Original Title: Suavemente

Original Author: Arthur Hayes, Crypto Trader Digest

Translated by: Peggy, BlockBeats

Editor's Note: Amidst the clamor of geopolitics, electoral maneuvering, and macro narratives, the author Arthur Hayes (co-founder of the cryptocurrency exchange BitMEX) deliberately avoids moral judgments and value alignments. Instead, he adopts a trader's cold perspective, compressing complex issues into a few market-verifiable core variables: nominal GDP, oil prices, credit expansion, and the resulting pricing of risk assets.

As one of the most controversial and "representative" voices in the crypto market, Hayes consistently dissects the trading implications behind political events from the angles of power, liquidity, and price. In this article, he converges the U.S. elections, energy prices, and the logic of money printing into a stark question: Will money printing continue, and will risk assets continue to rise?

Here is the original text:

A "Eavesdropped Conversation"

Scene: U.S. President Donald Trump connects via video to a plane transporting Venezuelan President Pepe Maduro from Caracas to New York.

Trump: Pepe Maduro, you are a bad guy. The oil from your country now belongs to me. USA! USA! USA!

Pepe Maduro: Damn it! You crazy American.

I can imagine that at this very moment, a certain group among the Venezuelan expatriates is letting loose in the "drug finance capital" of the Western Hemisphere—Miami, USA—dancing to the upbeat song "Suavemente" by Elvis Crespo.

As a qualified "armchair macroeconomic gambler," I must also express my views on this historic, game-changing, authoritarian, militarized… feel free to insert any superlative or pejorative here—U.S. "kidnapping/legal arrest" of a sovereign nation's leader.

I am sure countless authors using AI writing tools will produce millions of tokens of "word salad," attempting to characterize, model, and predict the future trajectory of these events. They will judge these actions from a moral high ground, telling you how other countries "should respond."

I will do none of that.

I only care about one question: Will the U.S. colonization of Venezuela cause the price of Bitcoin/cryptocurrency to rise or fall?

I am a ski bum, and to understand this chaotic universe, I need a simple analytical framework. Let me emphasize again: the only core goal of any political figure elected through democratic means is re-election.

Glory to God, loyalty to the country, or any lofty ideals must come after winning votes. Because if you are not in a position of power, you cannot effect any change. In this sense, this obsession with re-election is "rational."

For U.S. President Trump, two elections are truly important: the midterm elections in November and the presidential election in 2028.

Although he will not run for re-election in 2026, nor can he run for president a third time in 2028, the loyalty and obedience of his political supporters depend on their ability to successfully secure re-election. Now, people are "leaving" the already tattered MAGA tent because they fear that if they continue to act according to Trump's demands, their future electoral prospects will dim.

So the question arises: What can Trump do to ensure that those undecided voters—who are neither fully "blue team Democrats" nor fully "red team Republicans"—walk into the voting booth in 2026 and 2028 and vote "the right way"?

As of now, the blue team (Democrats) will regain control of the House of Representatives. If Trump wants to be a winner, he must quickly sort things out; there is little time left for policy pivots that could cause voters to switch sides.

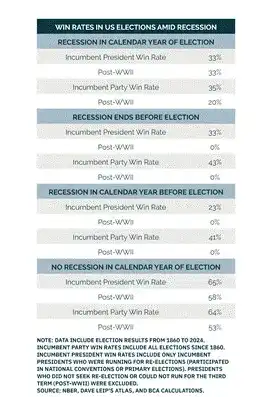

The most important point is that I will use some statistics and charts to demonstrate that the only thing the median voter truly cares about is the economy. The cultural issues that Trump's opponents and supporters obsess over on social media (though the memes are indeed good) are insignificant compared to how voters feel about whether they are "richer or poorer" when they walk into the voting booth and pull the curtain.

Stimulating the economy is actually quite easy; I am referring to nominal GDP. It essentially boils down to one question: How much credit is Trump willing to create? An increase in nominal GDP will push up financial asset prices; the wealthy will also "do their duty" by handing over their "bribes"—ahem, campaign donations to the red team—as a show of gratitude. But in the U.S., the rule is one person, one vote. If nominal GDP rises alongside soaring inflation, the lower classes have the power to drag the entire party down.

