On the last trading day before the New Year, the market experienced a slight decline, but the impact on sentiment was relatively low. Although the cryptocurrency market has faced criticism recently, Bitcoin ($BTC) has managed to maintain a slight oscillation pattern over the past two weeks, which is commendable. From a macroeconomic and political perspective, there haven't been any strong negative news lately. Macroeconomically, the Federal Reserve is still waiting for new data, and politically, Trump is working hard to ensure the smooth implementation of tariffs. The most concerning issue remains the geopolitical conflict between Russia and Ukraine, with no signs of a ceasefire in sight.

On a more optimistic note, the U.S. economy may be performing better than expected. Although the labor market has shown signs of decline and investor sentiment is not very optimistic, the GDP growth rate indicates that the U.S. is still quite a distance from recession. If the Federal Reserve can intervene sooner, a soft landing for the U.S. economy is still possible.

This makes the Federal Reserve's monetary policy a crucial factor in 2022, 2023, and 2024, marking the fourth significant year ahead. The entire year of 2025 will likely be influenced by Trump and the Federal Reserve, while 2026 will continue to see the interplay between Trump and the Federal Reserve. However, with Powell's term ending in 2026, it may present Trump with his best opportunity, making it a year of both opportunities and crises for risk markets.

Looking at Bitcoin's data, the turnover rate has slightly increased, but not significantly. Compared to previous working days, it remains relatively low. Overall investor sentiment is manageable; although there was a slight decline before the holiday, the impact on the New Year holiday should be minimal. The important market dynamics are likely to unfold a week later.

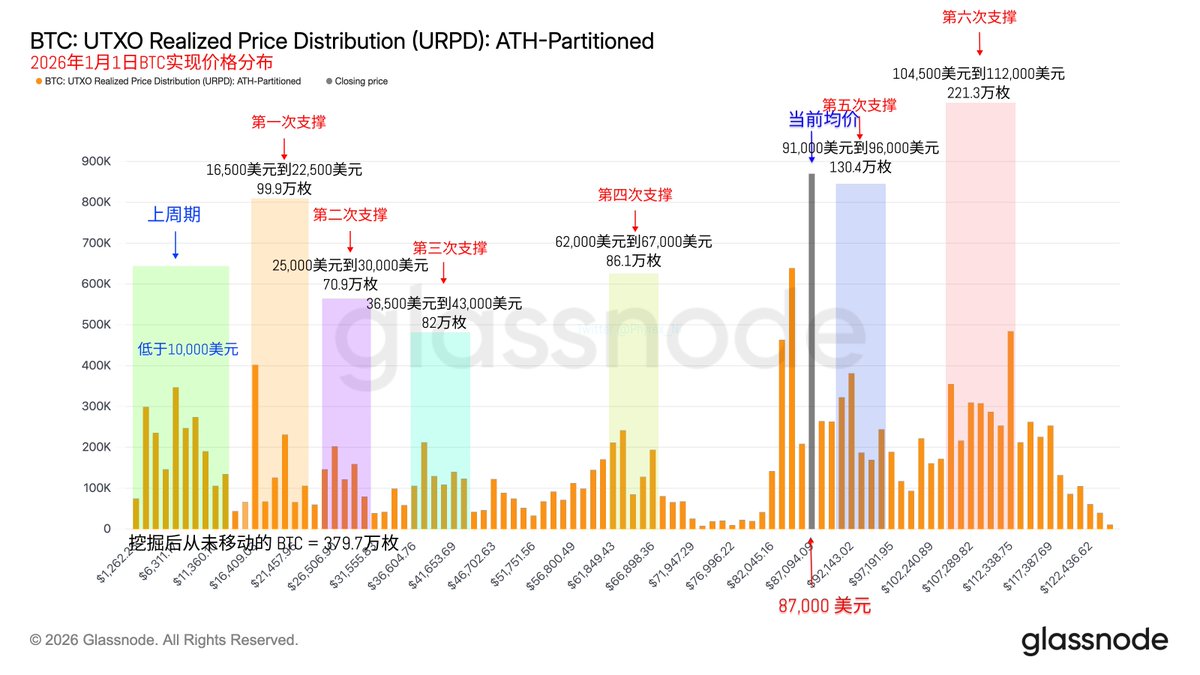

The accumulation at $87,000 is quite high, with nearly 900,000 coins stacked up. Historically, when the inventory at a single price point is excessively high, it prompts investors to make directional choices, with both upward and downward movements possible. However, each time this situation arises, whether it goes up or down, the volatility may be significantly larger than usual.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。