On January 2, in the time zone of UTC+8, Japan's start to what many local media outlets have dubbed the "Year of Digital Assets" was anything but calm: on one hand, the Polymarket Shanghai electricity price contract experienced a partial "flash crash" on New Year's Eve, exposing the fragile mindset of retail investors chasing high odds; on the other hand, Japanese regulators and institutions continued to make strides in areas such as Bitcoin spot ETFs, tax reform, and the entry of brokerages, intertwining compliance and speculative enthusiasm on the same timeline. The market, caught between black swan events and institutional dividends, displayed a typical Japanese hesitation—fearing to stand at the center of a bubble again while also worrying about missing the next wave of global wealth migration.

The "Contract Altar" of Polymarket's Electricity Price and Retail Investor Mindset

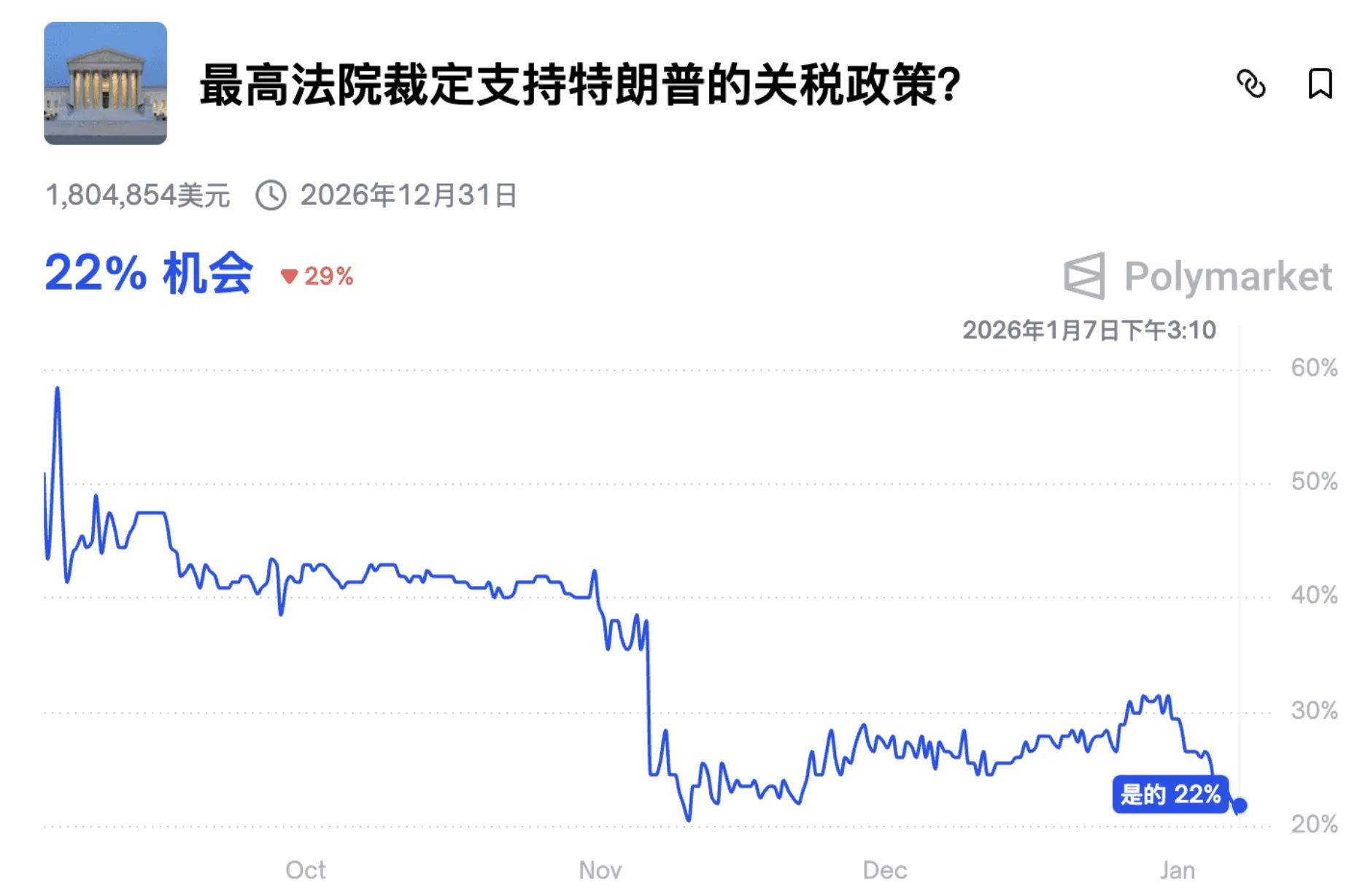

Surrounding the Polymarket Shanghai electricity price prediction contract, a highly symbolic "contract altar" unfolded during the New Year period. In the first half of the event, contract prices were pushed up by emotions, with some participants viewing it as a typical opportunity of "information advantage + odds advantage" on social networks, leading to a rapid increase in trading volume and positions. As details of the official electricity price plan were released, market expectations sharply reversed, and the buying side faced continuous sell-offs in a very short time, with price differences quickly erased or even reversed. The final results showed that most retail investors rushed in at the emotional peak and passively became the "last buyers" of liquidity before the results were finalized.

The evolution of this contract revealed several key characteristics. First, retail investors generally held overly high confidence in "policy expectation" contracts, tending to misinterpret scattered news and social discourse as "certain information," continuing to "add positions" even when the chip distribution and odds structure were already unfavorable. Second, when the market was extremely one-sided, many did not take profits in time, instead choosing to "believe in themselves one more time" due to sunk costs, resulting in a complete liquidation of all fantasies after the information was officially announced. Third, throughout the process, the real profits were made by a small number of quantitative funds and calm large players—they tested positions during the information ambiguity phase, gradually hedged when the odds were severely imbalanced, and completed their retreat when retail investor sentiment collapsed. This "contract altar" is not new, but it once again reminds the market during the New Year time node: in the absence of risk management and position discipline, prediction markets can easily evolve into an emotional experiment dominated by retail investors.

From Electricity Prices to ETFs: The Dislocated Resonance of Japanese Regulation and Institutional Actions

In stark contrast to the Polymarket case is Japan's steady progress in the direction of compliant digital assets:

● Loosening of Taxation and Institutional Environment: According to reports, starting in the second half of 2023, Japan's Ministry of Finance and Financial Services Agency have begun discussions on the tax system related to crypto assets, focusing on the accounting treatment of corporate holdings of crypto assets and taxation of unrealized gains. Some materials indicate that regulatory authorities intend to provide a more "neutral" tax burden environment for local Web3 projects and institutional holdings to reduce the pressure of projects moving abroad and funds migrating to Singapore and Dubai.

