Original Author: ChandlerZ, Foresight News

On January 5, during the public sale of the INX token on Sonar by the cross-chain aggregation DeFi platform Infinex, the team publicly acknowledged that "the sales mechanism was wrong" and announced three key adjustments to the rules: the removal of the $2,500 investment cap per user, allowing users to decide their own investment amounts; changing from random allocation to "maximum-minimum fair distribution," ensuring equal distribution for all participants until supplies run out, with any excess contributions refunded; and maintaining priority for Patron holders, although the specific details of the priority allocation will be determined after the sale ends.

In the announcement, the team attributed the issues to their attempt to balance existing sponsors, new participants, and fair distribution, which resulted in almost no interest. "Ordinary consumers hate lock-up mechanisms, whale players hate caps, and everyone hates complex rules."

Infinex's Sales Mechanism

Infinex is a crypto product project launched by Kain Warwick, co-founder of Synthetix. Initially, it was positioned more as a unified entry point/front-end layer for DeFi. With iterations, Infinex's positioning has gradually converged into a non-custodial wallet super application, as well as a chain-abstract/intention-driven multi-chain experience, emphasizing a user experience closer to that of centralized exchanges (CEX).

The token sale for Infinex on Sonar will take place from January 3 to 6, offering 5% of the token supply, with the fundraising amount reduced from $15 million to $5 million, and the fully diluted valuation (FDV) decreased from $300 million to $99.99 million. User registration opened on December 27, and the sale commenced on January 3. Additionally, the official team will sell an extra 2% of tokens to Uniswap CCA.

A significant part of the sales rules will be allocated to Patron NFT holders, while another portion will be distributed to non-Patron holders through a lottery. Each Patron NFT grants the holder the right to receive 100,000 INX tokens at the Token Generation Event (TGE), and holders of highly liquid Patron NFTs will receive corresponding allocation rights based on the number of Patrons they own.

According to Infinex, one Patron can allocate tokens worth $2,000, five Patrons correspond to $15,000, 25 Patrons can allocate up to $100,000, and 100 Patrons can unlock a maximum allocation of $500,000. Participants without Patron NFTs can still participate in the sale through a separate lottery, with a cap of $5,000 per person and a minimum purchase amount of $200.

In October 2024, Infinex raised $67.7 million last year by selling Patron NFTs, with participation from billionaires, top Silicon Valley investors like Peter Thiel's Founders Fund, Wintermute Ventures, Framework Ventures, and Solana Ventures, as well as angel investors including Ethereum co-founder Vitalik Buterin, Solana co-founder Anatoly Yakovenko, and Aave founder Stani Kulechov. Infinex stated that this fundraising model sells Patron NFTs to venture capitalists, angel investors, and the community.

Additionally, approximately 43,244 Patron NFTs were sold across the Ethereum, Solana, Arbitrum, Base, Polygon, and Optimism blockchains. On Monday, these NFTs were distributed to buyers on the Ethereum blockchain and are now available for purchase on the OpenSea and Blur NFT markets.

Why Change? Less than 10% Fundraising Progress on Launch Day

After the sales rules were announced, the community fell into controversy. The most concentrated criticism focused on the "public sale for retail investors requiring a one-year lock-up." Many believed this contradicted the liquidity expectations of a public offering, especially in a macro environment that is cautious and where funds prefer quick in-and-out strategies; long lock-ups naturally raise opportunity costs.

Moreover, many questioned the FDV as being too outrageous. At a stage that has not been fully validated, with income and cash flow not forming stable, quantifiable expectations, the project is essentially asking participants to pay in advance for execution and growth over the next few years with a public sale at a nearly nine-digit or even higher fully diluted valuation.

As a result, during the actual sale, Infinex's token sale on Sonar saw only slightly over $400,000 in sales on the first day, accounting for about 8% of the target $5 million. This INX token sale will last for 7 days, and the probability of exceeding $5 million in public sales on Polymarket has now dropped to 25%.

After the rule modifications, the relevant webpage shows that Infinex's sales amount has exceeded $1.33 million, accounting for 26.68% of the target $5 million, with 466 participating addresses and a total of 497 transactions.

Suspicious Bets on Polymarket

In addition to the controversy surrounding the sales rules, a more topical clue emerged in the prediction market. Some community members noticed that before Infinex officially announced the removal of the individual fundraising cap and the adjustment of the allocation mechanism, there was a rush to buy related to the fundraising threshold on Polymarket.

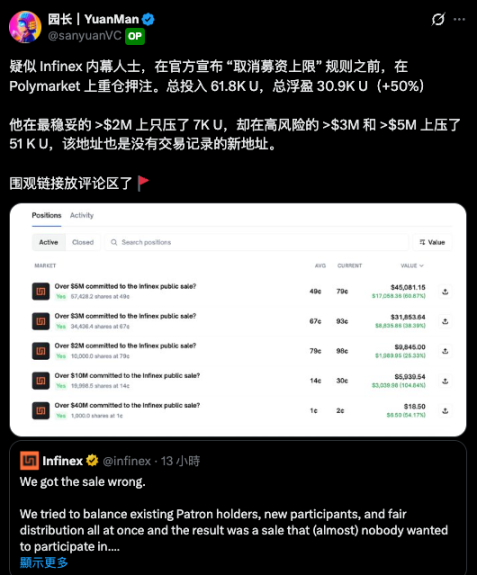

@sanyuanVC discovered that before the official announcement of the removal of the fundraising cap rule, a total of $61,800 was invested in Polymarket, with an unrealized profit of about $30,900. This address placed only $7,000 in a stable bet of over $2 million, while betting $51,000 in high-risk bets exceeding $3 million and $5 million; this address is also a new address with no trading history.

Some commentators speculated about insider trading or information leaks based on this, but there is no conclusion yet, and the project team has not responded.

As of the time of publication, Polymarket market bets on Infinex's public sale total subscription exceeding $2 million have risen to 98%. The probability of exceeding $3 million is 93%, and the probability of exceeding $5 million is 78%. Currently, the total trading volume for this event has reached $3.25 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。