According to the latest report released by the blockchain data platform Sentora on December 30, 2025, the global cryptocurrency holding structure is undergoing a profound transformation.

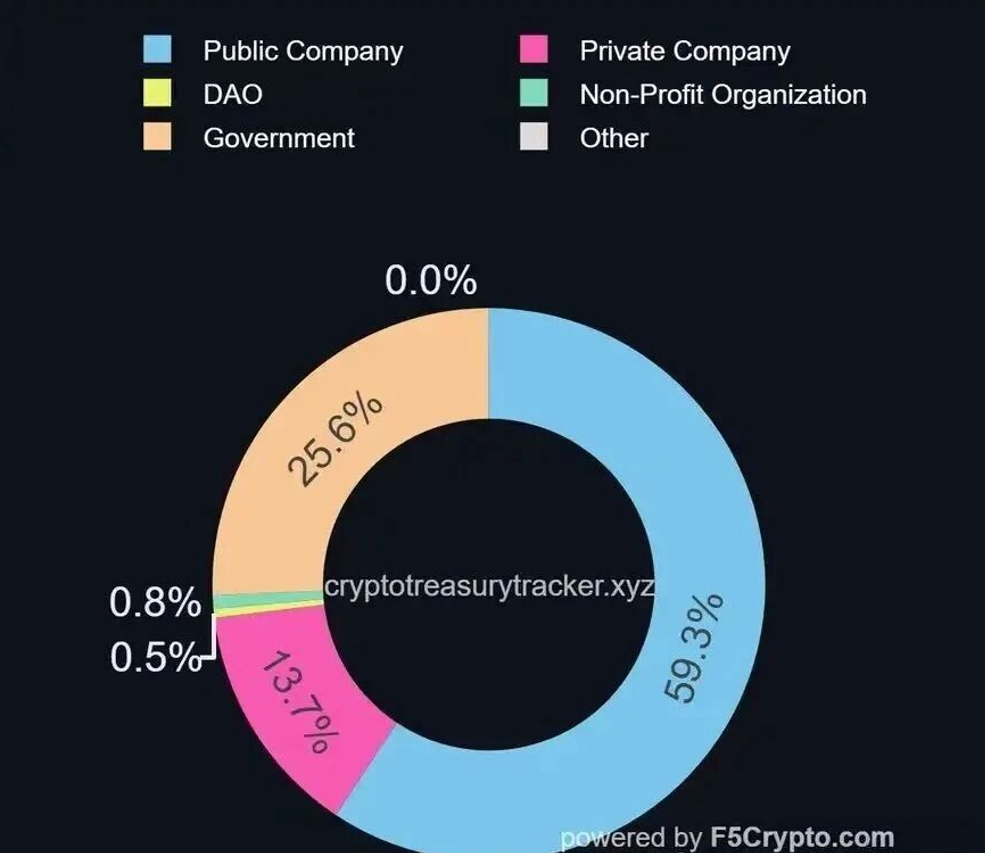

Data shows that there are currently 368 entities worldwide holding cryptocurrencies with a total value exceeding $185 billion. Notably, Digital Asset Treasury (DAT) companies, primarily consisting of publicly listed companies and private enterprises, hold 73% of these assets, becoming the absolute dominant force.

At the same time, the total amount of cryptocurrencies held by government agencies still accounts for over a quarter, maintaining a significant scale. This data clearly reveals that cryptocurrency holders are rapidly shifting from early individual investors to strategic holders at the corporate and national levels.

1. DAT Companies: The New Dominators of Crypto Assets

The Digital Asset Treasury (DAT) model, where companies incorporate cryptocurrencies like Bitcoin and Ethereum as strategic reserve assets into their balance sheets, has become a financial revolution sweeping the global capital markets. According to the segmented data in the Sentora report, among the 73% of corporate holdings, publicly listed companies account for 59.3%, while private companies account for 13.7%.

1.1. Rise of the Model and Scale Expansion

● The rise of the DAT model is not coincidental; it is closely linked to macro policies and changes in corporate financial strategies. In March 2025, the White House signed an executive order establishing a "Strategic Bitcoin Reserve," positioning Bitcoin as a national-level reserve asset, which provided crucial policy endorsement and confidence support for companies to allocate crypto assets strategically.

● The policy clearly states that the Bitcoin held by the government will be held as a reserve asset for the long term rather than sold, significantly influencing market expectations.

● Against this backdrop, the scale of DAT at the corporate level has rapidly expanded. As of September 2025, data shows that over 160 publicly listed companies worldwide have adopted the DAT strategy, with a total holding value exceeding $240 billion at that time. Among them, the total amount of Bitcoin held by publicly listed companies reached 864,210 coins, valued at approximately $10.743 billion, accounting for 4.34% of the circulating market value of Bitcoin at that time.

● Another report pointed out that as of September 10, 2025, the total amount of Bitcoin held by all DAT entities had exceeded 1 million coins, valued at approximately $11 billion, accounting for slightly more than 5% of the circulating supply of Bitcoin at that time.

