Author: Nick Maggiulli, Financial Blogger & Author of "Just Keep Buying"

Translated by: Felix, PANews

The investment community generally believes that excess returns (Alpha), or the ability to outperform the market, is the goal investors should pursue. This makes perfect sense. All else being equal, more Alpha is always better.

However, having Alpha does not always mean better investment returns. Your Alpha always depends on market performance. If the market performs poorly, Alpha may not lead to profits.

For example, imagine two investors: Alex and Pat. Alex is very skilled at investing, consistently outperforming the market by 5% each year. Pat, on the other hand, is a poor investor, underperforming the market by 5% each year. If Alex and Pat invest during the same time period, Alex's annual return will always be 10% higher than Pat's.

But what if Alex and Pat start investing at different times? Is there a scenario where, despite Alex's superior skills, Pat's returns exceed Alex's?

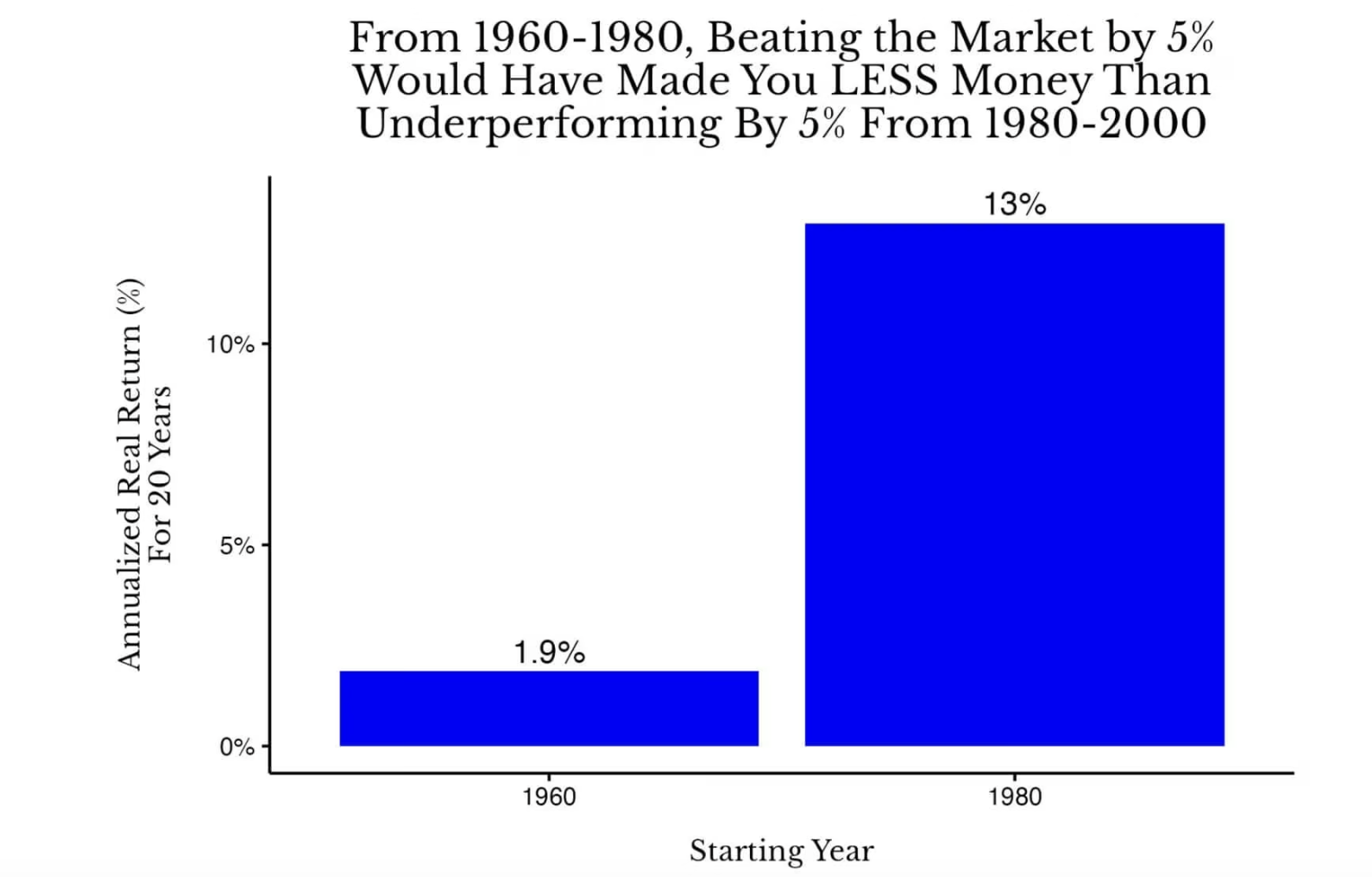

The answer is yes. In fact, if Alex invests in U.S. stocks from 1960 to 1980, while Pat invests from 1980 to 2000, then 20 years later, Pat's investment returns will surpass Alex's. The chart below illustrates this:

Comparison of 20-Year Real Annualized Total Returns of U.S. Stocks from 1960-1980 and 1980-2000

In this case, Alex's annual return from 1960 to 1980 is 6.9% (1.9% + 5%), while Pat's annual return from 1980 to 2000 is 8% (13% - 5%). Although Pat's investment skills are inferior to Alex's, Pat performs better in terms of inflation-adjusted total returns.

But what if Alex's competitor is a true investor? Currently, we assume Alex's competitor is Pat, who lags the market by 5% each year. However, in reality, Alex's true competitor should be an index investor who matches the market's returns.

In this scenario, even if Alex outperforms the market by 10% each year from 1960 to 1980, he would still lag behind the index investor from 1980 to 2000.

