The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

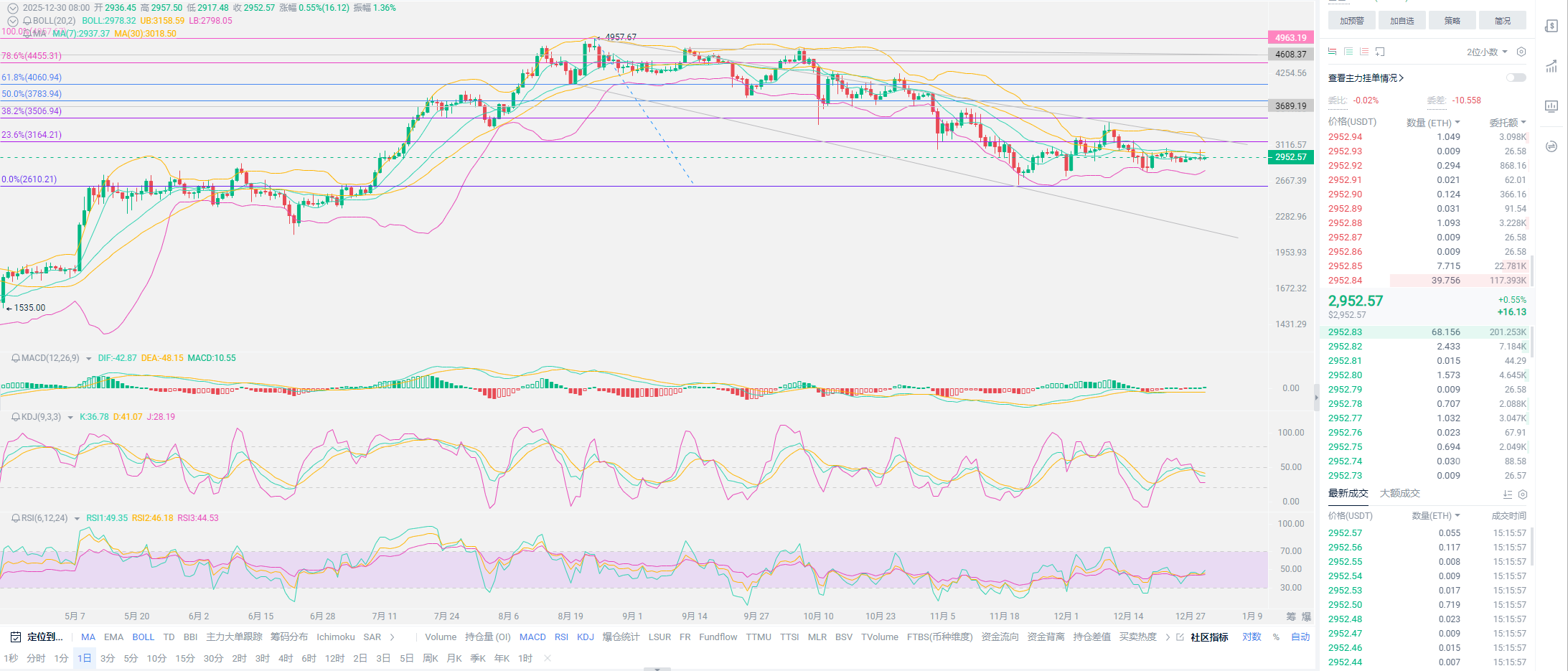

The entire cryptocurrency circle has experienced a standard "door painting" style correction; a significant portion of users are complaining to Lao Cui, asking why I can't be clearer? Personally, I believe I have been clear enough. As mentioned yesterday, the range has not been broken. As long as Ethereum cannot break through 3100, the market will naturally decline, and this pattern cannot be broken in the short term. At the same time, Lao Cui is naturally part of the bulls. As long as Bitcoin's stop-loss is above 10,000 and Ethereum's is above 500, there shouldn't be too much of a problem. Those who go long are not doing so to exit at break-even; they must have profits to consider this point. Yesterday, Bitcoin reached a position of 90,373, while the short-term correction went down to 86,760. I want to emphasize that Lao Cui's analysis uses the BN8-8 time frame, not the 0 point, so although the new low is indeed today's low on the 30th, the division still falls within yesterday's line, so please do not confuse them.

