The main narrative of the cryptocurrency market in 2025 will no longer revolve around the technical cycles of a single public chain or the self-circulation of on-chain narratives, but will enter a deepened stage dominated by "external variable pricing and competition for financial entry." Policies and compliance frameworks will determine the access boundaries for long-term capital, while macro liquidity and risk appetite will dictate whether trends can continue. Derivative leverage and platform risk control mechanisms will reshape volatility patterns and drawdown speeds at critical junctures. More importantly, a key narrative that will be repeatedly validated by the market starting in 2025 is: what determines price elasticity is no longer just the "intensity of on-chain narratives," but rather through which entry points capital enters, what investable targets it lands on, and how it exits under pressure. External variables and internal evolution jointly drive the transformation of the cryptocurrency industry in 2025, further establishing two clear paths for the future development of the cryptocurrency industry.

Accelerated Institutionalization and Breakthrough in Securitization: The Dominant Phase of External Variables in the 2025 Cryptocurrency Market

"Financialization" underwent a structural shift in 2025. The ways in which capital enters are no longer limited to on-chain native leverage but have diversified into multiple parallel and clearly layered channels. Cryptocurrency allocation has expanded from a single "asset exposure (spot/ETF)" to a dual-line structure of "asset exposure + industrial equity," and market pricing has shifted from a single-axis drive of "narrative - position - leverage" to a comprehensive framework of "institution - capital flow - financing capability - risk transmission."

On one hand, standardized products (such as ETFs) incorporate cryptocurrency assets into the risk budget and passive allocation framework of investment portfolios; the expansion of stablecoin supply solidifies the on-chain US dollar settlement base, enhancing the market's endogenous settlement and turnover capabilities; corporate treasury (DAT) strategies directly map the financing capabilities and balance sheet expansions of listed companies to the spot demand function. On the other hand, cryptocurrency companies have "securitized" licenses, custody, trading, clearing, and institutional service capabilities into publicly traded company stocks through IPOs, allowing institutional capital to purchase cash flows and compliance moats of cryptocurrency financial infrastructure in a familiar manner for the first time, and introducing a clearer benchmarking system and exit mechanism.

In the capital structure, IPOs play the role of "buying industry, buying cash flow, buying compliance capability." This path rapidly opened up in 2025, becoming one of the preferred choices for leading cryptocurrency companies and an external variable in the cryptocurrency industry.

In the previous five years, this path had not been clearly defined, not because the public market formally closed off the listing of cryptocurrency companies, but because the practical aspects of listing had long been in a state of "high barriers, difficult pricing, and difficult underwriting": on one hand, the unclear regulatory stance combined with high-intensity enforcement required core businesses such as trading, brokerage, custody, and issuance to endure higher densities of legal uncertainty disclosures and risk discounts in their prospectus materials (for example, the SEC sued Coinbase in 2023, accusing it of operating as an unregistered exchange/broker/clearinghouse, reinforcing the uncertainty of "business nature possibly being retroactively determined"). On the other hand, the tightening of accounting and auditing standards for custody-type businesses raised compliance costs and the threshold for institutional cooperation (for example, SAB 121 proposed stricter asset/liability presentation requirements for "custody of cryptocurrency assets for clients," which the market widely believes significantly increased the asset burden and audit friction for financial institutions engaging in cryptocurrency custody business). At the same time, industry credit shocks and macro tightening compounded, leading to a contraction in the overall IPO window in the US stock market, with many projects preferring to delay or change direction even if they wanted to leverage the public market (e.g., Circle terminated its SPAC merger at the end of 2022, and Bullish halted its SPAC listing plan in 2022). More critically, from the perspective of execution in the primary market, these uncertainties would be magnified into real "underwriting frictions": underwriters need to conduct stress tests through internal compliance and risk committees during the project initiation phase to assess whether business boundaries might be retroactively determined, whether key revenues might be reclassified, whether custody and client asset isolation would introduce additional balance sheet burdens, and whether potential enforcement/litigation might trigger significant disclosure and compensation risks; once these issues are difficult to standardize and explain, it leads to significantly increased due diligence and legal costs, longer risk factors in the prospectus, and unstable order quality, ultimately reflecting in more conservative valuation ranges and higher risk discounts. For issuing companies, this directly changes strategic choices: rather than pushing forward in an environment where "explanation costs are high, pricing is suppressed, and post-listing volatility is uncontrollable," it is better to delay issuance, turn to private financing, or seek mergers/acquisitions/other paths. The aforementioned constraints collectively determined that, at that stage, IPOs were more like a "multiple-choice question" for a few companies rather than a sustainable financing and pricing mechanism.

The key change in 2025 is that the aforementioned resistance has seen a clearer "relief/mitigation," allowing the listing path to regain continuity expectations. One of the most representative signals is the SEC's release of SAB 122 in January 2025 and the withdrawal of SAB 121 (effective that month), which directly removed the most controversial and "heavy asset burden" accounting obstacles for institutions participating in custody and related businesses, improving the scalability of the banking/custody chain and reducing the structural burden and uncertainty discount for related companies at the prospectus level. During the same period, the SEC established a cryptocurrency asset working group and signaled the advancement of a clearer regulatory framework, lowering the uncertainty premium regarding "whether rules will change or be retroactive"; meanwhile, legislative progress in the stablecoin sector further provided "framework-level" certainty, making it easier for stablecoins, clearing, and institutional services to be incorporated into the valuation system by traditional capital in an auditable and comparable manner.

