Original Author: StacyMuur

Original Compilation: Deep Tide TechFlow

If you participated in the Token Generation Event (TGE) trading of 2025, you might be familiar with this default script: a bustling first week, followed by a slow decline, and ultimately having to accept the fact that "the issue price is the highest point."

Most newly launched tokens not only perform poorly but even crash directly, as the market finally begins to view token economic models (Tokenomics) and liquidity as fundamentals rather than optional annotations.

Nevertheless, a few tokens achieved significant growth by the end of 2025 compared to their TGE prices. The rise of these tokens is not a flash in the pan, nor is it solely due to buying at extreme lows to profit; rather, it indicates that they indeed have real market demand.

Here are the tokens I summarized that performed strongly in 2025: $ASTER, $FOLKS, $AVICI, $RAIN, $TAKE, and $SENTIS (along with some "barely staying afloat" tokens like $IRYS, $FHE, and $CORN). While their performances vary, they share similarities.

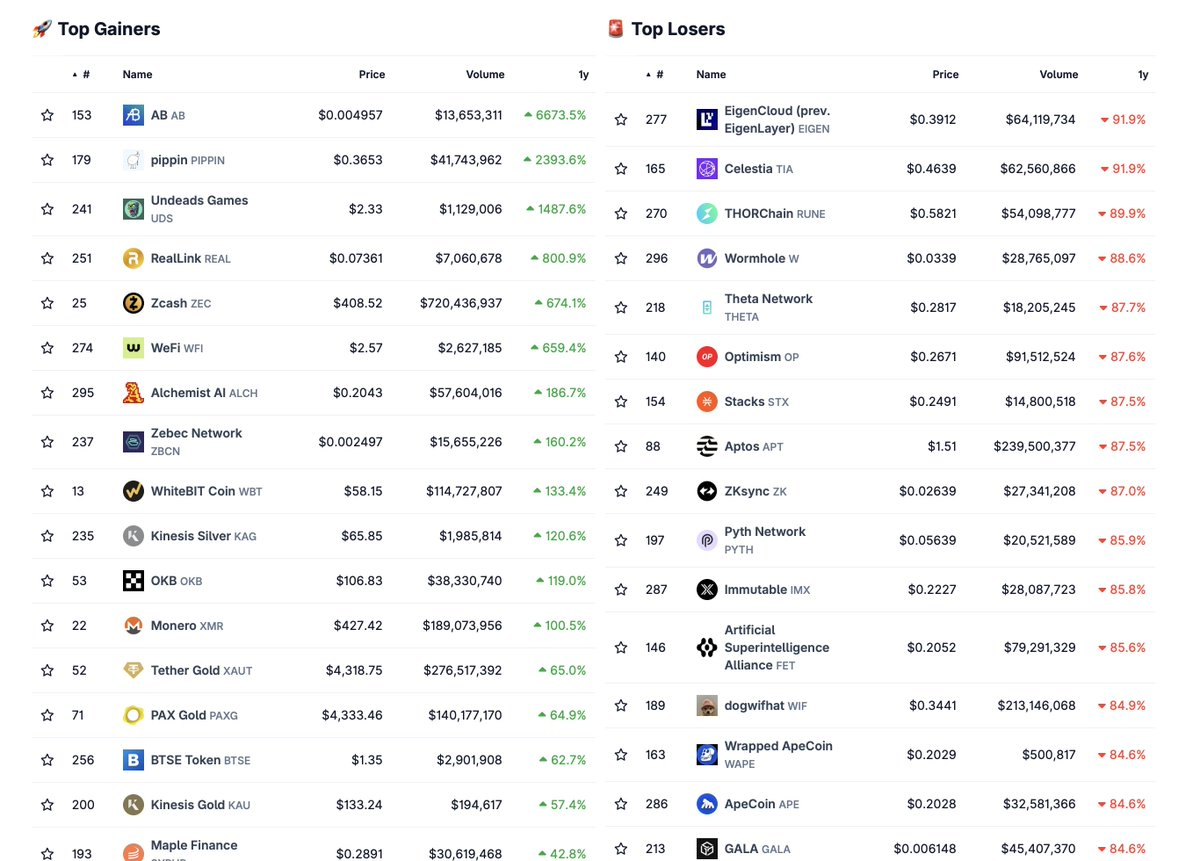

Winners of 2025

@Aster_DEX($ASTER) is one of the most typical success stories, achieving all the goals that every project dreams of on its first day: extensive trading platform coverage, deep liquidity, and a narrative of "DeFi perpetual contract" that traders truly understand and recognize. The core story throughout the year can be summarized as: "A perpetual contract trading platform with privacy features supported by Binance."

Although the price trend of $ASTER has sparked considerable controversy (you could attribute it to zero-knowledge proof-related themes, CZ's behind-the-scenes operations, or simply "better execution"), it is nonetheless one of the few tokens that were not suitable for "immediate sell-off" after the TGE.

