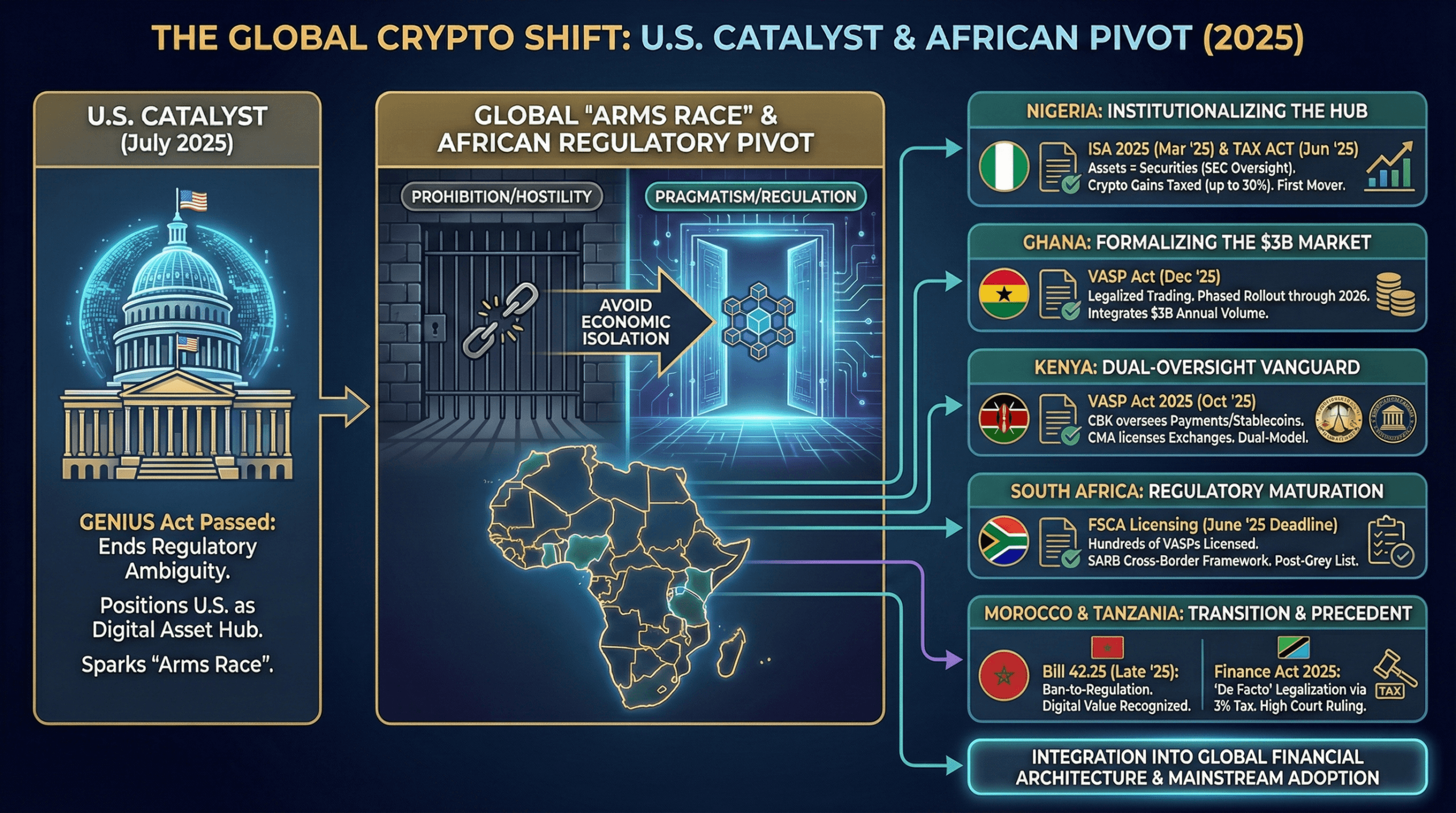

The Trump administration’s aggressive pivot to establish the United States as the global epicenter for digital assets has ignited a high-stakes “arms race” for the capital and human talent that underpin the blockchain economy. This seismic shift was codified on July 18, 2025, with the passage of the GENIUS Act, a legislative landmark that effectively ended the era of regulatory ambiguity. The Act served as a global catalyst, forcing previously hostile jurisdictions—most notably across the African continent—to rapidly dismantle prohibitive frameworks and race toward institutional integration to avoid economic obsolescence.

Although the conditions in many African countries made digital currencies an ideal means for storing value or transacting, governments and regulators were, until recently, very opposed to them. In some jurisdictions, residents engaging in cryptocurrency use or trading may be subject to criminal prosecution and imprisonment. However, as the U.S. government—which had also fought against cryptocurrency companies—began dismantling regulations targeting the crypto industry, African countries had a “light bulb” moment.

Suddenly, they began to describe cryptocurrencies and stablecoins as innovations that could change the cross-border payments landscape. Indeed, the Trump administration’s embrace of cryptocurrencies has pushed them into the mainstream, and the race is now on to see which countries will adopt “full crypto.”

Below is a list of African nations that have taken significant steps toward embracing cryptocurrencies, dismantling regulatory barriers, and paving the way for broader adoption.

