Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

On the last day of 2025, the global financial markets exhibited risk-averse sentiment in the trading atmosphere before the New Year holiday. The Japanese and South Korean stock markets were closed, while European and American stock and bond markets closed early, leading to a significant tightening of liquidity. The Federal Reserve's December meeting minutes revealed that although the FOMC agreed to cut interest rates, there were serious internal disagreements regarding the interest rate path for 2026. The dot plot suggests only 1 to 2 rate cuts, while the market is still aggressively pricing in about 60 basis points of rate cuts. Officials believe that future decisions will be a "delicate balance." Meanwhile, the precious metals market faced a severe setback, with the CME raising the futures margin for gold, silver, platinum, and palladium for the second time in a week, causing spot silver to plummet over 9% to below $71, gold to drop to a low of $4,273, palladium to fall over 7%, and platinum to decline over 11%. Nicholas Colas, co-founder of DataTrek Research, pointed out that silver is overvalued based on the silver-oil ratio, but Charlie Garcia, founder of R360, countered that the CME's actions are merely a "speed bump," and the new silver export control policy in China, effective January 1, 2026, will lead to a significant reduction in global supply, which is the long-term logic. Juan Carlos Artigas from the World Gold Council anticipates that if geopolitical tensions worsen, gold prices could reach $5,000 in 2026, while a recovery in the economy could lead to a pullback of 5% to 20%.

Bitcoin fluctuated between $88,500 and $94,500 in December. If it closes today below $90,000, it will mark three consecutive months of bearish candles. Killa stated that if Bitcoin falls below the weekly opening price ($87,952), it could drop to $86,300 or even $84,400. Both Ted and Lennaert Snyder believe that $90,000 is a key resistance level, and if it loses the $87,000 support, the price is highly likely to retest the $84,000 to $85,000 range. Castillo Trading believes that the current wide fluctuations are favorable for swing traders. Although CryptoQuant data shows a negative Coinbase premium and weak demand, institutional and major players are active: the Japanese listed company Metaplanet increased its holdings by 4,279 BTC in Q4, bringing its total holdings to 35,000 BTC; Bitfinex whale long positions reached a two-year high. Citigroup predicts a benchmark target for Bitcoin at $143,000. On the technical charts, multiple analysts, including Dami-Defi, pointed out that Bitcoin has formed symmetrical triangles and descending expanding wedges. If it can break through the key resistance at $90,000, the upward target could reach $107,000 or even $122,000. James Bull views it as a "Christmas bear market trap," believing that 2026 will see new highs.

Ethereum's price hovers between $2,900 and $3,000. Lennaert Snyder noted that ETH rebounded after testing the liquidity at $2,900, and if it cannot break through the $3,076 high, he will consider shorting; conversely, if it retraces to $2,800, he will attempt to go long. Ted emphasized that reclaiming $3,000 is necessary to open up upward space. Astronomer holds a strongly bullish view on ETH, believing it has maintained weekly lows for six consecutive weeks, with $5,000 on the horizon. On-chain data supports this optimistic sentiment, as ValidatorQueue shows that the number of Ethereum validators queuing to enter has exceeded the number exiting for the first time in six months; historically, this phenomenon has been accompanied by price doubling. Titan of Crypto pointed out that $2,750 is a critical watershed, with technical patterns resembling the pre-uptrend in Q4 2024. However, Murphy cautioned retail investors to be careful; although large funds have increased their positions in the $2,700 to $3,100 range, based on four criteria including sentiment, structure, and cost, only two are currently met, and the optimal bottom-fishing score has not yet been reached.

Recently, ETF applications have become a focal point. Grayscale has applied to the SEC to convert the Bittensor trust into a spot ETF (code GTAO), while Bitwise has submitted applications for 11 cryptocurrency ETFs, including AAVE, UNI, ZEC, CC, ENA, HYPE, NEAR, STRK, SUI, TAO, and TRX. Additionally, Canton Network (CC) has recently attracted attention, with a rise of over 75% since December and an 18% increase in the past 24 hours. The long-awaited Lighter has finally launched, completing its TGE and conducting a $675 million airdrop, currently hovering around a market cap of $2.7 billion; the X account of ElizaOS founder, which was banned in June, has finally been unbanned, and the token ELIZAOS briefly surged over 200%, with the current increase down to 80%.

2. Key Data (as of December 31, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $88,488 (YTD -5.45%), daily spot trading volume $39.23 billion

Ethereum: $2,977 (YTD -10.84%), daily spot trading volume $17.82 billion

Fear and Greed Index: 21 (Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.1%, ETH 12%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, POLYX, ZBT

24-hour BTC long-short ratio: 50.48% / 49.52%

Sector performance: Most crypto sectors rose, with SocialFi up over 3%, while Layer2 and DeFi sectors saw slight declines.

