Written by: Frank, MSX Research Institute

2025 is a year where capital, institutions, technology, and politics are accelerating in sync and pressing against each other.

All that is past is prologue.

As we close out 2025, looking back at the past 12 months of the U.S. stock market and global financial markets, it is difficult to summarize the year with linear terms like "upward" or "correction." Instead, it resembles a series of intense, mutually pressing structural changes—technological acceleration, capital expansion, political polarization, and institutional loosening occurring simultaneously and amplifying each other within the same cycle.

I initially attempted to approach this from a timeline perspective and tried to use market fluctuations as the main axis, but soon realized that what truly shaped the market landscape of 2025 was not a few landmark highs or crashes, but a set of recurring, overlapping narrative threads. When connected, the underlying tone of 2025 becomes exceptionally clear—it is a year of high contradictions yet strong directional sense:

- On one side, high walls continue to rise: AI builds new entry barriers with extremely high capital density, tariffs and trade frictions are repeatedly intensified, political polarization deepens, and a 43-day government shutdown directly highlights the "intensification of party strife."

- On the other side, however, fences are collapsing: regulatory attitudes towards AI/Crypto show systematic loosening, financial infrastructure undergoes comprehensive upgrades, and Wall Street reshapes "trading, clearing, and asset forms" in a more open and engineered manner.

In other words, 2025 is a macro watershed: the old order is reinforcing boundaries while the new order is dismantling frictions, and the collision of these two forces constitutes the background noise of all market movements and narratives this year (see further reading: “2025 Global Capital Market Flashback: AI Infrastructure Expansion, Confirmation of Interest Rate Cut Turning Point, and Return of Geopolitical Risk Premium”).

From the results, 2025 is undoubtedly a memorable year for investment—if you successfully avoided the violent fluctuations of Crypto, you could experience a long-lost sense of profit amidst the broad rise of major assets like U.S. stocks, Hong Kong stocks, A-shares, and gold and silver. Just as at the opening of the recent Xueqiu Carnival, Fang Sanwen typically posed the classic question: "Who made money this year?" and the audience responded with a nearly simultaneous wave of raised arms.

For this reason, I ultimately abandoned the idea of narrating 2025 through a single timeline and no longer attempted to summarize the year with a few crashes and new highs—this article chooses to break it down into ten recurring, overlapping narrative threads to review the key turning points in the U.S. stock market and global financial markets in 2025, and to attempt to answer a longer-term question:

What truly changed this year?

1. Power Convergence: Silicon Valley Right, Crypto New Nobles, and New Washington

On January 20, 2025, with the official inauguration of the new U.S. government, the Silicon Valley right and crypto new nobles completed a rare convergence of power, quickly launching a "lightning war" against the traditional establishment. It can be said that this convergence directly materialized into a series of disruptive personnel arrangements, policy priorities, and shifts in regulatory attitudes.

The first to be brought to the forefront was, of course, Elon Musk, wielding the surgical knife of D.O.G.E (Department of Government Efficiency). During his brief but high-pressure intervention, he targeted the long-overlapping regulatory system, especially in the AI sector, pushing for the withdrawal or merger of AI-related regulatory functions within the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC). This move, to some extent, broke the traditional intervention paths of the bureaucratic system on technological boundaries, significantly reducing institutional friction in emerging tech fields like AI.

Following this, the crypto industry experienced an epic vindication. With Gary Gensler stepping down as Chairman of the U.S. Securities and Exchange Commission (SEC), the long-standing "enforcement-style regulation" hovering over the crypto market began to loosen. The new SEC Chairman, Paul Atkins, quickly pushed for the release of a statement on "Securities Issuance and Registration in the Crypto Asset Market," shifting the regulatory logic towards rule-making and project compliance.

Under this systematic shift, several pending cases reached a phase of resolution, including the long-term investigations and accusations against projects like Coinbase (COIN.M), Ripple, and Ondo Finance being gradually withdrawn or downgraded. Crypto officially returned from being an enforcement target to the policy discussion table.

What is even more intriguing is the deep connections between the new government's core members and tech and crypto capital: from the Trump family's TRUMP/MELANIA tokens to direct involvement in projects like WIFI (USD1), and the roles of Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, Director of National Intelligence Tulsi Gabbard, and Secretary of Health and Human Services Robert F. Kennedy Jr. It can be said that from the president and his core aides to a number of cabinet officials, a group of decision-makers deeply embracing AI, Silicon Valley's tech right, and even Crypto are systematically entering the power center.

At the same time, New Washington's attitude towards AI underwent a fundamental change, shifting from "Eliminating Barriers to U.S. AI Leadership," "U.S. AI Action Plan," to the "AI Custodianship Act," with the policy narrative switching from "risk prevention" to "ensuring (absolute lead over China)," which has allowed many vertical AI companies to thrive in the secondary market.

The most representative examples are companies like Palantir (PLTR.M) and Anduril (not yet listed), which carry strong right-wing colors and the "technology serving the country" label, becoming some of the hottest targets on New Wall Street in 2025, with their market value and valuation rapidly rising.

Objectively speaking, over the past decade, new tech fields represented by AI and Crypto have become engines of wealth growth. These emerging industries emphasize efficiency, innovation, and decentralization, with the call for "less regulation" becoming a common demand. Therefore, the current convergence of power between the Silicon Valley right and crypto new nobles is essentially a phase of revelry centered around "technological freedom, capital efficiency, and regulatory loosening," with the market even momentarily viewing deregulation and technological supremacy as the only path to prosperity.

However, the stability of this narrative itself is worth caution, as the path of liberalization and deregulation will inevitably further strengthen the advantageous positions of tech giants and capital magnates—technologies like AI and Crypto will more efficiently concentrate wealth, accelerating the widening gap between the rich and the poor, marginalizing the interests of Trump’s base, including Rust Belt workers, social conservatives, and anti-globalization middle-class individuals (see further reading: “The Clash of Old and New Money Behind the 'Trump Trade': Peter Thiel and the Power Games of Crypto”).

