The price of Bitcoin has been fluctuating around the $91,000 mark, and the enthusiasm in the crypto market has suddenly cooled down. Investors are beginning to question whether this recent surge is merely a brief excitement or the start of a structural change.

Last night and this morning, the crypto market continued to decline, with Bitcoin dropping to a low of $90,675 and currently trading at $91,227, marking a 24-hour decline of 2.5%. This market adjustment raises doubts about the sustainability of the rebound, triggering concerns among investors about the future direction of the market.

Analysts point out that Bitcoin has fallen below the key support level of approximately $92,155 on the 4-hour chart, confirming a downward trend, with a potential target price of around $87,600 (the monthly opening price).

1. Market Pulse

● The pulse of the crypto market today shows signs of fatigue. According to the latest data, Bitcoin failed to hold its ground after a brief rebound, dropping to a low of $90,675 this morning and currently hovering around $91,227.

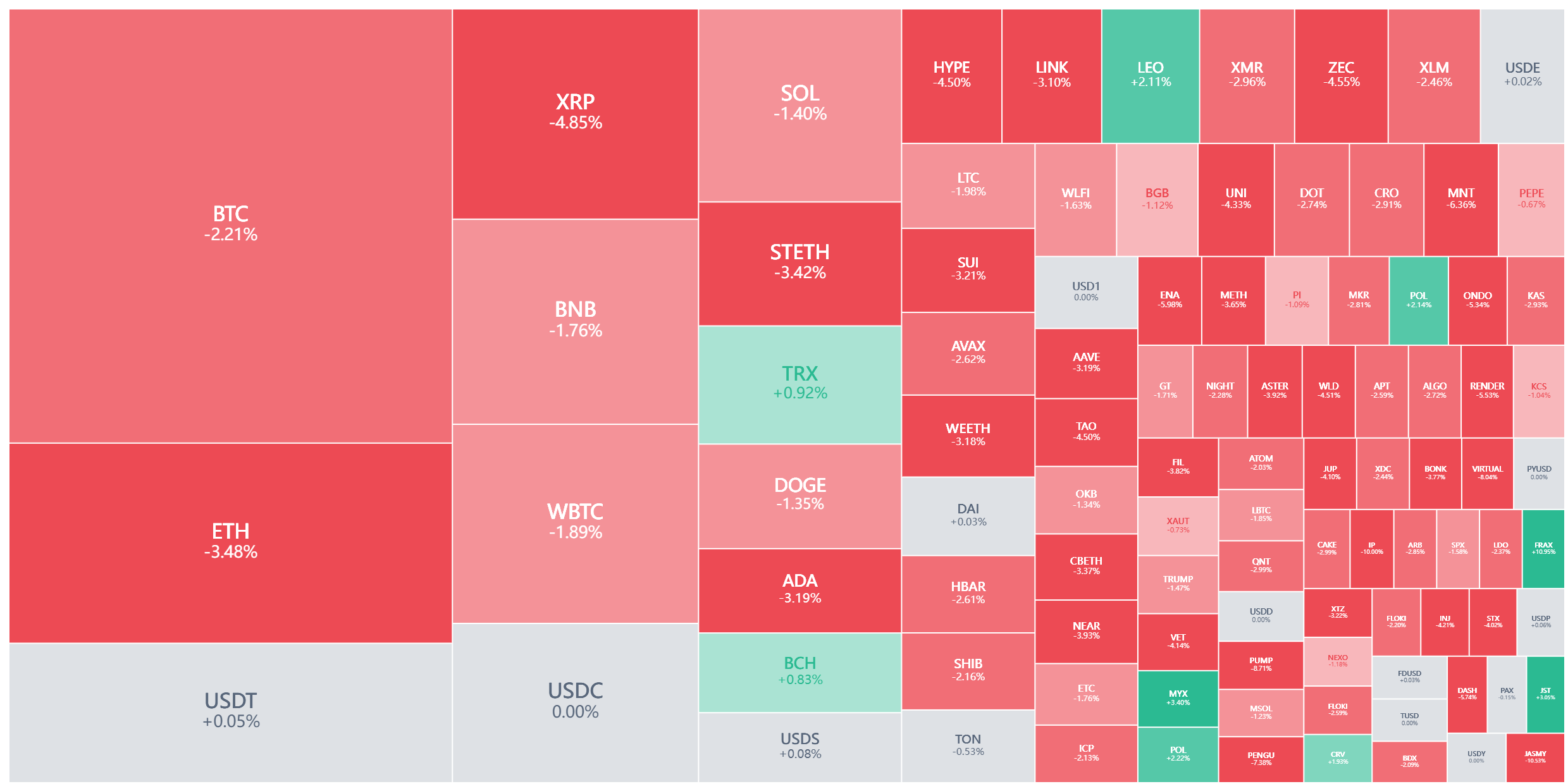

● Meanwhile, Ethereum is showing even weaker performance, currently priced around $3,165, with a 24-hour decline of 3.84%. SOL, a public chain token that has garnered market attention, is also under pressure, currently reported at $136.53, down 3.21%.

