Written by: Golem (@web3_golem), Planet Daily

A little story before the capture of the President of Venezuela…

On January 1, 2026, Eastern Time, after surviving assassination attempts, issuing currency, and a tariff trade war, Trump managed to get through the first year of his presidential term relatively smoothly. However, he had no time to celebrate, as he was conspiring with several key White House figures and military generals at his Mar-a-Lago estate in Florida for a military operation that would shock the world.

They were perfecting the details of the operation in a secret and highly secure room, the atmosphere tense. Trump suddenly felt thirsty and pressed the Coke button at the edge of the table, wanting a cold Coke. A waiter carrying Coke navigated through layers of Secret Service protection and delivered the still-fizzing drink to Trump’s side. "There must be no surprises regarding the operation against Maduro tomorrow," Trump mumbled.

Those who have long served politicians know to be a "deaf-mute" at the right time, or they will attract trouble they cannot handle. However, it was clear that this "Coke kid" intended to take a risk.

That night, the waiter, the "Coke kid," opened an account on Polymarket, the world's largest prediction market. Although he did not understand the crypto industry, he knew that last year, this platform had predicted in advance that Trump would become the 47th President of the United States. He then bought "yes" on several related predictions, including "The U.S. will invade Venezuela before January 31, 2026," at a time when the probability was only 6%, betting his entire monthly salary.

On January 2, 2026, at 10:46 PM Eastern Time, Trump issued the order for the raid, and over 150 aircraft took off from 20 bases, conducting a low-altitude assault on the Venezuelan coast.

On January 3, 2026, at 1:01 AM Eastern Time, the U.S. military breached Venezuela's air defense system. Delta Force ground troops arrived at Maduro's residence, smashed through the steel door, and after a firefight, the U.S. military captured the Maduro couple and immediately evacuated, with no U.S. casualties. Two hours later, the Maduro couple was taken to the U.S. Navy ship USS Iwo Jima and then transferred to New York.

A capture operation against the president of a sovereign nation was completed in just 5 hours, with Trump watching the entire operation from Mar-a-Lago.

On January 3, 2026, at 4:30 AM Eastern Time, Trump announced on Truth Social that the President of Venezuela and his wife had been captured and taken out of the country.

Meanwhile, predictions on Polymarket regarding "Maduro's resignation time" and "Trump's military action against Venezuela time" were quickly settled. The "Coke kid" had already resigned on January 2, having made his first pot of gold from this early bet…

(ps: This story is purely fictional. If any director wants to make a movie based on this, I am willing to provide this script free of charge.)

Insiders Knew About the U.S. Military Action 6 Days in Advance

Although the above plot has a fast-food novel flavor reminiscent of "Rebirth: I Am a Waiter at Mar-a-Lago," it may not be entirely false. The "Coke kid" is purely fictional, but the capture of Venezuelan President Maduro by the U.S. military is real, and it is highly probable that there were "insiders" who placed bets on Polymarket in advance.