These changes will rapidly transmit along the execution chain of the primary market: for underwriters, it becomes easier to transform from "inexplicable, unpriceable" to "disclosable, measurable, comparable" compliance conditions—conditions that can be written into the prospectus and compared horizontally by buyers, making it easier for the underwriting syndicate to provide valuation ranges, grasp issuance rhythms, and invest in research coverage and distribution resources. For issuing companies, this means that IPOs are no longer just a "financing action," but a process that engineers revenue quality, client asset protection, internal control, and governance structure into "investable assets." Furthermore, although the US stock market does not have a clear "cornerstone investor" system like the Hong Kong stock market, anchor orders and long-term accounts (large mutual funds, sovereign funds, some crossover funds) during the book-building phase function similarly: when regulatory and accounting frictions ease and industry credit risks clear, high-quality demand is more likely to return to the order book, helping stabilize pricing and ensure more continuous issuance, thus making IPOs more likely to transition from "occasional windows" back to "sustainable financing and pricing mechanisms."

Ultimately, the marginal improvements in policies and accounting standards will specifically reflect the rhythm of the annual market and the flow of funds through the primary market and capital allocation chain. From the perspective of the annual development in 2025, the aforementioned structural changes resemble a relay-style manifestation.

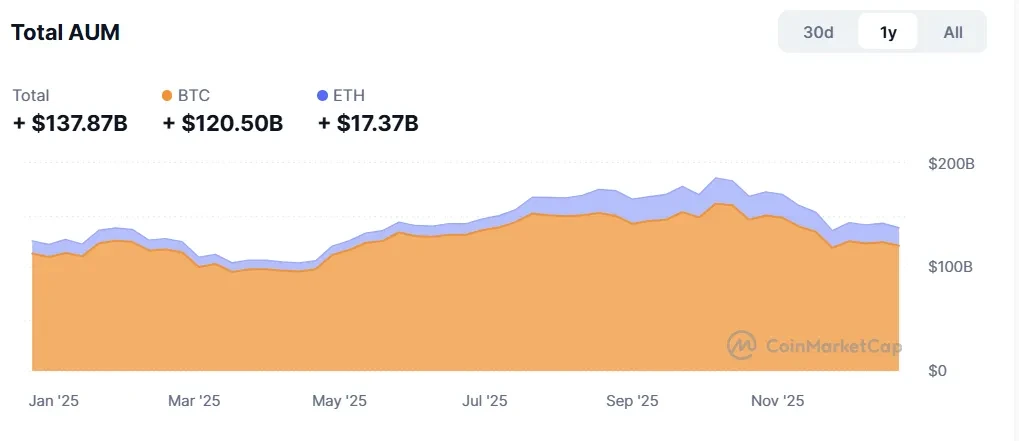

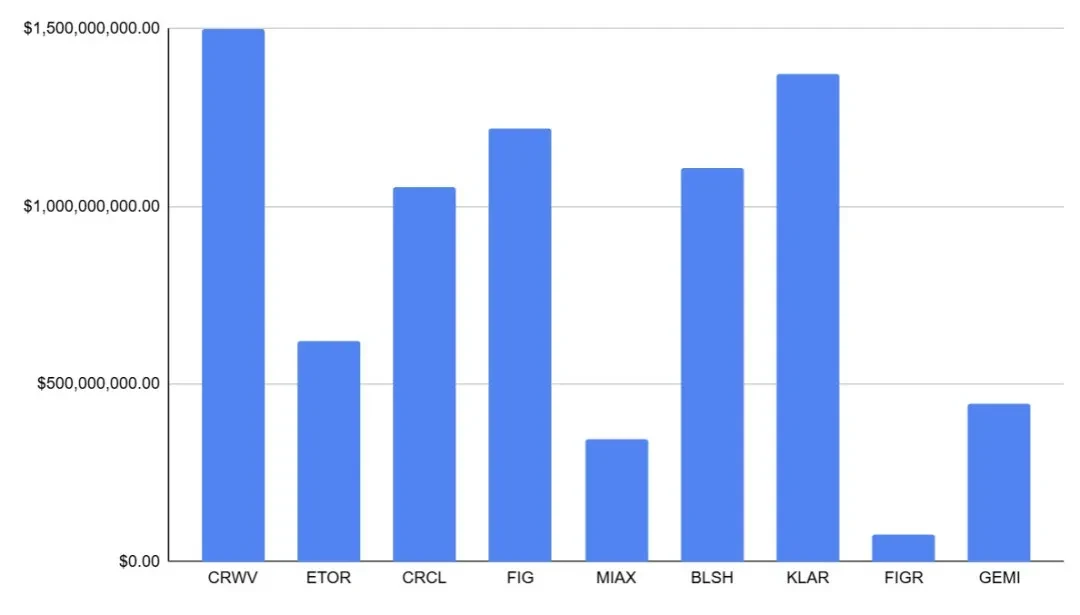

At the beginning of 2025, the convergence of regulatory discounts drove a reassessment of institutional expectations, with core assets benefiting first from clearer allocation paths; subsequently, the market entered a repeated confirmation period regarding macro hard boundaries, with interest rate paths and fiscal policies embedding cryptocurrency assets more deeply into the volatility models of global risk assets (especially US growth stocks). By mid-year, the reflexivity of DAT gradually became evident: the number of listed companies adopting treasury strategies rose to hundreds, with a total holding scale reaching the level of hundreds of billions of dollars, making balance sheet expansion an important source of marginal demand; at the same time, the configuration related to ETH heated up, making the transmission of "balance sheet expansion - spot demand" no longer solely revolve around BTC. By the third and fourth quarters, against the backdrop of multiple parallel channels and the rebalancing of funds between different entry points, the valuation center and issuance conditions of the public market began to more directly influence the capital