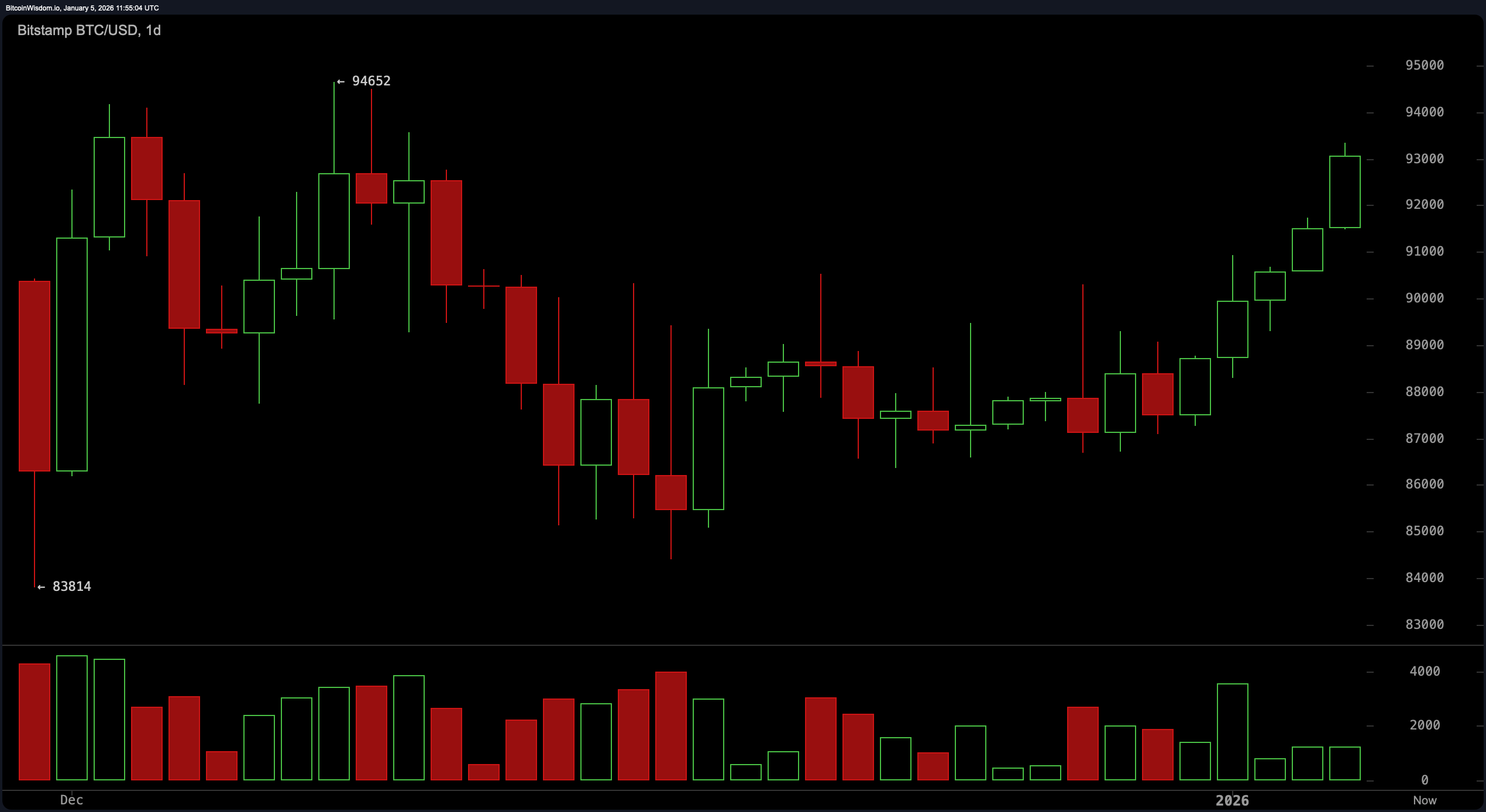

On the daily chart, bitcoin continues to display a constructive recovery from its late-December pullback, carving out a series of higher lows after defending the $85,000 to $86,000 base.

