Author: Jae

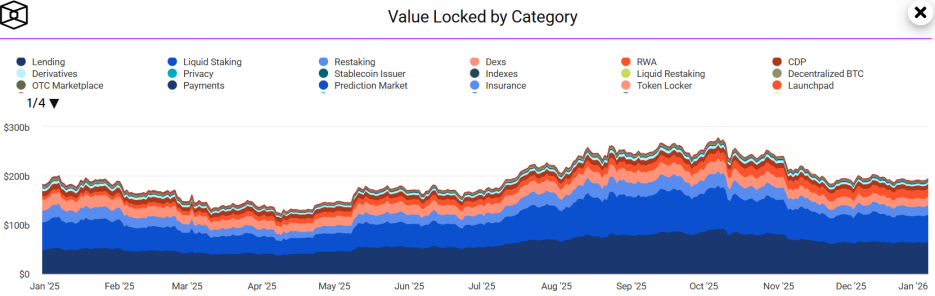

In 2025, the DeFi (Decentralized Finance) market took a thrilling roller coaster ride. At the beginning of the year, buoyed by optimism from Layer 2 performance breakthroughs and institutional capital inflows, the TVL (Total Value Locked) skyrocketed from $182.3 billion to a historic peak of $277.6 billion, making the trillion-dollar ecosystem blueprint seem within reach.

However, a sudden flash crash on October 11 in the fourth quarter, like a bucket of cold water, sharply reduced the TVL to $189.3 billion, erasing the annual growth to a negligible 3.86%. This intense volatility revealed the true texture beneath the glamorous narrative of DeFi: on one side, the deep evolution of staking, lending, and RWA (Real World Assets) sectors; on the other, the fragility under leveraged accumulation and the hidden pain of governance disconnection.

This was a tempering of ice and fire. The market witnessed Lido's waning dominance in staking, Aave's difficult journey through governance civil war, Hyperliquid facing fierce challenges from newcomers in the Perp DEX throne, and stablecoins oscillating between yield chasing and regulatory frameworks. DeFi in 2025 is no longer just an experimental ground for crypto natives; it is stumbling yet steadily stepping into the deep waters of global financial infrastructure.

DeFi Market TVL Rises and Falls, Monopoly Pattern Continues to Solidify

The curve of the DeFi market size in 2025 depicts a massive inverted V.

Starting from $182.3 billion at the beginning of the year, the TVL peaked at $277.62 billion mid-year amid market frenzy and ecosystem explosions. However, the flash crash in the fourth quarter brought everything to a halt, with the year-end figure falling back to $189.35 billion, nearly returning to the starting point.

But beneath the surface, the structure of capital underwent profound changes. The RWA sector emerged strongly, with its TVL surpassing traditional DEXs, becoming the fifth largest DeFi category. The capillaries of on-chain finance are extending deeper into the real economy.

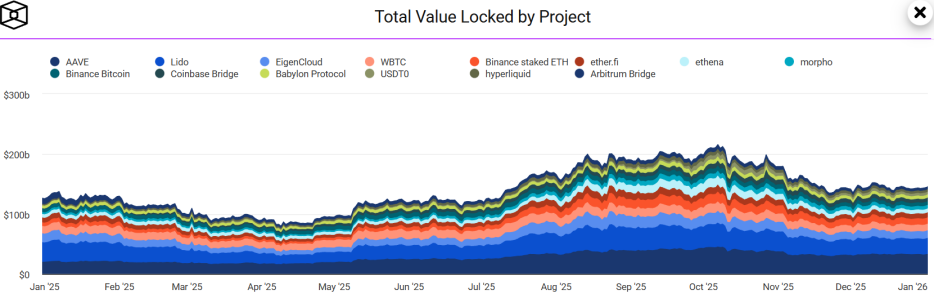

Monopoly has become more entrenched. The top 14 protocols, including Aave, Lido, and EigenCloud, accounted for 75.64% of the market share.