@FolksFinance($FOLKS): "Boring" Can Also Be a Winner

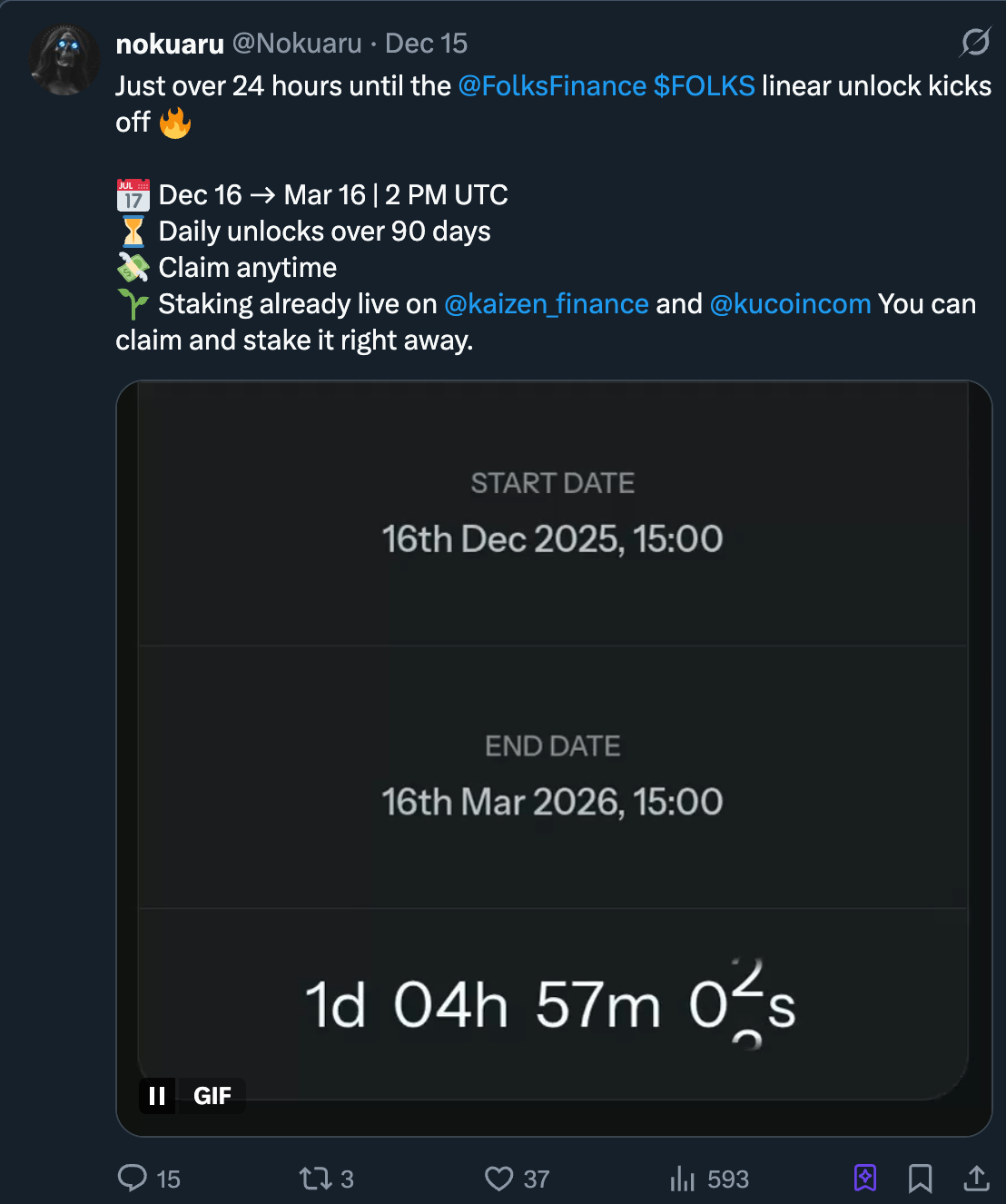

$FOLKS is a unique lending token that proved its value through "boring" this year, and "boring" became the winning formula. The success formula is: "Launch on Binance and Kraken on the first day, an ever-expanding cross-chain liquidity pool, and no obvious unlocking cliffs." Particularly the last point—"no unlocking cliffs"—is more important than most people are willing to admit.

Everything seemed to be smooth sailing… until the unlocking period arrived on December 15.

@AviciMoney($AVICI): Breaking the Rules with "Simple Narrative"

$AVICI is a rather special case; its success does not stem from the most complex technology but because it provides the clearest narrative for crypto Twitter (CT): "A fairly launched project with a real product."

What is most often mentioned is not the token economic model but the actual use case: "A truly operational new type of digital banking app, supporting Visa cards, real consumption scenarios." In a market filled with endogenous "utility," the selling point of $AVICI is refreshing, breaking away from on-chain virtual narratives and bringing tangible real-world applications.

Undoubtedly, this may be one of the best TGEs of the year.

When Tokens Rise for "Reason," They Can Move Steadily Forward

In the later cycle performance of 2025, the strongest reflexive winner is @Sentism_ai($SENTIS). Its layout is very straightforward: AI smart agent narrative + continuous incentive distribution + broad exchange support. On crypto Twitter, the mainstream view remains consistent: "AI smart agents are the next generation of DeFi automation layers." This clear narrative provides traders with a simple psychological model.

