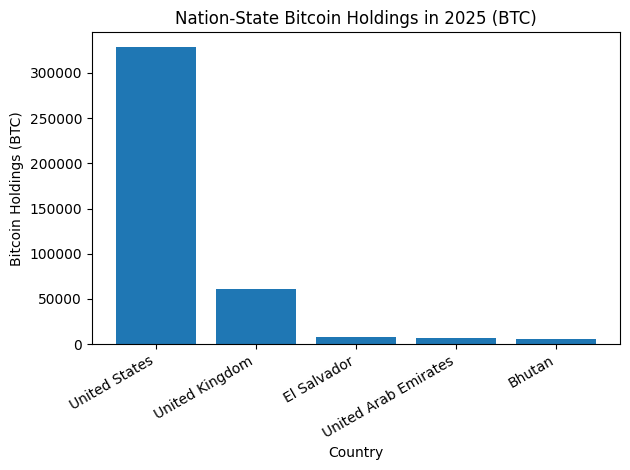

Early this year, in May, estimates put the United States’ bitcoin stash at 198,012 BTC, but a major confiscation—127,271 BTC tied to a wanted Chinese national—quickly made that pile much heavier.

Thanks to that seizure by U.S. authorities, the country’s holdings ballooned in short order. As 2025 winds down, data logged by Arkham Intelligence shows the U.S. government sitting on roughly 328,372.32 BTC. At current BTC exchange rates, that hefty trove carries a price tag of about $28.7 billion.

Right behind the United States sits the United Kingdom, with the U.K. government holding 61,245.01 BTC, according to Arkham records. The story traces back to 2018, when the U.K. Metropolitan Police raided a property tied to Jian Wen and Zhimin Qian, two Chinese nationals linked to a £5 billion investment fraud and money laundering scheme that ran from 2014 to 2017. During the operation, authorities seized devices containing more than 61,000 BTC, with the government securing full access to the holdings in July 2021.

Sitting below the U.K. in third place is El Salvador, a country where bitcoin ( BTC) holds legal-tender status. At present, the nation controls a cache of 7,509.37 BTC, according to Arkham’s logs. The government says these holdings come from national treasury allocations. Outside observers, including the International Monetary Fund (IMF), have raised doubts, suggesting El Salvador may not have acquired new bitcoin since early 2025 and that transactions labeled as “purchases” could simply reflect internal wallet transfers rather than genuine additions to reserves.

Next on the list is the United Arab Emirates (UAE), holding 6,568.30 BTC, a balance sourced directly from mining operations conducted through Citadel Mining. The ownership trail is straightforward: Citadel Mining is 85% owned by UAE Royal Group, a heavyweight conglomerate steered by Abu Dhabi’s ruling family. The UAE has recently climbed the ranks among nation-states holding BTC, as the region has increasingly positioned itself as a central hub for crypto, blockchain, and artificial intelligence (AI).

Bhutan ranks as the fifth-largest nation-state holding BTC, and much like the UAE’s position, its stash is built through mining. The Royal Government of Bhutan acquires bitcoin this way, with oversight handled by Druk Holdings (DHI), the sovereign wealth fund and commercial arm of the state. DHI has laid out an ambitious roadmap, targeting tenfold growth in these investments by 2035. That said, Bhutan trimmed its holdings in 2025 and once controlled a noticeably larger cache. Today, the country holds about 5,984.54 BTC, valued at just over half a billion U.S. dollars.

Also read: Bitcoin Logs 4th Straight Outflow Day With $189 Million Exit

Together, the top tier of nation-state BTC holders in 2025 paints a picture driven less by ideology and more by how each government arrived at its stack. Some landed here through court seizures and confiscated hardware, others via mining operations humming away in deserts or mountain valleys, and a few through treasury strategies that continue to spark debate.

Different routes, different rationales—but the common thread is that bitcoin has quietly found a place on sovereign balance sheets. Looking ahead to 2026, nation-state bitcoin ownership is no longer a novelty or a curiosity. It’s a line item markets track, critics dissect, and policymakers weigh with increasing seriousness. Whether these holdings expand, contract, or simply shift between wallets, governments owning BTC has moved from theory to hard data.

- Which country holds the most bitcoin in 2025? The United States leads all nation-states, holding roughly 328,372 BTC largely sourced from law enforcement seizures.

- Why do governments hold bitcoin? Nation-states acquire BTC through seizures, mining operations, or treasury strategies tied to financial policy decisions.

- Is bitcoin legal tender anywhere? El Salvador remains the only country where bitcoin is recognized as legal tender.

- How do analysts track government bitcoin holdings? Platforms like Arkham Intelligence monitor on-chain data to estimate wallets linked to government entities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。