Author: Liang Yu

Editor: Zhao Yidan

On December 25, 2025, a brief announcement from the Bank of China stirred ripples far beyond its literal meaning in the fields of cross-border payments and digital currencies. The announcement stated that, under the joint guidance of the People's Bank of China and the Central Bank of Laos, the Bank of China successfully completed its first cross-border QR code consumption payment using a digital RMB wallet in Laos. For Chinese tourists visiting Laos, this means they can pay directly with their mobile phones without needing to exchange for local currency; for Laotian merchants, it allows for real-time, compliant receipt of RMB funds without the need to modify any payment equipment. This service has been officially described as achieving a seamless experience of "payment - exchange - settlement," aimed at lowering the barriers to cross-border settlement and injecting new momentum into the payment integration between China and ASEAN.

On the surface, this is merely a small technological innovation concerning travel convenience. However, when viewed against the grand backdrop of intensifying competition among global central bank digital currencies (CBDCs) and profound changes brewing in the international payment system, the implementation in Laos is far from a simple expansion of scenarios. It cleverly validates a CBDC cross-border penetration paradigm that can be termed "Chinese-style": a dual-layer structure that is extremely lightweight at the front end while carrying substantial institutional arrangements and strategic intentions at the back end. Understanding this quiet payment revolution hinges on cutting through the fog of convenience surrounding "scan to pay," revealing the dialectical logic of its "light" and "heavy" aspects, and calmly assessing the complex realities it must face in terms of replication and expansion.

I. Surface and Core: A "Light as a Feather" Payment Revolution

The "light" of the "Laos model" is its most intuitive and also most misleading characteristic. This lightweight design precisely addresses the traditional pain points of cross-border payments, paving an almost imperceptible experience path for users and merchants.

First, there is nearly zero friction in the access for users and merchants. Chinese tourists only need to open the familiar digital RMB app, scan the existing QR code of the merchant, and the payment is completed, with automatic currency conversion occurring in the process. Laotian merchants do not need to invest in updating terminals or modifying systems as if they were integrating a completely new payment network; funds can be automatically credited. This "user-driven, zero modification for merchants" strategy minimizes the most stubborn initial resistance in promoting new technology—the costs of terminal modification and the costs of changing user habits.

Second, there is a commitment to efficiency with "payment equals settlement." Under the traditional agency model, cross-border payments must pass through multiple intermediaries, resulting in a settlement delay of 2 to 5 days and high costs. The "Laos model" constructs a direct settlement channel through the Bank of China's Vientiane branch, directly linking to the People's Bank of China's digital RMB cross-border payment platform, aiming to achieve funds being credited in seconds. For small and medium-sized merchants, the improvement in fund turnover efficiency translates into tangible competitiveness.

However, this extreme "lightness" at the front end is precisely supported by the "heaviness" of systemic and institutional arrangements at the back end. Every easy scan by users relies on the robust operation of a highly centralized and institutionally dense financial infrastructure.

This "heaviness" is first reflected in the complex inter-central bank coordination and institutional alignment. This business is not a solitary innovation by a commercial bank but is conducted as an "inter-central bank digital currency cooperation infrastructure project" under the joint guidance of the two central banks. This means that before technical connectivity, both parties had reached a high level of political and policy consensus in sensitive areas such as regulatory compliance, anti-money laundering (AML) standards, cross-border data flow, and respect for monetary sovereignty. The Bank of China's Vientiane branch, as the "designated digital RMB acquiring and clearing bank appointed by the Central Bank of Laos," is itself a product of this institutional coordination. The simplification of front-end processes moves and encapsulates all complex legal, regulatory, and accountability relationships to the back end, between the central banks and designated clearing institutions.

This "heaviness" is also reflected in the absolute dependence on a strong back-end infrastructure. The core hub of the business is the digital RMB cross-border payment platform established and managed by the People's Bank of China's Digital Currency Research Institute. This platform needs to have real-time, stable exchange rate quoting capabilities and complete the exchange of clearing and settlement instructions and compliance screening across different jurisdictions. The digital RMB international operation center, unveiled in Shanghai in September 2025, is specifically designed to coordinate the operation of such increasingly complex cross-border infrastructure. Therefore, the success of the "Laos model" is essentially a stress test of the cross-border payment infrastructure capabilities led by the People's Bank of China.

