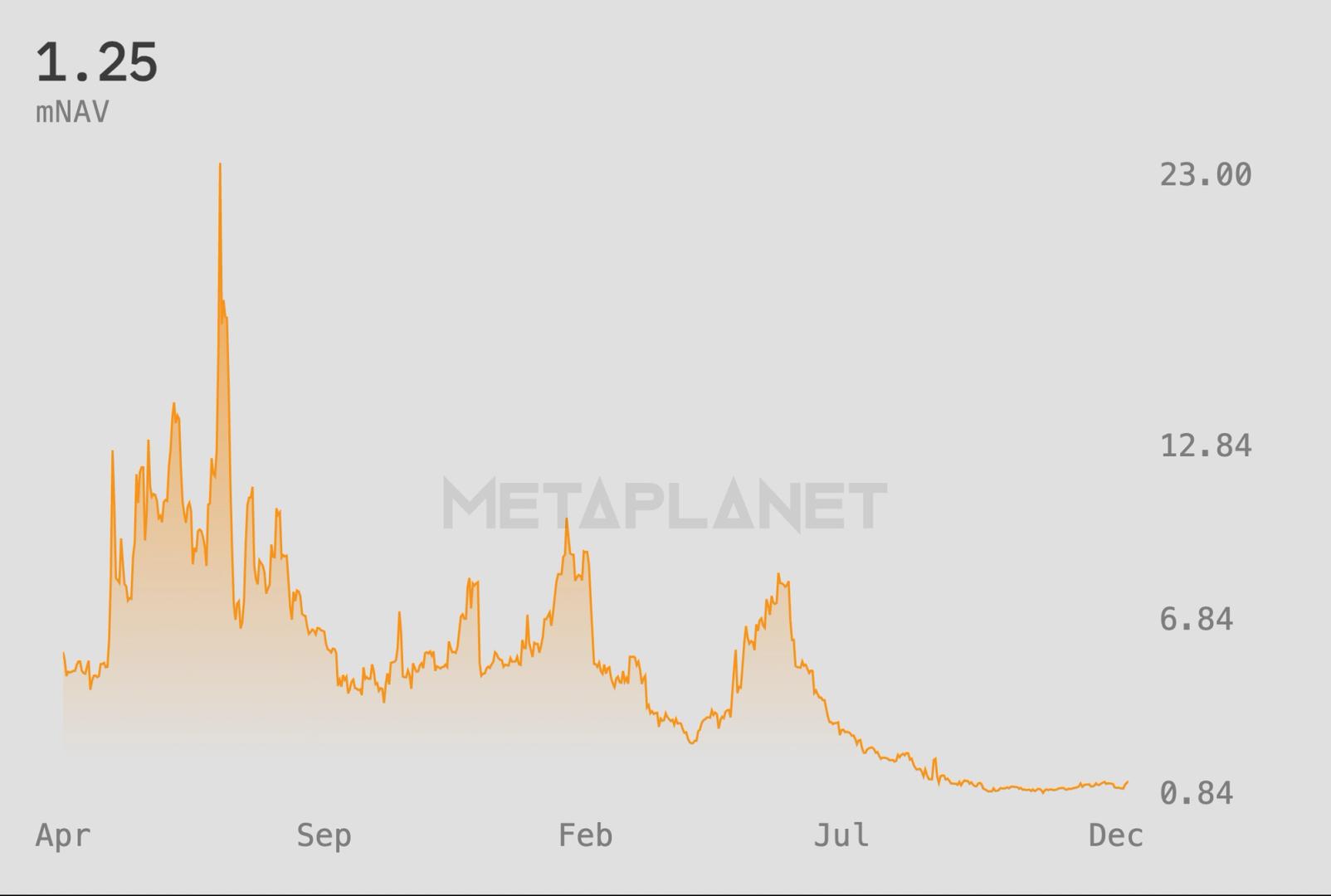

What to know : Metaplanet’s multiple to net asset value (mNAV) rose to around 1.25, its highest level since before the October liquidation crisis. The move followed MSCI’s decision not to exclude digital asset treasury companies from its global indexes. Strategy (MSTR) rose around 5% in pre-market trading while price action across other bitcoin treasury companies remained relatively muted.

Digital asset treasury company Metaplanet (3350) rose 4% in Tokyo on Wednesday after index provider MSCI decided not to exclude firms building cryptocurrency stockpiles from its global indexes.

Metaplanet is now up 20% since the start of the year. The rally means company is valued at a premium to its bitcoin holdings, with a multiple to net asset value (mNAV) of around 1.25, the highest level since before October's plunge in crypto prices, according to the company’s dashboard.

The decision ended months of uncertainty around index eligibility and lifted U.S. peers when the announcement was made after regular trading hours on Tuesday. Strategy (MSTR), the largest corporate holder of bitcoin was recently 5% higher in pre-market trading. Other digital asset treasury companies rose to a lesser extent.

Metaplanet shares closed at 531 yen ($3.4), having bottomed near 340 yen on Nov. 18. The company holds 35,102 BTC, making it the fourth-largest publicly listed bitcoin treasury company globally.

MSCI’s announcement removes a near term overhang for crypto treasury stocks, particularly those already included in major indexes. However, the index provider also signaled that a broader consultation on non operating and investment oriented companies is forthcoming, indicating that regulatory and index related risks for bitcoin treasury firms have been deferred, not eliminated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。