Bitcoin and Ethereum had a small surge yesterday to complete a false breakout, and since late last night, they have been stagnant. How can we make money in the current market? How can we increase the win rate for long and short positions? Let's analyze the market around this theme. It is now December 30, 2025. First, let's look at the 4-hour chart for Ethereum. It is very clear that it has been moving up and down within this range. If we want to short, we will wait for this position.

This position is 3,030, and there is also the position at 2,995, which means this former support has turned into resistance.

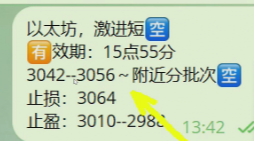

We can wait for this resistance; if it doesn't break below around 2,900, we will look to go long near 2,900, with a stop loss set at 2,900. Last night, our friends who followed the rhythm opened long positions in the range of 2,913 to 2,920. Before the crash last night, I mentioned in the group that I was shorting at 3,042, splitting into two orders at 3,042 and 3,056.

How to operate today? Right now, it seems to be stagnant again on this 4-hour chart. Isn't this the rhythm of stagnation? But it hasn't really died.

On the 4-hour chart, it hasn't broken my trend line, and the indicators have entered the bullish territory. Do you see this thick green line?

This thick green line has been tested twice without breaking, and it has formed a small bullish candle, with two or three 4-hour bullish candles testing the line.

So it should move upwards, to where? That would be around 2,995, 3,000 USD, and we can short near 3,030, with a stop loss set at this high point, which is yesterday's high around 3,056.

If you are pursuing a conservative approach for long positions, you can focus on this point around 2,893 or 2,890 to go long, with a stop loss at 2,880. A small stop loss of a few dollars is cost-effective, brothers. If we don't hit the stop loss, we can aim for around 2,990 to 3,000 USD. There is still room for profit.

Of course, we need to see if the market cooperates. If the market cooperates, then we can plan to short. Of course, we need to set a stop loss. For a range-bound market, we can go long at the bottom of the range and short at the top, with stop losses. It's that simple. For quick trades in between, we can use a 5-minute strategy. If you are looking for a more conservative approach, you can wait around 2,800.

Around 2,800, you can wait to go long at 2,810 or 2,820, with a stop loss at 2,800. What do you think about 2,800?

If you are worried about hitting the stop loss and then it surges back up, that would be a pity. You can split your long positions at two prices, 2,800-2,775, with a stop loss at 2,760.

For more market updates, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。