

Other competing crypto derivatives platforms tell a complementary story. Binance leads all venues with roughly $11.05 billion in OI, followed by Bybit at $5.26 billion and OKX near $3.23 billion. Other exchanges, including Kucoin and Bitget, posted sharper percentage increases, reflecting more tactical positioning over the last week.

Notably, hourly and four-hour open interest changes across major venues remain modest, suggesting leverage is being managed rather than aggressively expanded. That restraint matters as markets transition into a new calendar year, when liquidity conditions often shift.

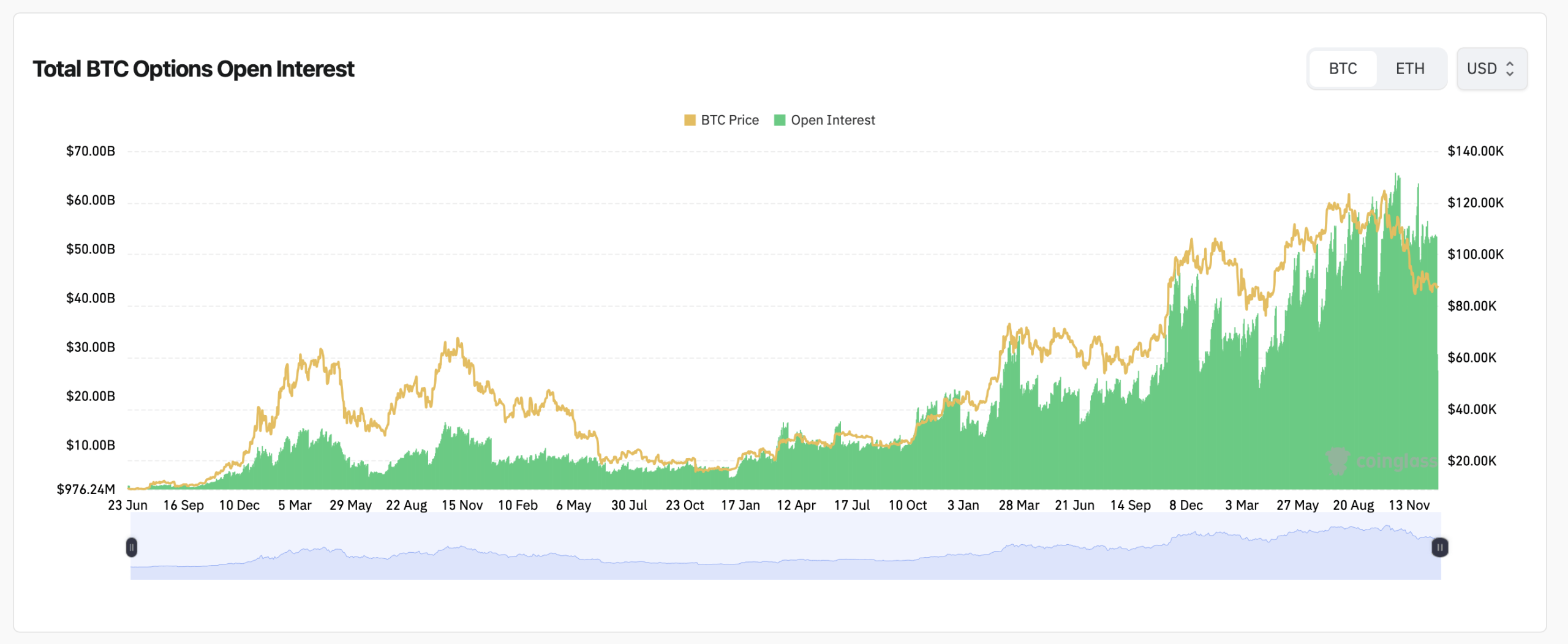

If futures show commitment, options reveal intent. Total bitcoin options open interest continues climbing, with a pronounced tilt toward calls. Current Coinglass data shows calls accounting for about 56.83% of total options OI, versus 43.17% for puts, indicating traders are leaning toward upside exposure even as spot prices stall.

That optimism carries into volume flows as well. Over the past 24 hours, call volume represented 54.15% of traded contracts, with puts trailing at 45.85%. The balance suggests hedging remains active, but directional bets still favor higher prices into early 2026. Moreover, CME’s options market adds another layer of insight.

Data stacking OI by expiration shows a heavy concentration in contracts expiring one to three months out, with notable build-ups extending into the three- to six-month window. Longer-dated exposure indicates traders are not just speculating on short-term moves but positioning for macro shifts early in 2026.

When viewed by position, CME options display a relatively even distribution between calls and puts, reinforcing the idea that participants are pairing directional bets with structured hedges rather than chasing one-sided outcomes. Max pain models offer a sobering counterweight to bullish call dominance. On Deribit, max pain levels cluster near $90,000, while Binance’s options market shows a similar gravity zone slightly below current spot prices.

These levels represent price points where the largest number of options expire worthless, often acting as the gravitational center during consolidation phases. With bitcoin trading just under those thresholds, the derivatives market is effectively daring spot prices to move decisively—or remain pinned into expiration. The long-term taker buy-sell ratio across all exchanges reinforces the broader theme: balance.

Recent readings hover near neutral, far from the extremes seen during prior bull or bear phases of years prior. At this stage of the game, buyers and sellers are meeting each other with discipline, not desperation. This equilibrium aligns with the broader derivatives picture—positioning is active, but it is not reckless.

Taken together, bitcoin futures and options data paint a market that is preparing, not panicking. Open interest remains elevated, calls outnumber puts, and expirations are stacked into the early months of 2026. Yet max pain levels and neutral taker flows remind traders that conviction still comes with caution.

Bitcoin may be consolidating in price, but derivatives markets suggest participants are laying the groundwork for the next phase rather than waiting on the sidelines.

- What is bitcoin futures open interest?

It measures the total value of outstanding futures contracts that have not been settled. - Why do bitcoin options calls exceed puts?

It suggests traders are positioning for higher prices while still managing downside risk. - What does max pain mean in bitcoin options?

It marks the price where the most options expire worthless, often influencing short-term price behavior. - Why does CME activity matter for bitcoin?

CME reflects institutional participation and regulated exposure to bitcoin derivatives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。