Trump and U.S. Treasury Secretary "Wild Bill" Basent have stated that they will keep the economy running hot. I believe they will do so, but the question is: How do they plan to control inflation?

The inflation that could truly sink re-election prospects is food and energy inflation. For Americans, the key indicator is gasoline prices because, for most people, there is almost no affordable and convenient public transportation. In the U.S., if you are a working-class laborer without a car, it is nearly impossible to live normally—unfortunate, but that is the reality. It is precisely for this reason that Trump and his aides would "colonize" Venezuela for oil.

When it comes to Venezuelan oil, many will immediately point out that this country has the largest proven oil reserves in the world. But the question is, who cares how much oil you have buried underground? The key is: Can this oil be profitably extracted?

I do not know the answer to that question, but Trump clearly believes that as long as he turns on the tap, Venezuelan oil will flow continuously to the refineries along the Gulf Coast, and cheap gasoline will soothe the lower classes by lowering energy inflation. I cannot assert whether Trump is correct, but the WTI and Brent crude oil markets will serve as the true "lie detectors."

The question is: When nominal GDP and the supply of dollar credit rise, do oil prices go up or down?

If GDP and oil prices rise together, the blue team Democrats win; if GDP rises but oil prices stagnate or fall, the red team Republicans win.

The brilliance of this analytical framework lies in the fact that oil prices will reflect the reactions of all other oil-producing countries and military powers—especially Saudi Arabia, Russia, and China—to the U.S. "colonization" of Venezuela.

Another advantage is that the market is reflexive. We all know that Trump will adjust policies based on the stock market, U.S. Treasury bonds, and oil prices. As long as the stock market continues to rise and oil prices remain low, he will continue to print money, expand, and take action around oil.

As investors, we can respond on a time scale that is almost synchronous with Trump—that is the best outcome we can hope for. This approach reduces the necessity for us to predict the ultimate trajectory of an extremely complex geopolitical system. Just look at the charts and adjust accordingly, gamblers.

Here are some charts and statistics that clearly show: If Trump wants to win the election, he must boost nominal GDP while simultaneously driving down oil prices.

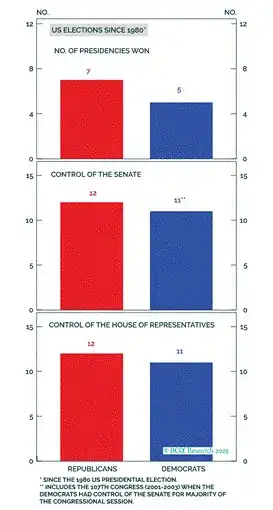

The red team and blue team are evenly matched.

Only a small portion of Americans determine which side controls the government.

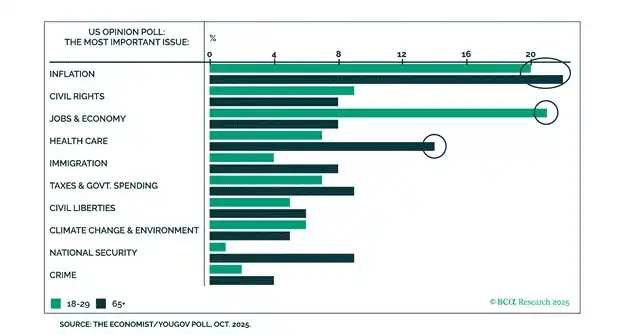

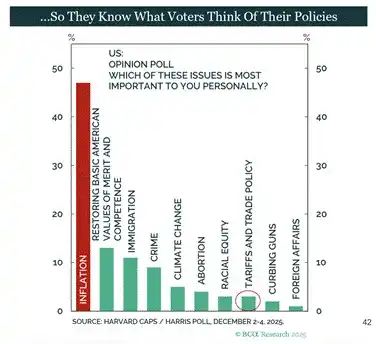

The economy and inflation are the two main issues voters care about; there is nothing else.