The race for regional crypto-dominance was blown wide open in December 2025 when Ghana announced the passage of the Virtual Asset Service Providers (VASP) Act. This landmark legislation effectively legalized cryptocurrency trading, transitioning an estimated $3 billion in annual transaction volume from a legal gray area into a structured, accountable ecosystem.

As outlined by Bank of Ghana governor Johnson Asiama, the Act introduces a sophisticated dual-regulatory gateway. Depending on the nature of their business, entities must secure approval from the central bank or the Securities and Exchange Commission (SEC). However, rather than an overnight “big bang” implementation, Ghana is executing a phased rollout through 2026.

This begins with a mandatory registration period to map the existing market—which already includes over 3 million active users—followed by stringent licensing requirements involving cybersecurity audits, capital adequacy ratios, and full compliance with the FATF Travel Rule. By formalizing these flows, Ghana isn’t just regulating a trend; it is integrating digital assets into the very fabric of its national financial architecture.

While Ghana left it late to make a decisive move, Nigeria—home to Africa’s largest crypto market—was one of the first countries on the continent to attempt to bring digital assets into the formal economy. The Investments and Securities Act (ISA) 2025, signed into law by President Bola Ahmed Tinubu on March 29, 2025, formally recognizes virtual assets as securities. The cornerstone of this legislation is Section 357, which provides a radical expansion of the definition of “securities” to include virtual and digital assets.

The ISA places them under the regulatory authority of the SEC, effectively ending the confusion over which regulator should oversee cryptocurrencies.

Read more: SEC Nigeria to Regulate Virtual Asset Service Providers Under New Law

The legitimization of the sector was further reinforced on June 26, 2025, with the signing of the Nigeria Tax Act (NTA) 2025. This legislative package did more than just “tax crypto”; it redefined gains from digital asset liquidations as chargeable gains, subject to a progressive income tax of up to 25% for individuals and 30% for corporate entities.

Kenya, one of Africa’s largest crypto markets, significantly advanced its regulatory framework when President William Ruto assented to the Virtual Asset Service Providers (VASP) Act 2025 on Oct. 15, 2025. The act officially commenced on Nov. 4, 2025. Unlike other African countries, Kenya’s VASP Act established a dual-oversight model: The Central Bank of Kenya (CBK) oversees payments and stablecoins, while the Capital Markets Authority (CMA) licenses exchanges.

After the Financial Action Task Force (FATF) added it to its “grey list” in February 2023 due to concerns over its unregulated digital asset market, South Africa immediately began taking steps to formalize cryptocurrencies. In 2024, South Africa issued licenses to crypto exchanges and other related entities, making it the first African country to do so.

Since then, it has issued more licenses, and in June 2025, the Financial Sector Conduct Authority (FSCA) enforced a hard deadline for all VASPs to be licensed or exit the market. According to Bitcoin.com News, by Dec. 10, 2025, the FSCA had received a total of 420 applications, with 248 approved and nine declined.

During the year, the South African Reserve Bank (SARB) introduced a targeted framework to regulate cross-border crypto transfers to prevent illicit financial flows and address exchange control loopholes.

Morocco’s pivot in 2025 is a textbook example of a “ban-to-regulation” transition. It was driven by the realization that high adoption rates—with more than 1 million Moroccans holding crypto despite the ban—made the 2017 prohibition ineffective.

The shift is crystallized in Bill 42.25, a legislative package published in late 2025 by the Ministry of Economy and Finance in collaboration with the central bank (Bank Al-Maghrib or BAM) and the capital markets watchdog (AMMC). Under the legislation, cryptocurrencies are recognized as a “digital representation of value” that can be held, traded, or resold—essentially treating them like virtual shares or bonds.

Tanzania’s stance in 2025 has become a “de facto” legalization. While the Bank of Tanzania (BoT) still officially labels crypto as “not legal tender,” the government has pivoted to taxing it, creating a legal precedent for its existence.

Under the Finance Act 2025, Tanzania implemented a 3% withholding tax on the gross value of digital asset transfers or exchanges. Furthermore, in a landmark December 2024 ruling that carried into early 2025, the High Court of Tanzania ruled that because the government taxes digital assets, they cannot be considered “illegal.” This effectively overruled the 2019 ban and forced the BoT to begin drafting formal VASP guidelines.

A new section of the Finance Act, gazette via Statutory Instrument 80 of 2025, amends the Securities and Exchange Act to create a formal regulatory universe for virtual assets. By defining these assets in law, Zimbabwe is signaling that cryptocurrencies are now a legitimate, taxable, and bankable asset class.

Under this regime, any entity acting as a VASP—including exchanges, custodians, and issuers—must be licensed by the Securities and Exchange Commission of Zimbabwe (SECZ). Operating without a license after April 30, 2026, will be a criminal offense. The reform is seen as providing the “legal certainty” required for pension funds and banks to finally engage with digital assets.

- Why did African countries shift on crypto? U.S. passage of the GENIUS Act in July 2025 forced global regulatory recalibration.

- Which African nation moved first? Nigeria led with the ISA 2025, formally recognizing digital assets as securities.

- How is Ghana approaching regulation? Ghana’s VASP Act 2025 legalized crypto trading with a phased rollout through 2026.

- What’s the regional impact? Kenya, South Africa, Morocco, Tanzania, and Zimbabwe followed with laws to integrate crypto into finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。