Author: FinTax

1 Introduction

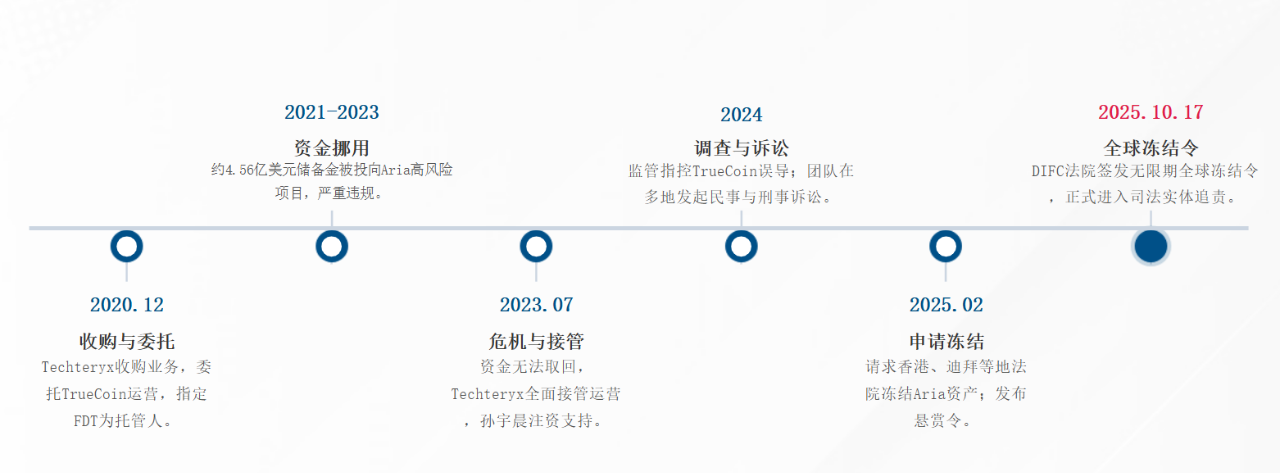

On November 27, 2025, a media briefing titled "Truth on the Ground, Justice Manifested - Progress of Global Judicial Pursuit of TUSD Reserve Assets" was held in Hong Kong, attracting widespread attention in the industry. Justin Sun, the founder of TRON, attended the event and disclosed key facts and preliminary results regarding the illegal appropriation and misappropriation of TUSD reserve assets, sparking significant concern within the blockchain industry. It was reported that on October 17, the Dubai International Financial Centre Court (referred to as DIFC Court) issued an indefinite global asset freeze order against Dubai-based trade finance company Aria Commodities DMCC, indicating that the funds involved "involve significant matters requiring trial," including forgery of authorization, breach of trust obligations, illegal transfer of reserves, and cross-border money laundering. All relevant individuals and entities were required to fully disclose the flow of funds, or face severe legal consequences.

The highly publicized case of the misappropriation of TUSD's $456 million reserve has made significant progress recently, involving capital encroachment across multiple jurisdictions including Hong Kong, Dubai, and the Cayman Islands. However, judicial proceedings are still ongoing, and the pressure to recover the funds remains. The vulnerabilities exposed in the custody and regulatory issues surrounding crypto assets cannot be ignored, leading us to question: after this incident, how can we trust crypto custody?

2 The TUSD Incident: The Disappearance of $456 Million in Trust

At the end of 2020, the Asian consortium Techteryx acquired the operating rights of the TUSD stablecoin from TrueCoin LLC. To ensure a smooth transition, Techteryx entrusted the original operator TrueCoin to continue managing TUSD's fiat reserves. TrueCoin recommended an offshore fund named Aria Commodities Finance Fund (ACFF), registered in the Cayman Islands, as the primary investment channel.

However, as the trustee, TrueCoin, in collusion with the Hong Kong trust institution First Digital Trust (FDT), abused its management authority. From 2021 to early 2023, FDT's CEO Vincent Chok directly approved the secret transfer of up to $456 million in fiat reserves to the private trade company Aria Commodities DMCC in Dubai in six batches. This Dubai company is reportedly wholly owned by the wife of the aforementioned ACFF fund's investment manager, creating a conflict of interest with the original investment target. To cover up the illegal source of the funds, the parties involved forged fund subscription documents, packaging the unauthorized reserves as related loans from the ACFF fund.

