Author: Liang Yu

Editor: Zhao Yidan

Currently, one of the hottest tracks in the global fintech field is undoubtedly the tokenization of real-world assets. Traditional capital giants and crypto-native institutions are entering the arena, painting a grand blueprint to bring trillions of dollars of physical assets onto the blockchain. However, beneath this vision lies a fundamental regulatory shackles that is difficult to break free from: in the vast majority of jurisdictions, RWA with income attributes, once touching the public market, will quickly fall under the strict framework of traditional securities law, leading to the entrapment of its liquidity essence.

While financial centers like Hong Kong and Singapore are cautiously exploring within the existing securities regulatory framework, Dubai in the Middle East has quietly completed a key paradigm shift. Here, there is no entanglement in the classic dilemma of "Are RWAs securities?" Instead, it has chosen to create a brand new category tailored for them—"Asset-Referenced Virtual Assets"—and has built a comprehensive compliance system from issuance, sales to trading. This means that a "compliance highway" focused on RWAs has been paved for the first time in a mainstream financial hub, with its endpoint directly pointing to global retail investors and high liquidity public markets.

This is not a relaxation of regulation, but a reconstruction of regulatory logic. Dubai's practice is revealing a future trend: in the second half of the RWA competition, core competitiveness will shift from technological implementation to more complex legal structure design and cross-sovereign regulatory coordination capabilities. It does not provide a "safe haven" to evade regulation, but rather a "new arena" that embraces innovation with clearer rules. Projects that can first understand and navigate this new set of rules may win a key hub position connecting traditional assets and global crypto capital.

I. When Global Regulators View RWA as Securities

The tokenization of real-world assets (RWA) is hailed as a bridge to bring trillions of dollars of traditional assets onto the blockchain, but its development has always been constrained by a fundamental contradiction. This contradiction is that the vast majority of RWAs with income rights (such as rental-generating real estate and interest-paying bonds) economically approach traditional financial securities.

Major global financial jurisdictions have generally chosen a path: to "penetrate" and "frame" RWAs using existing securities regulatory frameworks.

In the United States, the Securities and Exchange Commission's (SEC) "Howey Test" hangs over RWA projects like the sword of Damocles. Any tokenized arrangement involving "investment of money, a common enterprise, and an expectation of profits from the efforts of others" is likely to be deemed a security.

This determination means that projects must comply with strict information disclosure, registration, and reporting requirements. For example, BlackRock's BUIDL fund and Ondo Finance's OUSG have successfully operated tokenized government bonds in the U.S. because they fully acknowledge their securities nature and strictly adhere to relevant regulations.

The Monetary Authority of Singapore (MAS) explicitly proposed the principle of "same activity, same risk, same regulatory outcome" in its guidelines released in November 2025. MAS demonstrated through 17 specific cases that regardless of the technological form, as long as the economic substance of the token is equity, debt, or fund shares, it will be classified as a "Capital Market Product" (CMP) and fall under the existing securities and futures law regulation.

Hong Kong also adopts a "penetrative" regulatory approach, bringing security-type tokens under the licensing management of the Securities and Futures Commission (SFC). Although Hong Kong actively promotes sandbox pilots, its mature capital market regulations dictate that the issuance and trading of RWAs are primarily aimed at professional investors, with high thresholds for retail markets.

This regulatory path has led to a direct consequence: liquidity fragmentation. Projects are trapped within a small circle of qualified or professional investors, unable to conduct public promotions and struggling to access mainstream trading platforms for efficient secondary market trading.

The tortuous experience of early RWA projects, such as the tokenization of the St. Regis Aspen Resort—delayed listings and lackluster trading—partly stems from this. This creates a vicious cycle: without liquidity, it is difficult to attract large-scale funds; without large-scale funds, it is impossible to prove the universality of the model.

II. How Dubai Created an Independent Track for RWA

While other regions attempt to put new wine into old bottles, Dubai chose to create a new bottle. The core of this transformation is the establishment of the Dubai Virtual Assets Regulatory Authority (VARA) and its clear top-level design.

