Trump has recently made it clear that the core battleground for the 2026 midterm elections will focus on "prices" and "living costs," igniting a campaign centered around economic data.

“If this rule is abolished, there will be no government ‘shutdown’,” Trump said while urging Republicans to eliminate the Senate's filibuster rule. He is clearing legislative hurdles for the 2026 midterm elections to ensure his economic agenda can proceed without obstruction.

Behind this is a set of cold and efficient political arithmetic. BitMEX co-founder Arthur Hayes previously summarized Trump's re-election strategy into three actionable variables: suppressing oil prices, expanding credit, and inflating asset prices.

Recent information indicates that this "three-pronged approach" is rapidly evolving from theory into concrete policy reality, with its effects beginning to manifest in the global oil market and the candlestick charts of cryptocurrencies.

1. Core of the Election

By the end of December 2025, Trump has unmistakably set the tone for the upcoming midterm elections. He told the media that the 2026 midterm elections will revolve around “national economic success” and “price reduction.”

● He specifically emphasized that energy and gasoline prices have "clearly fallen." This is not coincidental economic data but a carefully crafted political signal. Making "prices" the core issue is Trump's most direct economic commitment to voters.

● Historical data shows that gasoline prices are a "thermometer" of American politics. If the national average gasoline price rises more than 10% compared to January in the three months leading up to the election, the ruling party often faces setbacks. Controlling oil prices means controlling the wallets and votes of low- to middle-income voters.

● Trump understands that the cultural wars and the noise on social media are far less real than voters' feelings when they pay at the gas station. His opponents and supporters may argue over various issues, but what ultimately decides the vote is whether voters feel richer or poorer.

2. The Politics of Oil Prices

Lowering oil prices is no easy task; it is a global geopolitical game. Trump's strategy is multifaceted, involving trade, diplomacy, and direct capacity intervention.

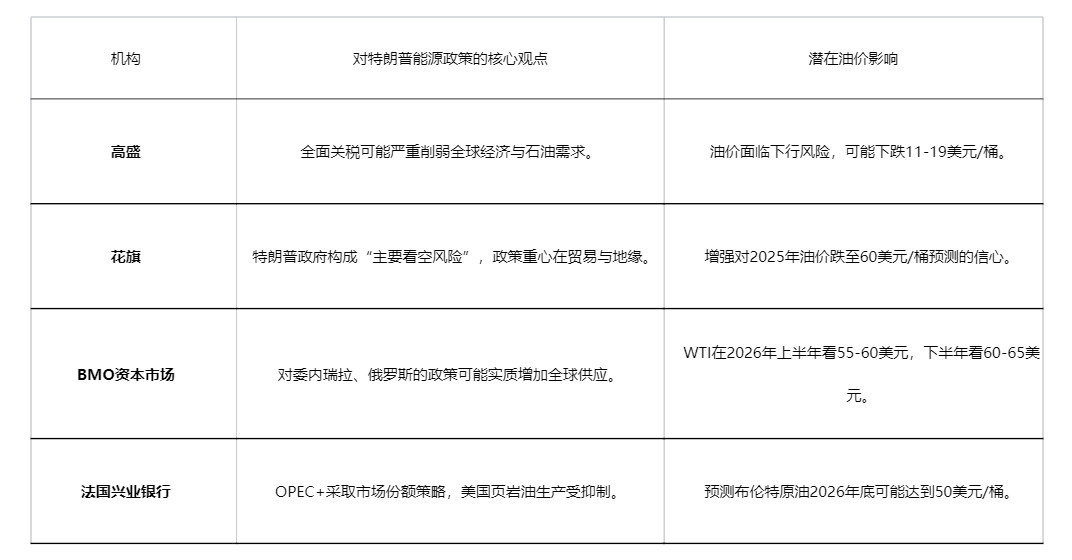

● The primary tool is tariffs. Analysts from major Wall Street firms Goldman Sachs and Citigroup point out that if Trump implements comprehensive import tariffs, it could severely weaken global economic growth and oil demand expectations, leading to a significant drop in oil prices.

○ Goldman Sachs analysts believe this could expose oil prices to a risk of falling by $11 to $19 per barrel. Citigroup views the Trump administration as a "major bearish risk" for the oil market.

● Secondly, opening new sources of crude oil supply. BMO Capital Markets' analysis emphasizes that Trump's attitude towards Venezuela could pave the way for increased oil imports and higher mid-term production.