Yesterday, it was also mentioned that spot gold, silver, and even all heavy metals were suddenly attacked by bears, which also brought a wave of capital into the cryptocurrency circle; such breakthroughs are not real breakthroughs, and Lao Cui's words are all afterthoughts. Yesterday, it was impossible to judge whether gold would turn back or whether the cryptocurrency circle could maintain its momentum. Based on the current results, the growth of gold will continue, starting from various countries abandoning the dollar and purchasing Bitcoin; this trend has already been established. When to judge a gold pullback, you need to assess based on the volume of purchases; currently, there are no signs of stopping. Continuous purchases will only lead to a surge in gold prices, which will also create a funding gap in the cryptocurrency circle. Don't think that Lao Cui is being alarmist; the giants in the cryptocurrency circle are basically aligned with the giants in gold. Both have similar structural attributes and are synchronous complements, endowing them with monetary attributes. There are also differences, one being officially recognized and the other being backed by the public.

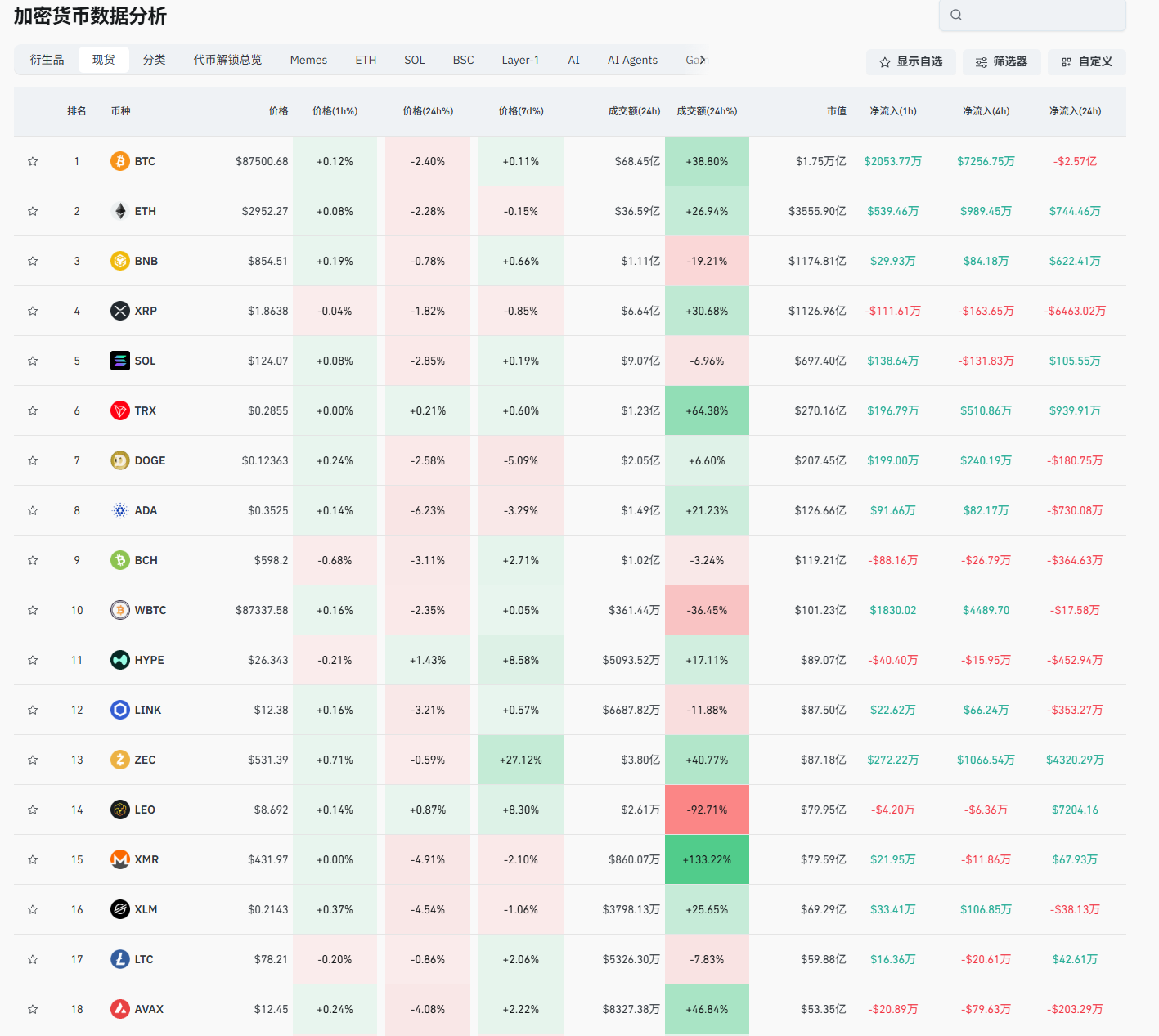

Having talked a lot about trends, let's get to some solid content. Since Bitcoin created a historical high of 126,208.5 on October 6 of this year, the entire cryptocurrency circle has begun a new round of decline. As of today, stabilizing around 90,000 seems quite challenging, with the lowest point reaching 80,600, a drop of 46,000 points, a decline of 30%. This is considered a bear market phase for any industry, and the cryptocurrency circle is no exception. If I still define the current stage as a short-term decline, then the overall trend is definitely leaning towards bears. The three pieces of news we missed are two interest rate cuts, along with the listing of small coins like SOL. This has led many friends to question long-term judgments. Lao Cui is not overly worried about this missed opportunity; it's just that the short-term stimulus is insufficient. Especially from a pattern perspective, the needle on October 10 completely shattered the bull market dream. Since that day, nearly 2.8 billion in funds have fled the cryptocurrency circle.

The turning point of the bull market also comes from the turnover among the giants. For the cryptocurrency circle, the current giants are basically configured at the highest level in the financial sector. BlackRock, MicroStrategy, and the official Americans. One could say that only aliens can catch this plate. Unexpected things always happen in the cryptocurrency circle. When Trump was in office, he shouted that cryptocurrency is the main theme of future finance, and the world basically responded to the call. Especially Japan, South Korea, and Europe established various regulatory agencies for the cryptocurrency circle, creating a momentum to follow the Americans to the end. Then, with Hong Kong's opening up, it once made Lao Cui feel that the concept of the cryptocurrency circle was about to be realized in our lifetime. However, the current nature is that nothing has landed, and the cryptocurrency circle has instead become a one-man show by the Americans. Countries are extremely strict in regulating the siphoning of funds through the cryptocurrency circle, and the funds flowing into the Americans are even less than before the listing.

