Author: Nancy, PANews

Last night (December 29), Bitcoin once again broke out of the "painting door" market. In the face of this repeatedly tugging and tense trend, the market's nerves seem to have long been numb.

Since Bitcoin's peak, it has only been three months, but investors feel as if they have been in the depths of winter for a long time. This psychological defense line collapse comes not only from the withdrawal of paper assets but also from a shake in confidence, with stocks soaring, indices hitting new highs, and gold and silver skyrocketing…

Traditional assets are celebrating, while crypto assets have unexpectedly fallen behind. Under this huge gap, players have started to vote with their feet, going short, cutting losses, and clearing out, as the crypto market falls into an unprecedented survival anxiety.

Entering Hell Mode, Trading Activity Drops to Freezing Point

Caution and defense have become the main melody of the crypto market at the end of the year.

In fact, the market value of stablecoins has quietly climbed to an astonishing $300 billion. According to historical experience, such a large off-exchange capital reservoir should be the fuel for a bull market, indicating that a large-scale bubble market is about to start. However, the reality is that the crypto market has not welcomed a collective celebration but has instead entered hell mode.

Looking back at the crypto market trends throughout the year, investor confidence has been severely impacted. Although Bitcoin and Ethereum reached historical highs this year, they failed to maintain their momentum and both turned downward. The altcoin market has been even more brutal; even new coins launched have struggled to escape the fate of spiraling declines, with liquidity exhaustion becoming the norm.

In this meat grinder market, both seasoned investors and newcomers find it hard to escape. Even Bitcoin holders are having a tough time, with over 30% of Bitcoin currently in a state of loss. The last time such a level of supply loss occurred was in October 2023, when the BTC price was around $26,000.

Accompanying the market slump, capital is rapidly retreating. Matrixport data shows that Bitcoin spot ETFs, as a barometer for institutional sentiment, have seen net outflows for nine consecutive weeks, with cumulative outflows nearing $6 billion. If this month ends with a net outflow, it will mark the most significant capital withdrawal since the ETF was listed in January 2024.

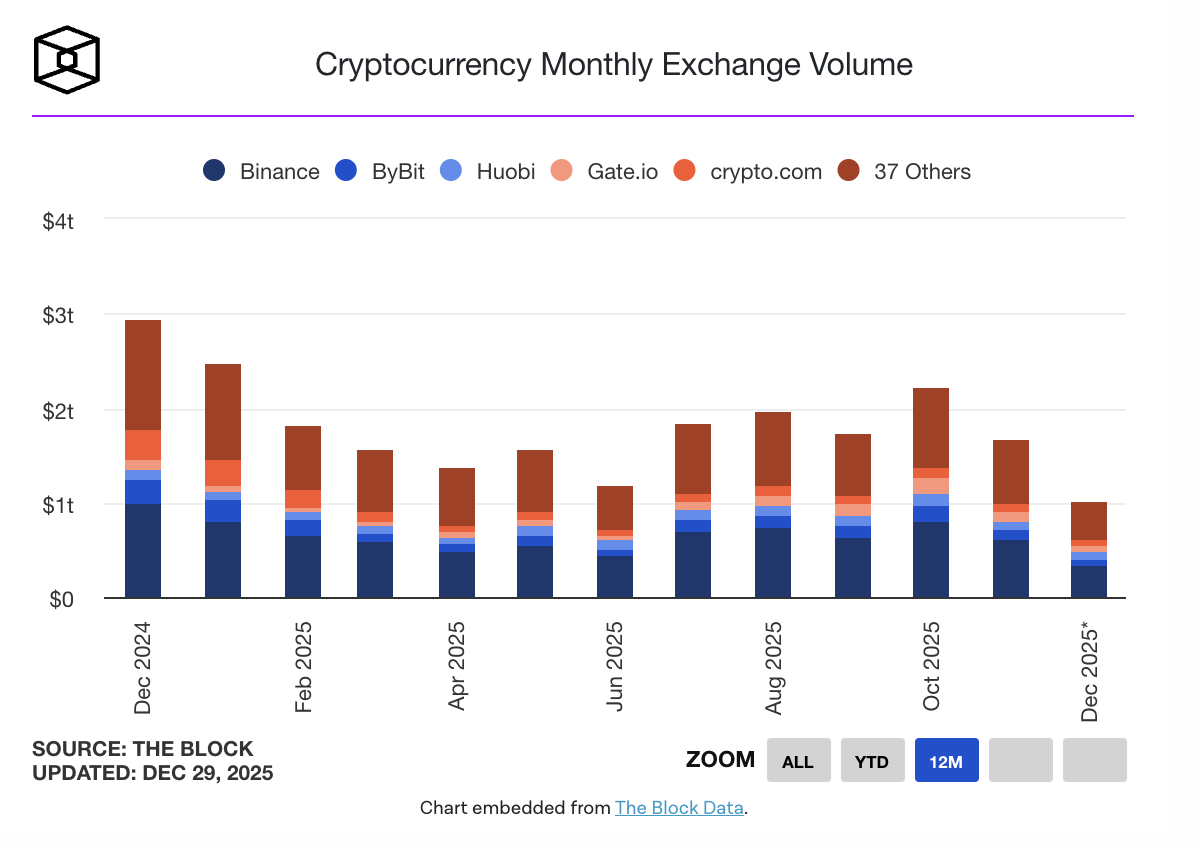

Trading activity has also dropped to freezing point. According to The Block data, the global cryptocurrency exchange spot trading volume in November fell to $1.59 trillion, the lowest level since June.

