Today, the S&P reached a new high, but $BTC experienced a decline. Many friends believe that Bitcoin is once again only following the downward trend, but the actual logic is that if there is no correlation between BTC and tech stocks, how much relevance would the situation in Venezuela have to cryptocurrencies? On Monday, there was a significant amount of buying in the spot ETF, which indicates a correlation, doesn't it? Of course, the rise in the U.S. stock market while BTC fell could likely be due to some trapped funds exiting as a result of the rise.

I mentioned on Sunday that this rise was event-driven. BTC's increase started over the weekend and has already been priced in by the market. Moreover, on Monday, the rise of $BTC significantly outpaced the U.S. stock market. A pullback after an event-driven rise is quite normal for sectors indirectly benefiting from cryptocurrencies. It has been fluctuating around $90,000 for half a month, and liquidity has not shown significant improvement. Personally, I think maintaining a slight fluctuation is already quite good.

The essence of 2026 still lies in U.S. monetary policy. Venezuela's actual goal is also to reduce inflation in the U.S. and globally, so the main theme for 2026 will still revolve around monetary policy and Trump's midterm election campaign. The current market requires more patience.

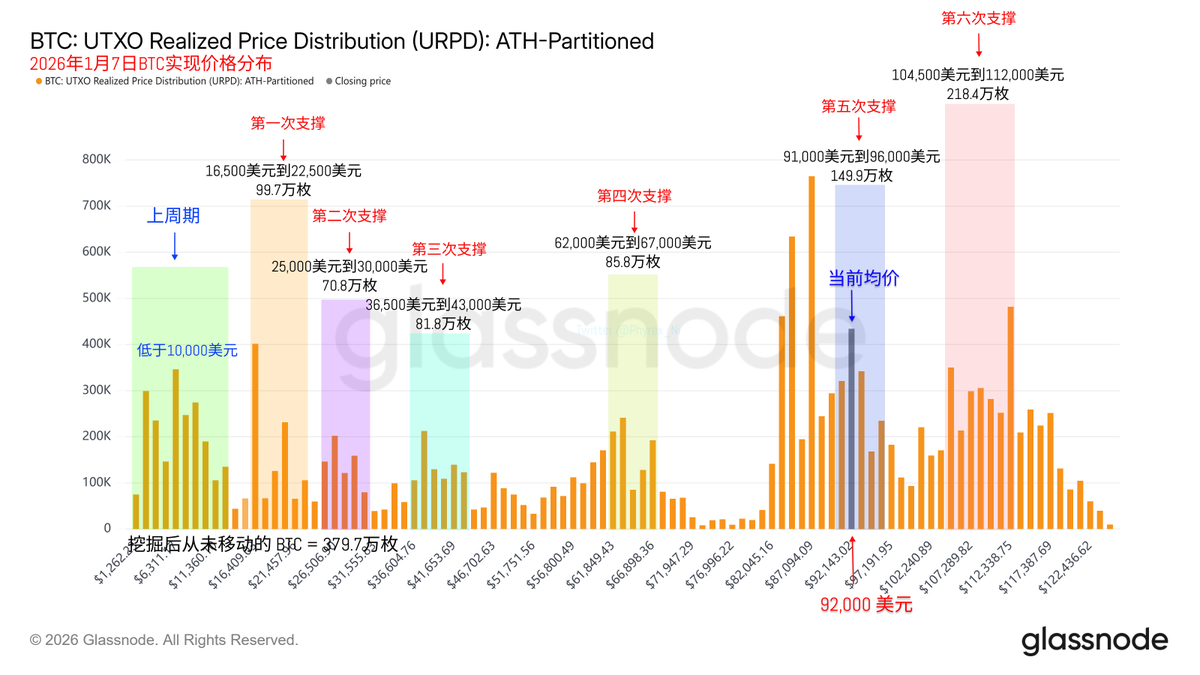

Looking back at Bitcoin's data, the turnover rate is still normal. Although the price has some fluctuations, there are no signs of panic among investors. By the close of the U.S. stock market, the price of $BTC had returned to around $93,000. From the data, it seems that some cryptocurrency investors are choosing to switch to the U.S. stock market, which indeed appears to have a clearer advantage at this moment.

However, I still believe that BTC and tech stocks have a strong correlation. As long as tech stocks can continue their upward momentum, at the very least, BTC will not perform too poorly.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。