allocation in the cryptocurrency sector: whether issuance was smooth and whether pricing was recognized gradually became a barometer for measuring "industrial financing capability and compliance premium," indirectly transmitting through the reallocation of funds between "buying coins/buying stocks" to spot pricing. As companies like Circle provided "valuation anchors" and more companies advanced their listing applications and preparations, IPOs evolved from "pricing references" to core variables affecting capital structure: ETFs primarily address the question of "can it be allocated, how to include it in the portfolio," while IPOs further resolve "what to allocate, how to benchmark, how to exit," driving some funds from the high-turnover on-chain leverage ecosystem to more long-term industrial equity allocations.

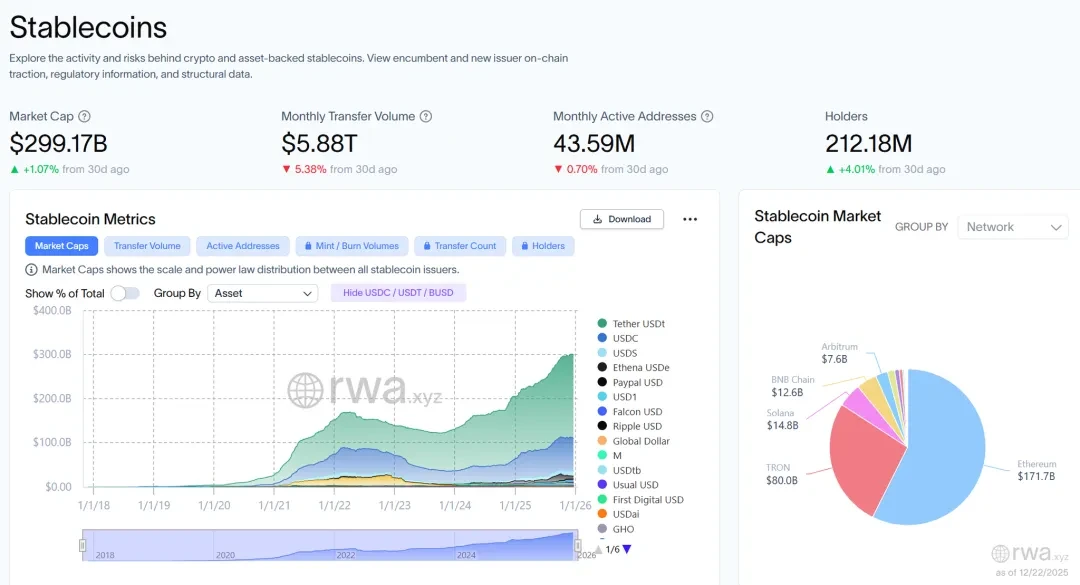

More importantly, this "entry competition" is not merely a theoretical framework but can be directly observed in capital data and market behavior. Stablecoins, as the on-chain US dollar settlement base, saw their supply scale rise from approximately $20.5 billion to the $30 billion range in 2025, stabilizing near the end of the year, providing a thicker settlement and liquidity buffer for on-chain trading expansion and deleveraging; ETF capital flows settled as explicit pricing factors, and under macro volatility and institutional rebalancing disturbances, IBIT still achieved a net inflow of approximately $25.4 billion for the year, increasing the explanatory power of "net flow/rebalancing rhythm" on price elasticity; the scaling of DAT caused the balance sheets of listed companies to begin directly affecting the spot supply-demand structure, potentially reinforcing trend expansion during upswings, while during downturns, valuation premium contractions and financing constraints could trigger reverse transmission, thereby coupling the volatility of traditional capital markets with the cryptocurrency market. Meanwhile, IPOs also provided another set of quantitative evidence: in 2025, a total of 9 cryptocurrency/crypto-related companies completed IPOs, raising approximately $7.74 billion, indicating that the public market financing window not only exists but also has real carrying capacity.

Source: rwa.xyz / Growth of Stablecoins in 2025

Source: CoinMarketCap / Annual Data on ETF Capital

Source: Pantera Research Lab / DAT Data

In this context, IPOs have become the "external structural variable" of the cryptocurrency market in 2025: on one hand, it expands the range of compliant capital that can be allocated, providing public market valuation anchors and benchmarking systems for stablecoins, trading/clearing, brokerage, and custody; on the other hand, its marginal increment is not linear and will still be constrained by macro risk appetite, secondary market valuation centers, and issuance windows.