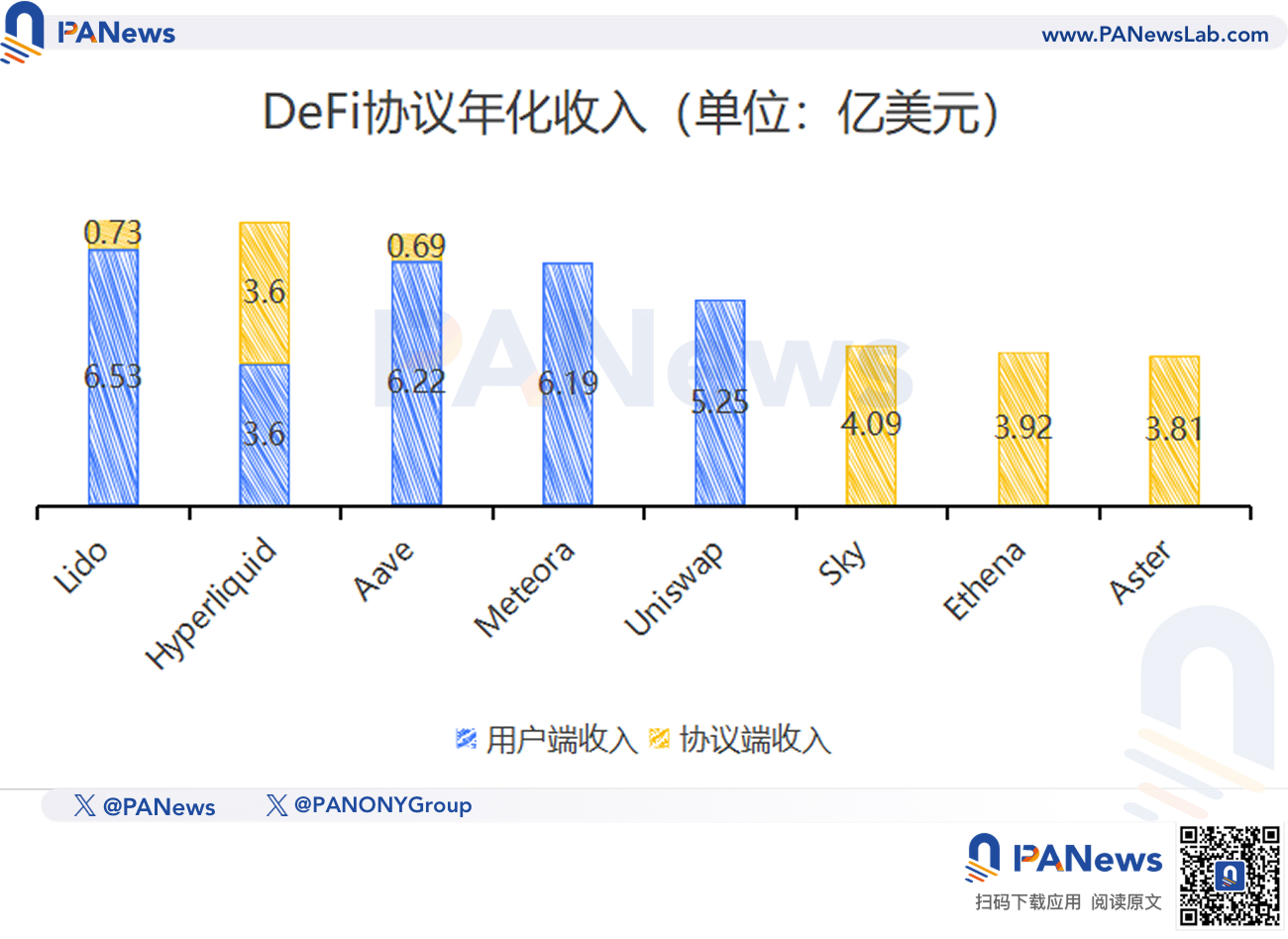

At the same time, the profitability of leading protocols soared, with the annual revenue of the top ten protocols doubling from $2.51 billion to $5.02 billion. Funds in the DeFi market are increasingly concentrating on a few core components.

Staking Protocols Return from Money Printing Machines to Safety Bases, Ethereum Ecosystem Remains Dominant

Staking was once the simplest and most straightforward yield story in DeFi. In 2025, this sector underwent a deflationary value return, with staking protocols evolving from mere DeFi yield tools to economic security engines for public chain networks.

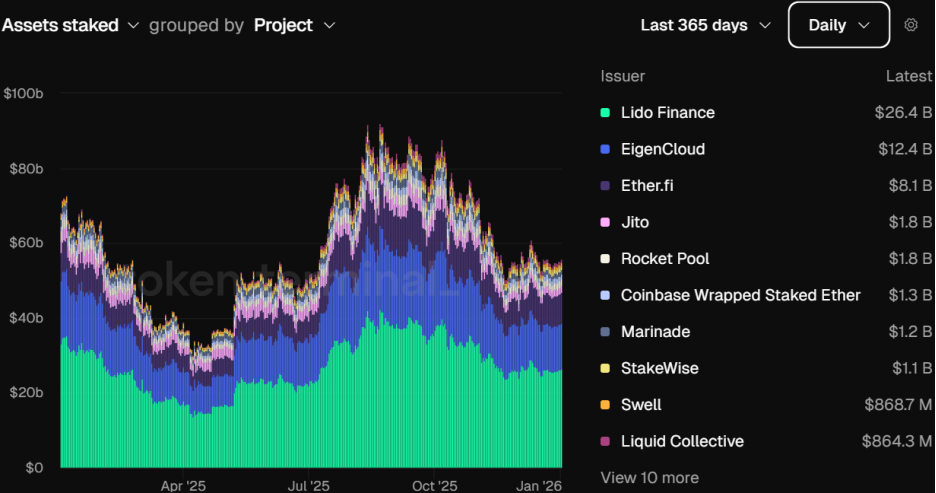

The TVL of the staking sector fell from a mid-year peak of $92.1 billion to $55.2 billion.

With the increasing security demands of the Ethereum ecosystem, over 35 million ETH (approximately 30% of the total supply) were locked in the validation network. However, the leading staking protocol Lido's dominance has decreased from over 30% at its peak to 24%. This is not a decline, but a maturation, decentralization, and diversification of Ethereum staking.