More significantly, this "heaviness" has chosen a technological governance path that is distinctly different from private payment solutions. Unlike the "decentralized, peer-to-peer" cross-border payment vision advocated by cryptocurrencies or global stablecoins, the digital RMB cross-border solution clearly prioritizes "regulatory compliance and system stability." It does not attempt to bypass existing financial intermediaries and regulatory frameworks but instead deepens the embedding of traditional responsible entities such as commercial banks and central banks into the payment process through technological upgrades, enhancing the effectiveness of centralized management. This determines that its expansion logic must be institutional first, with bilateral advancement, rather than relying on spontaneous network effects in the market.

II. Why Laos? The Triple Logic of Strategic Piloting

The choice of Laos for the "debut" of digital RMB cross-border retail payments, rather than Thailand or Vietnam with closer economic ties, is a well-considered strategic decision that reflects a pragmatic approach of "pilot first, controllable risks, and radiating to surrounding areas."

From a geopolitical and bilateral relationship perspective, Laos is an ideal "testing ground." The long-standing stable relationship between China and Laos, especially with the completion of the China-Laos railway, has created a physical "hard connectivity," generating urgent demand and natural scenarios for financial "soft connectivity." At the central bank level of both countries, there is a high level of political mutual trust, which can provide the necessary political assurance for sensitive cooperation on currency and financial data, reducing the complex international coordination costs in the early stages of the pilot.

From a financial ecosystem and market structure perspective, Laos possesses a "moderate" level of complexity. On one hand, Laos's retail payment system has a certain foundation, with QR code payments being relatively widespread, providing a fertile ground for "zero modification for merchants." On the other hand, its financial market scale is limited, and the competitive landscape for financial innovation is not as intense as in other Southeast Asian countries. Conducting the pilot here can both validate the feasibility of the technical solution and control the uncontrollable risks that may arise from scale or competition, making it a choice with "high success probability, high demonstration effect, and low systemic risk."

From the perspective of regional radiating demonstration effects, Laos can be considered an "ASEAN hub." As a member of ASEAN, Laos's successful experience has natural geographical and political advantages for showcasing and transmitting to neighboring countries such as Cambodia, Myanmar, and Thailand. Once the "Laos model" is validated as stable, effective, and mutually beneficial, it will become a compelling template for promoting the digital RMB in a broader ASEAN region, prying open a critical first door. This is strategically much more effective than pushing directly in a large country.

III. Path Comparison: The Differentiated Breakthrough of Digital RMB

To truly understand the breakthrough of the "Laos model," it must be compared within the existing spectrum of cross-border payment solutions. In the context of outbound payments by Chinese tourists, the digital RMB does not fill a gap but opens a differentiated channel in competition with existing paths.

Traditional Path One: Card Organization Networks (e.g., UnionPay, Visa/Mastercard). This is currently the most mainstream method. Its advantage lies in the extensive global acceptance network, but it also has significant drawbacks: merchants must pay high card processing fees, users may face opaque exchange rate costs due to dynamic currency conversion (DCC), and fund settlement still requires passing through multiple intermediaries, resulting in delays. The "payment equals settlement" and real-time exchange rates of digital RMB directly address these core pain points.

Traditional Path Two: Cross-border services from third-party payment giants (e.g., cross-border versions of Alipay, WeChat Pay). These services also provide the convenience of scan payments, but their underlying systems mostly still connect to users' bank cards or rely on local partners to establish "e-wallets," essentially building an application layer on top of existing card networks or local payment systems. The flow of funds and information still needs to pass through the multiple account systems of commercial institutions. The core difference in digital RMB cross-border payments is that its flow path remains entirely within the ledgers of the central bank and regulated commercial banks, achieving the integration of payment tools and settlement infrastructure, theoretically possessing higher settlement efficiency and controllability at the central bank level.