Overall, 2025 can be summarized as a year of "accelerated institutionalization, reinforced macro constraints, and the restart of securitization": the advancement of institutional and compliance pathways has increased the configurability of cryptocurrency assets, expanding the capital entry from a single on-chain structure to a parallel system of ETFs, stablecoin bases, DAT, and IPOs; at the same time, interest rates, tariffs, and fiscal frictions continue to shape liquidity boundaries, making market trends closer to the "macro-driven volatility" of traditional risk assets. The resulting differentiation in sectors and the return of "listed company vehicles" will constitute an important prelude to 2026.

IPO Window Warming: From Narrative Premium to Financial Lexicon

In 2025, the IPO window for cryptocurrency-related companies in the US stock market showed a significant recovery, evolving from a "conceptual window opening" into a set of publicly marketable samples that can be quantitatively tested: throughout the year, a total of 9 cryptocurrency/crypto-related companies completed IPOs, raising approximately $7.74 billion, indicating that the public market has restored its capacity to absorb financing for "compliant and accessible digital financial assets" to a considerable scale, rather than just symbolic small amounts. In terms of valuation, this group of IPOs covered a range of approximately $1.8 billion to $23 billion, essentially encompassing stablecoins and digital financial infrastructure, compliant trading platforms and trading/clearing infrastructure, regulated brokerage channels, as well as on-chain credit/RWA and other key segments, allowing the industry to begin building a sample pool of equity assets that can be tracked and benchmarked; this not only provides valuation anchors for the "stablecoin - trading - brokerage - institutional services - on-chain credit/RWA" chain but also allows the market's pricing language for cryptocurrency companies to systematically migrate towards a financial institutional framework (emphasizing compliance and licensing, risk control and operational resilience, revenue quality and sustainable profits). In terms of market performance, the 2025 sample generally exhibited a common characteristic of "strong initial public offerings followed by rapid differentiation": many companies had tight initial circulation (approximately 7.6%–26.5%), making short-term price discovery more elastic when the risk appetite window opened; the overall secondary market was strong on the first day, with some targets experiencing double-digit re-pricing, while many others also achieved double-digit positive returns, and several companies maintained their strength in the first week and month, reflecting that buyers had a "sustained absorption" of such assets during the window period rather than a one-time pricing; however, differentiation significantly increased after 1–6 months, aligning more closely with the traditional risk asset logic of "macro + quality"—companies more focused on retail and trading businesses were more sensitive to shifts in risk appetite and experienced quicker drawdowns, while assets more focused on upstream infrastructure and institutional absorption capabilities were more likely to receive sustained re-ratings.

Source: nasdaq.com / Total IPO Amounts of Cryptocurrency Companies in the US Stock Market in 2025

More critically, the "return" of US stock market cryptocurrency company IPOs has been highly sought after because it simultaneously meets three key concerns of the public market during a window period: buyable, comparable, and exitable. First, it transforms the previously hard-to-access "cash flows of cryptocurrency financial infrastructure" into stock assets that traditional accounts can directly hold, naturally fitting the compliance and risk control frameworks of long-term funds such as mutual funds, pensions, and sovereign funds; second, the IPO provides the industry with a batch of horizontally comparable equity samples for the first time, allowing buyers to no longer rely solely on "narrative intensity/transaction volume extrapolation" for valuation but to layer it using familiar financial institutional language—compliance costs and licensing barriers, risk preparedness and internal control governance, customer structure and retention, revenue quality and capital efficiency—when pricing methods become more standardized, buyers are more willing to offer higher certainty premiums during the window period; third, the IPO shifts the exit mechanism from "on-chain liquidity and emotional cycles" partially to "public market liquidity + market making/research coverage + index and institutional rebalancing," enabling funds to confidently provide stronger order quality during the issuance phase (including more stable long-term demand and anchor orders), which in turn reinforces the re-pricing momentum during the initial public offering phase. In other words, the enthusiasm is not solely driven by risk appetite but stems from the risk premium decline brought about by "institutional accessibility": when assets become easier to audit, easier to compare, and easier to incorporate into risk budgets, the public market is more willing to pay a premium for them.

Among these, Circle serves as the most representative case of a "stablecoin sector equity valuation anchor": its IPO was priced at $31, raising approximately $1.054 billion, corresponding to an IPO valuation of about $6.45 billion, while the secondary market strongly re-priced it during the window period—approximately +168.5% on the first day, +243.7% in the first week, +501.9% in the first month, peaking at $298.99 with a maximum increase of about +864.5%, and even maintaining around +182.1% over a six-month sample point. The significance of Circle lies not in the "increase itself," but in its transformation of "stablecoins" from assets that previously relied more on on-chain growth narratives to being priced by the market for the first time as a type of auditable, comparable, and risk-budgetable "financial infrastructure cash flow": compliance moats and settlement network effects are no longer just concepts but are directly reflected in the elevation of valuation centers through issuance pricing and sustained secondary absorption. At the same time, Circle also validates the typical "buying method" of the US stock market for such assets—when the window opens, a small circulation combined with high-quality buyer demand amplifies price elasticity; however, after the window shrinks, valuations return more quickly to fundamental realizations, with cyclical sensitivity and profit quality differentiation. This also constitutes our core reason for being optimistic about US stock market cryptocurrency company IPOs: the public market does not indiscriminately raise valuations, but it completes layering more quickly and clearly, and once high-quality assets establish benchmark valuations in the public market, their capital costs will decrease, refinancing and acquisition currencies will be stronger, and the positive cycle of growth and compliance investment will be easier to realize—this is more important than short-term fluctuations.