In 2022, Dubai enacted the "Virtual Assets Regulatory Law" and established VARA as an independent authority to specifically regulate virtual asset activities throughout Dubai (excluding the Dubai International Financial Centre). VARA's primary breakthrough is the legal definition of "virtual assets" as an independent, regulated digital representation of value, distinguishing it from traditional "securities."

This means that when a tokenized project enters Dubai, the first core question posed by regulators is no longer "Are you a security?" but rather "Are you a regulated virtual asset activity?"

In May 2025, VARA released an updated rulebook, tailoring a new category named "Asset-Referenced Virtual Assets" (ARVA) for RWAs. According to the rules, ARVA is clearly defined as tokens representing direct or indirect ownership of real-world assets (such as real estate and commodities) and sharing their income.

This move formally accepts RWAs institutionally, freeing them from the ambiguous debate over the applicability of securities law, and granting them a dedicated legal identity and issuance channel.

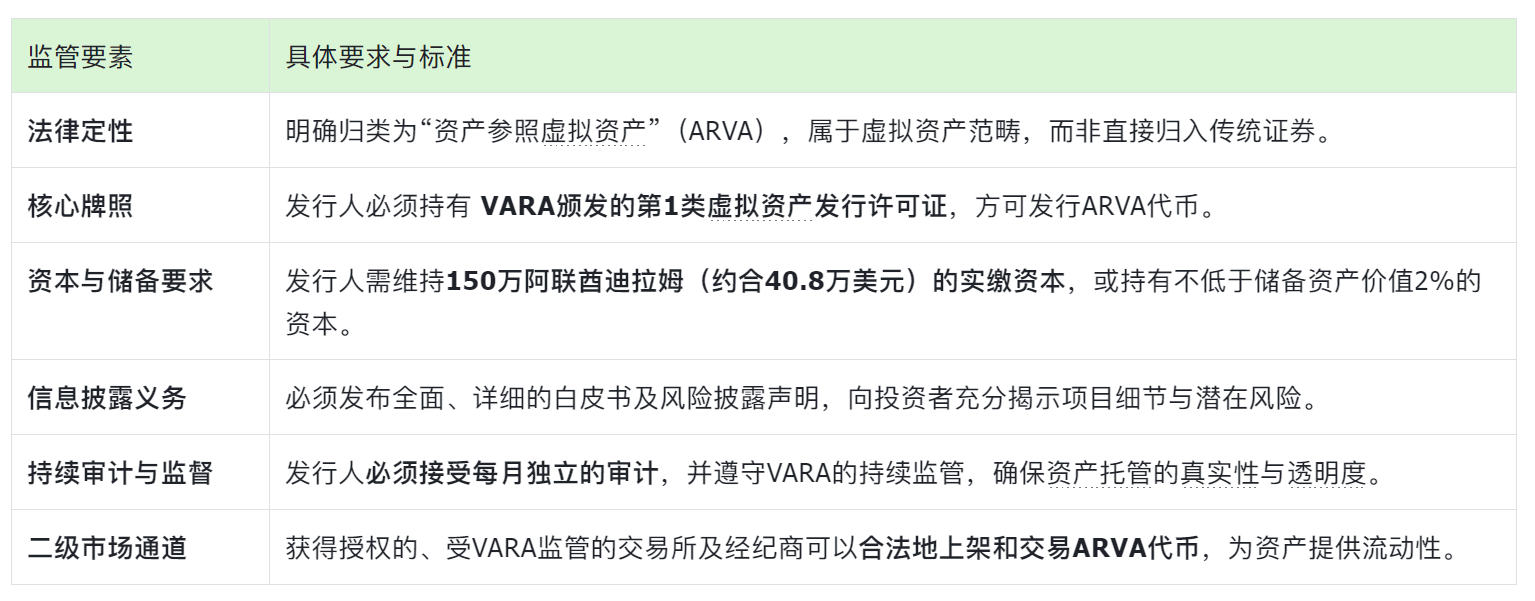

Chart: ARVA Issuance Framework under VARA Regulation

The essence of this framework lies in the "transformation of regulatory logic." It does not lower the requirements for investor protection, anti-money laundering, or project transparency. On the contrary, VARA's four mandatory rulebooks (covering corporate governance, compliance and risk, technology and information, and market conduct) construct an extremely strict compliance system.