As the 2025-2029 political cycle progresses, especially with the 2026 midterm elections approaching, electoral pressures and macro and fiscal constraints will gradually return to the policy core. The seemingly solid capital alliance is likely to show signs of differentiation. I have always believed that how to find a balance between the "new money" pursuing efficiency and the "old money" maintaining stability in the next four years and beyond will determine the ultimate direction of this power reshuffle.

This not only concerns the political and economic structure of the United States itself but will also, on a deeper level, influence the evolution direction of global capitalism in the new technological era.

2. AI: When Capital Builds High Walls, CapEx Drama Peaks

If in 2023-2024, the focus of AI competition remained on "whose model parameters are larger, whose exam scores are higher," then 2025 marks a return to common sense and a deep dive into competition: the moat of AI is redefined, no longer a single model breakthrough, but who has the ability to continuously bear the pressure of CapEx (capital expenditure) over a sufficiently long time dimension.

Looking back on the timeline, the comparison of facts at the beginning and end is quite humorous. After all, at the start of 2025, the Chinese AI startup DeepSeek released the DeepSeek-R1, which significantly impacted the global AI market's pricing logic with its low cost, high efficiency, and open-source approach, shaking the long-held "compute power" myth in Silicon Valley for the first time and sparking a global re-discussion on "whether compute power really needs to be so expensive."

It was precisely due to this impact that market skepticism about the huge return on investment in AI reached its peak. On January 27, Nvidia (NVDA.M) saw its stock price plummet 18% in a single day, bringing the "small model + engineering optimization" approach back into mainstream view.

However, the irony lies in the fact that although the efficiency revolution brought by DeepSeek is widely referred to as the "Sputnik moment" in the AI world, in the competition among leading players, the ultimate battleground for AI competition actually shifted this year from model architecture further down to electricity, infrastructure, and sustained cash flow investment.

This is specifically reflected in two sub-dimensions:

- On one hand, the physical world foundation supporting the models has become unprecedentedly expensive. Giants like OpenAI, Meta (META.M), and Google (GOOGL.M) have almost simultaneously upgraded their arms race, continuously raising CapEx expectations. The market predicts that the cumulative CapEx of these giants will soar to $2-3 trillion between 2025 and 2030 (see further reading: “OpenAI 2025 Review: $500 Billion Alchemy, Is the Shape of the AGI Wall Built by Capital Emerging?”);

- On the other hand, OpenAI, Google, and Chinese AI giants like Alibaba (BABA.M) are also engaging in comprehensive confrontations based on their respective advantages in technology, ecology, and commercialization, attempting to build a complete closed loop covering entry—cloud—compute power—application, with AI competition entering a system engineering game (see further reading: “Entry, Cloud, and Compute Power: Insights into OpenAI's 'AI Empire' from DevDay”);

It can only be said that within a brief window, the old order was indeed impacted. However, through rounds of tug-of-war, the market gradually formed a new consensus—AI competition is still a marathon with no visible finish line. The true moat does not lie in whether the model itself is smarter, but in who can endure a higher intensity of capital expenditure and sustained investment.

In other words, the impact of DeepSeek at the beginning of 2025 did not end the "expensive" nature of AI; rather, it pushed it into a more brutal and realistic phase: a high wall built by capital, energy, and time is slowly closing at the entrance to the AI world.

However, entering the fourth quarter of 2025, the market's pricing logic for AI began to show a subtle yet crucial turning point, such as the "divergence" in trends based on financial reports—companies like Oracle (ORCL.M) and Broadcom (AVGO.M) saw significant stock price pullbacks after their latest quarterly earnings releases, not due to a slowdown in AI-related revenues, but because the market began to reassess a key question: when CapEx has been fully drawn in advance, does the next phase of growth still possess the certainty of linear extrapolation?

In contrast, Micron Technology (MU.M) became a new anchor for capital during the same time frame, with visibility on HBM orders, price improvements, and profit release rhythms allowing it to transition from being a beneficiary of the AI narrative to a direct recipient of profit certainty, quickly gaining a repricing of funds.

The stark contrast between the two indicates that the market is no longer indiscriminately rewarding AI relevance but is beginning to distinguish between those burning CapEx and those harvesting CapEx. From a broader perspective, this also marks a shift in the AI investment paradigm from an infrastructure arms race to a new phase of cash flow and return audits.

Capital has not wavered in its long-term faith in AI, but it is no longer willing to pay a premium for every high wall—and this reordering of monetization capability and profit pathways may very well be the core focus that the market will repeatedly price in 2026.

3. Tariff Storm: The Violent Collision of New and Old Geopolitical Orders

In 2025, tariffs became more than just a macroeconomic variable; they officially evolved into the "number one killer" of risk appetite in the U.S. stock market.

Against a backdrop of historically high valuations and liquidity being extremely sensitive to policy, April 2, 2025, was dubbed "Liberation Day" by the White House, as Trump signed an executive order announcing a 10% baseline tariff on all imports to the U.S. and implementing precise "reciprocal tariffs" on countries with significant trade deficits.

This policy instantly triggered the most severe structural shock in global financial markets since the pandemic in 2020.

The consecutive crashes from April 3 to 4 became one of the most representative "stress tests" in recent years, with major U.S. stock indices recording their largest declines since 2020, resulting in an evaporation of approximately $6.5 trillion in market value, and the Nasdaq Composite Index and Russell 2000 Index even briefly entering a technical bear market (defined as a drop of over 20% from their peak).

Subsequently, the market entered a prolonged period of policy negotiation. Although a brief AI-driven rebound occurred in May due to the "90-day negotiation buffer," the market once again experienced a deep correction reminiscent of April as the government shutdown crisis and tariff uncertainties reignited in October.