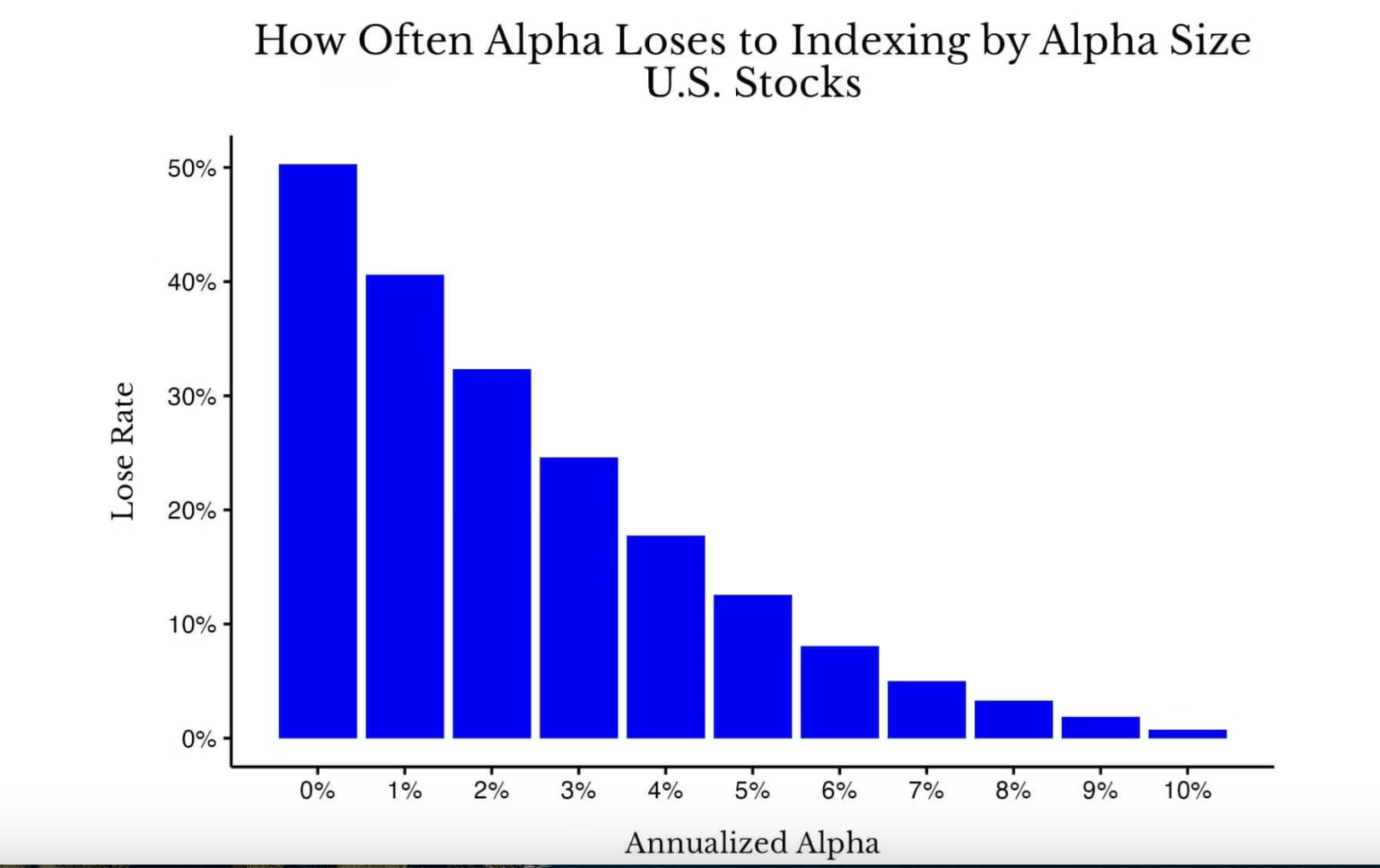

Although this is an extreme example (i.e., an outlier), you may be surprised to find that having Alpha leads to underperformance relative to historical performance quite frequently. As shown in the chart below:

Probability of Underperforming the Index Compared to Alpha Size in All 20-Year Periods of the U.S. Stock Market from 1871 to 2005

As you can see, when you have no Alpha (0%), the probability of beating the market is essentially equivalent to flipping a coin (about 50%). However, as Alpha returns increase, the compounding effect of returns does reduce the frequency of underperforming the index, but the increase is not as significant as one might imagine. For example, even with an annual Alpha return of 3% over a 20-year period, there is still a 25% chance of underperforming index funds during other periods in U.S. market history.

Of course, some may argue that relative returns are what matter most, but I do not agree with this viewpoint. Would you prefer to achieve market-average returns during normal times, or would you rather lose "a little less money" than others during a Great Depression (i.e., achieve positive Alpha returns)? I would certainly choose index returns.