● Brokerages and Traditional Finance Entering the Market: Several large Japanese brokerages and internet financial platforms have already touched on crypto-related businesses in 2023 through subsidiaries or partnerships, including custody, structured products, and linked services with overseas exchanges. Reports mention that some brokerages view Bitcoin and other assets as "part of alternative asset allocation" in internal materials and have begun researching index products based on this to warm up for future ETFs and other tools.

● ETF Narrative but No Clear Timeline: Japanese regulators have repeatedly mentioned in public that they will "reference the U.S. ETF path," but reports emphasize that no specific timeline or technical roadmap has been provided, nor have they committed to adopting the "U.S. template." Some internal reports from institutions only regard spot ETFs as a "medium to long-term option," discussing them alongside long-term trends such as NISA expansion and family asset reallocation, indicating that the policy level deliberately lowers short-term market expectations to avoid passively creating a new round of bubbles.

● Tug-of-War Between Stable Development and Capital Outflow: On one hand, Japanese authorities emphasize financial stability and consumer protection, maintaining a strict attitude towards high-leverage derivatives and anonymous coins; on the other hand, according to report statistics, local high-net-worth investors and crypto funds have allocated some funds to U.S. ETFs and other overseas products through offshore structures. This "outflow" trend, in turn, becomes an unavoidable reality pressure when discussing local products in Japan.

From these trends, it can be seen that Japan has shifted from "watching" to "conditionally testing" in terms of regulatory framework and institutional readiness. However, unlike the extreme emotions driven purely by the market in the Polymarket case, Japan's institutional progress deliberately maintains a slow pace and strong constraints, causing the compliance narrative and speculative story to resonate out of sync in time: regulation is still paving the way, while retail investors have already begun trial and error on on-chain and overseas platforms.

Japanese Caution Interwoven with Black Swans and Institutional Dividends

If the Polymarket electricity price contract is viewed as a decentralized "street experiment," then Japan's regulatory and institutional compliance layout resembles a slow and closed "conference room game." The two narrative lines seem unrelated, but they both point to the same core: against the backdrop of global liquidity repricing and the opening of institutional doors by U.S. ETFs, Japan must choose between "protecting existing wealth" and "embracing a new round of asset revaluation." The tragedy of retail investors in the electricity price contract reflects the instinctive desire of Japanese investors for high-odds opportunities in an environment shadowed by high inflation and stagnant wage growth, as well as a clear shortfall in risk management knowledge and practical experience. The gradual compliance insisted upon by regulators stems from a deep fear of the asset bubble memories of the last century, not wanting to replay a "lost decade" in digital assets.