From a higher-dimensional perspective, the essence of this round of tariff storms is not merely the short-term fluctuations of trade policy but rather the last counterattack of the old trade order under the new industrial structure. After all, the globalization dividend established over the past few decades was built on three premises: low tariffs, cross-border supply chain efficiency, and a relatively stable geopolitical framework.

However, entering a new phase where AI, semiconductors, energy, and security are highly intertwined, trade has long ceased to be just an efficiency issue; it has become an extension battlefield for national security, industrial control, and technological sovereignty. For this reason, tariffs were repriced in 2025; they are no longer just a cyclical policy tool but are viewed by the market as a structural friction cost in the process of geopolitical order reorganization, becoming a source of uncertainty that cannot be simply hedged but must be incorporated into a long-term pricing system.

This change also marks the formal entry of global capital markets into a new phase, where any future enterprise or profit must account for an additional high "geopolitical security cost" beyond operations/profits.

4. Pullbacks, Liquidations, and Recoveries: The U.S. Stock Market's Steady Position as the "Anchor of Global Risk Assets"

At the same time, if the tariff storm in April was an extreme stress test, the subsequent market performance actually tested the true "quality" of the U.S. stock market: the pullback was fierce, but the recovery was equally swift; capital did not exit for long but quickly flowed back into the core market after a brief deleveraging.

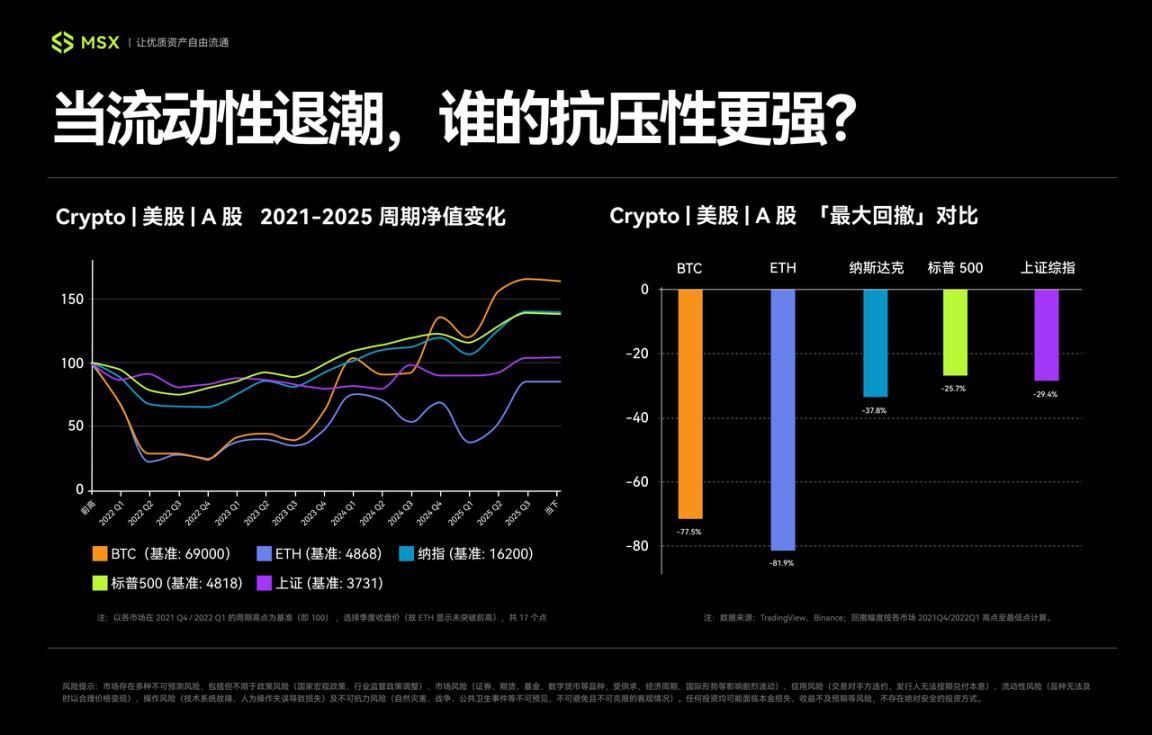

This textbook-like resilience is reflected not only in the speed of price recovery but also in its status as the ultimate safe haven for global liquidity—amid rising global uncertainties, the U.S. stock market remains the place where capital is most willing to "return" (see further reading: “Pullbacks, Liquidations, and Recoveries: The 4-Year Cycle Revelation of U.S. Stocks, A-Shares, and Crypto”).

From the annual timeline perspective, this resilience is not coincidental. On February 19, 2025, the S&P 500 reached an all-time high. Although it subsequently faced repeated pulls from AI bubble concerns and tariff shocks, the index did not trend towards destructive patterns but continuously completed structural re-evaluations amid volatility. This structural "stabilizing force" was further reinforced by the year's end:

As of the time of writing, the Nasdaq 100 (QQQ.M) rose 21.2% for the year, with the tech narrative still being the growth backdrop; the S&P 500 (SPY.M) increased by 16.9%, steadily refreshing its range in high-frequency trading; the Dow Jones and Russell 2000 (IWM.M) rose 14.5% and 11.8%, respectively, completing the structural puzzle from "value recovery" to "small-cap restoration."

Although precious metals like gold (GLD.M) and silver (SIVR.M) exhibited more dazzling performances in absolute return rates in 2025 (see further reading: “Piercing the 'Silver Frenzy': Behind the $60 New High, Is the Market Snatching Up the Last Batch of 'Liquidity Silver'?”), the value of the U.S. stock market lies not in being the fastest runner but in its irreplaceable structural profit-generating effect—it is both a deep-water port amid complex geopolitical games and a certainty that global capital repeatedly anchors in high-volatility environments.

As tariffs raise frictions, geopolitical tensions amplify noise, and technological revolutions reshape industrial structures, the U.S. stock market did not shy away from risk but absorbed, repriced, and ultimately bore the risk.