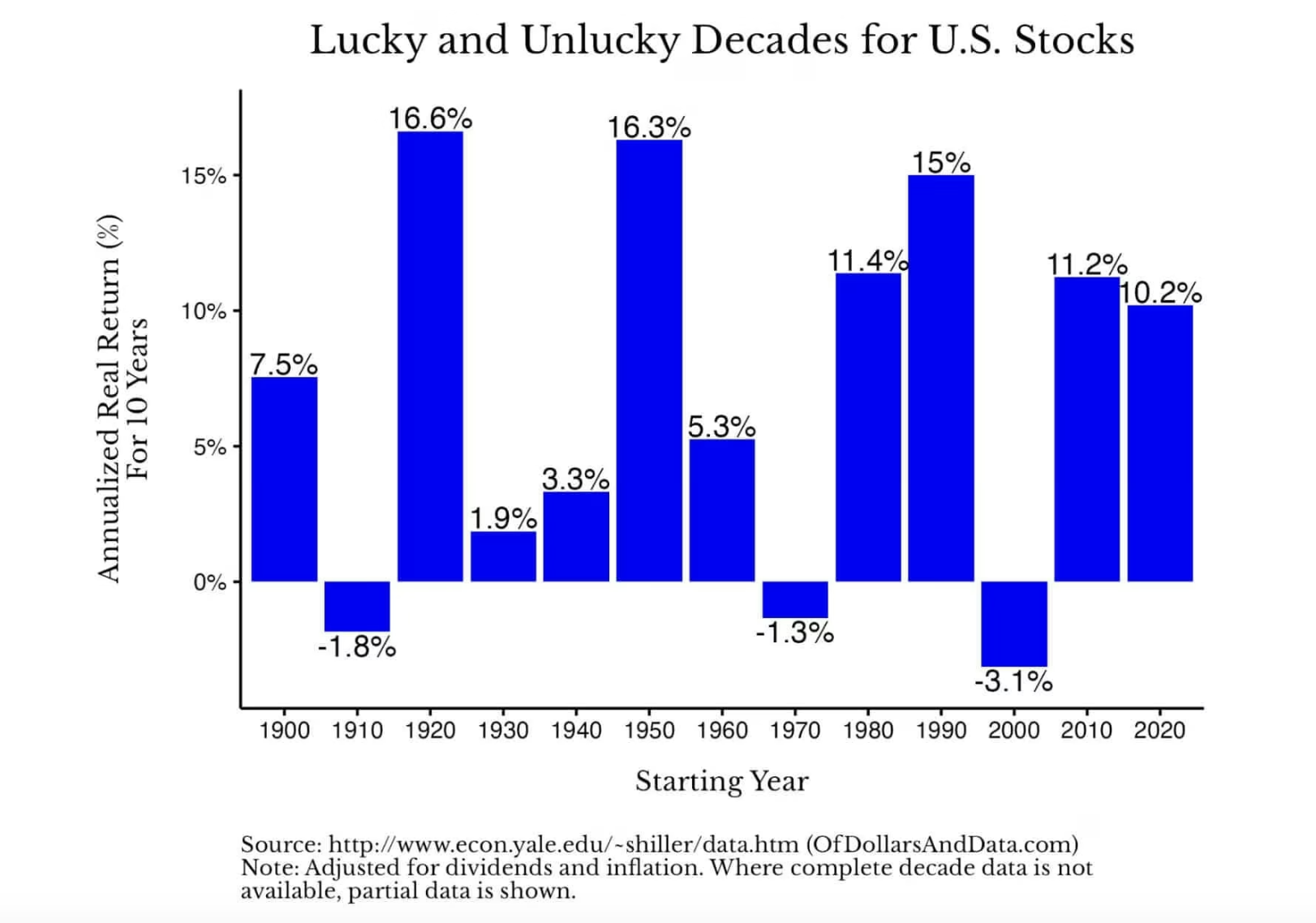

After all, in most cases, index returns yield quite decent profits. As shown in the chart below, the real annualized returns of U.S. stocks fluctuate over ten-year periods, but are mostly positive (Note: Data for the 2020s only shows returns up to 2025):

All of this indicates that while investment skills are important, market performance is often more critical. In other words, pray for Beta, not Alpha.

From a technical standpoint, β (Beta) measures the extent to which an asset's returns move relative to market fluctuations. If a stock has a Beta of 2, then when the market rises by 1%, that stock is expected to rise by 2% (and vice versa). For simplicity, market returns are typically referred to as Beta (i.e., a Beta coefficient of 1).

