Author: Jae, PANews

The last airdrop suspense of this year came to an end last night (December 30). Perp DEX (Decentralized Perpetual Contract Exchange) Lighter announced the completion of its airdrop distribution, totaling $675 million for early participants, bringing a touch of warmth to the cold market by the end of 2025.

Although the winter market appears somewhat bleak, the competition for liquidity and trading experience in the Perp DEX battlefield is becoming increasingly fierce. The industry is witnessing the gradual replacement of early automated market makers (AMMs) by high-performance centralized limit order books (CLOBs). Based on zk-rollup, Lighter has quickly stood out, attempting to redefine the standards of on-chain derivatives trading with its zero-fee strategy and customized ZK circuit technology path.

Historically, airdrops have been difficult to balance, and Lighter undoubtedly faces the same issues encountered by other airdrop projects: dissatisfaction with the airdrop and user retention in the post-airdrop era.

Airdrop Reactions Are Polarized, Token Distribution Sparks Controversy

Lighter completed its TGE yesterday, and the protocol token LIT exhibited significant volatility in its early performance. In pre-market trading on several centralized exchanges, LIT briefly reached a high of $3.9. After the official TGE commenced, the price surged to $7.8 in a short time, then fell back and stabilized in the range of $2.6 to $3.

According to monitoring by Bubblemaps, the total amount airdropped to early participants on the first day of LIT's launch reached $675 million. Since the airdrop distribution, approximately $30 million has flowed out of Lighter.

Lighter's airdrop effort is considered generous, yet community feedback is polarized. Supporters argue that the initial airdrop accounts for 25% of the total supply, equivalent to about $690 million directly allocated to Season 1 and Season 2 point holders, with no lock-up restrictions, contrasting sharply with the lower token allocations of many other projects at TGE; opponents contend that the point conversion rate for Season 1 and Season 2 is about 20 to 28 LIT tokens per point. For some high-frequency users, this is roughly equivalent to the fees they paid, failing to deliver the expected "big gains."

The biggest controversy surrounding this TGE lies in Lighter's token economics. The total token supply is 1 billion, with 50% allocated to the ecosystem and the other 50% to the team and investors, set to unlock linearly over three years. This plan has been criticized by the community as "team-dominated": while investor lock-ups are strict, the overall proportion is too high, potentially diluting community interests. The 25% of airdropped tokens without lock-up may create short-term selling pressure, while the 50% locked-up share could lead to long-term potential selling pressure, which is not conducive to the stable growth of LIT's market value.

From a valuation perspective, Lighter's pricing directly competes with Hyperliquid and Aster. Although its trading volume once surpassed these two competitors, doubts remain about the rationality of its valuation.

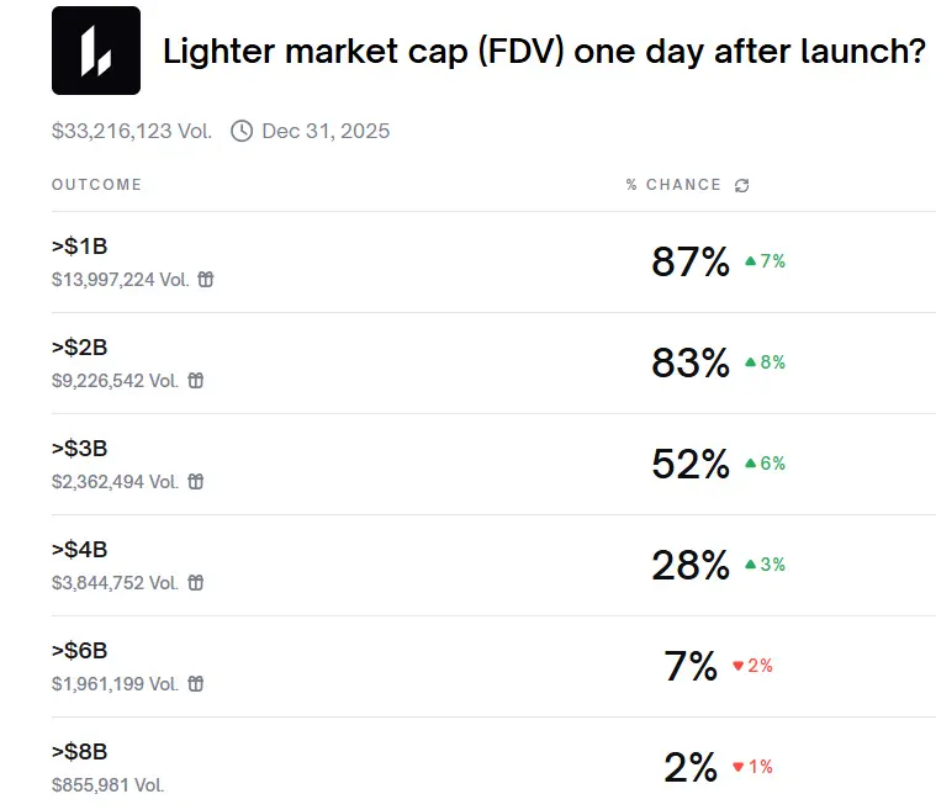

CoinGecko data shows that LIT currently has a market cap of about $680 million, with an FDV (Fully Diluted Valuation) exceeding $2.7 billion. A week ago, Polymarket predicted an 83% probability that "Lighter's market cap will exceed $2 billion the day after its launch."