For this reason, in the violently colliding year of 2025, the U.S. stock market was able to firmly maintain its position as the "anchor of global risk assets."

5. Computing Power Equals Power: From NVIDIA's $5 Trillion to the "Heavy Infrastructure" Echoes of Various Sub-sectors

If the U.S. stock market was able to firmly maintain its position as the "anchor of global risk assets" in 2025, then the heaviest link in the anchor chain undoubtedly points to computing power.

On October 29, 2025, the global capital market witnessed a historic moment as NVIDIA (NVDA.M) saw its market capitalization surpass $5 trillion, becoming the first company in capital market history to reach this milestone, with a valuation exceeding the total market capitalization of several developed countries, including Germany, France, the UK, Canada, and South Korea.

Even more symbolically, the non-linear acceleration trajectory presented by its market cap leap: it took 410 days to cross from $3 trillion to $4 trillion, while it took only 113 days to go from $4 trillion to $5 trillion. This change itself is difficult to explain solely by performance growth, marking the market's shift to pricing core assets using the new metric of "computing power hub" (see further reading: “Impacting $5 Trillion? A Comprehensive Interpretation of GTC 2025, NVIDIA's 'AI Factory' Prototype Emerges”).

Objectively speaking, NVIDIA's significance has long transcended the growth narrative of individual stocks. With its strong binding to the GPU and CUDA ecosystem, it occupies 80%-90% of the key share in the AI chip market, and the extreme dependence of large model training and inference on scaled computing power makes it an indispensable infrastructure node in the entire AI industry chain.

However, it is also at this stage that the market gradually realized that the limits of computing power are colliding with the boundaries of the physical world. Therefore, the speculation logic of the AI sector underwent a profound shift, with bottlenecks no longer existing solely in the GPUs themselves but continuously transmitting downstream along the industry chain: computing power → memory → electricity → energy → infrastructure.

This transmission chain also directly triggered a round of capital linkage across multiple sub-sectors.

The first to ignite were memory and storage, as the scale of AI training and inference continued to expand, the computing power bottleneck began to shift from GPUs to HBM (High Bandwidth Memory) and the storage systems themselves. In 2025, HBM remained in a state of supply shortage, and NAND flash prices entered a new upward cycle, leading to impressive performances of 48%-68% for companies like Micron Technology (MU.M), Western Digital (WDC.M), and Seagate Technology (STX.M).

At the same time, data centers, typical "electricity-guzzling beasts," meant that companies with nuclear energy assets and independent power grids began to hold hard currency in the AI era. Thus, in 2025, several companies originally viewed as defensive assets in the energy and utilities sector instead exhibited tech stock-like trends: Vistra Corp (VST.M) +105%, Constellation +78%, GE Vernova +62%.

This spillover effect even further transmitted to Bitcoin mining companies, which were originally seen as old-cycle assets. As AI encroached upon and redistributed electrical resources, companies like IREN (IREN.M), Cipher Mining (CIFR.M), Riot Platforms (RIOT.M), Core Scientific (CORZ.M), Marathon Digital (MARA.M), Hut 8 (HUT.M), CleanSpark (CLSK.M), Bitdeer (BTDR.M), and Hive Digital (HIVE.M) were reintroduced into the new valuation framework of "computing power—energy" (see further reading: “AI Kills Miners: 'Energy Runoff' Tears Open a New Cycle, What Fate Do Mining Companies Stand At?”).

Of course, as the year drew to a close, the AI chip market was not without its ripples.

In November, Google released Gemini 3, which surpassed OpenAI's GPT-5.1 in multiple benchmark tests. At the same time, there were reports that Google plans to sell its self-developed TPU chips on a large scale and aims to double TPU production to 7 million units by 2028, a 120% increase from previous expectations.

Even more impactful is the pricing strategy; Morgan Stanley predicts that Google's TPU costs are only one-third of NVIDIA's, which is expected to force the AI chip market back to a "cost-performance" commercial game rather than a pure "scarcity" monopoly, posing a structural challenge to NVIDIA's market share and extremely high profit margins.

6. Trump-style Capitalism: From Intensified Political Polarization to State Intervention in Capital

If AI and tokenization are the "technological manifestations" of 2025, then the institutional fluctuations caused by political polarization and the deep shift in U.S. industrial policy constitute the most complex "underlying background" of 2025.

