Beijing Time, January 6, 2026, a cross-chain fund related to Tornado Cash has gradually revealed a money laundering and gambling chain spanning HYPE tokens, ETH spot, and derivatives on Ethereum. Funds originating from a wallet on the Tron network entered Ethereum through a cross-chain bridge, were split and injected into Tornado Cash, and then flowed to the same address cluster, where they were unstaked and sold off on HYPE, combined with large ETH long positions on HyperLiquid, forming a highly engineered path for capital maneuvering. Simultaneously, the U.S. Ethereum spot ETF saw a net inflow of $165-168 million in a single day, with over $340 million in compliant funds accumulated over the previous two days continuously buying ETH. These two distinctly different capital flows hedged and overlapped within the same time window, creating a bizarre price tension. The on-chain visible actions of "money laundering—selling—hedging" raise the core suspense of this event: who are they betting against, and how will it penetrate ETH's short-term fluctuations at critical price points?

Tron’s Dirty Money Bridge: 2,479 ETH…

This game begins with a suspicious fund on the Tron network. According to security firm PeckShield, the involved funds were initially located in a wallet within the Tron ecosystem and migrated to the Ethereum network via a cross-chain bridge, completing the first step of "inter-chain money laundering." Upon reaching Ethereum, these funds were further injected in batches into Tornado Cash, where they were mixed and restructured, ultimately confirming that 2,479.1 ETH flowed out through this path, corresponding to an amount of approximately $7.9 million. PeckShield noted that this fund flow pattern is highly similar to the "pig butchering" scam fund paths they have tracked in the past, thus labeling it as "suspected to be related to pig butchering scams." However, it currently remains at the level of associating on-chain behavior with typical scam patterns, lacking judicial evidence that can directly point to specific cases or suspects. From the timeline, the trajectory of these funds can be summarized as follows: the original wallet on the Tron chain transferred the funds to Ethereum via a cross-chain bridge, then entered Tornado Cash for mixing, and the cleaned ETH subsequently concentrated towards the address cluster 0xB8b4…3714 and its associated addresses. It is this cluster that subsequently acted on HYPE and ETH, laying the groundwork for future unstaking, selling, and hedging.

From Money Laundering to Ambush: HYPE…

Once the washed ETH flowed into the address cluster, the on-chain narrative began to shift from "concealing sources" to "positioning." According to currently available single-source information from The Block Beats, addresses related to this cluster successively completed the unstaking of 1 million HYPE, worth approximately $26 million at the time, and subsequently sold off 600,000 HYPE, realizing about $1.6 million in cash. These figures have not yet been cross-verified by multiple parties, so it is essential to emphasize the singularity of the source and the incompleteness of the information when citing them. However, the overall rhythm remains clear: first, a large unstaking to release chips, then partial selling to recoup liquidity. On-chain, the rhythm of "unstaking → partial selling" serves to extract disposable cash flow for participants, freeing up capital for subsequent operations in the spot or contract markets, while still retaining a substantial HYPE position, keeping them deeply embedded in the project ecosystem and market sentiment. This high-level unstaking and targeted selling inevitably exert pressure on HYPE's price and liquidity, especially during phases of limited circulation and shallow market depth, where concentrated selling pressure can easily be interpreted by the market as "the project team dumping" or "whales cashing out." However, it is important to emphasize that current on-chain data cannot indicate the true identity relationships between these addresses and the project team, core members, or specific off-market interests. Questions of "who is dumping" and "whether there is insider trading" remain at the level of market speculation, lacking conclusive evidence.

Whale's Three-Step Strategy: USDC Buying Spree…

Beyond the aforementioned fund path, another anonymous whale's operation outlines a high-leverage long strategy distinct from simple selling. According to on-chain tracking by The Block Beats and TechFlow, this participant first injected $12.5 million USDC into a designated address, then proceeded to buy approximately 10,152.8 HYPE on the secondary market, further investing these chips into a staking contract to lock in potential staking returns. Meanwhile, this address placed a long position of 3,500 ETH on the decentralized contract platform HyperLiquid, nominally valued at about $11 million at the time, forming a composite position structure of HYPE spot plus staking returns, combined with ETH perpetual longs. TechFlow's observations also revealed that this whale quickly profited $36,092 through just three Ethereum transactions, showcasing not only their sharp timing in short-term trades but also exposing their frequent rebalancing and intricate gaming style. From a position structure perspective, this whale exchanged USDC for HYPE spot and participated in staking, binding themselves to the project to enjoy potential upside gains and staking returns; on the other hand, they opened a high-leverage long position on ETH perpetual contracts, ensuring that as long as mainstream market sentiment is bullish and ETH prices rise, their overall paper profits can be amplified across multiple dimensions. This combination not only has a leverage effect on price but also amplifies liquidity and sentiment impacts on the secondary market: the whale's large buy orders and staked holdings intensified the concentration of HYPE chips, while the ETH long positions on the contract side provided additional elasticity for price increases, making each adjustment in their positions capable of stirring market nerves.