Looking ahead to 2026, the market focus will shift from "whether a window exists" to "whether subsequent listing projects can continue to advance and form a more continuous issuance rhythm." According to current market expectations, potential candidates include Anchorage Digital, Upbit, OKX, Securitize, Kraken, Ledger, BitGo, Tether, Polymarket, Consensus, etc., totaling about 10 companies, covering a more complete industrial chain from custody and institutional compliance entry, trading platforms and brokerage channels, stablecoins and settlement bases, asset tokenization and compliant issuance infrastructure, to hardware security and new information markets. If these projects can continue to land in the public market and receive relatively stable capital absorption, their significance will not only be "a few more financing deals" but will further standardize investors' logic of buying into cryptocurrency companies: they will be more willing to pay premiums for compliance moats, risk control and governance, revenue quality, and capital efficiency, while also being quicker to filter through valuation centers and secondary performance during macro headwinds or weakened issuance conditions. Overall, we are optimistic about the directional trend of US stock market cryptocurrency company IPOs: 2025 has already validated the public market's absorption capacity through quantity, financing scale, and market re-pricing; and if 2026 can continue this trend of "continuous issuance + stable absorption," IPOs will resemble a sustainable capital cycle—pushing the industry from a "narrative-driven phase of market fluctuations" further towards "sustainable pricing in the public market," allowing companies with genuine compliance and cash flow quality to continuously expand their leading advantages at lower capital costs.

Industry Structural Differentiation and Product Line Formation: Internal Evolution of the Cryptocurrency Industry

To determine whether this public market path can continue and which companies are more likely to be "accepted" by the market, the key is not to reiterate "whether a window exists," but to return to the structural evolution that has already occurred within the industry in 2025: growth drivers are shifting from single-point narratives to multiple sustainable product lines, forming volatility and differentiation mechanisms that are closer to traditional risk assets under macro and regulatory constraints—it is within this mechanism that the capital market will decide which business models deserve a more stable valuation center and lower capital costs.

In 2025, the structural changes within the cryptocurrency industry became clearer than ever: market growth no longer primarily relies on risk appetite spillover driven by a single narrative but is jointly driven by several more sustainable "product lines"—trading infrastructure is becoming more specialized, application forms are closer to mainstream finance, and capital entry is more compliant, gradually forming a closed loop across on-chain and off-chain. Meanwhile, capital behavior and pricing rhythms are more deeply integrated into the global risk asset framework: volatility resembles "risk budget rebalancing under macro windows," rather than the relatively independent market driven primarily by on-chain narratives and internal liquidity cycles of the past. For practitioners, this means that the focus of discussion shifts from "which narrative will explode" to "which products can stably generate transactions, retain liquidity, and withstand the pressure tests of macro volatility and regulatory constraints."

Within this framework, the traditional "four-year cycle of cryptocurrency" further weakens in 2025. The cycle logic has not disappeared, but its explanatory power has been significantly diluted: ETFs, stablecoins, corporate treasuries, and other channels have brought larger volumes of funds into observable and rebalancable asset allocation systems; at the same time, interest rates and US dollar liquidity boundaries have become harder constraints, making risk budgets, leverage pricing, and deleveraging paths closer to traditional markets. The result is that upward movements increasingly depend on the resonance of "macro risk appetite + net inflows," while downward movements are more easily amplified in "liquidity tightening + leverage reduction." The performance of various sectors throughout the year resembles a set of collaborative evolutions: what truly drives structural upgrades is not the explosion of a single narrative, but rather the continuous thickening of funding entry and trading scenarios through stablecoin expansion, deepening derivatives, and event contracts, while simultaneously reinforcing risk transmission.

Stablecoins in 2025 exhibited two main lines advancing simultaneously, but with different rhythms: one is "compliance certainty elevation," and the other is "cyclical fluctuations of yield models." The key to the former is that, with the emergence of compliance frameworks and more comparable market samples, the stablecoin business model is more easily priced by mainstream funds based on cash flow and risk attributes; the latter is reflected in yield-type/synthetic dollars being highly sensitive to basis, hedging costs, and risk budgets, showing significant contraction after expansion. Taking Ethena's USDe as an example, its supply approached a high of nearly $15 billion in early October, then fell back to around $8.5 billion in November, and experienced a brief decoupling during the deleveraging window in mid-October. The industry-level insight is that yield-type stablecoins are closer to "amplifiers of macro and basis"—contributing liquidity during favorable conditions and amplifying volatility and risk re-pricing during adverse conditions.

The upgrade of trading infrastructure accelerated in 2025, centered around on-chain derivatives. Platforms like Hyperliquid continuously approached centralized exchanges in terms of depth, matching, capital efficiency, and risk control experience, achieving a monthly transaction volume of approximately $300 billion by mid-year, indicating that on-chain derivatives have the foundational capacity for scaling. Meanwhile, new entrants like Aster and Lighter are pushing the sector from "single platform dividends" to "market share competition" through product structure, fees, and incentive systems. The essence of competition lies not in short-term trading volume but in whether usable depth, clearing order, and stable risk frameworks can be maintained during extreme market conditions; the expansion of derivatives also makes volatility more "macro-oriented"—when interest rates and risk appetite shift, on-chain and off-chain deleveraging often occurs more synchronously and rapidly.