● The overall market is exhibiting a corrective trend, with the synchronized decline of the three major digital assets prompting investors to reassess the sustainability of the recent rebound. Trading volume data indicates a cautious attitude among market participants.

2. Key Resistance Levels

● Analysts clearly indicate that Bitcoin is currently facing a key resistance level around $95,000, which has become the focal point of contention between bulls and bears. If it can hold this position, aggressive strategies may consider reversal signals; otherwise, the market will revert to a range-bound pattern.

● Technical analysis experts note that Bitcoin has lost the support level of approximately $92,155 on the 4-hour chart, further confirming the short-term bearish momentum.

● After breaking below this support level, the next important level to watch is around $90,500. Experts also warn that if Bitcoin's price can successfully break above approximately $96,500, market sentiment may turn bullish.

3. Institutional Perspective

In contrast to retail sentiment, the institutional perspective is more calm and structured. The recent rise in the crypto market appears to be a price recovery, but the underlying logic is far more complex than simply "the market has risen a few dollars."

● Institutional investors may be engaging in structural asset reallocation rather than simply following market sentiment. During this process, the behavior of large long-term holding institutions resuming their accumulation of Bitcoin is noteworthy.

● Analysis shows that some institutional funding sources are not short-term leverage but rather long-term capital allocation through methods such as stock issuance. This indicates that the participation model of institutions is shifting from the traditional "buy high, sell low" to a more strategically minded "structural allocation."

4. Market Structure Change

A close observation of capital flows reveals that the market structure is undergoing subtle changes. During the upward movement, different funds are entering in a structured, phased manner, exhibiting characteristics of a "multi-phase rebound."

Analysis of capital flows shows a significant increase in the participation of family offices in crypto investments. A survey indicates that about 74% of global family offices have already explored or are currently exploring crypto investments.

These traditional capital sources are entering the market through structural exposure allocation rather than event-driven buying and selling. Their participation is reshaping the composition of capital in the crypto market, making market behavior more complex and long-term.

5. Mainstream Asset Analysis

Among mainstream digital assets, Bitcoin, Ethereum, and Solana exhibit different technical patterns.

● Bitcoin faces a key resistance level near $95,000 and needs to break this level to open up new upward space. Analysts set a target range showing support around $90,500 and resistance near $96,500.

● Ethereum faces a resistance area between $3,120 and $3,300. Analysts point out that $3,050 to $3,100 is an important short-term support range, while a drop below $2,900 could trigger a deeper correction.

● Solana's technical structure is relatively clear, forming a trading range around $117 support and $147 resistance, which the market views as a structural watershed.

6. Positive Signals

Despite the market facing short-term adjustments, some structural positive signals are emerging. As the new year approaches, Bitcoin has cleared a significant portion of legacy positions in the spot, futures, and options markets.

● The deleveraging event by the end of 2025 and the expiration cycle at the end of the year have effectively reset the market's structural constraints, leaving a clearer and more transparent signal environment.

● Early signs of market reactivation are currently emerging. ETF capital flows are beginning to stabilize, participation in the futures market is being rebuilt, and the options market is also clearly turning bullish. These dynamics collectively indicate that the market is shifting from a defensive, distribution-driven behavior model to selectively taking on risk again.

7. Mid to Long-Term Outlook

Looking ahead to 2026, some institutional analysts hold an optimistic view. The Bernstein analyst team released a report expressing confidence that the market for digital assets like Bitcoin has bottomed out, believing that the $80,000 level at the end of November is the bottom.

● Bernstein maintains its forecast: Bitcoin will reach $150,000 in 2026 and $200,000 in 2027. Analysts note that even if Bitcoin drops 6% in 2025, the outlook for a tokenized "super cycle" led by several leading companies will continue to drive institutional adoption.

● This indicates that professional institutional investors are viewing the crypto market as an emerging asset class rather than just a high-risk speculative tool. This shift in perception may attract more traditional capital into this field in the long term.

The market's reaction to key resistance levels will determine the short-term direction. The contest for $95,000 has become a watershed for bulls and bears, while deeper changes have already occurred.

Capital from family offices is flowing in through structural allocation, and institutional investors' rebalancing operations are replacing the emotional buying of retail investors. The crypto market is quietly transitioning from "narrative-driven short-term trends" to "structural participation behavior."

Whether Bitcoin can hold the $90,500 support level or Solana's efforts to shed the "meme coin" label point to the same conclusion: the crypto market is undergoing a difficult transformation from adolescence to maturity.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。