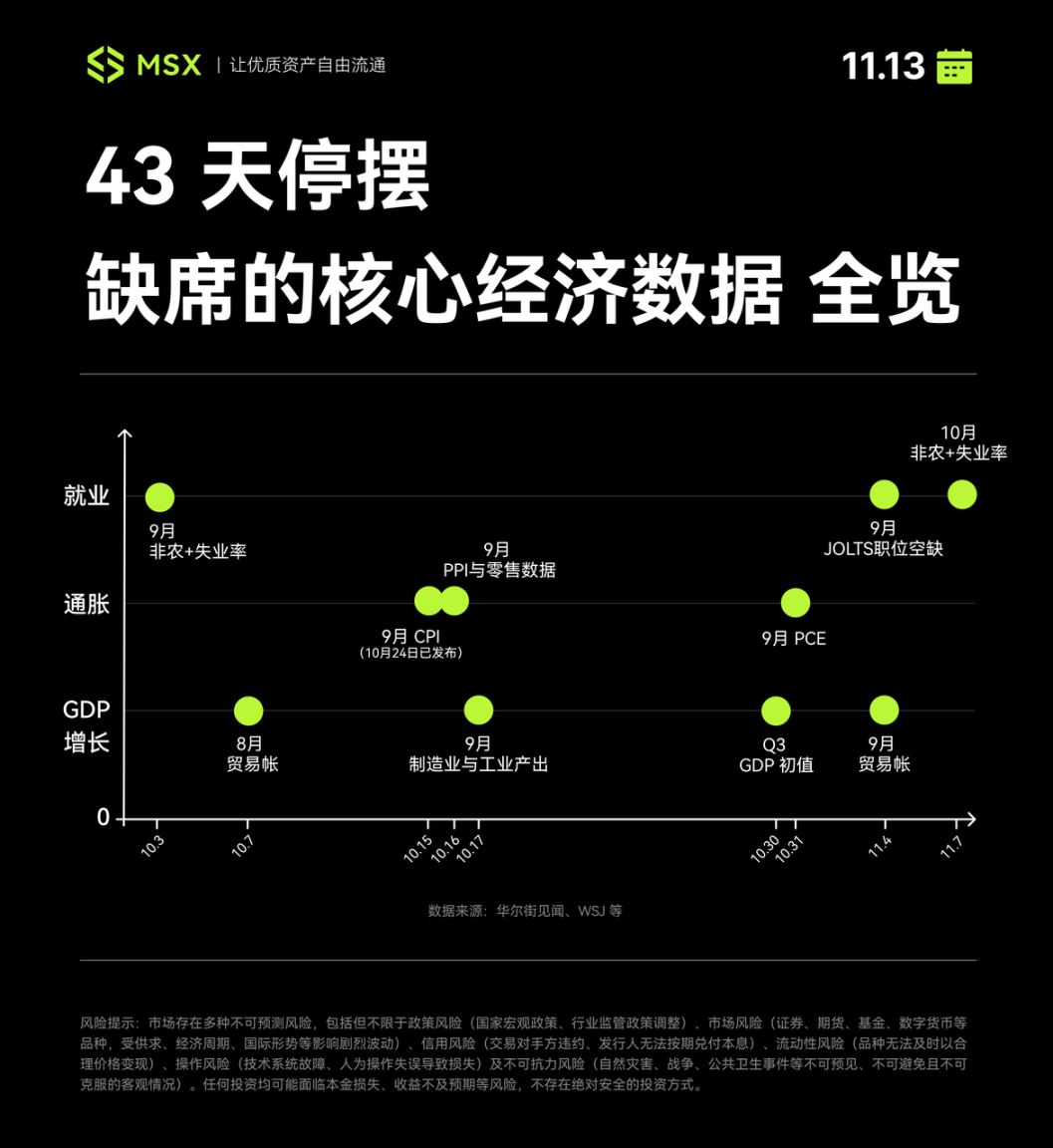

This year, the market witnessed an unprecedented 43-day federal government shutdown in the U.S. Widespread flight delays, interruptions in food assistance programs, stagnation of public services, and hundreds of thousands of federal employees forced into unpaid leave… It can be said that this month-long deadlock impacted the livelihoods and economic operations of American society to nearly every capillary (see further reading: “Shutdown Ends, Flood Comes: After 43 Days of 'Information Vacuum', How Will Backlogged Data Impact the Market?”).

However, more concerning than the economic losses is the institutional signal conveyed by this shutdown. Political uncertainty is shifting from a "predictable event" to a source of systemic risk. In traditional financial frameworks, risks can be priced, hedged, or deferred; but when the institution itself frequently malfunctions, the market's options suddenly shrink, either raising the overall risk premium or temporarily withdrawing.

This also explains why the U.S. stock market experienced multiple sharp corrections in 2025, not due to the deterioration of any specific macro data, but rather as a brutal stress test of the market's reliability on institutions.

In this highly polarized political environment, the economic governance logic of the new U.S. government began to show a more distinct characteristic: the state’s will is no longer satisfied with traditional subsidies and tax incentives but chooses to directly intervene in capital structures.

Unlike past industrial policies that primarily relied on subsidies, tax incentives, and government procurement, 2025 saw the emergence of a more controversial and symbolically significant shift: moving from "grant subsidies" to "direct equity participation," constructing a support system with "financial participation" in equity. The author has also observed numerous discussions on "Trump-style capitalism" (or a variant of state capitalism).

The Intel (INTC.M) agreement served as the first shot fired, marking a milestone agreement where the federal government would directly acquire 10% equity in Intel, signifying the U.S. federal government’s role as a long-term shareholder in key strategic industries.

From the supporters' perspective, this shift is not without logic; after all, for many fields at the technological frontier but still in early commercialization (such as quantum computing), direct government equity participation can theoretically significantly reduce financing uncertainty, extend the cash flow runway for companies, and provide stable expectations for long-term R&D. Compared to one-time subsidies, equity-based support is also seen as more aligned with "long-termism" policy goals.

For this reason, there were rumors that the U.S. government might consider exchanging federal funds for equity in quantum computing companies like IonQ (IONQ.M), Rigetti Computing (RGTI.M), and others (see further reading: “The Final Battle for Computing Power: Will Quantum Computing Be the Next 'AI Moment'?”, “Is the U.S. Government Going to 'Invest' in Quantum Computing? Understanding the First Shot of the 'Policy Equity' Era”), but the U.S. Department of Commerce quickly denied this, clearly stating that no formal negotiations had been initiated regarding equity in the aforementioned quantum computing companies.

This clarification reflects that the policy boundaries are still in a state of repeated negotiation and highlights the high sensitivity of the topic. In fact, the core issue is not whether the government truly invests in a particular quantum company, but how the market should reprice the boundaries of policy, capital, and risk when the state begins to intervene as a shareholder in cutting-edge technology industries.

This state-driven resource allocation has long been the original sin criticized and questioned by Western public opinion and capital markets regarding China's photovoltaic, new energy, and other industrial policies over the past few decades. Now, this boomerang has circled half the globe and struck the U.S. right between the eyes.

7. Decoupling of Major Currency Policies: The Fed Turns Left, the Bank of Japan Turns Right

Beyond industrial policy, the changes in monetary policy in 2025 further expose the systematic contraction of macro-control space.

Amid the ongoing tug-of-war between inflation and employment, the Federal Reserve officially restarted its interest rate cut cycle in September 2025, subsequently cutting rates by 25 basis points in both October and December, for a total reduction of 75 basis points over the year.