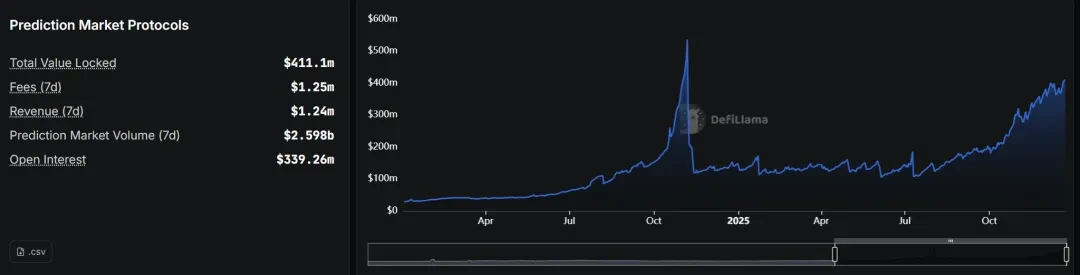

Prediction Markets expanded in 2025 from crypto-native applications to a broader event contract market, becoming a new incremental trading scenario. Represented by platforms like Polymarket, the participation and trading volume of event contracts significantly increased; monthly trading volume grew from less than $100 million in early 2024 to over $13 billion in November 2025, with sports and politics becoming the main categories. The deeper significance lies in the fact that event contracts transform macro and public issues into tradable probability curves, naturally fitting media dissemination and information distribution, making it easier to form cross-layer user entry points, and further strengthening the coupling between crypto and macro variables (even political variables).

Overall, the structural upgrade in 2025 is pushing the industry from "narrative-driven price discovery" to "product-driven capital organization." The layering of stablecoins, the infrastructuralization of on-chain derivatives, and the contextualization of event contracts collectively expanded funding entry and trading scenarios, allowing for faster and more systematic risk transmission; against the backdrop of enhanced macro and interest rate constraints, the market cycle structure further aligns with mainstream risk assets, while the explanatory power of the four-year cycle continues to weaken.

Dual Main Lines of Stablecoins: Compliance Certainty and Yield Cycles

In 2025, stablecoins upgraded from on-chain trading mediums to the dollar settlement layer and funding base of the crypto system, achieving clear layering: USDT/USDC continued to form the mainstream fiat stablecoin "cash layer," providing a liquidity network covering global trading and settlement; yield-type/synthetic dollars like USDe/USDF became more like "efficiency tools" driven by risk appetite and basis, exhibiting significant cyclicality in expansion and contraction.

The most direct signal throughout the year was the substantial thickening of the on-chain dollar base: the total supply of stablecoins expanded from approximately $205 billion to over $300 billion, highly concentrated at the top (around $186.7 billion for USDT and $77 billion for USDC by year-end); issuers collectively held about $155 billion in U.S. Treasury bonds, bringing stablecoins closer to a "tokenized cash + short-duration Treasury" infrastructure combination. The usage side also strengthened: stablecoins accounted for about 30% of on-chain crypto trading volume, with total on-chain activity exceeding $4 trillion for the year, and the scale of payment-type on-chain transactions estimated at $20–30 billion per day, with real demand for cross-border settlement and fund allocation continuing to rise.

On the institutional level, the GENIUS Act, implemented in July, incorporated requirements for licensed issuance, 1:1 reserves, redemption, and disclosure for payment-type stablecoins, and established access paths for foreign issuers, leading to the institutionalization of "compliance premiums": USDC benefited more from enhanced compliance and institutional availability, while USDT should not be simply classified as a compliant stablecoin under the U.S. framework; its advantage lies in the global liquidity network, but availability in the U.S. market will depend more on implementation details and channel compliance.

The yield-type sector completed its repositioning: taking Ethena's USDe as an example, supply fell from a high of about $14.8 billion in early October to around $6–7 billion by year-end, validating its structured attribute of "expansion in favorable conditions and contraction in adverse conditions."

Looking ahead to 2026, stablecoins remain the most certain growth trajectory: competition among mainstream fiat stablecoins will shift from scale to channels and settlement networks, while yield-type products will continue to provide liquidity in favorable conditions but will be priced more strictly based on stress testing and redemption resilience.