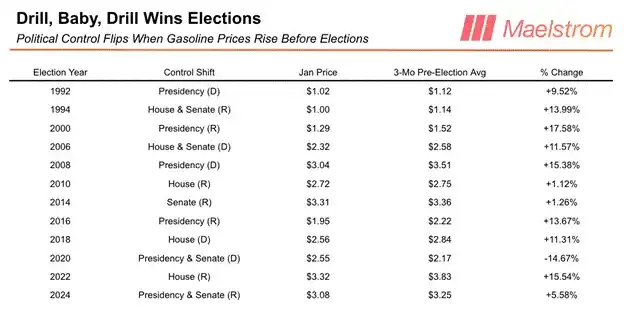

"The 10% Rule": If the national average price of gasoline rises by 10% or more compared to the average level in January of the same natural year in the three months leading up to the election, one or more branches of government often change party hands.

Bitcoin Mooning

Due to the energy-intensive nature of proof-of-work (PoW) mining, Bitcoin is the purest form of monetary abstraction. Therefore, the price of energy itself has no direct relationship with the price of Bitcoin—because whether energy prices rise or fall, all miners face the same directional cost changes.

The real importance of oil prices lies in whether they will force politicians to stop printing money. If oil prices rise too quickly and too high due to economic activity expansion (which is itself a derivative variable of energy), then politicians must find a way to bring oil prices down—such as "taking oil from other countries" or slowing credit creation—otherwise, they risk being ousted by voters.

The 10-year U.S. Treasury yield and the MOVE index, which measures volatility in the U.S. bond market, will tell us whether oil prices have become unbearable.

Investors face a difficult choice: invest in financial assets or invest in physical assets.

When energy costs are low and stable, it is reasonable to invest in financial assets like government bonds; but when energy costs are high and highly volatile, it is more prudent to store wealth in energy commodities.

Thus, when oil prices rise to a certain level, investors will demand higher returns from government bonds, especially 10-year U.S. Treasuries. U.S. politicians cannot stop fiscal deficit spending because "free money" is always a winning strategy in elections.

When oil prices rise and the 10-year Treasury yield approaches 5%, politicians must change their behavior. The reason is that as the 10-year yield approaches 5%, the massive leverage embedded in this dirty fiat financial system begins to spiral out of control, and bond market volatility (as measured by the MOVE index) will spike.

The entire fiat system is essentially a highly leveraged arbitrage trade. When volatility rises, investors must sell assets, or they risk losing even their custom-tailored Savile Row suits.

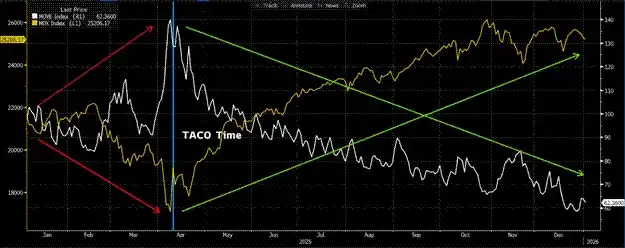

A recent example is "Liberation Day" on April 2 of last year, and the "Trump TACO" incident seven days later on April 9.

If you remember, Trump threatened to impose extremely high tariffs, high enough to genuinely reduce global trade and financial flow imbalances—this would be highly deflationary on a macro level. The market responded with a sharp drop, and the MOVE index soared to a high of 172 at one point.

And just the day after the volatility spiked, Trump "backed down" (TACO), announcing a "suspension" of the tariff measures, and the market found its bottom and quickly rebounded.

MOVE Index (white line) vs. Nasdaq 100 Index (yellow line)

Trying to use historical data to determine at what level oil prices and the 10-year U.S. Treasury yield would cause Trump to rein in the Fed's money printing is pointless. When it actually happens, we will know; if oil prices and yields start to rise sharply, it means—it's time to be cautious about risk assets.