○ This move directly targets reducing domestic refining costs in the U.S. At the same time, promoting a peace agreement between Russia and Ukraine could normalize Russian oil exports, further increasing global supply.

The effects of these policies are already beginning to show. A BMO report indicates that since Trump took office, WTI crude oil prices have fallen from around $75 per barrel to below $60 per barrel.

The other side of this game is OPEC+. Analysts from Société Générale note that OPEC+ seems to have chosen a market share strategy rather than a price defense strategy.

They have accelerated production increases, aiming to normalize output as quickly as possible before September 2026. The report suggests that this is partly to "please" Trump, who hopes for lower oil prices.

3. The Money Printing Machine

Controlling oil prices creates space for another core policy: unrestrained credit expansion. A low-inflation environment is a prerequisite for turning on the money printing machine.

● Trump and his Treasury Secretary "Wild Bill" Basant have made it clear that they want the economy to "run hot." This means a large-scale stimulus led by fiscal policy. However, this directly challenges the traditional cornerstone of U.S. monetary policy—the independence of the Federal Reserve.

● Recent analyses point to the core of the issue: the confrontation between Trump and the Federal Reserve has escalated from a war of words to a substantive "power grab." He is attempting to create a "super majority" within the Federal Open Market Committee (FOMC) that supports significant interest rate cuts by dismissing board members and installing loyalists.

● Bitunix analysts warn that if monetary policy is completely controlled by politics, the U.S. economy may repeat the mistakes of the 1970s: first experiencing a credit-driven brief boom, followed by an inevitable slide into "stagflation."

● Economic growth slows or even stagnates, while inflation remains high. This politician-led interest rate decision-making is often closely tied to the election cycle, trading long-term economic health for short-term electoral gains.

● The consequences will not only be market volatility but also a systemic devaluation of the dollar's credit and its status as a global reserve currency. When global markets begin to lose confidence in U.S. monetary policy, long-term borrowing costs will be repriced.

4. The Crypto Wave

As the credit waters of fiat currency overflow, funds will inevitably seek new reservoirs. Cryptocurrencies, especially Bitcoin, have become the most direct recipients of this liquidity feast.

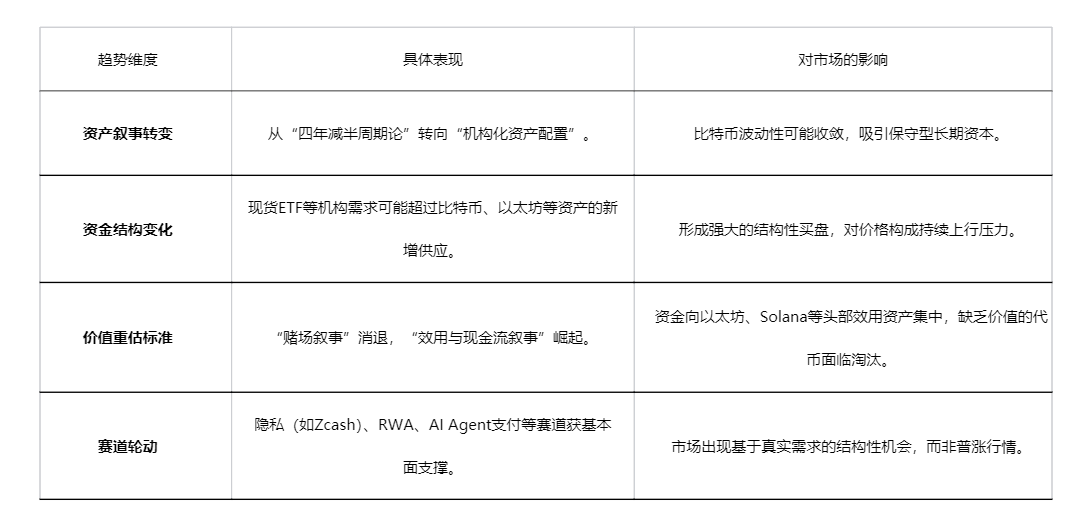

● The crypto research platform Bankless has proposed a landmark view in its 2026 forecast: the traditional "four-year halving cycle" theory of Bitcoin may become invalid.

● The driving force in the market has shifted from retail sentiment to a continuous and predictable flow of institutional funds represented by spot ETFs. As purchases by giants like BlackRock become routine, the significance of supply shocks from halving has relatively diminished.

● Bankless even predicts that Bitcoin's volatility in 2026 may be lower than that of tech star stocks like Nvidia. This change will fundamentally overturn the traditional financial community's bias against cryptocurrencies being "too volatile," thereby attracting more conservative family offices and pension funds to enter the market.