However, in the current macro environment, the market's understanding of this round of rate cuts has already changed. Observers know that this does not signal a return to a loose cycle; rather, it resembles a "pain relief treatment" under pressure on the economic system and even politics. This also explains why multiple rate cuts have not alleviated market uncertainty as expected; instead, the U.S. stock market has further differentiated structurally.

Ultimately, everyone is increasingly aware of a reality: the available space for monetary policy is becoming increasingly limited, especially under the constraints of high debt, high fiscal deficits, and structural inflation. The Federal Reserve can no longer provide market support through significant easing as it did in the past.

In simple terms, each rate cut today feels more like drinking poison to quench thirst rather than creating new growth momentum.

In stark contrast, while the Federal Reserve is shifting to rate cuts, the Bank of Japan is firmly advancing monetary policy normalization—on December 19, the Bank of Japan announced a 25 basis point rate hike, raising the policy rate to 0.75%, the highest level since 1995, and the fourth rate hike since the end of its eight-year negative interest rate policy in March 2024.

As of December 26, according to Jin10 data, although inflation in Tokyo, Japan, has cooled more than expected, and pressures on food and energy prices have eased, the market generally believes this is insufficient to prevent the Bank of Japan from continuing its rate hike process. The divergence between the two policies is pushing the global monetary policy landscape to the forefront, severely squeezing the space for yen carry trades that have been maintained for years, forcing global capital to reassess the risk structure across currencies and markets.

Objectively speaking, by 2025, monetary policy has gradually lost the aura of a "magic wand." In the context of deeper state capital intervention and rising geopolitical walls, interest rates are no longer a universal lever for adjusting the economy but rather a painkiller to prevent acute systemic collapse.

Among the major global central banks, Japan is becoming the "last bastion" of tightening global liquidity, which could very likely become one of the fiercest sources of risk in 2026.

8. The Fed's "Balancing Act": Rate Cut Cycle and New Leadership Outlook

At the same time, the invasion of political pressure is gradually causing the "altar" of the Federal Reserve to collapse.

In 2025, Trump's attacks on Powell extended from 𝕏 to the White House. As Powell's term is set to expire in May 2026, the market has already begun to trade in advance on the policy orientation of the "next Federal Reserve Chair" or even the "current shadow Federal Reserve Chair."

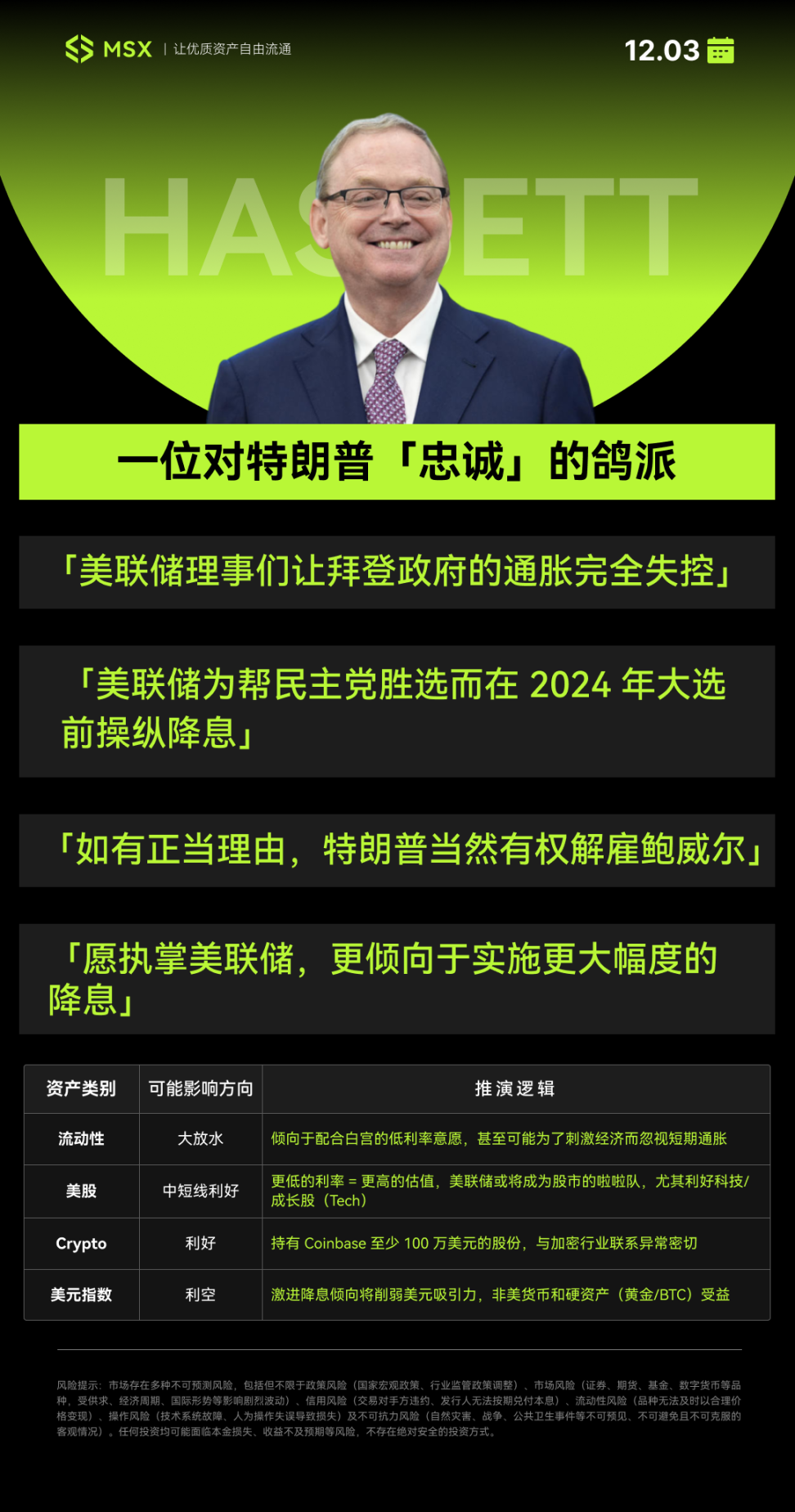

If the eventual successor is represented by the "loyal dove" Kevin Hassett, then the Federal Reserve, following the White House's baton, is likely to release more aggressive liquidity signals in the short term, leading to a sentiment-driven frenzy in the Nasdaq and Bitcoin. However, the cost of this could be a renewed loss of control over inflation expectations and further erosion of the dollar's credibility (see further reading: “Outlook for the New Fed Chair: Hassett, Coinbase Holdings, and Trump's 'Loyal Doves'”).