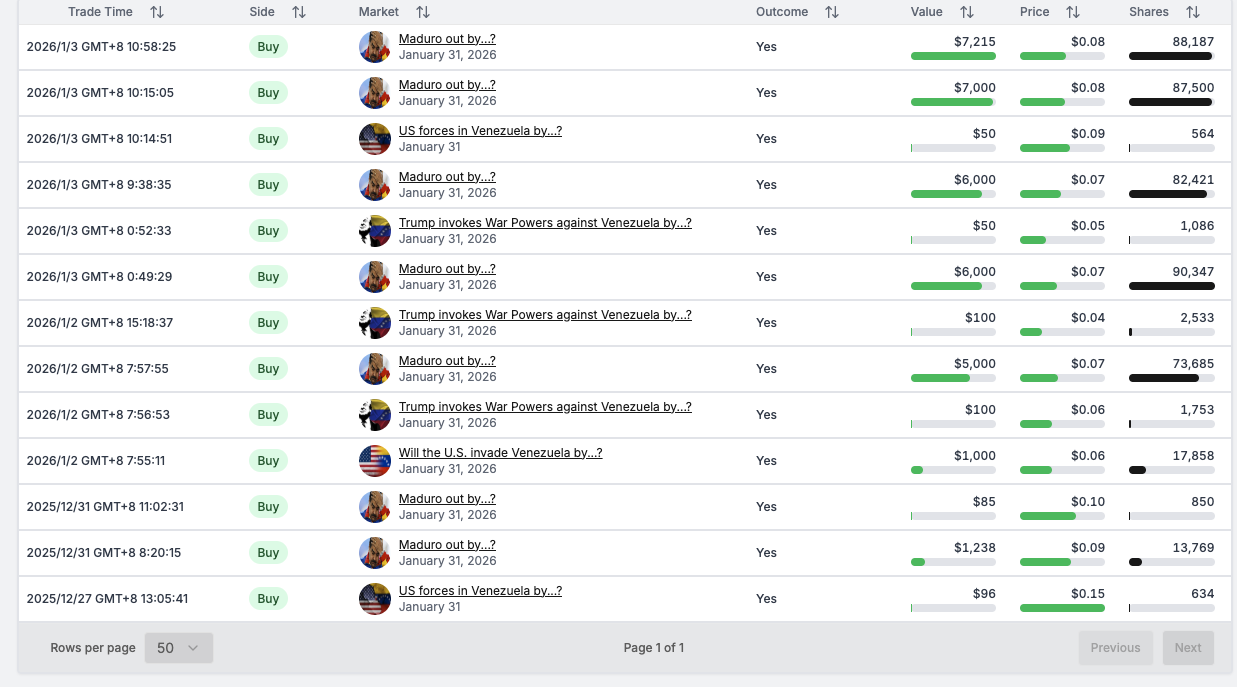

According to monitoring by Lookonchain, before Trump announced Maduro's capture, three insider addresses on Polymarket suddenly placed bets on his resignation, collectively profiting $630,400. All of these addresses were created and funded just days before the event. Among them, address 0x31a5 (0x31a5…8eD9) invested $34,000 and profited $409,900; address 0xa72D (0xa72D…eBd4) invested $5,800 and profited $75,000; and address SBet365 invested $25,000 and profited $145,600.

Of these three addresses, the most impressive is 0x31a5 (0x31a5…8eD9). The U.S. military's capture of Maduro occurred at 1:00 AM Eastern Time on January 3, and the media and other countries first received this news at 4:30 AM Eastern Time on January 3, which is when Trump announced the completion of the operation on Truth Social.

However, this insider at address 0x31a5 (0x31a5…8eD9) first bet that "Maduro will resign before January 31, 2026" at 7:20 PM Eastern Time on December 30, 2025, and even placed a bet on "The U.S. military will attack Venezuela before January 31, 2026" as early as December 27.

0x31a5 (0x31a5…8eD9) placed bets before the U.S. military's actual action

This suggests that the "insider" may have known about the U.S. military's actions six days in advance and began building positions on Polymarket. Obtaining the operational plans of the so-called world's strongest armed force—the U.S. military—so early may not be something any hacker or national intelligence agency could accomplish, but Polymarket did.

It has no listening capabilities but merely opens a fast track for human greed. Undoubtedly, this insider must be close to U.S. politicians or senior military officers, or perhaps even hold a significant position themselves. It is unlikely they are a U.S. soldier involved in the operation, placing bets while fighting. Although they do indeed trade crypto. _(Related reading: _U.S. Soldiers' Investment Records: Missiles and K-lines Fly Together, Military Bases Become the Craziest Crypto Trading Zones in the U.S._ )_

More importantly, the actors involved hardly need to worry about identity exposure. Polymarket inherently possesses advantages of anonymity: no KYC, account creation costs close to zero, ample liquidity, and crypto settlement ensuring privacy. Under such conditions, it is very difficult to trace addresses and confirm real identities afterward.

So when the cost of participation is driven down to an extremely low level while the potential returns are extremely high, this is no longer a moral issue but a problem of incentive design. In the face of such mechanisms, even seemingly respectable politicians with just causes can hardly guarantee they will never cross that line.