The most significant change in the staking sector is the realization of compliance. In May 2025, the formal guidelines provided by the U.S. Securities and Exchange Commission (SEC) clarified that staking activities do not constitute securities issuance, clearing obstacles for custodial institutions and pension funds to allocate LSTs (Liquid Staking Tokens) on a large scale. Now, LSTs are no longer just tools for earning staking rewards but have become high-liquidity quality collateral, penetrating into lending, derivatives, and other application scenarios.

Re-staking protocols achieved a leap from concept to a multi-billion dollar market in 2025, fundamentally enhancing capital efficiency. EigenLayer transformed into EigenCloud, with its TVL once exceeding $22 billion, becoming the second-largest staking protocol. EigenCloud creates multi-layered yields for holders by reusing already staked ETH while providing security for multiple Active Validator Services (AVS).

Ether.fi achieved over $8.5 billion in TVL and accumulated protocol revenue exceeding $73 million, solidifying its position as a leading liquidity re-staking protocol.

Re-staking protocols not only changed the staking logic of ETH but also pioneered a new business model of "shared security." However, the staking sector experienced a noticeable capital rotation in 2025.

With the realization of airdrop expectations and the decline of early incentives, funds shifted from protocols lacking real utility to leading platforms with actual service revenue, marking the completion of the staking sector's transformation from speculation-driven to business-driven.

Lending Sector Reaches New Heights, Enters Professional Layering Stage

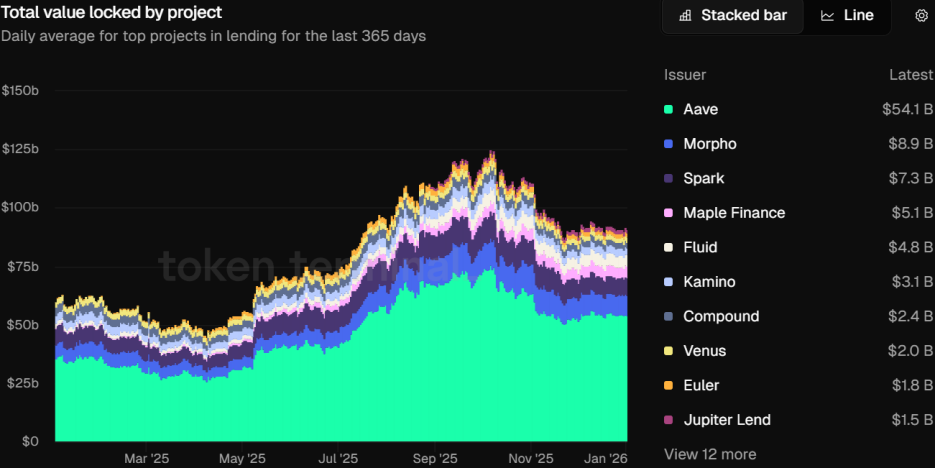

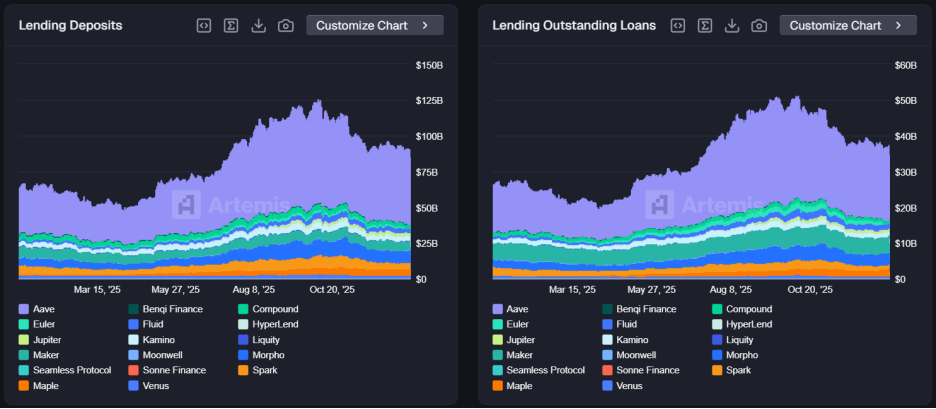

Lending is the cornerstone of DeFi, with the sector's TVL reaching a historic high of $125 billion, stabilizing at $91.6 billion by year-end.

Aave maintained its leading position with over 50% market share, even amidst a "sovereignty struggle" governance civil war at year-end, with its TVL remaining above $54 billion, showcasing the depth of its foundation.

From the perspective of on-chain lending scale, the deposit size rose from $64.1 billion to $90.9 billion, a year-on-year increase of about 42%; the outstanding loan size increased from $26.6 billion to $37.6 billion, a year-on-year increase of about 41%.

Notably, the peak deposit size during the year was $126.1 billion, and the peak outstanding loan size was $51.5 billion, both setting historical highs.

The capital utilization rate remained above 40% throughout the year, indicating a relatively favorable level.