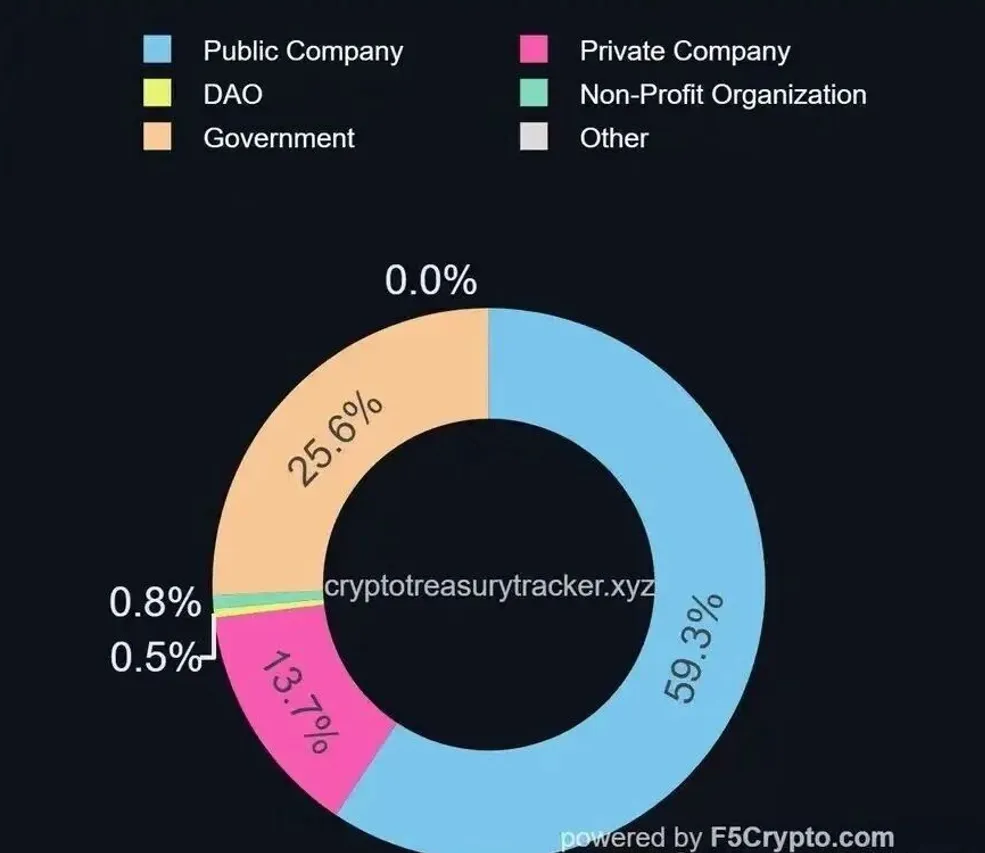

Emerging Path Three: Private Stablecoins. Stablecoins represented by USDC and USDT can indeed achieve fast, low-cost cross-border transfers through blockchain networks and are widely used in cryptocurrency trading and specific cross-border remittance scenarios. However, they face severe regulatory uncertainties, lacking clear payment licenses in most jurisdictions, making it difficult to gain large-scale access to mainstream offline merchants. The fundamental distinction between digital RMB and stablecoins is that the former is a digital extension of sovereign credit, while the latter is collateralized by private institutional credit. This essential difference determines the vast disparities between the two in terms of compliance, final settlement security, and macro policy adaptability.

Therefore, the competitive strategy of the "Laos model" is very clear: in terms of user experience, it aims to match and attempt to surpass the convenience of third-party payments; in terms of settlement efficiency, it challenges the slowness and expense of traditional card organizations; and in terms of compliance and sovereignty, it delineates its boundaries from private stablecoins, emphasizing its status as a legal currency backed by central bank liabilities.

IV. A Long Journey: From Bilateral Bonsai to Multilateral Forest

The digital RMB cross-border payment platform that the "Laos model" relies on is part of the People's Bank of China's blueprint for constructing the next generation of cross-border payment infrastructure. This blueprint has a clear dual-layer structure: one is the bilateral direct connection model, as demonstrated by the Laos case, and the other is the more ambitious multilateral central bank digital currency bridge (mBridge) project.

Currently, the bilateral model represented by Laos is the mainstay. This "single point access" model is flexible and efficient, suitable for quickly initiating cooperation with specific partners and accumulating practical experience. The Bank of China's Vientiane branch is connected to such a platform. However, it is important to recognize that the "global reach" capability of this model currently reflects more of a potential in terms of technical architecture. Its large-scale promotion heavily relies on complex bilateral negotiations and system alignments with target countries, and the marginal costs have not significantly decreased due to technology.

More revolutionary in prospect is the multilateral central bank digital currency bridge (mBridge). This project is jointly promoted by the Digital Currency Research Institute of the People's Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the UAE, and the Bank for International Settlements (BIS), and has entered the "Minimum Viable Product (MVP)" stage. Its core innovation lies in allowing multiple CBDCs from different jurisdictions to conduct "peer-to-peer" instant exchanges and settlements within a shared system through a blockchain-based universal platform, processing a transaction in just 6-9 seconds and potentially reducing costs by nearly half. As of November 2025, mBridge has processed cross-border payment transactions amounting to approximately 387.2 billion RMB, with digital RMB transactions accounting for about 95.3%, demonstrating strong vitality.

The three principles of "no loss, compliance, and interoperability" that mBridge follows are designed to address the most critical concerns of sovereignty and privacy in cross-border digital currency cooperation. Its distributed architecture allows each participating central bank to maintain control over its own currency system while achieving the necessary data-controlled sharing for compliance through privacy computing technology.

