Written by: Martin Young, CoinTelegraph

Translated by: Deng Tong, Jinse Finance

Since the beginning of this year, the Federal Reserve has had a significant impact on the cryptocurrency market, and this influence may continue until 2026 due to ongoing disagreements among policymakers.

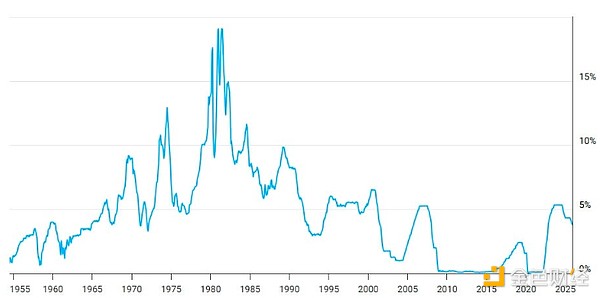

The Federal Reserve cut interest rates three times in 2025, with the most recent cut on December 10, bringing rates to between 3.5% and 3.75%.

However, despite rates remaining at their highest level since 2008, forecasts indicate that there may only be one more rate cut in 2026.

Key factors influencing policymakers' decisions include labor market data, inflation trajectory (especially the impact of tariffs), and overall economic growth.

Federal Reserve Chairman Jerome Powell's term will end in May, at which point the Fed will welcome a new chair. President Donald Trump has already begun looking for candidates who are most likely to adopt a dovish stance.

Despite three rate cuts this year, U.S. interest rates remain at their highest level in 18 years. Source: Macro Trends

What actions will the Federal Reserve take in early 2026?

The Federal Reserve will hold its next meeting from January 27 to 28, which will be the first update of policy guidance from the Fed Board, potentially setting the tone for the quarter.

Data from the CME Group shows that investors predict only a 20% chance of a 25 basis point rate cut in January, while the probability of a cut at the mid-March Fed meeting rises to 45%.

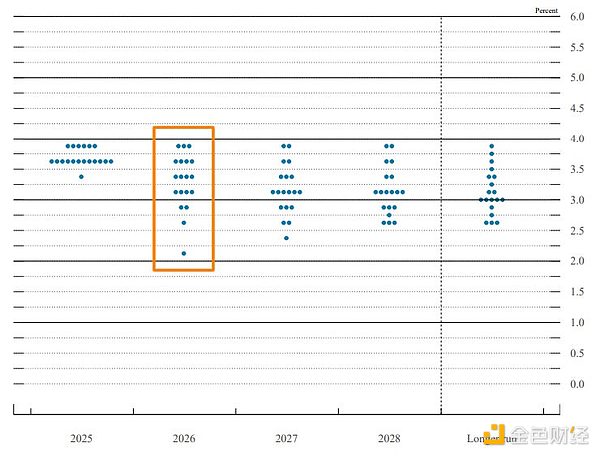

Dot Plot Shows Discrepancies

The dot plot from December 2025 shows each policymaker's forecast for interest rates, revealing significant discrepancies, with roughly equal numbers predicting zero, one, or two rate cuts, creating substantial uncertainty for the market in early 2026.

The chart clearly illustrates the Fed's thinking, but forecasts often change with new economic data.

The current median forecast for the end of 2025 is 3.6%, roughly in line with current levels; the median forecast for the end of 2026 is 3.4%, indicating only one rate cut in 2026.

The December dot plot shows discrepancies among policymakers regarding the interest rate trajectory at the end of 2026. Source: Federal Reserve

Analysts at Charles Schwab stated after the Fed's December rate cut that "the updated forecasts are not particularly hawkish," with 12 out of 19 policymakers expecting at least one more rate cut next year.

Analysts hope for two rate cuts in 2026.

Jeff Ko, Chief Analyst at CoinEx Research, pointed out that the Fed "faces serious internal divisions," and the dot plot shows "significant divergence in opinions, with no clear consensus on the interest rate path for 2026."

"I believe the Fed is likely to cut rates twice in 2026. The Fed may pause rate cuts in January and then cut once in March, which will occur during Powell's remaining term, ending in May."

"If labor market conditions remain weak, even if inflation may exceed 3% in the second quarter, such a timing for rate cuts would be reasonable. After the leadership transition, the new Fed leadership may continue to gradually ease monetary policy for the remainder of the year."

Jeff Mei, COO of BTSE Exchange, noted that several scenarios could unfold for the Fed in the first quarter.

"The most basic scenario is that the Fed cuts rates once in the first quarter and maintains the current scale of Treasury repurchases, which would release some liquidity into the market, benefiting cryptocurrency inflows," he said.

"In a bullish scenario, if inflation decreases and unemployment rises, the Fed will have to take more aggressive measures, cutting rates twice and increasing Treasury repurchase efforts. The cryptocurrency market will benefit from this as demand for risk assets surges."

However, the worst-case scenario is that if inflation rises again, the Fed will be forced to completely halt rate cuts and Treasury repurchases. He added that such concerns could lead to a crash in the stock and cryptocurrency markets.

Hopes for 2026 Fed Policy Have Diminished

Justin d'Anethan, Head of Research at Arctic Digital, stated that most people had high hopes for the end of quantitative tightening policies and the Fed potentially entering a dovish new era.

"However, most are disappointed because the Fed, while appearing to be easing, remains very cautious," he added.

"This more cautious approach undermines the fervor that most cryptocurrency traders (or once did) expected for an asset that can essentially hedge against reckless central bank policies, currency devaluation, and ultimately global market liquidity."

Nevertheless, the new chair may change the Fed's overall interest rate policy stance and its willingness to support risk assets like cryptocurrencies.

When interest rates decline, investors often seek high-risk assets like cryptocurrencies, as the appeal of traditional investments such as bonds and fixed deposits diminishes. This increases demand and buying pressure, and prices typically follow suit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。