Internally, the lending sector is undergoing a silent migration: market preferences are shifting from CDP (Collateralized Debt Position) protocols represented by MakerDao to currency market protocols represented by AAVE. Research from Galaxy indicates a complementary relationship between the two, with currency market protocols capturing over 80% of on-chain credit scale, while CDPs shrank to below 20%. This reflects users' preference for obtaining funds in lending pools with high liquidity depth rather than establishing capital-inefficient collateralized debt positions.

At the same time, modular protocols like Morpho and Euler V2 are meeting the customized needs of professional users by creating risk-isolated lending vaults. The lending sector is bidding farewell to a one-size-fits-all approach, entering a refined and layered professional era.

However, the pursuit of higher capital efficiency through unsecured loans remains an unsolved challenge in 2025, despite experiments like 3Jane based on user identity and credit scoring being underway.

Yield Protocols Become DeFi Infrastructure, Competitive Landscape Gradually Diversifies

2025 was a year when the yield sector transitioned from a niche market to DeFi infrastructure, with its TVL rising from $8.1 billion to $9.1 billion, a year-on-year increase of 12.5%, with a peak of about $18.8 billion during the year.

In traditional finance, the fixed income market size far exceeds that of the stock market, and the maturity of protocols like Pendle finally filled the critical gap of interest rate trading in the DeFi market.

Pendle established a predictable interest rate discovery mechanism on-chain by splitting assets into PT (Principal Tokens) and YT (Yield Tokens). The protocol not only achieved a magnitude leap in asset scale but also filled the gap in the on-chain fixed income curve with its interest rate products.

In 2025, Pendle's TVL fell from $4.3 billion to $3.7 billion, a year-on-year decrease of about 13%. However, its cumulative revenue steadily rose from $17.99 million to $61.56 million, a year-on-year increase of 242%, reflecting the resilience of the protocol's fundamentals. Even during market downturns, Pendle maintained stable revenue-generating capabilities.

The new product Boros launched by the protocol further extended its business reach into the funding rate trading market, providing a tool for derivatives players to hedge holding costs, seen as the protocol's second growth curve.

Related: Pendle's Strategic Expansion: Boros Emerges, Innovating the Funding Rate Trading Paradigm

The competitive landscape of the yield sector shows a transition from a single dominant player to diversification. While Pendle still holds a major market share, new entrants like Spark Savings are also rapidly expanding.

In the long run, yield protocols may become an important link connecting DeFi with institutional capital.

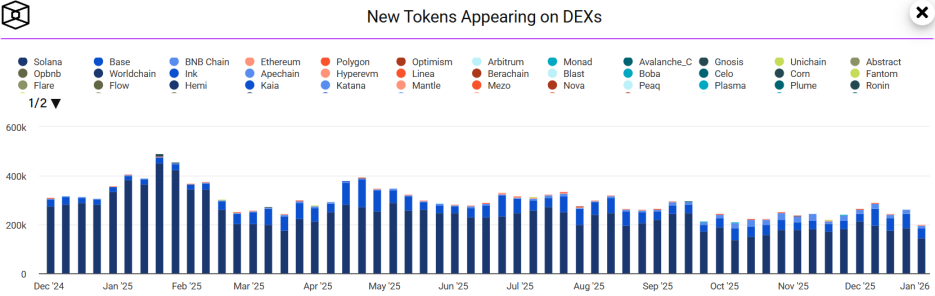

DEX User Stickiness Significantly Increases, Participating Players Gradually Diversify

In 2025, DEX continued to accelerate its catch-up with CEX (Centralized Exchanges) in user experience and liquidity efficiency. The sector's TVL fell from $22.3 billion to $16.8 billion, a year-on-year decline of about 25%, with a peak of $26.6 billion during the year.

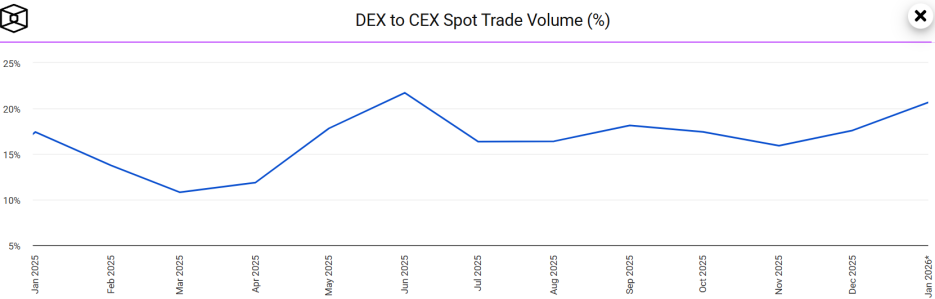

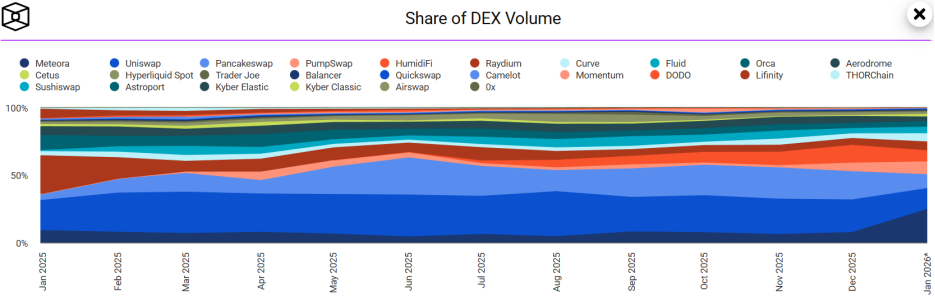

Driven by the speculative frenzy of meme coins and the booming ecosystems of Solana, Base, and others, DEX's share of cryptocurrency spot trading reached an astonishing 21.71% in June.