However, the road from a mature bilateral model to a widespread multilateral network is long. It faces significant challenges such as the unification of technical standards, cross-border regulatory coordination (especially in anti-money laundering and data privacy), compatibility of legal frameworks, and the establishment of equitable governance mechanisms. The pilot in Laos can be seen as a critical single-track test and the establishment of technological and institutional confidence on the path to the multilateral future envisioned by mBridge.

V. Prospects: The ASEAN Replication Path of the "Laos Model"

The successful validation of the "Laos model" undoubtedly opens up imaginative space for the internationalization of the digital RMB. In the short term, replicating this model to other Southeast Asian countries with close ties to Chinese tourists and friendly political relations (such as Cambodia and Myanmar) is a logical next step. In the medium to long term, the vision is to build an efficient cross-border payment corridor for digital RMB along the trade routes of the "Belt and Road" and the Regional Comprehensive Economic Partnership (RCEP), ultimately serving larger-scale trade settlements and investment exchanges.

However, any rational industry observer must point out that as applications move from "pilot" to "promotion," and from "retail" to "wholesale," a series of deeper institutional and technical tensions will inevitably surface. The optimistic narrative surrounding the "Laos model" must be accompanied by a calm "problem checklist":

First, there is the subtle game of exchange rate pricing power. In the current retail scenario, the exchange rate is quoted in real-time by the Chinese clearing bank, and Laotian merchants passively accept it. Once the business scale expands or enters the realm of bulk trade settlements, can the exchange rate formation mechanism remain so "smooth"? Will the central banks and commercial institutions of the target countries demand greater participation in pricing? This touches on the core of monetary sovereignty and the depth of financial markets.

Second, there is the contradiction between cross-border data availability and regulatory sovereignty. Digital RMB transactions inherently carry traceability. To meet compliance requirements such as anti-money laundering, to what extent and in what manner should transaction data be shared with the regulatory authorities of the target countries? How can the boundaries of data sharing be defined to satisfy the regulatory requirements of the other party while protecting the privacy of domestic users and China's data sovereignty? This is a gray area that has yet to reach international consensus.

Third, there is the long-term nature of competition in technical paths and standards. The "Laos model" is highly centralized in its technology. This presents a philosophical difference from the CBDC paths based on distributed ledger technology (DLT) being explored in Europe and other regions. In the future, will global CBDC interoperability adopt China's hybrid architecture (compatible with both accounts and blockchain), or will it follow other technical standards? This standards battle will determine the power dynamics of the international payment system for decades to come.

Finally, and most fundamentally, is the potential tension in capital account management. Currently, the pilot is strictly limited to tourism consumption under the current account, representing a "small, high-frequency" compliance safety zone. Once the convenience of cross-border flow of digital RMB creates a siphoning effect and is attempted for circumventing capital controls, how will it be compatible with the existing foreign exchange management framework? This is not only a challenge faced by China but also a problem that all countries promoting the cross-border use of CBDCs under conditions of incomplete capital account openness must address.

Conclusion

The first QR code payment of digital RMB in Laos, though quiet, clearly signals the knock of a new era. It demonstrates a realistic path for the internationalization of CBDCs based on national credit, leveraging financial infrastructure exports, and starting from bilateral cooperation. This path is "light" in user experience, capable of challenging the market positions of old giants; it is "heavy" in institutional coordination, indicating that its expansion cannot be achieved overnight.

For professionals in the field, the value of the "Laos model" lies not only in itself but also in the excellent observational prism it provides: through it, we glimpse the steady layout of major power financial strategies behind technological convenience, understand the profound interdependence between front-end innovation and back-end institutions, and anticipate the friction, negotiations, and compromises that will inevitably accompany a global payment system reconstruction driven by sovereign digital currencies.

In the race for the internationalization of the digital RMB, the first half is about technological research and domestic scenario validation, where China has significantly taken the lead; the second half involves ecosystem building, standard setting, and complex international governance coordination. The successful first battle in Laos is merely the starting whistle for the long second half of the game. The real test lies in how to transform a successful "lightweight" model into a "heavy institutional" arrangement that can be universally accepted and trusted by economies with different cultures, institutions, and development demands. This journey encompasses both the vastness of the stars and the sea and the real valleys that need to be traversed.

Some sources of information:

・ "Bank of China Completes the First Cross-Border QR Code Consumption Payment Business in Laos"

・ "Digital RMB and Cross-Border QR Code Payment Services Launched in Mohan"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。