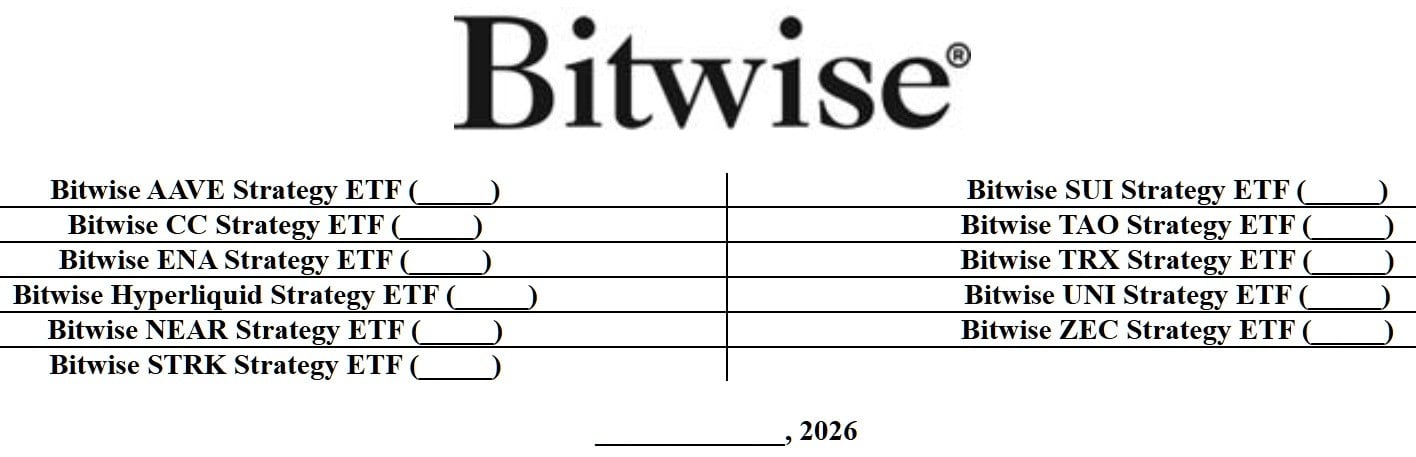

Asset management firm Bitwise filed a post-effective amendment with the U.S. Securities and Exchange Commission (SEC) on Dec. 30 to register 11 cryptocurrency strategy exchange-traded funds (ETFs) tied to individual protocol tokens.

The asset manager’s Form N-1A filing amends the registration statement of Bitwise Funds Trust to include single-asset crypto strategy ETFs tied to AAVE, CC, ENA, Hyperliquid, NEAR, STRK, SUI, TAO, TRX, UNI, and ZEC. Each fund is structured as a separate series of the trust and seeks capital appreciation through exposure to a specific digital asset rather than traditional equity or fixed-income securities.

Bitwise’s SEC filing on Dec. 30. Source: SEC.

The prospectus specifies that all 11 products are cryptocurrency-focused ETFs that obtain exposure through a combination of direct token holdings, investments in non-U.S. exchange-traded products, and derivative instruments referencing the underlying crypto asset. Under normal market conditions, each fund intends to invest at least 80% of net assets plus borrowings in instruments providing exposure to its respective token, with direct holdings generally capped at 60%.

Read more: Bitwise Unloads 10 Predictions: ‘Bulls Will Win out’ Across Bitcoin, Altcoins, Crypto ETFs

The filing further details that the funds may utilize wholly owned Cayman Islands subsidiaries to hold digital assets and derivatives while maintaining regulated investment company status under the Internal Revenue Code. Risk disclosures address digital asset volatility, custody and cybersecurity threats, regulatory classification uncertainty, derivatives usage, liquidity constraints, and concentration risk.

The company emphasized that fund performance will not precisely mirror the spot price of the underlying cryptocurrency due to fees, structural features, and reliance on third-party exchange-traded products. Shares of each fund are intended to list and primarily trade on NYSE Arca, with creations and redemptions conducted in large blocks through authorized participants. Bitwise Investment Manager LLC is identified as the investment adviser, with portfolio managers designated to oversee the funds once operations commence.

- What cryptocurrencies are included in Bitwise’s new ETF filing?

The filing covers single-asset ETFs linked to tokens including AAVE, UNI, TRX, NEAR, SUI, and ZEC. - How do the Bitwise crypto strategy ETFs gain token exposure?

They use a mix of direct token holdings, non-U.S. exchange-traded products, and crypto-linked derivatives. - Will these Bitwise ETFs track spot crypto prices exactly?

No, performance may differ due to fees, fund structure, and reliance on third-party products. - Where are the proposed Bitwise crypto ETFs expected to trade?

Shares are intended to list and primarily trade on NYSE Arca.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。