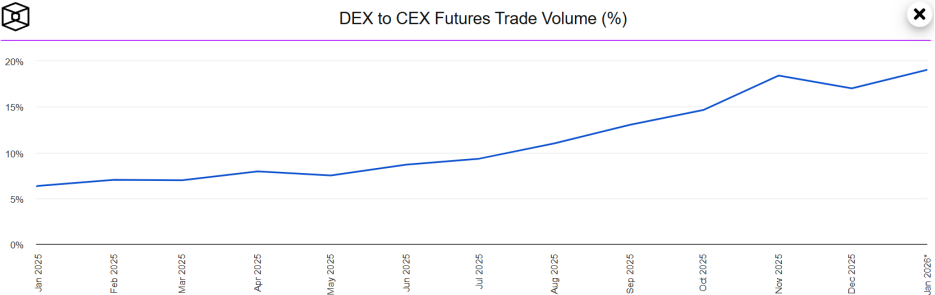

In 2025, DEX's user stickiness significantly increased. For eight consecutive months, the trading share of DEX against CEX remained above 15%, breaking the previous pattern of only briefly spiking during bull market peaks.

Data from Artemis shows that the spot trading volume on DEXs in Solana reached as high as $1.7 trillion in 2025, accounting for 11.92% of the global spot market total, surpassing Bybit, Coinbase, and Bitget, second only to Binance. Since 2022, Solana's on-chain share has surged from 1% to 12%, while Binance's market share has dropped from 80% to 55%, indicating that spot trading activity is gradually migrating on-chain.

In terms of market share, Uniswap continues to maintain its leading position in the sector, especially in decentralized governance and value capture.

In September, the Uniswap Foundation registered Uniswap Governance as a decentralized non-profit association (DUNA) in Wyoming, establishing a legal structure for protocol governance and naming its entity "DUNI." This move allows Uniswap to don the cloak of compliant governance while paving the way for activating the protocol's fee mechanism.

Related: Uniswap's Compliance Breakthrough: How DUNA Paves the Way for Fee Switch and Token Empowerment?

In December, Uniswap officially activated the protocol fee switch through the UNIfication governance proposal and burned 100 million UNI tokens.

Although Uniswap remains the sector leader, the technical route of DEX has undergone a structural change from traditional AMM (Automated Market Maker) to Prop AMM (Proprietary Automated Market Maker).

Notably, the low-slippage dark pool model of the emerging DEX HumidiFi on Solana is reshaping traders' behavior patterns. HumidiFi contributed 36%-50% of the spot trading volume on the Solana network, with daily SOL/USD trading volumes frequently surpassing those of major CEXs like Binance. Despite HumidiFi's ultra-low fee rate of 0.001% sparking widespread sustainability debates, the protocol's outstanding performance in anti-MEV, front-running prevention, and privacy execution has made it the preferred DEX for professional institutions and whale investors.

Additionally, cross-industry giants like Opensea have also launched spot trading businesses in search of a second growth curve.

The diversification of players further drives the overall prosperity of the DEX sector. Data from cryptodiffer shows that in 2025, the top three DeFi protocols ranked by fees were Meteora, Jupiter, and Uniswap, each exceeding $1 billion.

Perp DEX Challenges CEX, From Monopoly to Feudal Lords

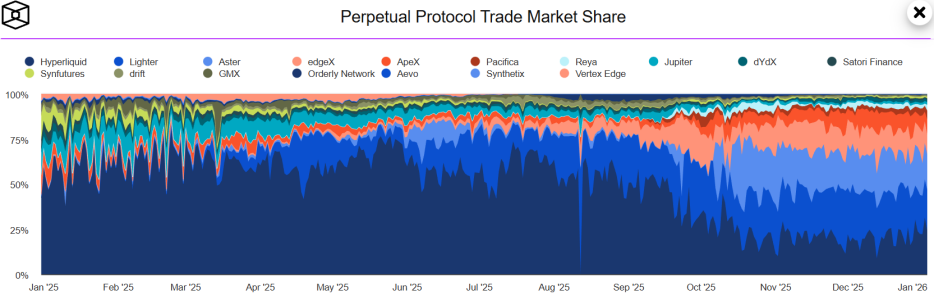

If 2024 was the experimental period for Perp DEX, then 2025 is its explosive period, beginning to take shape as a challenger to CEX. Relying on customized Layer 1 and high-performance ZK-Rollup, the execution speed and trading depth of on-chain derivatives have achieved qualitative breakthroughs.