The real difference is that it designs a complete closed-loop path for RWAs from issuance to listing, from institutional focus to retail access, rather than forcibly stuffing them into a traditional securities issuance channel that is not fully compatible.

III. Why is it Different? A Global Coordinate Comparison of the Dubai Path

The success of the Dubai model can be more clearly understood in comparison to the global regulatory landscape. Different jurisdictions have shaped distinct RWA regulatory philosophies based on their legal traditions and financial development goals.

According to a research report by China Galaxy Securities, global regulatory paths can be roughly divided into "strong regulation with safety priority" and "innovation-oriented pilot priority."

The United States is a typical representative of the former, relying on the case-by-case judgment of the Howey Test for its "penetrative regulation." While it can flexibly respond to complex situations, it also brings significant uncertainty and compliance costs to the market. Singapore and Hong Kong represent a cautious balance of innovation.

Singapore's "technology neutrality" principle emphasizes economic substance, providing clear classification standards for various tokens, but its conclusions often still lead most RWAs toward existing capital market product regulatory frameworks. Hong Kong, on the other hand, maintains a high licensing threshold while leaving room for innovation through sandbox mechanisms based on mature financial regulations.

Dubai represents a more thorough "structural innovation" path. It does not patch the old framework but builds a parallel, modern regulatory infrastructure for virtual assets and RWAs from scratch.

Chart: Core Comparison of Major Global RWA Regulatory Paths

The commercial results brought about by this difference are evident. An RWA project eager to gain broad liquidity and access global retail funding pools may struggle under traditional paths, but within Dubai's framework, it may find a compliant shortcut.

A tokenization project for apartments supervised by Dubai's land department in 2025 sold out within minutes, with buyers from over 35 countries, 70% of whom were retail investors making their first investment in Dubai real estate, is a direct reflection of the advantages of this model.

IV. Not a Lawless Land: The Stringent Requirements Behind Dubai's RWA Opportunities

Viewing Dubai as a "regulatory lowland" or "watered-down licensing" is a serious misunderstanding. VARA provides a clear but not easy compliance highway, not a rule-less wilderness. Its strictness is reflected in multiple dimensions.

First, there are extremely high thresholds for license applications and ongoing operations. Any institution wishing to provide virtual asset services in Dubai must undergo VARA's rigorous two-stage application process. This is not just about submitting forms and paying fees, but involves a comprehensive in-depth review of corporate governance, risk control, technical security, and anti-money laundering measures.

Once licensed, companies must continuously comply with the four mandatory rulebooks covering corporate governance, compliance and risk management, technology and information security, and market conduct norms. ARVA issuers must also fulfill stringent ongoing obligations such as monthly independent audits.

Secondly, the standards for anti-money laundering (AML) and know your customer (KYC) are extremely stringent. The UAE faces immense pressure in the global Financial Action Task Force (FATF) assessment, leading to AML/KYC requirements for virtual asset service providers that are among the highest international standards.

This requires projects to establish robust off-chain identity verification and on-chain monitoring hybrid systems, potentially involving collaboration with professional compliance service providers, integrating real-time sanctions list screening, and developing suspicious activity reporting mechanisms. For attempts to combine DeFi and RWA, how to meet these requirements while maintaining decentralized characteristics is a significant technical challenge.