Mechanically, $SENTIS does not rely on a one-time launch frenzy. Its continuous token distribution mechanism (task rewards/backward airdrops/participation incentives) keeps users active. This dynamic often translates into sustained spot demand, as participants will position themselves for future allocations and ecological milestones. This mechanism can even support the price before actual on-chain usage becomes apparent.

@overtake_world($TAKE): "Web2 Distribution + Web3 Infrastructure" in the Gaming Market

$TAKE follows a similar successful template but packages it as a gaming trading market. The narrative throughout is "Web2's distribution capability combined with Web3's technical support."

Its advantage lies in clear logic—players trade assets, $TAKE serves as the toll token, while the staking and revenue-sharing mechanism provides incentives for holders. When people talk about "real yield," they often refer to token issuance dressed in APY, while $TAKE's logic is closer to "transaction fees → buybacks → stakers." Even if some question this model, the market still recognizes its development direction.

@Rain__Protocol($RAIN): A Model of Event-Driven Repricing

$RAIN is a more typical case of event-driven repricing rather than "fundamental victory."

The main rise of this token comes from a simple and clear message: a company is going public on Nasdaq and plans to allocate nine-figure funds to a treasury strategy based on $RAIN. Such news can quickly change market positioning behavior—liquidity providers adjust spreads, trend traders flock in, and onlooking funds quickly return due to the story being simple and clear enough.