In 2025, the contract open interest in the Perp DEX sector exceeded $16 billion, with its trading volume relative to CEX rising from 6.34% to 17%.

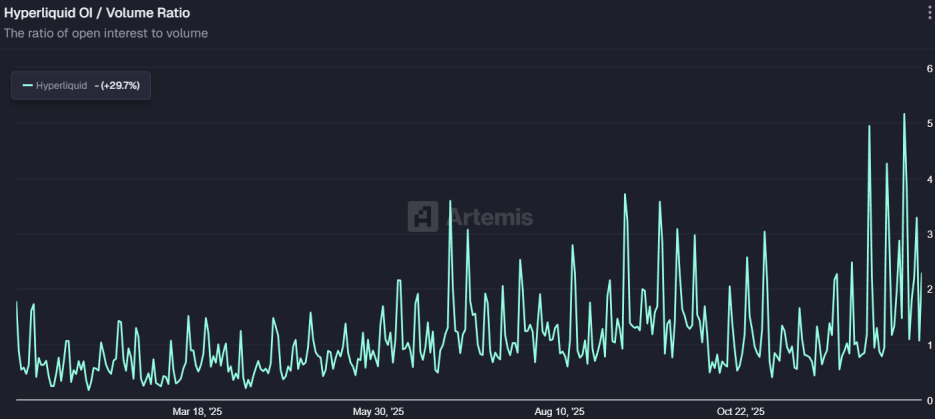

Hyperliquid is the frontrunner in the Perp DEX sector, supporting 200,000 TPS and sub-second settlement, with performance comparable to mainstream CEXs. Its annual trading volume exploded from $617.5 billion to $3.55 trillion. The OI/Vol (Open Interest/Volume) ratio of the protocol has consistently maintained a high level around 2, indicating that its trades are primarily for genuine hedging and trend positions rather than mere volume mining.

Hyperliquid's success lies not only in technology but also in its "no VC, community-first" token economics model, which has garnered significant trust premiums in the current market environment, where VC tokens are generally viewed unfavorably.

However, Hyperliquid's market share has halved from 43% to 22%. This indicates that the competitive landscape of the Perp DEX sector is evolving from Hyperliquid's monopoly to a situation where multiple players are emerging.

Challenges mainly come from two strong competitors: one is Aster, backed by the Binance ecosystem and skilled in social fission; the other is Lighter, which leverages ZK proof technology to create a zero-fee model. Together, they captured half of the market share in 2025, quickly diverting retail funds.

Related: Aster's "Trojan Horse": How It Stealthily Targets Hyperliquid's Throne via BNB Chain?

Hyperliquid is responding with institutional-level features like "portfolio margin." The Perp DEX battle is no longer just about who is faster; it is a comprehensive showdown of technical routes, traffic strategies, and capital efficiency.

Related: Hyperliquid to Launch Portfolio Margin, Is It a Killer Feature or a Weapon?

RWA Deeply Penetrates On-Chain Market, Achieving Scalable Expansion

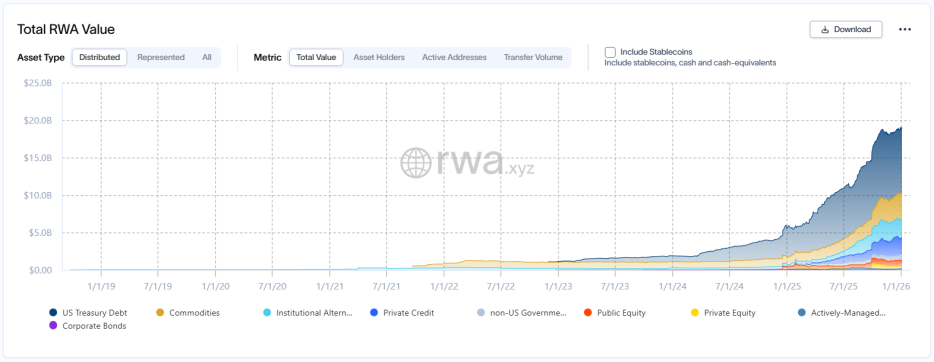

In 2025, the wall between the on-chain market and real-world assets was accelerated to be torn down, marking a year of scalability for RWA. The market value of tokenized assets (excluding stablecoins) soared from $5.6 billion to over $20 billion.

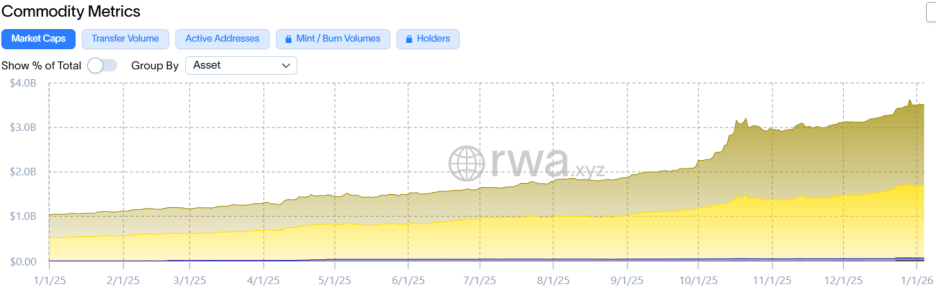

Against the backdrop of the comprehensive launch of RWA narratives and the accelerated on-chain migration of global assets, traditional giants like Swiss precious metals group MKS PAMP have also restarted or explored tokenized products, marking a deep convergence between on-chain finance and real assets.