Predicting the Truth or Rejecting Insider Information

But we can imagine another possibility: if the Venezuelan government had monitored the abnormal buying on Polymarket in advance, would things have changed? (This is not difficult, as the insider's betting is quite obvious; large bets in a low-probability market can be easily detected if there is a proactive monitoring system.)

Then perhaps the Venezuelan government would have become alert before the U.S. military's action. To be safe, Maduro might have moved to a more difficult-to-breach underground bunker; or he could have reorganized the military in advance to prepare for battle (Odaily note: At the time of the operation, half of the Venezuelan military was in a relaxed state due to the Christmas holiday), which could have resulted in U.S. casualties rather than zero; or at the very least, Venezuela could have sought support from other countries in advance or publicly declared the potential U.S. military action at the United Nations to politically constrain the opponent.

Of course, the above assumptions are very rough, and this incident may indeed be a coincidence, but the fact that "the probability changes on Polymarket regarding major political events always precede the release of mainstream information" has become a reality.

Once this pattern is repeatedly validated, the price signals of prediction markets will no longer just be trading results but will begin to be viewed by the outside world as a reference indicator. Its function may gradually approach the Pentagon's "Pizza Index"—an informal yet highly sensitive risk thermometer.

This is certainly something the U.S. authorities do not want to see.

Previously, U.S. Congressman Ritchie Torres planned to propose the "2026 Prediction Market Public Integrity Act," aimed at establishing restrictive rules against potential "insider trading" behaviors in prediction markets. The bill intends to prohibit federally elected officials, politically appointed personnel, and executive branch employees from trading prediction market contracts related to government policies or political outcomes when they have access to or can reasonably obtain significant non-public information in the course of their duties.

After the exposure of the "insider incident" regarding Maduro on Polymarket, this bill may receive significant attention from the U.S. government. Kalshi's public relations account immediately responded that its platform rules explicitly prohibit any trading behavior based on significant non-public information.

Kalshi can make such guarantees because it has adhered to compliance principles since its inception, with very high KYC requirements for platform users. If insider trading occurs, Kalshi can quickly identify user identities and even freeze user funds.

Polymarket has naturally become a haven for these insiders. To some extent, insider trading and Polymarket are mutually reinforcing. Polymarket provides a safe house for insiders to make money, while insider trading brings more trading volume and visibility to Polymarket.

Many of Polymarket's breakout moments have been due to it revealing truths ahead of traditional media. This is not because Polymarket players are exceptionally clever, but because a few individuals are guiding the probabilities. Ideally, prediction markets reflect collective wisdom, but in reality, they are merely playgrounds for insiders.

For most ordinary people, this may not be a bad thing. With prediction markets like Polymarket, people can sense the direction of certain events earlier, reducing their passive suffering from sudden news, and no longer being completely subject to emotional public opinion and delayed media narratives. From the results, this actually resembles a form of information-level "decentralization."

But for the groups at the top of the pyramid, the situation is quite the opposite. For a long time, "who knows what and when" has been an order in itself. The truth is not that it cannot be made public, but that it needs to be released at the right time and in the right concentration. Anyone attempting to break this rhythm will be seen as a challenge to the existing rules.

Therefore, Polymarket may once again run into the iron plate of U.S. regulation. In 2024, Polymarket's founder was raided by the FBI at his home in New York, marking the most tense confrontation between Polymarket and the U.S. government. Now, Polymarket has returned to the U.S. market and obtained CFTC approval, indicating that relations have eased.

However, any form of information leak regarding high-level confidential military or security matters, such as the capture of Maduro, is something the U.S. government finds difficult to accept. Currently, as prediction markets attempt to achieve compliance positioning and seek institutional space, the emergence of such events, even if ultimately deemed coincidental, will be interpreted as a potential threat at the regulatory level.

What prediction markets face is not just a compliance technical issue, but whether they are inadvertently intruding into the sensitive boundaries of traditional information security and national governance.

If predictions no longer lead the truth, what remains? This question cannot be avoided in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。