Conversely, if the successor leans more towards a "reformist" path like Kevin Walsh, the market may experience a painful period due to liquidity tightening. However, under deregulation and a stable monetary framework, long-term capital and traditional financial institutions may gain a greater sense of institutional security (see further reading: “Fed 'Successor' Reversal: From 'Loyal Doves' to 'Reformists', Has the Market Script Changed?”).

We cannot predict who will become "the last person to talk to Trump." This unpredictable state may continue until the moment the candidate is finalized.

But regardless of who ultimately prevails, one fact will not change: interest rates themselves are gradually evolving from an economic variable to a part of political gamesmanship. After all, in 2020, Trump could only criticize Powell on Twitter; by 2025, Trump, returning with an overwhelming victory, is no longer satisfied with merely being an observer.

Whether the leading actor is Hassett or Walsh may determine the direction of the plot, but the overall director of this drama has firmly become Trump.

9. Financial Infrastructure Revolution: From 5×16 to 5×23, and then to 7×24?

If there is one change in 2025 that is most likely to be underestimated yet could produce long-term chain reactions, the answer lies not in a particular star stock or sector but in the trading system itself.

This is also the most far-reaching yet easily overshadowed invisible transformation of 2025, as Wall Street officially decided to actively dismantle barriers and move towards tokenization and 7×24 hour liquidity.

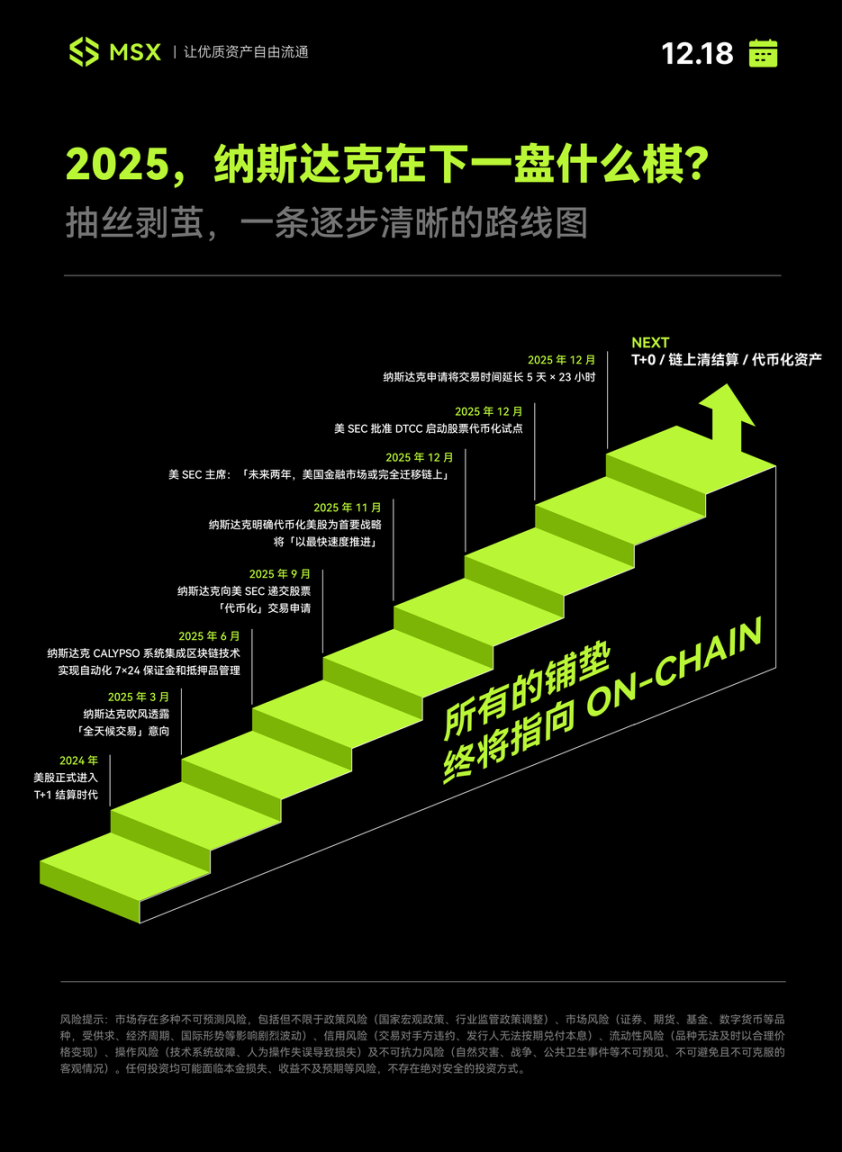

If we extend our perspective and connect the recent intensive actions of Nasdaq, we can be more certain that this is a strategic puzzle with a subtle and gradual approach, aiming to ultimately enable stocks to possess the liquidity, settlement, and pricing capabilities akin to tokens. To achieve this, Nasdaq has chosen a path of gentle reform with a strong traditional financial style, with a roadmap that unfolds step by step:

- The first step occurred in May 2024, when the U.S. stock settlement system officially shortened from T+2 to T+1, a seemingly conservative yet crucial infrastructure upgrade;