Upgrades of On-Chain Derivative Platforms and Share Wars

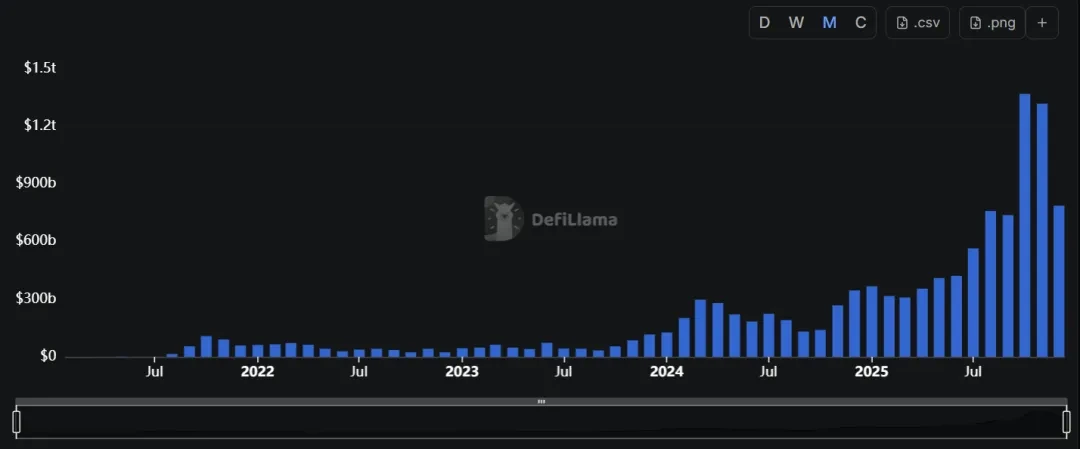

In 2025, on-chain perpetual contracts transitioned from "available products" to the infrastructure stage capable of "supporting mainstream trading": matching and latency, margin and clearing mechanisms, risk parameters, and risk control links became closer to the engineering standards of centralized exchanges, allowing on-chain derivatives to begin to have the capacity to divert mainstream transactions and participate in price discovery during certain periods. Meanwhile, capital and risk transmission became more "macro-oriented": during the window of risk appetite and interest rate expectations switching in the U.S. stock market, the volatility and deleveraging rhythm of on-chain perpetual contracts resonated more easily with traditional risk assets, significantly increasing the market cycle's sensitivity to "macro liquidity—risk budgets."

On the scale side, a sustainable trackable "on-chain derivatives market" has formed. As of the end of 2025, the 30-day trading volume of on-chain perpetual contracts was approximately $1.081 trillion, with the total market open interest around $15.4 billion, reflecting that this sector has the capacity to regularly support large-scale trading and risk exposure. Leading platforms still occupy the core mindset of "depth and risk control," but the competitive logic underwent substantial changes in 2025: the competition for market share no longer primarily relied on subsidies and the speed of listing, but shifted more towards depth, open interest accumulation, and the stability of clearing orders during extreme market conditions. For example, Hyperliquid had an open interest of about $6.88 billion and a 30-day trading volume of approximately $180.4 billion, reflecting "stronger risk exposure accumulation + relatively stable trading volume."

More encouragingly, new entrants in the second half of 2025 were no longer just conceptual challengers but joined the competition with quantifiable data, rewriting the share structure: Lighter had a 30-day trading volume of approximately $233.2 billion, a cumulative trading volume of about $1.272 trillion, and open interest of about $1.65 billion; Aster had a 30-day trading volume of approximately $194.4 billion, a cumulative trading volume of about $811.7 billion, and open interest of about $2.45 billion. According to open interest rankings, Hyperliquid, Aster, and Lighter are now in the top three (approximately $6.88 billion / $2.41 billion / $1.60 billion), indicating that the sector has entered a mature stage of "multi-platform parallel competition."

Source: DeFiLlama / On-Chain Perpetual Contract Trading Volume

For the industry, the competition in on-chain perpetual contracts in 2025 entered the "quality and resilience pricing" stage—trading volume can be amplified by short-term incentives, but the scale of open interest, the sustainability of fees/income, and risk control performance during extreme market conditions better reflect real capital retention and platform stickiness. Looking ahead to 2026, the sector is likely to evolve along two lines simultaneously: one is the continued increase in the penetration of on-chain derivatives; the other is that under fee compression and elevated risk control thresholds, the market will further concentrate on a few platforms capable of maintaining depth and clearing order over the long term. Whether new platforms can transition from scale sprinting to stable retention depends critically on their capital efficiency and risk framework under stress testing, rather than on the trading volume performance of a single phase.

Prediction Markets Transitioning from Crypto-Native to Event Contract Markets

In 2025, prediction markets completed an upgrade from phase-specific spikes to more independent, sustainable trading scenarios based on the "event contracts (probability pricing)" validated during the 2024 U.S. presidential election: they no longer primarily rely on short-term traffic from a single political event but instead, through high-frequency/reusable contract categories like sports, macro, and policy nodes, sediment "probability trading" into more stable trading demand and user habits. Due to the inherently externalized nature of event contract subjects (macro data, regulatory bills, elections, and sports schedules), the activity level of prediction markets significantly enhanced its linkage with U.S. stock market risk appetite and interest rate expectation switches, and the rhythm of industry applications further shifted from "crypto internal narrative cycles" to a function of "macro uncertainty × event density × risk budget."