Lighter CEO Vladimir Novakovski stated in a podcast interview that the token would not skyrocket immediately upon launch, and realistic expectations are to start from a relatively healthy position. The Rollup founder Andy also tweeted that if LIT's FDV is around $2 billion, he would choose to buy in.

Overall, Lighter's TGE performance met expectations but did not surprise, and combined with the overall market downturn, the community's overall response to the protocol has been muted.

Top Capital Bets on Harvard Genius to Build Lighter

The story of Lighter begins with its founder, Vladimir Novakovski, a typical blend of "the kid next door" and Wall Street elite. He entered Harvard at 16 and graduated early, subsequently being personally recruited by Ken Griffin, founder of global market-making giant Citadel. This experience at a top quantitative fund has given him a deep understanding of the microstructure of traditional financial markets and the essence of liquidity management.

However, this genius's ambition did not stop at Wall Street. He successfully founded the AI social platform Lunchclub, which was valued at over $100 million in Web2. In 2023, he keenly identified a gap in on-chain financial infrastructure, leading 80% of his team to transition to All in Crypto, fully committing to the development of Lighter.

"We invested in Lighter primarily because of Vladimir and his team's engineering capabilities," said Joey Krug, a partner at top Wall Street VC Founders Fund, revealing the underlying logic of capital investment: In an extremely complex technological arena, the density of top talent is the main moat.

In November 2025, Lighter announced the completion of a $68 million funding round, achieving a post-investment valuation of $1.5 billion.

Notably, the participation of well-known brokerage Robinhood may signal an important message: Traditional financial giants are seeking Perp DEX infrastructure that can truly support institutional-level trading volumes. This will not only bring funding to Lighter but also introduce potential user groups from traditional financial institutions.

ZK Empowers Lighter to Achieve 15K+ TPS While Ensuring Verifiability

2025 is a watershed year for the Perp DEX sector. While early protocols like dYdX and GMX have validated the feasibility of on-chain derivatives trading, they have consistently struggled to compete with CEXs (Centralized Exchanges) in terms of execution speed, slippage control, oracle delays, and liquidity depth. Lighter, however, achieves sub-second transactions and higher capital efficiency by adopting a CLOB model and high-performance Layer 2 architecture.

The core logic behind this evolution is that verification equals trust. Lighter does not require users to trust the matching engine; instead, it generates verifiable cryptographic proofs for every order match, every risk assessment, and every liquidation activity through customized ZK circuits. This architecture ensures that even if the sorter attempts to act maliciously or is attacked, the underlying Ethereum mainnet contracts can still guarantee asset security.

Lighter's technological moat is built on a seemingly contradictory combination: decentralized trust (ZK) and centralized efficiency (CLOB). Its architectural design not only pursues high performance but also emphasizes transparency and non-custodial nature, giving it a strong "Ethereum-native" attribute in its technical narrative.

Unlike many general-purpose ZK virtual machine protocols, Lighter has chosen a more challenging path: customizing ZK circuits (zkLighter) for trading logic. This allows the protocol to generate proofs with extremely high efficiency, achieving a throughput of over 15,000 TPS (transactions per second) and soft finality of less than 10 milliseconds, sufficient to meet the stringent requirements of high-frequency traders.

It is worth mentioning that Lighter's underlying data structure employs a "super tree" architecture to ensure that even under extremely high concurrency, the execution price of each order will be the optimal price at that time.

To prevent extreme risks of the sorter going offline or refusing service, Lighter has also designed an "escape pod" mode. Since all account balances and position data are published as Blob data on Ethereum, users can generate their own account value proofs based on publicly available historical data and directly withdraw funds on the mainnet without needing authorization from the sorter. This mechanism also enhances Lighter's resistance to censorship and asset sovereignty compared to Perp DEX protocols that build their own L1 consensus.

Zero-Fee Model Reshapes Protocol Customer Acquisition Logic

Lighter's ability to attract such a high density of capital and user attention is not solely due to its high performance and verifiability, but also because of its triple innovation in fee structure, capital efficiency, and liquidation logic.

In a context where Perp DEXs generally rely on trading fees for profit, Lighter has thrown a "zero trading fee" bombshell into the market.

The protocol has designed a clever dual-account model to balance commercial sustainability.

Retail Account (Standard): Waives all Maker and Taker fees for ordinary users. Although this incurs a slight delay of around 300ms, it is highly attractive for most non-high-frequency users.

Premium Account: Offers zero-latency channels for institutions and high-frequency traders but charges very low fees (Maker 0.002%, Taker 0.02%).