The advance back above $90,000 has been supported by expanding bullish candles and improving follow-through, suggesting continuation rather than a fleeting relief rally. Resistance remains defined between $94,500 and $95,000, a zone that was previously rejected. As long as daily closes hold north of $90,000, the broader trend bias remains firmly constructive, even if bitcoin insists on testing traders’ patience along the way.

BTC/USD 1-day chart via Bitstamp on Jan. 5, 2026.

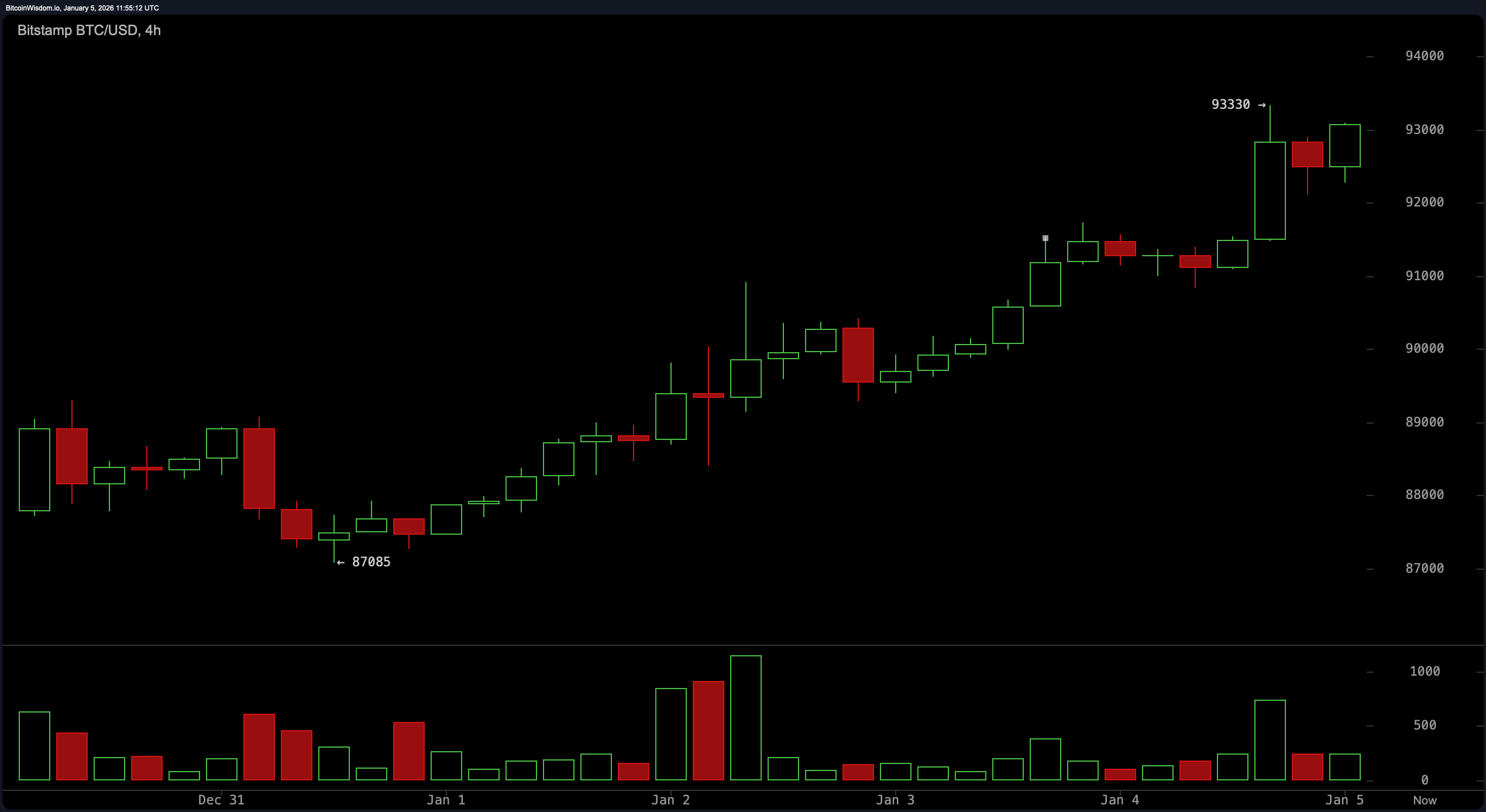

The four-hour chart adds clarity to the structure, showing a textbook stair-step advance marked by higher highs and shallow pullbacks. A decisive push through the $91,500 region accelerated price toward the $93,300 area, followed by consolidation rather than a sharp reversal — a notable detail for anyone watching momentum behavior. Volume has expanded during impulsive moves and faded during pauses, a pattern that typically favors continuation. Initial resistance sits near $94,500, with an extension toward the $95,000 to $96,000 zone if acceptance builds above current levels. A sustained move below $91,000 would be the first serious crack in this otherwise tidy structure.