- Shortly thereafter, at the beginning of 2025, Nasdaq began to signal its intention for "around-the-clock trading," hinting at plans to launch uninterrupted trading services five days a week in the second half of 2026;

- Subsequently, Nasdaq integrated blockchain technology into the Calypso system to achieve 7×24 hour automated margin and collateral management. This step did not create any visible changes for ordinary investors but sent a very clear signal to institutions;

- By the second half of 2025, Nasdaq began to push forward on institutional and regulatory fronts. In September, it formally submitted a "tokenized" trading application for stocks to the SEC, and in November, it explicitly stated that tokenization of U.S. stocks was a primary strategy to be "advanced as quickly as possible";

- Almost simultaneously, SEC Chairman Paul Atkins stated in an interview with Fox Business that tokenization is the future direction of capital markets. By putting securities assets on the blockchain, clearer ownership rights can be established, and he expects that "within about two years, all U.S. markets will migrate to operate on-chain, achieving on-chain settlement";

Against this backdrop, Nasdaq submitted an application to the SEC in December 2025 for a 5×23 hour trading system (see further reading: “U.S. Stocks Sprint Towards 'Never Closing': Why Did Nasdaq Launch the '5×23 Hour' Trading Experiment?”); in this context, The Economist also published an article discussing “How RWA Tokenization Will Change Finance,” drawing a highly symbolic analogy: If history can serve as a reference, the current stage of tokenization is roughly equivalent to the internet in 1996—at that time, Amazon sold only $16 million worth of books, while today, three of the "Magnificent Seven" tech giants dominating U.S. stocks had not even been born.

From yellowed paper certificates to the electronic SWIFT system in 1977, and now to atomic settlement via blockchain, the evolution curve of financial infrastructure is replicating and even surpassing the speed of the internet.

For Nasdaq, this is a gamble of "being revolutionized if not self-revolutionized"; for the crypto industry and new RWA players, this is not only a brutal reshuffling of winners and losers but also a historic opportunity comparable to betting on the next "Amazon" or "NVIDIA" in the 1990s (see further reading: “Nasdaq Hits the Gas: From 'Drinking Soup' to 'Eating Meat', Is U.S. Stock Tokenization Entering the Decisive Stage?”).

10. The "Year of AI Agents": It Exploded, but Not Completely

The most frequently heard term in 2025, yet one that seems to be missing something, is undoubtedly "the Year of AI Agents."

One word to describe this year's AI Agent market is "explosive."

The market has reached a clear consensus that AI is transitioning from a passive response dialog box to an agent form capable of autonomously calling APIs, handling complex task flows, executing operations across systems, and even participating in decision-making in the physical world. The explosive popularity of Manus at the beginning of the year indeed fired the first shot (as of the time of writing, Meta has reportedly acquired Manus for billions of dollars, with Xiao Hong set to become Meta's Vice President). Following this, other multi-agent products like Lovart and Fellou emerged, creating an illusion in the market that "the application layer is about to explode."

However, to be realistic, while the direction of agents has been validated, they have not yet scaled effectively. Early hit products quickly faced issues of declining user engagement and reduced usage frequency. They have proven "what agents can do," but have yet to answer "why they should be used long-term."

This is not a failure but a necessary stage in the technology diffusion cycle.

In fact, whether it is OpenAI's CUA (Computer-Using Agent) or Anthropic's MCP (Model Context Protocol), the focus is not on a specific application but rather on a longer-term judgment: the AI capability curve will be exceptionally steep over the next two years, but the real value release relies on system-level integration rather than single-point functional innovation.

For this reason, the AI Agents of 2025 resemble a directional tuning. According to the diffusion pattern of innovative technologies, transitioning from a "year one" to large-scale implementation will take at least three years, so 2025 is merely about completing the consensus shift from 0 to 1.

Of course, it is worth noting that as the year draws to a close, a highly dynamic new variable has begun to emerge—ByteDance's exploration of AI terminal forms, pulling agents back to the issues of hardware entry and scene binding. This does not necessarily mean that AI phones will succeed immediately, but it reminds the market once again: the ultimate fate of agents may not lie in a single app but in becoming actors within the system.

This time, capital may have run ahead of applications, but once the direction is set, there is no turning back in 2026.

Conclusion | What Did 2025 Leave Behind?

In a sense, 2025 was not a year that provided answers but rather a "year one" of collective turning.

Looking back on this year, the global capital market seems to be situated in a maze constructed of paradoxes:

- On one side, high walls continue to rise: global trade frictions are heating up, tariff barriers are returning, political polarization is intensifying, the shadow of government shutdowns looms, and great power competition has moved from backstage to the forefront;

- On the other side, fences are collapsing: regulatory attitudes towards new technologies are shifting dramatically (re-evaluation of SEC/CFTC policies), financial infrastructure is accelerating the dismantling of barriers (comprehensive on-chain / tokenized assets), and AI is bringing cross-temporal and cross-spatial productivity leaps;

This extremely absurd and opposing landscape essentially reflects the continuous establishment of new boundaries by political and geopolitical structures, while Washington and Wall Street are attempting to dismantle the old barriers between finance and technology.

In fact, the alarm has long been sounded.

When precious metals like gold and silver lead this year's major asset classes, even outperforming most tech stocks, we might realize that the assertion of a "great change" is not a prophecy. After all, the capital expenditure games in AI, which can easily reach hundreds of billions of dollars, are destined to be unsustainable, and the geopolitical competition looming over the global capital market is pushing us toward the "Minsky moment" that has been warned about for years—namely, the collapse point after excessive expansion.

Shakespeare wrote in "Romeo and Juliet": "These violent delights have violent ends." As the shadow of 2025 gradually recedes and the bell for 2026 is about to ring, what we may have to face is not the result of a single event but rather the natural extension of this structural state.

The real change may not lie in "what will happen," but in—the market no longer allows participants to pretend that nothing will happen.

Goodbye, 2025; hello, 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。