Market interest has plummeted. As a barometer of retail sentiment, Google Trends shows that global search volume for the term "cryptocurrency" continues to decline, with the U.S. region dropping to its lowest point in a year.

CryptoQuant analyst Darkfost also pointed out that the market sentiment index, constructed from media articles, X platform data, and more, shows that the general consensus in the current crypto market has turned bearish. However, he also believes that when a common consensus is formed, the market often reverses, proving that most people are wrong.

Can't Outperform the Stock Market, Can't Compete with Precious Metals

The crypto market remains weak, while many traditional assets are particularly strong.

This year, the neighboring major stock market has staged a "big short squeeze." A-shares of new stocks performed strongly, with an average first-day increase of over 256%, and none broke below par; the Hong Kong stock market has warmed up, with over 40 stocks doubling in price; the three major U.S. stock indices closed strongly, with the S&P 500 index rising nearly 18%, the Dow Jones index rising 14.5%, and the Nasdaq index increasing by as much as 22%; the South Korean composite index Kospi even achieved an astonishing increase of over 76%.

Retail investors are rushing in. For example, in the U.S. stock market, KobeissiLetter data shows that this round of U.S. stock market gains is historic, with the proportion of U.S. household stocks in net assets exceeding that of real estate, a phenomenon that has only occurred three times in the past 65 years; JPMorgan analysts pointed out that retail investment in the U.S. stock market is expected to grow by 53% by 2025, reaching $303 billion, becoming the main force behind the stock market rise.

In the showdown of safe-haven assets, physical precious metals have also outperformed Bitcoin. Gold, silver, and platinum have recently reached historical highs, and despite experiencing dramatic flash crashes, the annual increase remains considerable. In contrast, Bitcoin's status as "digital gold" is facing severe challenges. The BTC to gold and silver ratios have dropped to new lows since November and September 2023, respectively.

This has also drawn ridicule from outside the circle. For instance, gold enthusiast Peter Schiff bluntly stated that one of the best trades in 2025 is to "sell Bitcoin and buy silver," as the anticipated crypto Christmas rally did not occur, Bitcoin's launch pad malfunctioned, and precious metals took off. If Bitcoin does not rise when tech stocks are up, and does not rise when gold and silver are up, then it may never rise.

Just a month ago, Peter Schiff was at a disadvantage in a debate with CZ about the "value of gold and Bitcoin."

What was once expected to be a year of policy dividends ultimately ended with Bitcoin closing down for the year, and the performance of other crypto assets was even more dismal. According to CoinGecko data, this year only RWA, Layer1, and the U.S. domestic narrative sector recorded increases, while other sectors experienced double-digit declines, with the market lacking a profit-making effect.

Capital is always profit-seeking. When traditional markets offer more certain returns, the attractiveness of crypto assets plummets. To retain liquidity and users, many crypto platforms have begun to offer related traditional assets, such as Binance, Kraken, Bitget, Hyperliquid, and Robinhood providing tokenized stock services; on-chain commodities are also on the rise, with tokenized gold trading volume surging; some crypto DAT companies have even started to include gold in their reserve assets to enhance the robustness of their balance sheets, etc. (Related reading: After the crazy rise of gold and silver, on-chain commodity trading is heating up)

Guard Your Circle of Competence, Don't Be the "Fool" at the Table

Crypto capital and attention are flowing out, and even the "crypto trading powerhouse" South Korea is showing clear signs of cooling down, with retail investors abandoning coins for stocks, trying to find more stable and sustainable returns in a larger pool.

However, as Buffett's "fool at the table" theory suggests, entering a new arena does not equate to having the qualifications to stay at the table.

Taking the U.S. stock market as an example, for most people, opening an account takes only a few minutes, but that does not mean the threshold is genuinely low. Compared to the crypto market, the U.S. stock market is a highly mature and deeply institutionalized system. The vast majority of retail investors face a comprehensive dimensionality reduction attack in terms of information, resources, tools, experience, and risk control capabilities.

In the crypto field, retail investors can still capture some frontline sentiment and structural changes through communities, social media, and on-chain data, and even dance with the market makers at certain moments. In the U.S. stock market, however, those on the opposite side often possess quantitative models, experienced analyst teams, industry research channels, and long-term data accumulation, making the competition level incomparable.

Moreover, many investors transitioning from the crypto space to the U.S. stock market have not synchronized their cognitive framework upgrades. When faced with complex variables such as financial statements, industry barriers, business models, and macro policies, they still rely on the emotional speculation and short-term thinking used in crypto trading, lacking the ability to understand and grasp the complete business cycle.

The reason the U.S. stock market has been able to emerge from a long-term bull market is more due to the continuous improvement of corporate profitability, a clear and stable shareholder return mechanism, and a long-term competitive environment of survival of the fittest. Companies like Microsoft, Amazon, Google, and Apple have all undergone several rounds of cyclical tests, ultimately weathering volatility and achieving value accumulation.

More importantly, many newcomers are in a severe survivor bias. After the darkest moments following the 2009 financial crisis, the U.S. stock market began the longest bull market in history. This means that young investors have not truly experienced the complete baptism of a deep bear market, and the favorable conditions have amplified their optimistic sentiment towards the market, mistaking the Beta returns brought by the market rise for Alpha created by their own abilities. According to a recent report released by Coinbase, about 45% of investors holding crypto assets in the U.S. come from the younger demographic.

What seems like a land of gold is, in fact, fraught with peril; the real threshold comes more from cognition. Rather than being led by narratives, it is better to guard your circle of competence, lower expectations, and patiently wait for the wind to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。