Once the funds arrived in Dubai, they were invested by Aria Commodities DMCC into illiquid high-risk or failed projects, including asphalt manufacturing facilities in the Middle East and coal mining rights in Africa, leading to a substantial depletion of TUSD's fiat reserve assets. In 2023, Techteryx began to notice unusual movements in the reserves, took over operations, and appointed an independent professional team to conduct a comprehensive investigation into FDT, exposing the black-box operations.

In January 2024, the crisis fully erupted, with TUSD's price severely decoupling and facing the risk of billions of dollars in cascading liquidations. At this critical moment of "life and death," Justin Sun provided approximately $500 million in personal funds to Techteryx, assisting the TUSD project in overcoming the crisis and successfully stabilizing the TUSD price, thus avoiding a severe blow to the DeFi ecosystem.

Subsequently, with Sun's support, the TUSD project initiated a "global asset preservation" legal battle. In the Hong Kong lawsuit, FDT was accused of breaching the trust agreement and was sued for damages. In the Dubai lawsuit, Techteryx sought a court confirmation that the funds ultimately flowed to Aria Commodities DMCC still legally belonged to Techteryx. In September 2024, the U.S. SEC publicly characterized TrueCoin's actions as fraudulent. As of October 17, 2025, the DIFC Court made a groundbreaking ruling, issuing an indefinite global asset freeze order, freezing $456 million in global assets of Aria Commodities DMCC and its affiliates.

Figure 1: Key Timeline of the TUSD Reserve Misappropriation Case

3 Analysis of the TUSD Incident: Why Did the Huge Reserves Flow Out?

3.1 The Trust Structure of TUSD Reserves

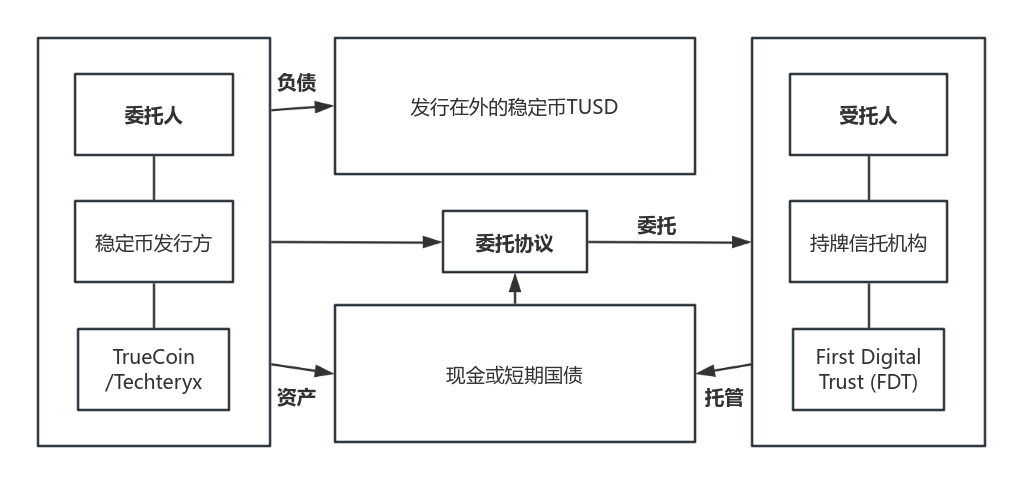

The TUSD reserve misappropriation case is a typical example of centralized risk, clearly exposing the vulnerabilities of traditional financial trust mechanisms in managing stablecoin reserves. To understand how the funds were misappropriated, we first need to understand the trust structure employed by TUSD. The issuance of stablecoins like TUSD (TrueUSD) is strictly anchored to a "1:1" ratio with reserve assets, requiring the reserves to be highly liquid assets to ensure they are always available for user redemption. The stablecoin issuer (the principal) entrusts the reserves to a trust institution (the trustee) for management, with the core responsibility of the trustee being to safeguard the funds and invest them in low-risk ventures as agreed. This structure relies on trust in the trustee for asset security.

