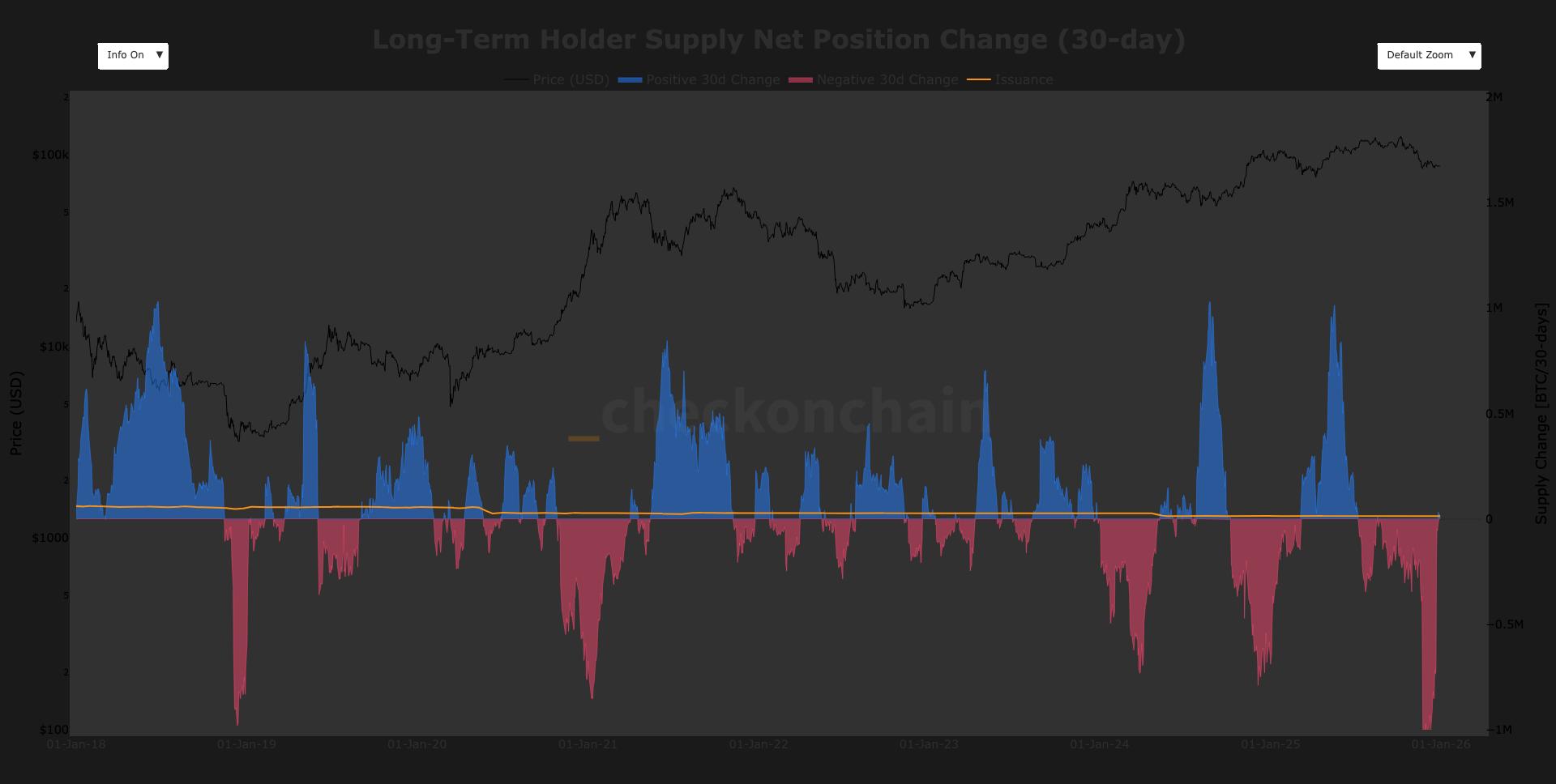

What to know : Long-term holders have recorded a positive 30-day net position change, accumulating around 33,000 BTC as recent buyers mature into holders. During this current correction, long term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019. This marked the third major wave of long term holder selling this cycle, following distribution in March and November 2024.

Long-term holders (LTH) of bitcoin have shifted back into accumulation for the first time since July.

LTHs, defined as entities that have held bitcoin for at least 155 days, have accumulated roughly 33,000 BTC on a 30-day net basis, according to onchain data analysts checkonchain.

Selling from LTHs has been one of the two of the largest sources of sell pressure this year along with miner capitulation.

LTHs were a major source of distribution, while miners are typically forced to sell bitcoin while mining at a loss.

Since it takes 155 days for short-term holders to transition into long-term holders, this suggests that buyers from the past six months are now becoming long-term holders and are outpacing the distribution.

LTHs sold more than 1 million BTC during the 36% correction from October, marking the largest sell-pressure event from this cohort since 2019, a period that ultimately coincided with the bear market low that year, with bitcoin at around $3,200.

The October sell-off was the third LTH distribution phase since the current cycle began in 2023. The first occurred in March 2024 when bitcoin reached $73,000 and over 700,000 BTC were sold, while the second took place that November when bitcoin reached $100,000 and more than 750,000 BTC were distributed by LTHs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。