The political upheaval in Venezuela transformed from market rumors to reality within 24 hours, while SpaceX's trillion-dollar market value dream received 67% approval in a collective vote by traders.

Predictions of Maduro's ousting on Polymarket saw its implied probability soar from about 7% at the beginning of January 2026 to over 99% within hours, as the market quickly responded with real money to the sudden military action.

Meanwhile, in the valuation predictions for the cryptocurrency project Lighter, the market is 93% confident that its fully diluted valuation will exceed $2 billion.

In the balance of the prediction market, every bet by the public is a quantitative vote for the future.

1. Cryptocurrency: High Valuation Consensus for Lighter

Data from Polymarket shows that the market exhibits extremely high confidence in the emerging cryptocurrency project Lighter. At the time of the token generation event, its initial fully diluted valuation exceeded $2 billion.

● Market pricing indicates that the probability of Lighter maintaining a valuation of over $1 billion is 100%, with a 93% probability of exceeding $2 billion, and a 52% probability of surpassing $3 billion.

● This strong market expectation is not unfounded. Lighter is not merely a perpetual contract exchange; it is building a decentralized trading infrastructure aimed at fintech companies and professional market makers.

● Its trading volume in on-chain real-world asset perpetual contracts is already leading in its niche, which is a key advantage distinguishing it from similar projects. The market seems to be betting that it will become an important bridge connecting traditional finance and the crypto world.

2. Political Upheaval: Maduro's Ousting and Market Reaction

At the beginning of the new year in 2026, the political landscape of South America underwent a dramatic change, and the prediction market almost simultaneously captured this trend.

● Market data shows that the probability of Venezuelan President Maduro stepping down before January 31 surged from about 7% to over 99% due to the impact of the sudden event, with trading activity being extremely active.

● This market anomaly closely followed the actual events. In the early hours of January 3, 2026, the U.S. launched military action against Venezuela, after which then-President Trump announced the arrest of Maduro and his wife.

● Analysts point out that the core strategy of the U.S. action is to first weaken Cuba to isolate the Maduro regime, a strategy related to the lessons learned from Trump's first term. The market revealed the high likelihood of the event occurring through probability changes before key information became widely known to the public.

3. Commercial Space: SpaceX's Trillion-Dollar Valuation Bet

The commercial space sector is about to witness a milestone event, as the market actively prices SpaceX's IPO prospects.

● According to Polymarket data, the market believes there is a 67% probability that SpaceX's closing market value on its IPO day will exceed $1 trillion, reflecting a bullish expectation for its IPO.

● This optimistic sentiment stems from a fundamental shift in SpaceX's business model. The company has evolved from a space company into a complex entity that integrates global communications, space transportation, and future infrastructure.

● Its core business, Starlink, is expected to have over 8.5 million users by 2025, with projected revenues of $12 billion to $15 billion, becoming a stable cash cow. Market rumors suggest its IPO target valuation could reach $1.5 trillion to $1.7 trillion, which, if successful, would set a new global IPO record.

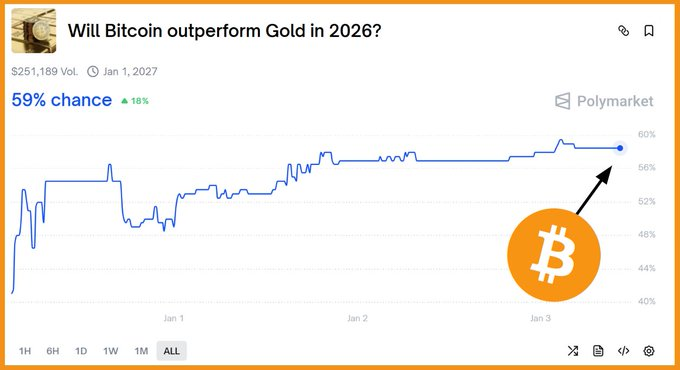

4. Asset Showdown: The Race Between Bitcoin and Gold

In the wave of digitalization, the value competition between traditional safe-haven assets and emerging digital assets has garnered significant attention.

● The market holds an optimistic view that Bitcoin will outperform gold in 2026, with the current implied probability at 59%. A report by professional research firm K33 Research also expressed a similar view in its "2025 Annual Review," maintaining a constructive bullish outlook for 2026 and predicting that Bitcoin will outperform stock indices and gold.

● The report suggests that the macro policy environment will shift towards easing, with expectations that Trump may appoint a dovish Federal Reserve chair, creating a "plentiful" environment favorable for scarce assets like Bitcoin.

● From a regulatory perspective, the Clarity Act is expected to pass in the first quarter of 2026, and broader crypto legislation is also anticipated to be signed early in the year, all of which could serve as positive factors for Bitcoin.

5. Personnel Nominations: Trump's Federal Reserve Chair Choice

Trump's personnel arrangements have always been a focal point for the market, especially regarding the nomination of leaders for the critical Federal Reserve. The market once had high expectations for Trump's nomination of Kevin Hassett as Federal Reserve chair, with an implied probability of 63% in early December 2025.

However, the prediction market is highly dynamic, and this personnel change prediction requires close attention to the latest developments and official news.

6. Tech Bubble: Sustainability Concerns of the AI Boom

As the artificial intelligence boom continues for several years, the market has begun to focus on whether there is a bubble behind it and the risk of a burst.

● On Polymarket, the prediction contract for "the AI bubble bursting by the end of 2026" has an approximate probability of 40% (corresponding to a "Buy Yes" price of 39 cents). Notably, this is the most concentrated betting option among all predictions regarding the timing of the "AI bubble burst."

● Wall Street has already begun to discuss key factors that could puncture the AI bubble. Major concerns focus on two aspects: first, the enormous capital expenditures that giant companies cannot sustain, with just Alphabet, Microsoft, Amazon, and Meta expected to exceed $400 billion in capital expenditures over the next 12 months; second, many AI companies are highly reliant on external financing, and a tightening financing environment could trigger a chain reaction.

7. Industry Mergers and Acquisitions: The Ultimate Integration of Streaming Media

The consolidation of giants in the entertainment industry has always been a topic of great interest in the market, especially regarding the competition for quality content assets.

Polymarket data shows that the implied probability of Netflix successfully acquiring Warner Bros is about 24%. The background of this prediction is that in December 2025, Netflix disclosed an agreement with Warner Bros. Discovery to acquire its Warner Bros. business (including HBO) for cash and stock, with a transaction value of approximately $82 billion.

However, this deal has not yet been completed and is facing a hostile bid from Paramount's Skydance. The market's probability pricing reflects a certain possibility for the transaction, but it also faces multiple uncertainties such as regulatory scrutiny and competitive bids.

8. Other Macro Predictions: Interest Rate Cuts, Recession, and Political Risks

In addition to the aforementioned events, Polymarket also features other predictions involving macroeconomic and political factors, collectively outlining the market's overall expectations for 2026:

● Federal Reserve Interest Rate Cut Expectations: The market generally expects the Federal Reserve to further ease monetary policy in 2026. The most probable scenario is a cumulative rate cut of 0.50%, with about 10% of bets distributed on a total cut potentially reaching 1.25%.

● Risk of U.S. Economic Recession: Despite concerns, the market believes that a formal recession in the U.S. in 2026 is not a high-probability event, with the current implied probability at only 27%.

● Trump's Political Risks: The market assigns an implied probability of 16% that Trump will face impeachment again before the end of 2026. The market pricing seems to consider the limited time and the current balance of political power.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。