Long and Short Stranglehold at $3,190:…

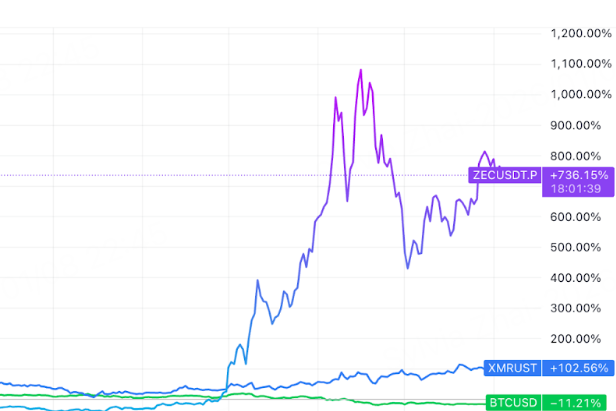

As the positions on HYPE and ETH expanded synchronously, ETH spot and contracts exhibited a rare long-short standoff within a relatively narrow price range. On-chain and derivatives data indicate that the $3,190-$3,215 range has become the main battleground for short-term offense and defense, with longs and shorts repeatedly changing hands and frequent liquidations and reductions occurring. Beyond technical and post-market data, what is more noteworthy is the structural difference in capital—on one side are the suspicious whale long positions shadowed by Tornado Cash and "pig butchering," while on the other side is the strong net inflow of the U.S. Ethereum spot ETF over several days. Statistics from multiple data agencies show that the Ethereum spot ETF recorded a single-day net inflow of $165-168 million on the day of the event, with cumulative net inflows exceeding $340 million over the previous two days, of which BlackRock alone contributed about 60% of the incremental funds. This means that at the critical price point near $3,190, one side consists of anonymous addresses betting long using high-leverage contracts and highly volatile tokens, with some funding sources intertwined with Tornado Cash's money laundering path; the other side is gradually absorbing spot, targeting longer-term compliant ETF funds, continuously locking ETH into custody within the regulatory framework. The former seeks short-term explosions, leveraging volatility and leverage to amplify returns, while the latter builds buy-side support below the price in a "slow variable" manner. In the interplay of on-chain and off-chain funds, ETH's market is suspended on a web of funds with distinctly different styles.

Money Laundering Closed Loop and Hedging Techniques: This Game…

If we connect the above actions, we can see a highly closed path of capital and risk management: suspicious funds first cross-chain into Ethereum and are washed through Tornado Cash into "clean" 2,479.1 ETH; subsequently, these ETH flow into the address cluster 0xB8b4…3714, where 1 million HYPE is unstaked, releasing chips worth about $26 million and preparing sufficient liquidity for subsequent operations; of which 600,000 are sold off, extracting about $1.6 million in cash flow, providing ammunition for constructing 3,500 ETH longs and other potential hedging positions on HyperLiquid. This forms a possible closed-loop hypothesis: through "money laundering ETH → unstaking HYPE → selling for cash → building long and hedging positions on HyperLiquid and ETH spot," participants attempt to conceal suspicious funds within complex positions and multi-layered trading structures while leveraging market volatility to amplify returns. In extreme scenarios, if faced with forced liquidations, law enforcement seizures, or black swan events on the project side, their losses on HYPE could potentially be offset by profits from ETH contracts or spot longs, forming an alternative logic of "hedging risk through volatility." Of course, from a compliance and regulatory perspective, all current judgments can only be based on observable on-chain behavior patterns, classifying them as a sample within the "suspected money laundering + market manipulation" path, and cannot directly escalate to "insider trading" or point to specific institutional participation. Whether in terms of address ownership, operational motives, or the underlying organizational structure, there is a lack of judicial evidence support, and any further accusatory descriptions would exceed the boundaries of existing facts.

Ethereum Under Regulatory Shadows: Sentiment…

Returning to Ethereum itself, this capital game is unfolding between two incompatible narratives: one revolves around the gray chapter of Tornado Cash funds, where dirty money infiltrates Ethereum through cross-chain and mixing, rapidly maneuvering within high-volatility assets like HYPE and HyperLiquid, leveraging unstaking, selling, and contract leverage to drive short-term profits; the other is represented by the compliant chapter of the U.S. Ethereum spot ETF, where institutional funds continue to flow in steadily within the regulatory framework, absorbing spot at a pace of $165-168 million in a single day, with a cumulative total exceeding $340 million over the previous two days, providing a kind of "funding floor" imagination for ETH prices. In the short term, around the critical price point of $3,190, the game between longs and shorts around whale positions and ETF buying will continue, and adjustments of large on-chain positions may significantly amplify volatility, with risks of liquidation and reverse cascading not to be ignored. However, unlike past cycles, the continuous net inflow of compliant ETFs provides ETH with a sort of "buffer," meaning that even if localized on-chain funds experience cascading or gray chips are concentrated and liquidated, the probability of evolving into a systemic collapse has decreased under the hedge of institutional buying. For ordinary participants, there are at least three clues worth continuously tracking: first, whether regulatory and law enforcement actions will follow regarding Tornado Cash funds and the address cluster 0xB8b4…3714, and whether new judicial actions will change on-chain behavior patterns; second, whether the chips behind the 1 million HYPE unstaked on the HYPE side will continue to be thrown into the market, as their rhythm and scale will directly relate to the project ecosystem and the risk exposure of related positions; third, whether the current strong net inflow of the Ethereum spot ETF can be maintained, especially whether leading institutions like BlackRock will sustain their current approximately 60% share of the incremental funds. If the pace of compliant funds slows down while the game of gray chips intensifies, then the dangerous bet of "dirty money going long on ETH" may soon evolve from an on-chain story into real fluctuations on the price curve.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。