The intertwining of institutional dividends and black swans has given the Japanese market a contradictory temperament: on one hand, policies and institutions are building a framework for compliant inflows and long-term allocations, preparing for the "balance sheet entry" of assets like Bitcoin; on the other hand, the main battlefield for retail investors remains concentrated on high volatility, high opacity prediction contracts, and high-leverage tools, expending significant energy in short-cycle emotional cycles. The gap between the two means that even if Japan sees local ETFs or a more favorable tax system in the future, those who can systematically enjoy the dividends may still be the professional funds that have already understood portfolio management and cross-asset hedging, rather than ordinary investors who gamble everything on the electricity price contract.

The Tug-of-War Between Retail Speculation and Regulatory Patience

Regarding the future path of digital assets in Japan, there are significant internal divisions in the market. Some participants believe that due to Japan's serious aging population and large savings, as long as a spot ETF and tax optimization path similar to that of the U.S. is provided, pension funds, insurance capital, and high-net-worth family assets will inevitably gradually flow into assets like Bitcoin, thereby raising its price center in the medium to long term. This group of observers often focuses on policy documents, institutional announcements, and cross-border capital flows, viewing retail "altars" like the Polymarket electricity price contract with a more observational or even sarcastic attitude, considering them mere noise and tuition in the main trend.

Another group emphasizes that the conservative tradition of Japanese regulation may continue to suppress risk appetite, causing local products to lag behind markets like the U.S. and Hong Kong. In their view, the reason retail investors repeatedly "test the waters" on high-volatility contracts is precisely because the local market lacks standardized products that offer a more balanced risk-return profile, controlled leverage, and higher information transparency, forcing those seeking higher returns to create their own "tracks" through cross-border accounts and on-chain platforms. This perspective often advocates for accelerating the pace of launching local compliant products to "bring existing risks back into the regulatory view," rather than attempting to suppress demand through administrative restrictions.

The regulatory stance lies somewhere in between. On one hand, they clearly see the facts of capital outflow and retail speculation abroad, knowing that being overly conservative may further marginalize Japan in the global asset repricing wave; on the other hand, in the absence of comprehensive investor education and penetrating regulatory tools, recklessly opening high-complexity products will almost inevitably trigger collective rights protection and political pressure at cyclical turning points. Thus, a typical tug-of-war pattern has formed: retail investors continuously use their own capital to pressure test new narratives, while regulators filter continuously with time and thresholds, attempting to only open the floodgates at "controllable nodes."

Who Will Price Japan's Digital Assets Next?

Looking ahead to 2024 and the following key years, the evolution of Japan's digital asset trajectory largely depends on three variables: the direction of the global macro cycle, the pace of advancement in ETFs and institutionalization in the U.S. and other major markets, and the rhythm of Japan's own tax reform and financial product innovation. On a macro level, if major economies enter a longer period of high interest rates, the attractiveness of traditional fixed-income products will rise, while the roles of gold and Bitcoin as hedging assets will increasingly be placed on the tables of institutional asset allocation committees; Japan is merely a part of this global rebalancing. The capital-absorbing effect of U.S. spot ETFs and the competitiveness of regional products in places like Hong Kong will have a substantial impact on Japan's policy window: when the scale of outflow capital reaches a certain level, the voices pushing for local products will inevitably strengthen.

For ordinary Japanese investors, the truly worth pondering question is how to complete the identity transformation in this process: from short-term speculators repeatedly frustrated in high-uncertainty prediction contracts like the Polymarket electricity price contract to asset allocation participants who can understand tax systems, product structures, and long-term risk-return ratios. Whether Japanese regulators and institutions will provide sufficiently clear, user-friendly, and transparent tools will directly determine the threshold for this transformation. From a global perspective, Japan's "digital year" is unlikely to be marked by the approval of a specific ETF, but rather unfold in a more long-term manner: as its regulatory framework gradually stabilizes, tax systems become more neutral, and retail education slowly progresses, Japan will find its place again in the global crypto capital landscape; by then, what determines prices may no longer be the emotional screams in the electricity price contract, but the silent and persistent position adjustments of pension funds and family offices.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。