Figure 2: The Trust Structure of TUSD

3.2 Causes of Fund Outflow

The occurrence of this misappropriation case is not merely a random error by a single entity, but rather the result of various overlapping factors, including the project's lack of governance and oversight, the violations by the trust company and related parties, and the inherent institutional weaknesses of the traditional trust structure.

From the perspective of project governance, Techteryx poorly selected and supervised the reserve management party and trustee. After acquiring the ownership of the TUSD project from TrueCoin, the operational rights of TUSD remained with TrueCoin. Subsequently, TrueCoin colluded with institutions like FDT to secretly transfer large amounts of reserves to the private company Aria Commodities DMCC in Dubai through a series of fraudulent transactions. From the perspective of oversight, the project lacked transparent disclosure and independent audits. Although stablecoins should maintain a "1:1" correspondence between reserves and circulation, in this incident, FDT ultimately invested part of the reserves into high-risk, illiquid areas such as mining, shipping, and manufacturing from 2021 to 2023, rather than traditional low-risk assets like cash or highly liquid government bonds. It was not until Techteryx discovered that FDT could not pay the annual interest as agreed and refused to respond to redemption requests that they realized something was wrong. In July 2023, Techteryx formally took over all operational rights of TUSD from TrueCoin and initiated a comprehensive investigation into FDT with an independent professional team.

From an institutional perspective, the trust's cost of trust is excessively high, testing human nature. The details in the court documents of the TUSD reserve misappropriation case fully demonstrate the fragility of the trust mechanism. It is alleged that FDT and its associates engaged in "forgery of authorization" and "breach of trust obligations," using reserve funds for high-risk investments without proper disclosure and investor consent. Vincent Chok, the CEO of the Hong Kong trust institution FDT, as the "gatekeeper" of the funds, abused his trustee position not only by approving the illegal transfer of $456 million in reserves to a private company in Dubai but also by receiving over $15.5 million in secret illegal kickbacks. The parties involved subsequently forged fund subscription documents to package the misappropriated funds as "related loans" to cover up their illegal source, constituting clear fraudulent behavior. The court's ruling explicitly stated that the individuals involved "fully knew and jointly engaged in fraudulent means and harmful acts." This incident vividly exposes the high moral hazard of centralized managers (trustees) in traditional trust relationships involving human intermediaries. Once a trustee violates their fiduciary duty, their actions can have catastrophic consequences for the entrusted assets, fully reflecting that traditional trust structures are built on trust in human nature, with the coercive constraints of technology or rules being limited.

4 Insights and Recommendations

The TUSD incident reveals not a technical issue, but a structural risk stemming from an over-concentration of trust in a single institution. For institutions and individuals wishing to operate or invest in the crypto asset space safely and sustainably in the long term, compliance design is not an additional cost but a necessary preparation to reduce systemic risk. Truly effective compliance arrangements involve not only finding a trustworthy custodian but also deploying risk isolation mechanisms in advance and following up with timely oversight.

First, it is essential to clearly distinguish between legal ownership of assets and economic benefits, ensuring that reserve assets are legally independent of the project party and the custodian itself, so that they are not included in their balance sheets in the event of bankruptcy, liquidation, or internal violations;

Second, in fund allocation and key decision-making, multi-signature arrangements and other checks and balances should be introduced to prevent any single entity from unrestrainedly accessing core assets;

Finally, in choosing the jurisdiction for legal proceedings, priority should be given to jurisdictions with high enforcement efficiency and clear regulatory boundaries, and through professional legal and tax design, ensure that cross-border fund flows, directive paths, and audit chains have clear and traceable legal bases, avoiding the loss of accountability and remedial space due to overly complex structures;

Due to differences in cross-border regulatory standards, frequent adjustments in tax rules, and the unique attributes of crypto assets, relying on generic solutions may struggle to balance compliance with long-term stability. Therefore, when developing crypto asset businesses, seeking support from experienced third parties can help reduce subsequent compliance and tax risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。