The Practical Path of "Hundredfold Signals"

In the world of Web3, information is money. In the previous article, we explored how the "Signal" feature of the OKX wallet empowers different types of investors. Now, it's time to put theory into practice. Faced with a vast amount of on-chain data, how can we accurately filter out the next potential "smart money" signal that could yield a hundredfold return from the OKX wallet's "Signal"?

This article will combine practical scenarios to reveal the hardcore filtering techniques of the OKX wallet's "Signal" feature, allowing you to capture those fleeting wealth codes like an experienced on-chain detective.

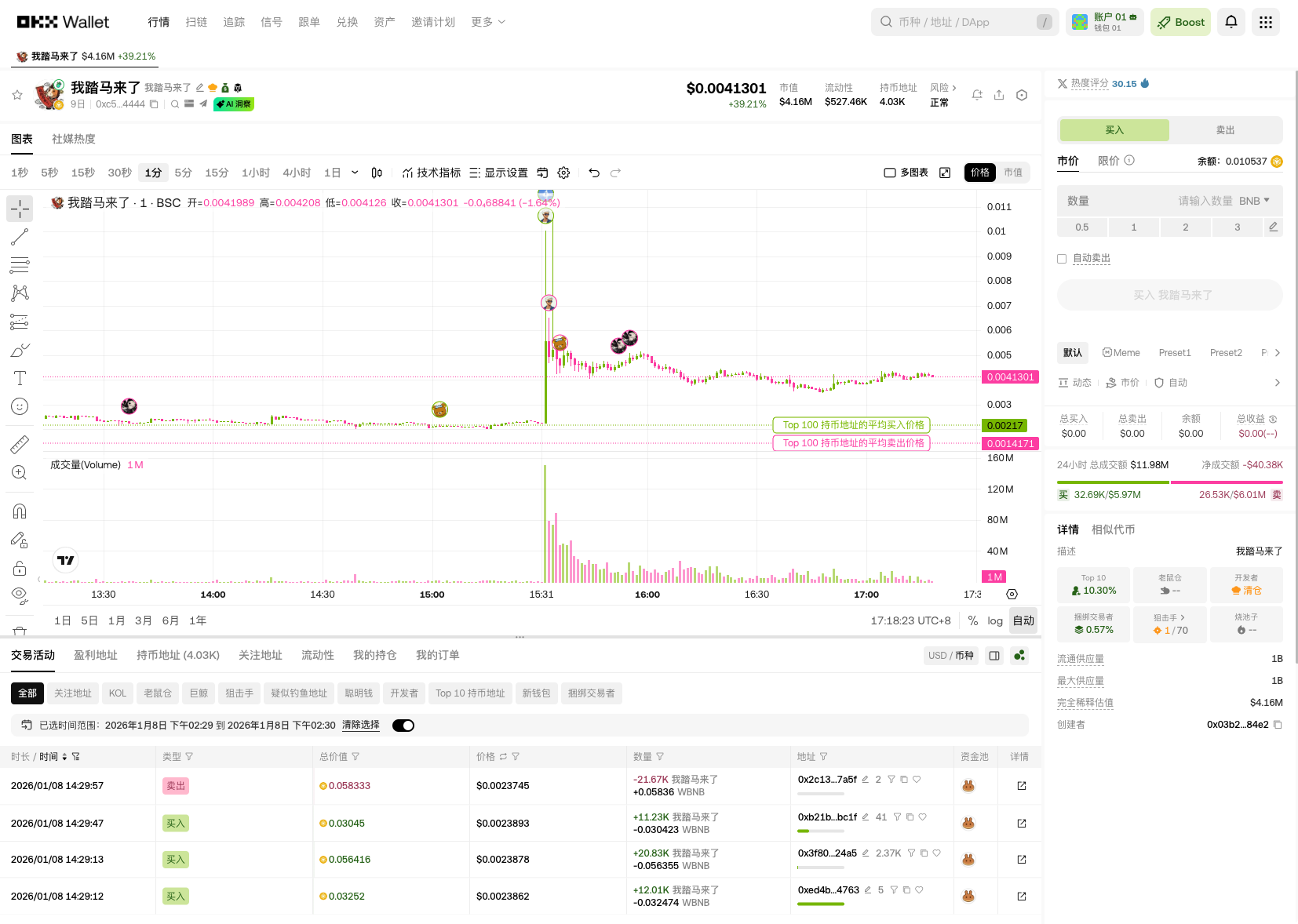

Chapter 1: OKX Wallet "Signal" Interface: Your On-Chain Intelligence Center

The "Signal" interface of the OKX wallet is a highly integrated on-chain intelligence center. Understanding its components is the first step to efficient filtering.