Furthermore, asset ownership and legal isolation are fundamental requirements. VARA explicitly requires that ARVA must have clear real-world asset support. This means that the legal ownership of the underlying assets must be clear, undisputed, and must achieve bankruptcy isolation from the issuer's own assets through legal structures such as special purpose vehicles (SPVs).

Any ambiguity in ownership or legal structural defects will directly lead to the project's failure to pass regulatory review. The deep involvement of Dubai's land department in real estate tokenization is precisely to ensure a solid link between on-chain tokens and off-chain property legal rights.

Finally, the risk of being deemed a "de facto security" still exists. Although Dubai has created the ARVA category, regulators do not turn a blind eye to financial substance. If a project is nominally a "functional" or "usage rights" token, but its economic substance, marketing language, and user expectations point to collective investment and profit sharing, VARA may still classify it as a "collective investment scheme" (CIS) or similar structure requiring stricter regulation.

Additionally, project parties must be wary of cross-border regulatory risks. Being compliant in Dubai does not mean ignoring the laws of the asset's location or the investor's country. For example, selling tokenized products that may fall under SEC jurisdiction to U.S. citizens can still lead to serious legal consequences.

V. The RWA Competition Enters the "Legal Engineering" Era and Dubai's Hub Role

Dubai's practice in the RWA field marks the beginning of a new era: the core of RWA competition is shifting from the early "technical demonstration" phase to the "legal engineering" phase, where the ability to design legal and regulatory structures is key.

The leading RWA projects of the future will inevitably be those teams that can master cross-jurisdictional laws, cleverly design SPV structures, and achieve financial innovation within a strict compliance framework. Dubai's VARA framework provides the first standardized professional arena for this high-difficulty competition.

From a broader trend perspective, the flow of global capital and projects is undergoing subtle changes. In the past, capital from the Middle East flowed to Europe and the United States in search of investment opportunities. Now, there is a phenomenon where financial technology and RWA projects from Europe and the United States actively flow to Dubai seeking compliant landing.

The driving force behind this is not tax incentives, but rather the certainty of a regulatory system that matches innovation, which has become the most scarce resource. By providing this resource, Dubai is shaping itself into a key hub connecting trillions of dollars of traditional world assets with global liquidity in the blockchain world.

At the same time, other global financial centers are also accelerating their adjustments. Singapore and Hong Kong are continuously refining their guidelines, and the EU's MiCA regulations have been fully implemented. The future landscape will be one of "diverse coexistence and differentiated competition." The Dubai model, with its openness to the retail end and complete liquidity solutions, may attract specific types of assets and projects, forming a differentiated complement to New York's institutional path and Singapore's refined classification path.

For entrepreneurs, asset owners, and investors involved, making choices has become crucial yet challenging. Understanding the essence of the Dubai model—it is not an evasion of regulation, but a more compatible and cutting-edge regulatory embrace—is the first step to making informed decisions.

In Dubai, the story of RWA is no longer a theoretical blueprint or a niche experiment. From real estate tokens that sell out in minutes to global institutions queuing to apply for VARA licenses, a new market connecting real assets with global retail investors, safeguarded by clear rules, has already transitioned from framework to reality here.

UAE lawyer Irina Shifer believes that the silence surrounding early security token offerings (STOs) stemmed from a lack of clear regulation, viable secondary markets, and liquidity. Now, Dubai's regulatory authorities have directly addressed these failures.

In Dubai, regulated exchanges and broker-dealers are now authorized to distribute and list Asset-Referenced Virtual Assets (ARVA) tokens. This marks the development of RWA moving from theory to execution, from concept to framework.

In the next five years, bridges connecting traditional finance with the crypto world will increasingly be built in places willing to rebuild foundations for innovation.

Sources of some materials:

· "Mankiw Research | Is the Optimal Compliance Solution for Global RWA Actually in Dubai?"

· "A Crypto Oasis in the Desert: Overview and Application Guide for Dubai VASP Licenses"

· "When RWA Connects to DeFi: Implementation Paths and Challenges of KYC/AML Compliance"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。