Related: Swiss Gold Giant MKS PAMP "Returns," Re-entering the Gold Tokenization Sector

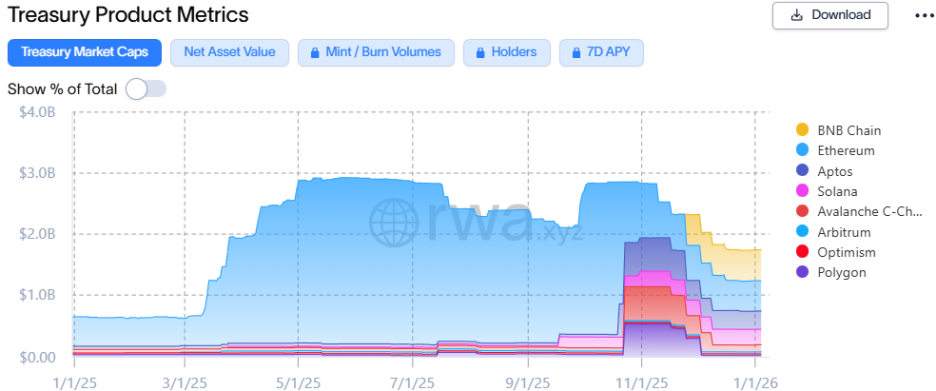

Tokenized U.S. Treasuries are becoming a conveyor belt connecting traditional risk-free yields and on-chain strategies. BlackRock's BUIDL fund achieved textbook-style expansion in 2025, rapidly growing from $650 million to $1.75 billion, further solidifying its position as a leading tokenized U.S. Treasury product. BlackRock brings not only capital but also brand endorsement, allowing BUIDL tokens to serve as underlying collateral in protocols like Aave and Euler, and through cross-chain distribution, enabling U.S. Treasury yields to access the DeFi market.

RWA may be becoming a counter-cyclical tool. When the crypto market experienced a pullback in March 2025 due to tariff policies, the tokenized U.S. Treasury market actually increased by $1 billion in market value within a month, a rise of about 33%.

The same situation occurred again in November 2025. Tokenized gold and silver products, driven by rising precious metal prices and geopolitical turmoil, saw their market value exceed $3.5 billion, reflecting the demand and trend for funds seeking safe havens on-chain.

Related: After the Surge in Gold and Silver Prices, On-Chain Commodity Trading Booms

Stablecoin Sector Regulation Takes Shape, Ushering in Dual Evolution of Scale and Structure

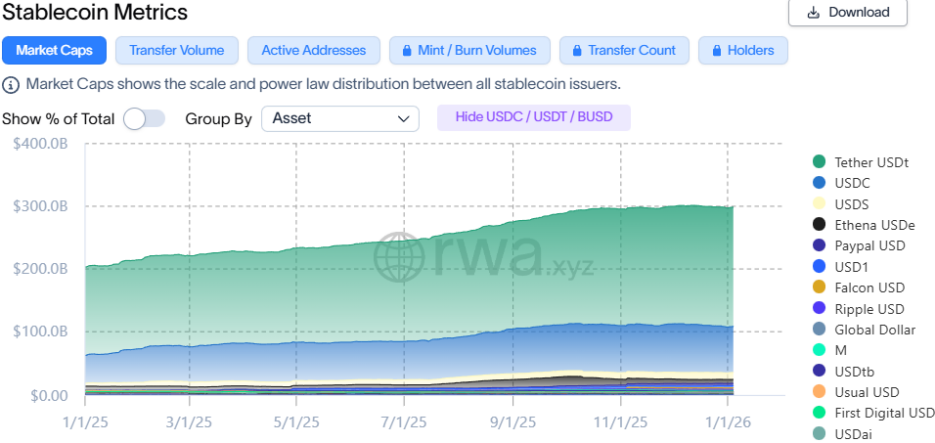

The stablecoin sector is advancing amid compliance and innovation. In the DeFi landscape of 2025, stablecoins have evolved into the monetary foundation connecting payments, trading, and collateral. The maturity of this sector is primarily reflected in the implementation of compliance and the innovation of models.

2025 marks a turning point for the global stablecoin regulatory framework, moving from theory to practice. With the advancement of the U.S. GENIUS Act, a federal-level stablecoin framework is taking shape, allowing traditional banks like JPMorgan and Citibank to participate more deeply in stablecoin issuance and reserve management.

Related: U.S. Banking Industry Jointly Resists the GENIUS Act, Stablecoin Shockwaves Shake Traditional Giants

The full implementation of the European Markets in Crypto-Assets (MiCA) regulation mandates that crypto asset service providers (CASPs) transition to compliant stablecoins, leading to significant liquidity rotation in the European market.