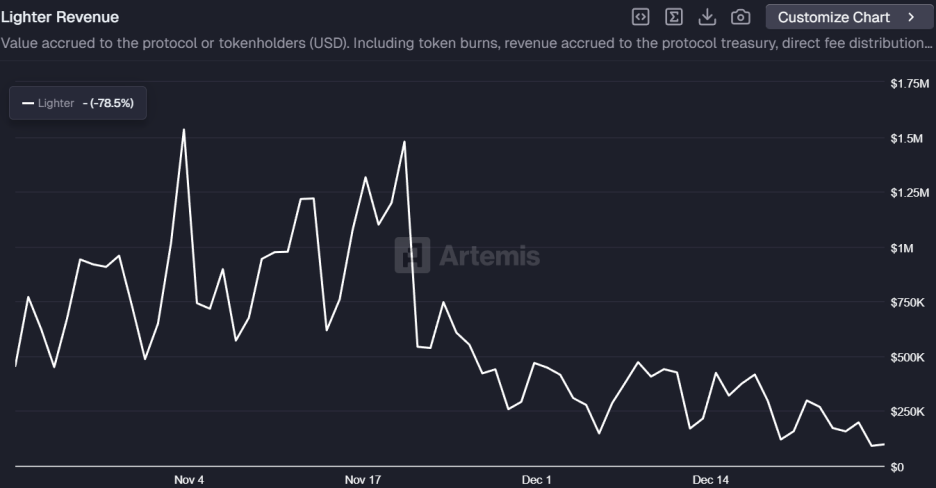

Currently, Lighter's revenue mainly comes from premium account fees and liquidation fees, with daily average revenue of about $200,000, initially validating the feasibility of its customer acquisition model.

However, due to the market downturn, Lighter's revenue levels have declined over the past week. The expectations for the token airdrop have been fulfilled, and the protocol's actual revenue-generating ability remains to be observed.

If zero fees are the hook for attracting users, then the Universal Full Margin (UCM) system is the killer feature for retaining professional funds.

Traditional Perp DEXs typically require users to deposit stablecoins like USDC as margin, which is less capital efficient. In response, Lighter has introduced the UCM system, allowing traders to directly use interest-bearing assets stored on Ethereum L1 (such as stETH, LP tokens, or even Aave deposit positions) as collateral for L2 leveraged trading.

The cleverness of this design lies in the fact that users' collateral assets do not need to move across chains but are mapped to L2 through ZK proofs. This means users can earn L1 staking rewards while opening positions on L2.

In the event of liquidation, the system generates a cryptographic proof submitted to the L1 contract, automatically deducting the corresponding assets. This "assets remain static, credit extends" model significantly enhances capital efficiency, eliminating the difficult trade-off users face between yield-bearing assets and trading funds.

The liquidation mechanism has also been the most contentious aspect of Perp DEXs. Lighter ensures that liquidation actions are fully verifiable through ZK circuits, reducing the likelihood of malicious pinning or forced liquidations by the platform.

Additionally, Lighter has launched risk-layered liquidity pools:

- LLP (Lighter Liquidity Provider): This is the main protocol pool, acting as the counterparty and liquidation executor. It not only earns profits from losers but also captures funding rates and liquidation fees. Currently, the annualized yield of LLP remains around 30%.

- XLP (Experimental Liquidity Provider): An isolated pool specifically designed for experimental assets (such as pre-market tokens, RWA, and low liquidity altcoins). XLP does not participate in forced liquidations, and its risk exposure is also isolated from the main protocol, making it suitable for liquidity providers with a higher risk appetite.

OI/Vol Ratio Lingers Around 0.2, Data May Experience "Dehydration" Post-Airdrop

The rapidly accelerating Lighter is not without its shadows.

The exaggerated OI/Vol (Open Interest/Volume) ratio of the protocol has raised widespread market skepticism. Although the ratio has recently rebounded, Lighter had long maintained a ratio around 0.2, which means that on average, every $1 of open interest was traded about 5 times within 24 hours, significantly deviating from a healthy organic holding pattern (OI/Vol 0.33), exhibiting clear signs of wash trading.

This phenomenon primarily stems from Lighter's aggressive point incentive program. Although the protocol employs measures such as scarcity of invitation codes and weighted holding duration for defense, the TGE (Token Generation Event) has concluded, and the retention of these high-frequency flows will also impact Lighter's true market share.

Frequent downtime incidents at Lighter have also exposed its lack of system stability. On October 9, the protocol experienced a downtime lasting 4.5 hours. On December 30, Lighter encountered an issue where the prover stalled, preventing users from withdrawing normally. For a derivatives platform carrying billions of dollars in funds, stability is a lifeline.

The emergence of Lighter represents a new stage in the evolution of Perp DEX: from decentralization to verifiable high performance. The protocol addresses the trust issue through the security of the Ethereum mainnet and ZK technology, entering the Perp DEX battlefield with a zero-fee strategy.

However, the competition in the Perp DEX sector is no longer just a technical contest, but a comprehensive game of liquidity, community ecology, and product quality. Whether Lighter can grow from a technical dark horse to a leader in the sector depends on its ability to continuously attract and retain genuine trading demand in the post-airdrop era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。