1.2. Leading Companies and Strategy Diversification

● The head effect in the DAT field is very pronounced. MicroStrategy (now renamed Strategy) is a pioneer of this model, with its stock price skyrocketing over 2460% in five years, far exceeding the performance of the S&P 500 index during the same period, thanks to its aggressive strategy of continuously increasing Bitcoin holdings through debt financing.

● In 2025, financing activities in the DAT field were very active, with over $15 billion raised by public and private companies for this strategy, even surpassing the scale of traditional cryptocurrency venture capital.

At the same time, the asset selection of DAT is also showing a trend of diversification. While Bitcoin remains the absolute mainstay (total value approximately $215 billion), assets like Ethereum (total value exceeding $23 billion) and Solana (total value reaching $3.4 billion) have quickly become new favorites for corporate treasuries.

For example, SharpLink Gaming became one of the largest publicly listed companies holding Ethereum after announcing a massive financing; while BitMine has accumulated nearly 380,000 Ethereum worth approximately $1.5 billion, with total holdings exceeding 3 million coins.

1.3. Operational Model and Market Effects

The operational model of DAT companies has transcended simple "buy and hold." They use complex financial instruments, such as issuing convertible bonds or conducting equity financing, to raise funds to purchase more crypto assets, attempting to create a growth flywheel of "buy coins - stock price rises - financing - buy coins again."

This model brings significant leverage effects to their stocks: when cryptocurrency prices rise, the stock price increases of DAT companies often far exceed the assets themselves.

This model has also attracted widespread industry participation. In addition to tech companies, aquaculture companies like Nocera Inc., game retailers like GameStop, and even traditional automotive giant Tesla have incorporated cryptocurrencies into their balance sheets. This marks the DAT strategy as having crossed industry boundaries, becoming a more widely accepted tool for corporate financial management and strategic hedging.

2. Government Holdings: From Law Enforcement Seizures to Strategic Reserves

On the other side of the thriving DAT companies, governments are another significant holder in the global cryptocurrency market. Sentora data shows that government agencies hold 25.6% of cryptocurrencies, which is still a substantial figure.

2.1. Scale, Composition, and Sources

The sources of cryptocurrency assets held by governments are relatively concentrated, mainly coming from the seizure of criminal proceeds during criminal or civil forfeiture procedures by law enforcement agencies. According to data from blockchain analysis company Chainalysis in May 2025, the total value of the top 20 cryptocurrencies held by the U.S. government was approximately $20.9 billion, with Bitcoin accounting for $20.4 billion, a proportion exceeding 97%, and other digital assets amounting to about $493 million.

The U.S. government is one of the largest government holders globally. The executive order in March 2025 not only established Bitcoin's strategic reserve status but also systematically addressed the previous issue of "decentralized management and lack of unified policy" regarding seized cryptocurrencies across various federal agencies. The order authorized the Treasury to establish two core reserves:

● Strategic Bitcoin Reserve: Specifically for the custody and long-term holding of all Bitcoin owned by the government, stipulating that it must not be sold and should serve as a reserve asset for the U.S.

● U.S. Digital Asset Reserve: Used to manage other digital assets held by the government besides Bitcoin.

2.2. Policy Shift and Strategic Intent

The U.S. government's shift from "immediate sale of seized assets" to "strategic holding" represents a fundamental policy change. The background of the executive order clearly outlines its logic: the Bitcoin protocol limits the total supply to 21 million coins and has never been breached; due to its fixed supply characteristics, the first country to establish a strategic Bitcoin reserve will gain a strategic advantage. The document even points out that the premature sale of seized Bitcoin has already cost U.S. taxpayers over $17 billion.

This national-level strategic move provides a model for local governments. In May 2025, New Hampshire officially signed a bill, becoming the first state in the U.S. to legislatively pass a "Strategic Bitcoin Reserve" plan. The bill authorizes the state treasury to invest up to 5% of public funds in Bitcoin and precious metals, and it establishes detailed legal standards for government-level secure custody. This marks the beginning of digital assets penetrating from "private wealth allocation" to "public asset management," with pioneering demonstration significance.

2.3. Professionalization of Custody and Management

To manage these substantial assets, the U.S. government has moved towards a professional custody path. The U.S. Treasury has signed a five-year custody and trading service contract with cryptocurrency exchange Coinbase to manage its digital asset reserves. The New Hampshire bill also established strict technical standards for government holdings, including requirements that private keys be held solely by the government, stored in multiple geographically dispersed secure data centers, transactions require multi-party authorization, and regular independent audits. These measures aim to ensure the security of national crypto assets and lay a systemic foundation for long-term holding.

3. Deep Impacts of the Reshaped Landscape

The combined holdings of nearly $185 billion in cryptocurrencies by enterprises and governments are having a series of profound structural impacts on the market.

3.1. Market Structure Stabilization and Formation of "Sticky Demand"

The large-scale holdings by enterprises and governments create a massive "non-liquid supply" or "sticky demand" in the market. These entities, especially those adhering to long-term holding strategies like DAT companies and government reserves, typically do not sell easily due to short-term price fluctuations.