BTC/USD 4-hour chart via Bitstamp on Jan. 5, 2026.

Zooming into the one-hour chart, bitcoin is consolidating tightly after a sharp impulse, hovering above prior resistance like it knows exactly what it just did. The short-term structure shows sideways action with higher lows, a behavior more consistent with continuation than distribution. Volume surged on the breakout and has since cooled, which is typical during a pause before resolution. Tactical levels remain well-defined, with support clustered around $92,300 to $92,500 and momentum favored on a clean hold above $93,300. A loss of $92,000 on a closing basis would invalidate this short-term setup and shift the tone quickly.

BTC/USD 1-hour chart via Bitstamp on Jan. 5, 2026.

Oscillators paint a nuanced picture rather than a screaming headline. The relative strength index ( RSI) sits at 64, while the stochastic oscillator reads 95, both registering neutral conditions rather than exhaustion. The commodity channel index (CCI) at 263 and the average directional index (ADX) at 21 suggest momentum is present but not overheated. The awesome oscillator remains positive, while momentum and the moving average convergence divergence ( MACD) both signal upside pressure without tipping into excess. In other words, the engine is running smoothly — no redline, no sputtering, just steady horsepower.

Moving averages (MAs) reinforce this tone, with shorter-term exponential moving averages (EMA) and simple moving averages (SMA) from 10 through 50 periods positioned below the current price, reflecting short- and medium-term strength. Longer-term measures tell a more cautious story, as the 100- and 200-period EMA and SMA remain overhead, underscoring that bitcoin is still working through higher-time-frame resistance. That tension between shorter-term strength and longer-term friction is precisely what makes this zone so interesting. Bitcoin is pressing higher with confidence, but it still has something to prove — and it clearly enjoys the drama.

Bull Verdict:

Bitcoin is coasting along with the price holding firmly above the psychologically critical $90,000 level, supported by higher lows across the daily, four-hour, and one-hour charts. Short- and medium-term moving averages are stacked beneath price, momentum, and the moving average convergence divergence ( MACD) remain constructive, and volume behavior confirms demand on advances. As long as bitcoin continues to consolidate above reclaimed resistance near $93,000 without aggressive rejection, the technical structure favors continuation pressure toward the $94,500 to $95,000 zone. In plain terms, the trend is intact and behaving exactly how healthy trends behave — controlled, confident, and unapologetically persistent.

Bear Verdict:

Despite the strength, bitcoin is trading directly beneath a well-defined resistance band, with longer-term exponential moving averages (EMA) and simple moving averages (SMA) still overhead and acting as structural friction. Oscillators such as the stochastic oscillator and commodity channel index (CCI) are elevated, hinting that upside momentum could cool if follow-through fails. A sustained loss of $92,000 to $91,000 would break short-term structure and expose the market to a deeper retracement toward the upper $80,000s. In other words, bitcoin looks strong — but if it trips here, gravity will waste no time reminding everyone who’s still in charge.

- What was bitcoin’s price on Jan. 5, 2025?

Bitcoin traded at $93,055 on Jan. 5, 2025, moving within a 24-hour intraday range of $90,925 to $93,169. - What does the bitcoin chart trend show right now?

Technical analysis across the daily, four-hour, and one-hour charts shows bitcoin maintaining higher lows above $90,000. - Are bitcoin indicators signaling strength or weakness?

Momentum indicators and shorter-term moving averages reflect underlying strength, while longer-term averages still cap upside. - Why is $93,000 a key level for bitcoin?

The $93,000 area sits just below major resistance and is acting as a critical consolidation zone for bitcoin’s next directional move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。