Therefore, Lao Cui attributes the fundamental reason for this bull market interruption to the failure of global layout. The funds in the cryptocurrency circle have not completed a closed loop, but are instead limited to circulation between countries. The attitudes given by everyone are also very clear: money can be given, but siphoning is not allowed. So, for the next round of the bull market to explode, this problem needs to be solved. If the globalization issue cannot be resolved, the next wave of market will only be a bubble. At the same time, there is no need to lose confidence; the fundamental solution to this problem does not lie with us; Trump will take care of these matters. The tariff upgrades against the EU, Japan, and South Korea are all forcing them. The giants at this stage are also more focused on observing the results of this struggle; the overall funds have not fled. Although we are prohibiting trading, the output is not low. Russia is laying out nuclear power station mining; why should you lose confidence? Even North Korea is training professional hackers to steal assets from the cryptocurrency circle. Although this layout is despicable, isn't it also a scenario for the application of the cryptocurrency circle?

From Bitcoin's perspective, the current price has basically returned to below last year's same period price; people are always influenced by short-term fluctuations on long-term goals. Has the pattern been broken? This directly affects our profits, and naturally, there will be concerns. At this moment, Lao Cui recalls the time of 519 when Grayscale published, "You are crying while I am bottom fishing." Therefore, in today's article, Lao Cui will provide his operational thoughts, which everyone can refer to. The known conditions are that the retail capability of gold's absorption has weakened. After this drop, the golden body has been broken, and most retail investors will hesitate. Market sentiment may follow the footsteps of the cryptocurrency circle. The remaining factor is the tug-of-war among the giants. Our purchase of gold will continue, seeking to decouple from the dollar, with gold being the primary anchor. Coupled with the continuous outflow from the stock market, funds will flow into the cryptocurrency circle in the future. The cryptocurrency circle is not far from rebounding, and it is very suitable to invest in some coins at this stage.

Lao Cui summarizes: As the month ends, regarding the year-end of 25, I will provide a detailed report tomorrow. Overall, spot trading has not been very profitable, and this year's market is not optimistic. For the future layout of Bitcoin and Ethereum, this Bitcoin chart is very clear. If you are mainly trading contracts, you can try going long around 87,000, with a take-profit position of 500-1000 points. For Ethereum, it's around 2900, with a take-profit position of 2950-3030, and do not be too greedy. The layout for spot trading will be much easier; just invest regularly. In 26, Lao Cui always sees it as a year of new highs. At the same time, everyone needs to pay attention to the globalization process of the cryptocurrency circle. Currently, Singapore and Dubai are forming Asia's crypto center; it depends on whether the data from Asia will flow here. Next, we look at Europe's layout; can Trump force Europe to compromise? As long as one person gives in and builds a cryptocurrency network, it will cause short-term growth in the cryptocurrency circle. Europe will become the barometer of the bull market, and Ethereum will also become the foundation of globalization.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one place, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。