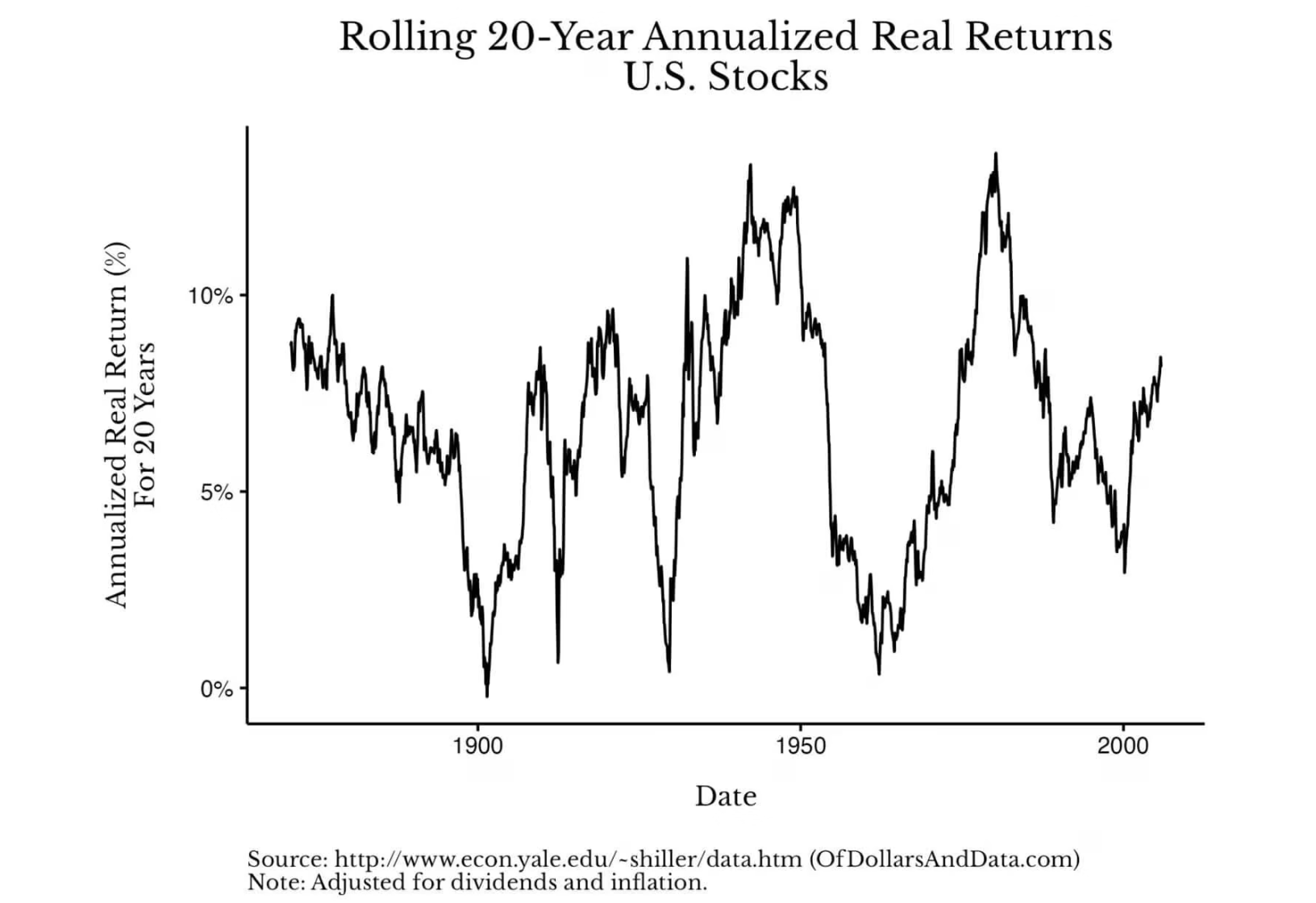

The good news is that if the market does not provide enough "Beta" during one period, it may compensate with returns in the next cycle. You can see this in the chart below, which shows the 20-year rolling annualized real returns of U.S. stocks from 1871 to 2025:

This chart visually demonstrates how returns rebound strongly after periods of stagnation. For example, in U.S. stock market history, if you invested in 1900, your annualized real return over the next 20 years would be close to 0%. However, if you invested in 1910, your annualized real return over the next 20 years would be about 7%. Similarly, if you invested at the end of 1929, your annualized return would be about 1%; whereas if you invested in the summer of 1932, your annualized return would soar to 10%.

This enormous difference in returns further underscores the importance of overall market performance (Beta) relative to investment skills (Alpha). You might ask, "I can't control how the market will move, so why does this matter?"

It matters because it is liberating. It frees you from the pressure of "having to beat the market" and allows you to focus on what is truly controllable. Instead of feeling anxious about the market being out of your control, view it as one less thing to worry about. Consider it a variable you do not need to optimize because you cannot optimize it at all.

So what should you optimize instead? Optimize your career, savings rate, health, family, and so on. In the long run, the value created in these areas is far more meaningful than the few percentage points of excess returns sought in a portfolio.

A simple calculation shows that a 5% raise or a strategic career shift can increase your lifetime income by six figures or more. Similarly, maintaining good physical health is also an effective risk management strategy that can significantly hedge against future medical expenses. Additionally, spending time with family can set a positive example for their future. The benefits of these decisions far outweigh the returns most investors hope to achieve by trying to beat the market.

In 2026, focus your energy on the right things, chasing Beta, not Alpha.

Related Reading: Two-Year Investment Review: The Feast of Bitcoin, the Funeral of Altcoins, Why Did Your Assets Shrink in a Bull Market?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。