The weekend news is still focused on Venezuela, and the best market reaction will be seen in U.S. stock futures and the opening of the U.S. spot market. When the futures open tomorrow morning, it will primarily reflect the views of Asian investors on the events in the U.S. and Venezuela, while in the evening, it will be the expectations of European and American investors.

From the current information, the outlook is quite optimistic. If Venezuela's oil, gold, and rare earths can be successfully developed, they will be mined in conjunction with the U.S., which will help the U.S. economy and alleviate inflation.

In recent years, the biggest concern for U.S. tech giants has been the rare earth supply chain being constrained by Asia. If Venezuela's rare earth resources are mined under U.S. joint development, it will directly reduce the supply chain risk premium for U.S. high-tech manufacturing, and the market will be willing to give Nasdaq a higher price-to-earnings ratio. I have always believed that tech stocks have a positive correlation with Bitcoin.

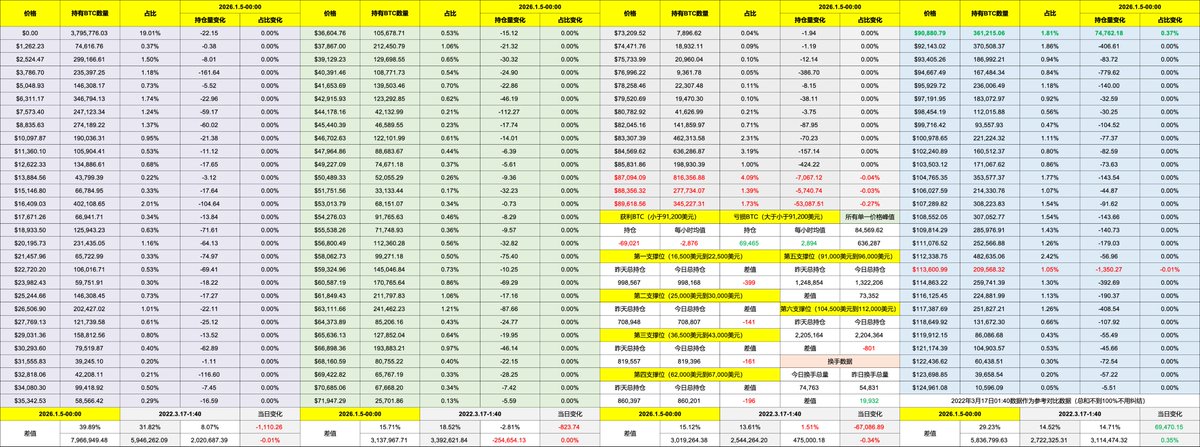

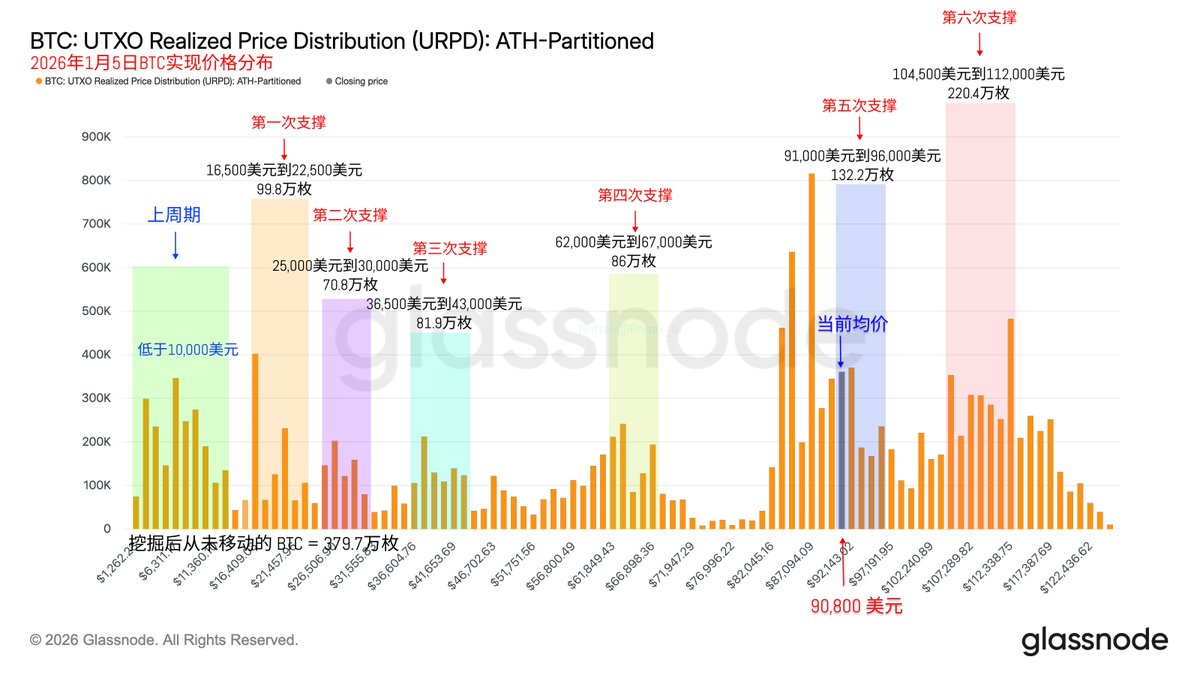

Looking back at Bitcoin's data, the turnover rate continued to rise on Sunday, with an increase in selling from short-term profit-taking investors, but the market has not shown signs of being unable to absorb this, indicating that many investors still believe that Bitcoin ($BTC) should have good development in the upcoming 2026.

The chip structure has not changed significantly. Whether it can successfully build a bottom around $87,000 mainly depends on the trend after the U.S. stock market opens on Monday. If it can truly break the $90,000 curse, then there will still be good opportunities in the market.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。