● Market consensus is becoming unprecedentedly optimistic. Another report, integrating views from several top institutions, suggests that with continued allocations from sovereign funds and corporate treasuries, Bitcoin is expected to challenge the $250,000 historical high in this cycle.

● More importantly, funds will not be evenly distributed across all tokens. The market in 2026 will undergo profound "de-bubbling," with funds efficiently concentrating on top assets with real utility and cash flow.

● Ethereum, as the settlement layer for global decentralized finance, will have its value reassessed. Meanwhile, public chains like Solana, which have established advantages in high-frequency application scenarios, will also be revalued due to their irreplaceable utility.

● At the same time, the logic of the privacy track is undergoing fundamental changes. It is no longer just a tool for avoiding regulation but a basic infrastructure necessity for traditional financial institutions to enter the market.

● Institutions like JPMorgan need to build "on-chain dark pools" using privacy technology to prevent trading information from being leaked or front-run during on-chain transactions. Therefore, privacy protocols like Zcash, which have compliance-friendly characteristics, are evolving into institutional-level financial tools.

5. The Ultimate Game

Trump's "three-pronged approach" is not an isolated policy but a precisely coordinated political-economic re-election machine.

● Lowering oil prices serves as a pressure valve to maintain social stability, winning public tolerance for radical fiscal spending policies. Large-scale money printing and credit expansion are the engines that stimulate nominal GDP and create a sense of economic prosperity, driving up financial asset prices and satisfying the wealthy class, who in turn contribute political donations.

● The rise of cryptocurrencies is both a result of this liquidity feast and, in turn, a certain proof of policy success—capital market prosperity is the most glamorous billboard during the campaign.

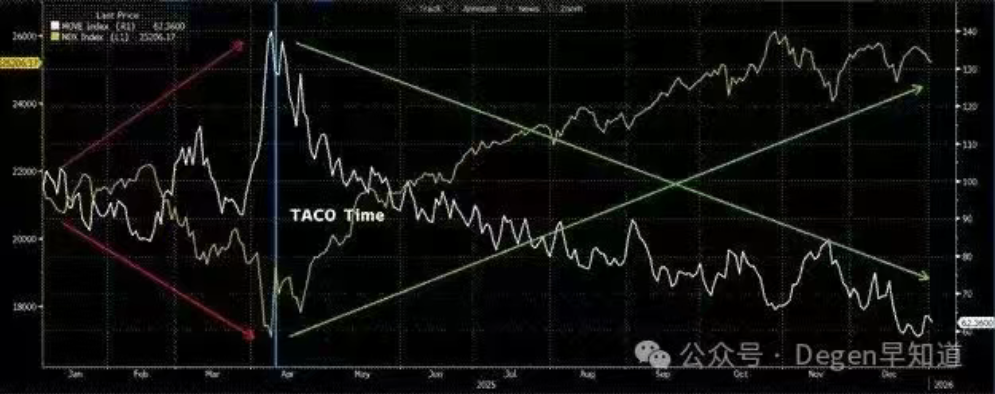

● The real risk lies in the fragile balance point of this machine: the 10-year U.S. Treasury yield. If oil prices soar uncontrollably due to global supply and demand or geopolitical conflicts, it will trigger rising inflation expectations, forcing the 10-year Treasury yield to break critical levels (e.g., 5%).

This would detonate the leverage of the entire financial system built on cheap dollars, causing the MOVE index, which measures bond market volatility, to soar, ultimately forcing policymakers to slam the brakes. At that moment, the euphoria of risk assets will come to an abrupt halt.

For investors, the key is to identify and track these observable signals rather than getting caught up in endless political and moral debates. Trading charts do not lie.

Oil prices, bond yields, and the dollar liquidity index form the dashboard for observing the operational status of this "Trump machine." As long as oil prices hover at low levels, yields remain moderate, and liquidity continues to be abundant, then going long on risk assets, especially Bitcoin and core crypto assets that absorb fiat currency overflow, is the logical choice.

Crypto market analysts expect that based on the growth of global money supply and its comparison to the market value of gold, Bitcoin's target price in this round of upward cycle is likely to challenge the $250,000 high.

In the trading rooms of Wall Street, traders are closely monitoring the Brent crude oil futures curve and the real-time price of Bitcoin. They know that these two seemingly unrelated curves are being invisibly tied together by the election politics of the White House, becoming the most genuine compass for global capital flows.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。