The baseline scenario is: oil prices remain low or even decline, while Trump and "Wild Bill" Basent will print money like crazy, just like in 2020. The reason is that the market will initially believe that U.S. control over Venezuelan oil will lead to a significant increase in daily crude oil production. As for whether these optimistic predictions about a surge in crude oil supply will materialize once engineers actually bring millions of barrels per day of capacity online, no one can say for sure.

But that doesn't matter. You just need to remember one thing: Trump will turn on the money printing machine faster than Israeli Prime Minister Benjamin "Butcher of Bedouins" Netanyahu can change his narrative on "why Iran deserves another round of military strikes."

If this logic isn't enough to convince you that now is the time to go long on all risk assets due to aggressive U.S. money printing, then remember—Trump is the most "socialist" U.S. president since Roosevelt.

He printed trillions of dollars, and unlike previous presidents, in 2020 he directly handed money to everyone. You better believe he will not lose the election because of "insufficient money printing."

Mamdani and Trump are both New Yorkers; you know what they say—birds of a feather flock together.

Real traders must stop projecting emotions onto terms like "socialism, communism, capitalism." No government truly acts according to the pure forms of these "isms"; everyone is just distorting and assembling these concepts for their own political purposes.

Don't be a sucker; just buy.

If we understand the situation according to Trump and his aides, one thing is certain: credit will expand.

Red team Republican legislators will continue to pass fiscal deficit spending; the Treasury led by "Wild Bill" Basent will issue bonds to finance it; and the Fed, under the leadership of that "beta version of a coward, towel boy" Jerome Powell and his successor, will print money to buy these bonds.

This "self-reinforcing cycle" truly kicked off in 2008. As Lyn Alden said, "Nothing can stop this train."

As the quantity of dollars continues to expand, the prices of Bitcoin and some cryptocurrencies will take off.

The rise of Bitcoin (digital gold) directly stems from money printing. This can be clearly seen from the U.S. dollar liquidity conditions index I constructed (Bloomberg code: .USDLIQ U Index).

Trading Tactics

Before discussing Maelstrom's current positions, I want to quickly review my trading performance from last year.

I say "my performance" because all trading decisions were made by me personally. Last year, my liquidity steering wheel was generally profitable. My goal was to cover daily expenses with trading profits, and I achieved this multiple times. Although I ended up profitable, I also wasted a significant amount of PNL on a few bad trades.

My largest single loss came from trading a PUMP token immediately after it launched. Additionally, I must stay away from meme coins—I only made money on meme coins with TRUMP.

The good news is: my most profitable trades came from HYPE, BTC, PENDLE, and ETHFI.

Last year, only 33% of trades were profitable, but my position management was correct: the average profit from winning trades was 8.5 times the average loss from losing trades.

This year, I will improve my performance by focusing on what I truly excel at: building medium-term large positions based on clear macro liquidity logic, and this logic must support a "plausible-sounding" altcoin narrative. As for those garbage coins or meme coins that I gamble on purely for fun, I will significantly reduce position sizes.

Looking ahead, the core market narrative this year will revolve around privacy. ZEC will become the beta in the privacy track, and we have already established a large long position in ZEC at an excellent price in Q3 2025.

The current focus of the Maelstrom team is to find at least one altcoin leader in the privacy narrative that can truly perform and bring excess returns to the portfolio in the coming years.

As we enter 2026, Maelstrom's risk exposure is nearly maxed out. We will continue to invest idle cash generated from various financing trades into Bitcoin, so our positions in dollar stablecoins are very low.

To achieve excess returns relative to BTC and ETH: I will sell BTC to increase positions in privacy-related assets; I will sell ETH to increase positions in DeFi. In both cases, as long as I choose correctly, these altcoins I hold should outperform mainstream assets as fiat credit continues to expand.

If/when oil prices rise and lead to a slowdown in credit creation, I hope to take profits then, accumulate more sats, and buy some mETH.

What a fulfilling day.

I finished writing this article on a rest day while skiing in the wild. Now it's time to hit the gym and lift some heavy weights to ensure that when I "emerge from hibernation" in March, I still look incredibly fit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。