Although this does not directly prove $RAIN's long-term product-market fit or eliminate execution risks, it explains why $RAIN's trading performance does not resemble that of typical small-cap TGE tokens: its buying power does not rely solely on retail reflexivity but rather on a narrative that appears sufficiently "institutional," attracting sustained attention and larger-scale funds.

"Respectable but Not Top-Tier" Tokens

- @irys_xyz($IRYS) and @mindnetwork_xyz($FHE): These two projects belong to the "AI infrastructure and privacy arbitrage" track, both benefiting from the AI-related boom, maintaining prices above their initial ranges, and keeping sufficient liquidity to avoid becoming "dead charts." If they can translate buzzwords into actual on-chain usage, they are likely to succeed, as mere narratives cannot last long.

- @use_corn($CORN): While $CORN did not exhibit explosive performance, it performed more steadily compared to its peers, resembling a "structured product." In the punishingly expansive market of 2025, stability itself is a signal.

- @LoadedLions_CDC($LION): $LION demonstrated the importance of distribution and ecological appeal. Although it did not dominate the popular narratives of 2025 (such as AI, perpetual contracts, points, etc.), it also did not completely crash. The risk lies in the possibility that if the usage rate of GameFi tokens cannot break out of its core community, it may fall into a "permanent discount" dilemma.

Common Traits of Winners

After stripping away narratives and emotions, some structural patterns gradually emerge.

- Distribution is More Important than Hype

The strongest-performing tokens avoided significant internal liquidity sell pressure at the TGE.

For example: $AVICI (team holds 0%), $SENTIS (activity-based token release), $TAKE (community and user incentives).

Insight: The holder structure at the time of issuance is more important than the background of private investors.

- Reasonable Initial Valuation Beats Perfect Timing

Many high-performing tokens were not issued during the market's hottest phase but chose a reasonable initial valuation, allowing the market to reassess their value later.

For example: $AVICI was issued with an FDV (Fully Diluted Valuation) of about $3.5 million and had an available product, showing asymmetric growth potential.

Insight: Tokens that can "earn" high valuations often perform better than those that are overvalued from the start.

- Actual Use (or Short-Term Visible Use) Drives Price Increases

The trading volume of ASTER's perpetual contracts, the expansion of FOLKS's lending business, $AVICI's credit card spending, and $TAKE's market trading volume are not just promises on a white paper but observable real signals.

Even $SENTIS, still in its early stages, links token issuance to on-chain activity, maintaining market interest through a feedback loop between usage and price.

Insight: Today's market has no patience to wait for visions to materialize. Actual use > beautiful visions.

- Unlocking Structure > Unlocking Scale

RAIN has a large token supply, but its unlocking is linear and transparent, so the dilution effect has been priced in by the market. SENTIS gradually releases tokens through participation activities, while $TAKE links token issuance to growth.

In other projects, what truly destroys market confidence is not the dilution itself but those dilution models filled with uncertainty and unlocking cliffs.

Insight: Predictable dilution is bearable, while sudden dilution cannot be accepted by the market.

- Exchange Listings are Necessary but Not Decisive

Almost all high-performing tokens have good exchange channels, but merely relying on exchange listings cannot determine success or failure.

The role of exchange listings is to amplify results: they can help strong tokens accelerate their rise while also causing weak tokens to fall faster. Even without being listed on Binance, $AVICI's success was not hindered.

Insight: Liquidity is an accelerator, not a foundation.

Core Summary

2025 quietly marks a shift in the market.

The market no longer pays for potential but begins to reward structured design:

- Reasonable circulation

- Fair distribution mechanism

- Credible actual use cases

- Controllable unlocking patterns

The "heroes" of 2025 are not flawless projects; they simply possess the ability to survive under their own issuance pressure.

If the focus of 2024 was narrative, then the core of 2025 is token design under pressure testing.

And this is precisely the lesson that most new TGE projects have yet to learn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。