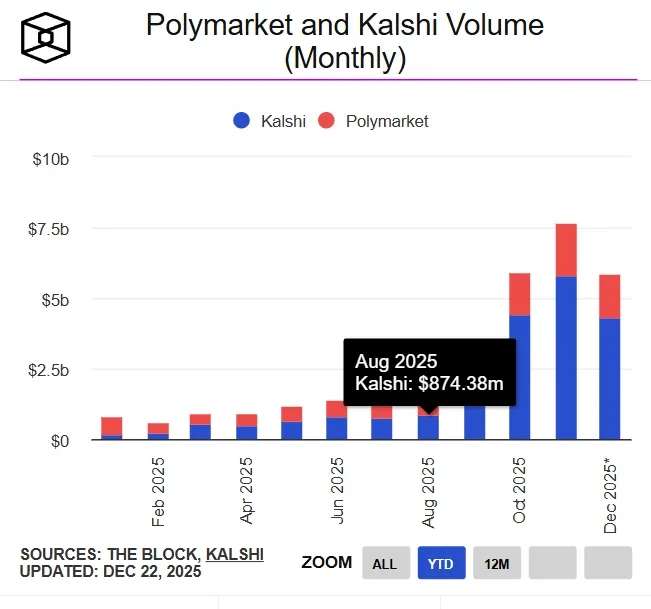

On the data level, the prediction market sector experienced exponential expansion in 2025: the total trading volume for the year was approximately $44 billion, with Polymarket at about $21.5 billion and Kalshi at about $17.1 billion, and the scale of leading platforms was sufficient to support stable market making and category expansion. Growth exhibited clear event-driven peaks throughout the year: monthly nominal trading volume surged from less than $100 million in early 2024 to over $13 billion in a single month in 2025 (with November as a representative month), demonstrating that high-attention event windows possess strong elasticity. Structurally, prediction markets evolved from being "politically spike-driven" to "sports high-frequency retention + multi-category event expansion": Kalshi's trading volume in November 2025 was approximately $5.8 billion, with about 91% coming from sports; the platform disclosed that its trading volume had reached over $1 billion per week, claiming a growth of over 1000% compared to 2024, reflecting that it has established a certain foundation for normalized trading.

Source: DeFiLlama / Overview of Prediction Market Data

Source: theblock.co / Trading Volume of Polymarket and Kalshi Markets

Combined with the previously mentioned capital structure changes and the industry shifts brought by cryptocurrency company IPOs, the prediction market sector rapidly upgraded from "crypto entrepreneurship" to "financial infrastructure/data assets": Kalshi completed $1 billion in financing in December, with a valuation of about $11 billion, and approximately $300 million in financing at a valuation of about $5 billion in the previous two months; at the same time, traditional market infrastructure players also began to enter with heavy capital, with reports that ICE (the parent company of the New York Stock Exchange) plans to invest up to $2 billion in Polymarket, giving it a pre-investment valuation of about $8 billion. The common implication of these transactions is that event contracts are not only seen as "trading products" but also as integrable market data, sentiment indicators, and risk pricing interfaces.

Looking ahead to 2026, prediction markets are likely to become one of the more structurally incremental elements with higher certainty in the crypto application layer: growth drivers will come from event density and information uncertainty, with commercialization moving closer to a combination of "transaction fees + data products + distribution channels." If compliance paths, distribution entry points, and dispute resolution standards become clearer, prediction markets are expected to transition from phase-specific blockbusters to more normalized event risk trading and hedging tools; their long-term ceiling will primarily depend on three hard indicators: real depth (capable of supporting large amounts), reliable settlement and dispute governance, and controllable compliance boundaries.

Conclusion

Looking back at 2025, the core characteristics of the crypto market are the externalization of pricing frameworks and the deepening of channel competition: funding entry shifted from an endogenous cycle driven by on-chain leverage and narratives to a multi-channel system formed by ETFs, stablecoin dollar bases, corporate treasuries, and equity channels (cryptocurrency company IPOs in the U.S.). The expansion of channels enhanced asset configurability and reinforced macro boundary conditions—market trends increasingly depend on the coordination of net inflows and financing windows, while drawdowns are more easily concentrated and released in deleveraging and clearing chains.

The internal structural evolution of the industry further confirms this migration: stablecoins have completed layering between the "cash layer" and "efficiency tools," on-chain derivatives have entered the stage of scaled capacity and share competition, and prediction markets and event contracts have formed more independent trading scenarios. More importantly, the return of IPOs has "securitized" crypto financial infrastructure into auditable, benchmarkable, and exitable equity assets, allowing mainstream capital to participate in a more familiar way and driving the valuation system towards "compliance moats, risk control governance, income quality, and capital efficiency"—this is the core basis for our optimism in this direction.

Looking ahead to 2026, the industry's slope is more likely to depend on three variables: whether institutional channels can continue, whether capital retention is sustainable, and the resilience of leverage and risk control under stress scenarios. Among them, if U.S. stock market crypto company IPOs can maintain more continuous advancement and stable absorption, they will continue to provide valuation anchors and financing flexibility, reinforcing the industry's shift towards sustainable pricing in the public market.

Reference Links

https://app.rwa.xyz/stablecoins

https://coinmarketcap.com/etf/

https://datboard.panteraresearchlab.xyz/

https://defillama.com/perps

https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting

ArkStream Capital is a crypto fund founded by native cryptocurrency individuals, encompassing primary market and liquidity strategies, investing in web3 native and cutting-edge innovations, dedicated to promoting the growth of web3 founders and unicorns. The ArkStream Capital team entered the cryptocurrency field in 2015, coming from MIT, Stanford, UBS, Accenture, Tencent, Google, and other universities and companies. The portfolio includes over 100 blockchain companies, including Aave, Sei, Manta, Flow, Fhenix, Merlin, Avail, Space and Time, among others.

Website: https://arkstream.capital/

Medium: https://arkstreamcapital.medium.com/

Twitter: https://twitter.com/arkstream_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。