As of September 2025, the over 1 million Bitcoins held by DAT represent more than 5% of the circulating supply, and this concentration enhances the "stickiness" of demand, providing a certain buffer during market downturns. The long-term locking policy of government reserves further withdraws a large number of potential sell orders from the market.

3.2. Price Support Mechanism and Volatility Changes

This structural change is reshaping the price discovery mechanism of cryptocurrencies. On one hand, the continuous financing and buying behavior of DAT companies, along with the government's "in-only" reserve policy, constitute a strong structural buying force. On the other hand, this may also lead to decreased market liquidity at certain stages, causing prices to rise more significantly when the circulating supply decreases, but it could also amplify volatility in extreme cases due to decisions made by a few large holders (though the probability is low).

Analysis suggests that the demand from institutions like DAT, combined with potentially easing monetary policies, provides macro-level support for cryptocurrencies like Bitcoin. Some viewpoints indicate that the "programmatic" demand component from DAT, combined with its scarcity, may allow Bitcoin to perform better than other assets under favorable macro conditions.

3.3. Need for Improved Regulatory Framework and Disclosure Requirements

As the DAT model becomes mainstream, regulatory agencies' attention has sharply increased. Although mainstream exchanges like Nasdaq have yet to issue formal rules specifically for DAT, the market's demand for transparency and information disclosure regarding digital asset operations is continuously rising. Strengthening due diligence and, in some cases, requiring shareholder approval are becoming market practices. Stricter disclosure requirements may compress the market premium of DAT companies with weak governance, while companies with high internal controls and transparency will be favored. This indicates that the DAT field will transition from a phase of wild growth to a "PvP" (survival of the fittest) phase centered on compliance, transparency, and governance levels.

3.4. Radiation to Traditional Finance and Public Perception

The large-scale adoption by enterprises and governments has greatly accelerated the socialization process of cryptocurrencies. The report "2025 Global Crypto Status" released by Gemini shows that the strategic Bitcoin reserve plan launched by former U.S. President Trump significantly boosted public confidence, with 23% of U.S. non-cryptocurrency holders stating that the plan enhanced their trust in digital assets. At the same time, spot cryptocurrency ETFs have also gained widespread popularity in several countries around the world. The endorsement from enterprises and nations is dissolving the "marginal" and "speculative" labels of cryptocurrencies, promoting their evolution into a formal asset class.

4. Challenges and Future Prospects

Despite the clear trends, the current landscape is also accompanied by significant risks and challenges.

4.1. Concentration of Potential Risks

The high concentration of holdings in DAT companies and governments may bring about new systemic risks. For DAT companies, their business models heavily rely on the rise in cryptocurrency prices and the ability to secure continuous financing. If the market enters a prolonged downturn or the financing environment tightens, companies that use high leverage (especially those employing complex debt instruments) may face immense pressure.

Analysts warn that some companies lacking sustainable core businesses and overly reliant on the DAT strategy are vulnerable to severe corrections when cryptocurrency prices stagnate or decline. Short-selling institutions have also begun to question the sustainability of certain DAT models, believing they have become "mediocre and uninspired."

2. Market Cycle Test

The inherent strong cyclicality of the cryptocurrency market is the ultimate test for all DAT participants. Risks that are masked during a bull market may be fully exposed in a bear market. The president of the digital asset wealth management platform Amber Premium pointed out that the key during a downturn is not to "bet on direction," but to establish a systematic "defense-adjustment-protection" mechanism, including liquidity management, asset rebalancing, and transparent risk disclosure. Only those entities with long-term awareness, sound governance mechanisms, and risk mitigation capabilities can navigate through cycles.

3. Future Trend Outlook

Looking ahead, the holding pattern of cryptocurrencies may exhibit the following development trends:

● Top Integration and Survival of the Fittest: The DAT field will accelerate integration, with capital and resources concentrating on leading companies with sound governance, high transparency, and scale advantages. Small participants lacking core competitiveness and robust financial models may be eliminated.

● Diversification of Asset Allocation and Deepening of Strategies: The cryptocurrency asset allocation of enterprises and governments will evolve from a single Bitcoin to a multi-asset portfolio that includes Ethereum, Solana, and others. Holding strategies will also deepen from passive accumulation to active management strategies that include staking and yield farming.

● Global Policy Diffusion: The legislation and practices of the U.S. and New Hampshire regarding government-held crypto assets are likely to have spillover effects, prompting other countries and regions with similar considerations regarding national sovereignty, financial innovation, or inflation hedging to imitate and explore.

The data showing that 368 entities globally hold over $185 billion in cryptocurrencies is a milestone signal. It marks the transition of the cryptocurrency market from a primary stage dominated by retail and speculative capital to a new era driven by corporate balance sheets and national strategic reserves.

This "institutionalization" and "strategization" of the holding structure is fundamentally changing the liquidity, volatility, and intrinsic logic of the cryptocurrency market. Although the road ahead is still filled with market fluctuations and regulatory challenges, a new financial asset landscape reconstructed by digital technology, with deep participation from enterprises and nations, is clearly visible.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。