Related: USDT Exits, EURC Takes Its Place, Euro Stablecoin Surges Over 170% Against the Trend

The transparency of regulation has also directly translated into an entry ticket for institutions. Stripe acquired Bridge and integrated the USD stablecoin USDB; PayPal issued PYUSD; Klarna launched KlarnaUSD. A report from DeFiLlama indicates that the settlement amount of regulated stablecoins exceeded $50 trillion in 2025, with monthly processing volumes surpassing Visa and PayPal in several months, demonstrating the superiority of blockchain as a payment infrastructure.

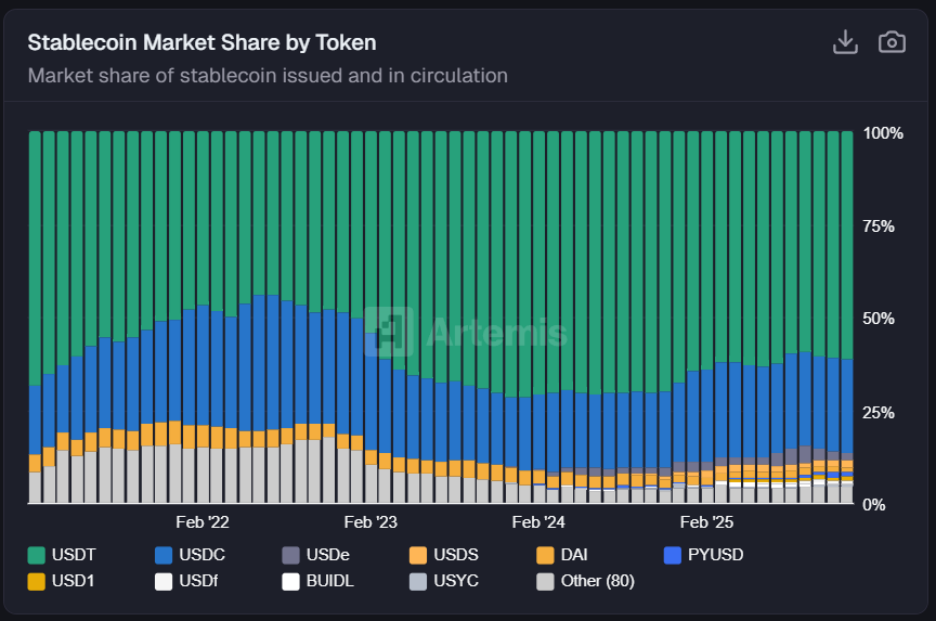

As the lifeblood of DeFi, stablecoins experienced a dual evolution of scale and structure in 2025. The total market capitalization once soared to $300 billion, while the competitive landscape exhibited "internal innovation under a bipolar monopoly."

USDT maintained an absolute lead with over 60% market share, while USDC ranked second due to its transparency and compliance.

The rising expectations for interest rate cuts spurred strong demand for on-chain yield-bearing assets, with users' preference for yield-generating stablecoins surpassing that for traditional payment stablecoins. A report from DeFiLlama noted that the scale of yield-bearing stablecoins surged from $9.5 billion to over $20 billion in 2025, a year-on-year increase of over 110%.

The synthetic dollar USDe issued by Ethena emerged as a standout in 2025. The protocol does not rely on fiat reserves but achieves delta neutrality by establishing equivalent perpetual contract shorts on yield-bearing asset positions like ETH.

Thanks to high-leverage circular leverage on Aave and Pendle, the supply of USDe once approached $15 billion. However, a flash crash on October 11 caused USDe to briefly depeg to $0.65 on the Binance spot market, leading to a subsequent decline in USDe's TVL to $6.3 billion, a 58% drop from its historical peak.

Subsequently, Ethena launched a white-label platform in an attempt to create a second growth engine.

Related: Ethena After the Depeg Turmoil: TVL Halved, Ecosystem Hit, How to Start a Second Growth Curve?

Misfortunes do not come alone; in November, Stream and Elixir faced a crisis as their yield-bearing stablecoins xSUD and deUSD both went to zero due to external fund managers' liquidation. This event not only dealt a heavy blow to the market but also sounded the alarm: even seemingly safe stablecoins must be wary of the complex underlying strategies, as systemic risks have shifted from the code layer to the counterparty layer.

In contrast, MakerDAO has shown steady growth after rebranding to Sky. Although the expansion of its stablecoin USDS faced bottlenecks, it integrated RWA assets directly, incorporating government bond yields to provide stable and sustainable local currency yields, pushing USDS's market capitalization beyond that of USDe, elevating it to third place in the sector.

The evolution of these seven sub-markets has transformed the DeFi market of 2025 into more than just an isolated experiment. It showcases powerful financial engineering capabilities, turning staking, lending, yields, and even government bonds into programmable Lego blocks. However, it has not escaped human greed: governance conflicts, leverage collapses, black box operations… The "10/11 flash crash" serves as a mirror, reflecting the cracks behind the splendor.

Nevertheless, the crash did not lead to a systemic collapse. Leading protocols demonstrated resilience in the storm, and real application scenarios are solidifying, which may be the price of the DeFi market's coming of age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。