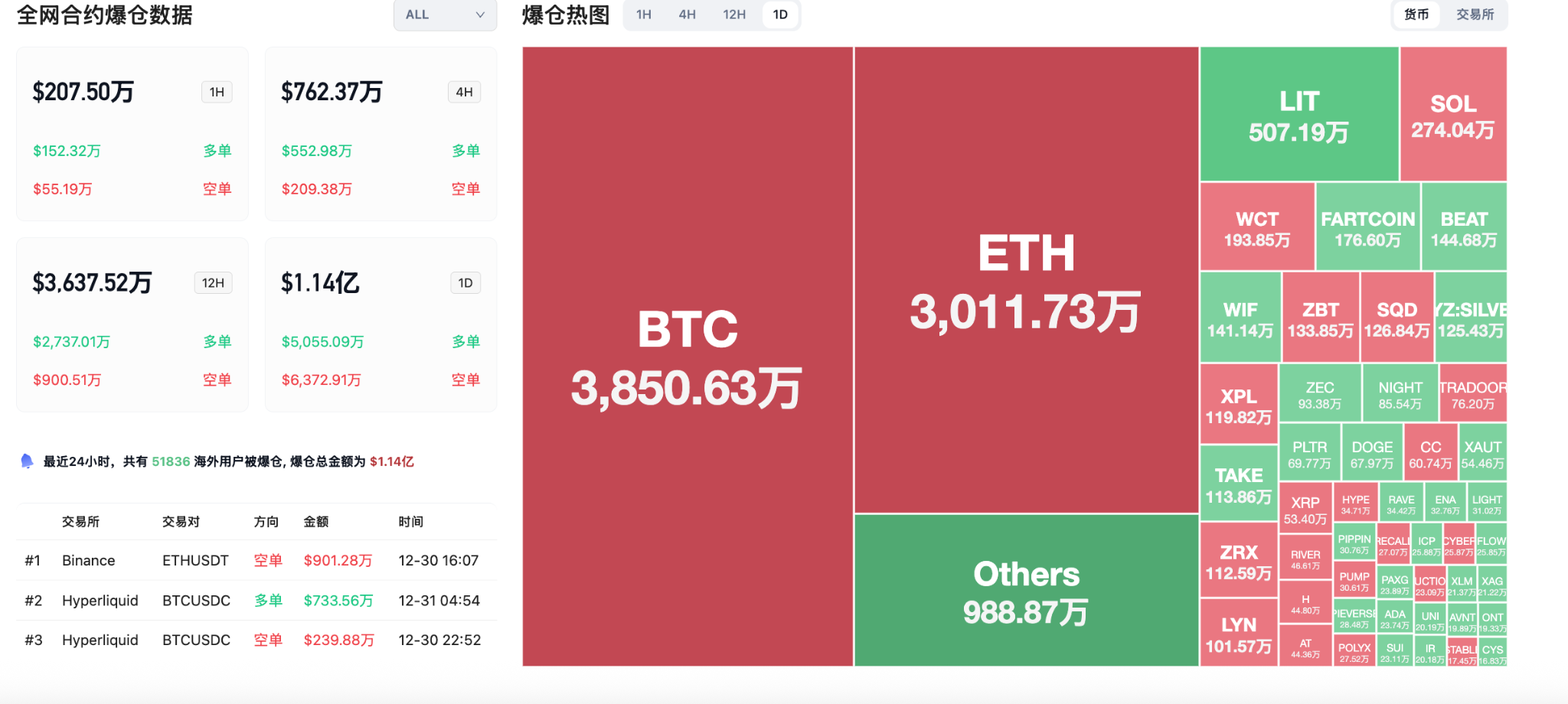

24-hour liquidation data: A total of 51,836 people were liquidated globally, with a total liquidation amount of $114 million, including $38.5 million in BTC, $30.11 million in ETH, and $5.07 million in LIT.

3. ETF Flows (as of December 30)

Bitcoin ETF: +$355 million, turning from net outflow to net inflow after 7 days of continuous outflow.

Ethereum ETF: +$67.836 million inflow, with no net outflows among nine ETFs.

Solana ETF: +$5.21 million

XRP ETF: +$15.55 million

4. Today's Outlook

The second phase of the Stable pre-deposit activity has opened for withdrawals

Hats Finance will stop its centralized custody front-end and server operations on December 31

The Bank of Lithuania warns: Crypto services without MiCA licenses will be illegal from January 1

U.S. initial jobless claims for the week ending December 27 (in ten thousand): previous value 21.4, expected value 21.5

Buffett officially steps down, Abel will take over as Berkshire CEO (January 1, 2026)

On New Year's Day, A-shares, Hong Kong stocks, U.S. stocks, the UK, and Japan and South Korea will be closed, and the China Financial Futures Exchange will also be closed.

Today's top gainers among the top 100 cryptocurrencies: Canton Network up 15.4%, Chiliz up 10.6%, MemeCore up 9.5%, DoubleZero up 7.3%, Story up 6.4%.

5. Hot News

Arthur Hayes has just withdrawn tokens worth approximately $2 million

Analysis: Only about 12% of public token sales in 2025 are still above the issuance price

The Zama protocol has launched its mainnet and completed its first cUSDT transfer on Ethereum

LIT launched with a $675 million airdrop and has withdrawn $30 million from Lighter

Sui announces the launch of private trading features in 2026

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。