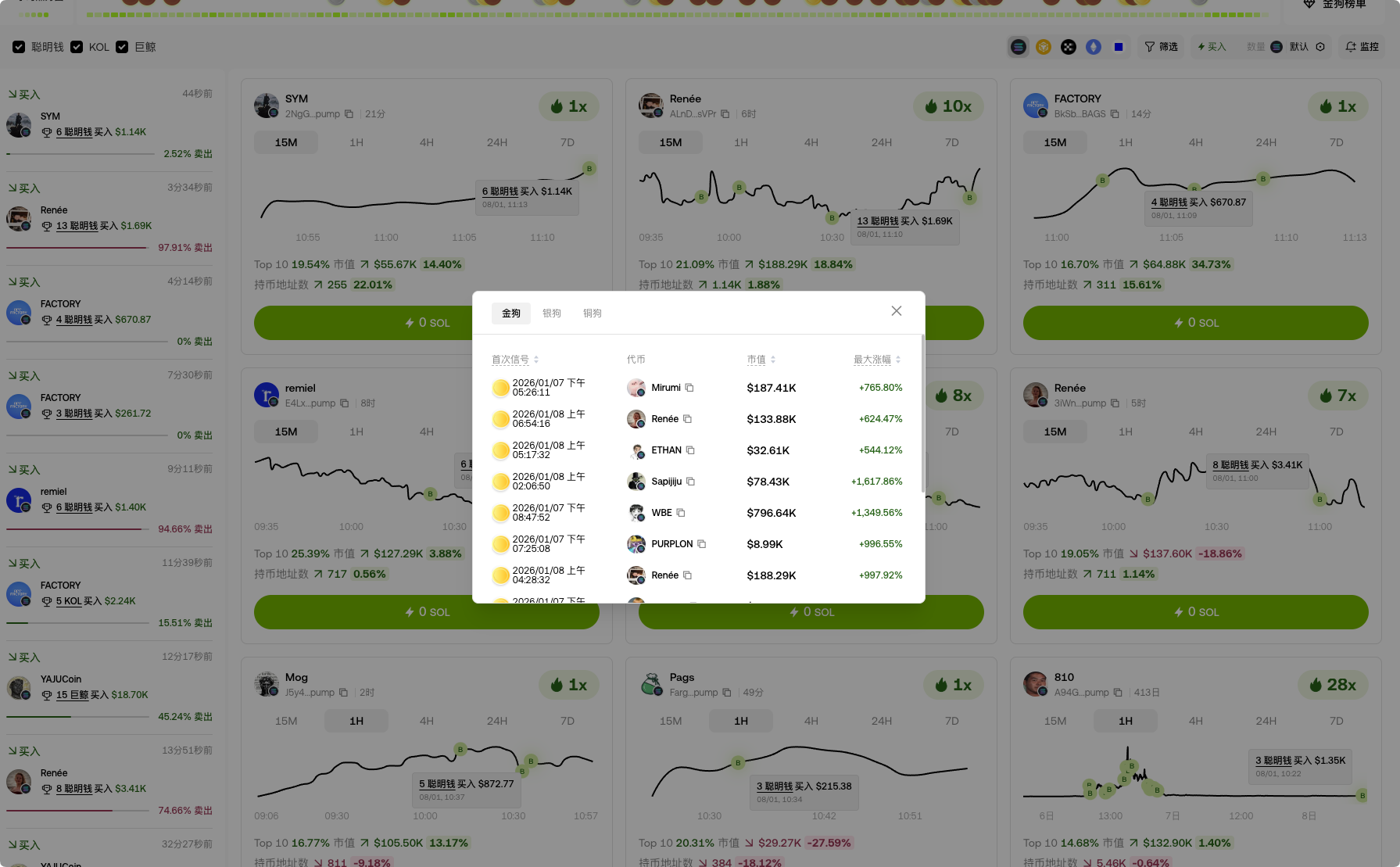

1. Left Filter Area: Locking in the Type of "Smart Money"

This is your "radar station," where you can filter the type of "smart money" you are interested in based on different needs:

- KOL: Focus on addresses with significant community influence that may drive market sentiment.

- Whales: Track addresses holding large amounts of funds that may influence market trends.

- Address Radar: Monitor large buy and sell data in real-time to detect fund movements at the first opportunity.

Practical Tip: When market hotspots emerge, prioritize monitoring the movements of "whales" and "KOLs." Their early positions often signal the start of a market trend.

2. Central Trend Cards: Insights into Token Lifecycle

Each token has a trend card that condenses key information:

- Price Change Trend: Visually displays the token's price fluctuations, such as "maximum increase of 73 times," etc.

- Number of Holding Addresses: Reflects the market heat and dispersion of the token.

- Market Cap Trend: Assesses the market potential and risk of the token.

Practical Tip: By combining price trends and the number of holding addresses, you can determine the stage of the token. For example, if it is in the early rising stage with a steady increase in holding addresses, it is usually a signal worth paying attention to.

3. Top Gold Dog Rankings: Quickly Capture Market Hotspots

This is the "barometer" of daily hotspots, featuring the most active tokens on-chain:

- Gold Dog, Silver Dog, Bronze Dog: Track trading records and increases of popular tokens at different levels.

Practical Tip: The "Gold Dog Rankings" is an excellent entry point to discover emerging value targets. When a new coin just makes the list and performs well across various metrics, it is your opportunity for in-depth research.

Chapter 2: Practical Filtering Strategy: Three Steps to Lock in Quality Signals

Having mastered the interface information, the next step is to implement specific filtering strategies. We will break down how to lock in quality signals in three steps.

Step 1: Observe Buy Signals, Track Large Holder Positions

Core: Early buying by smart money is often a precursor to price increases.

Scenario 1: KOL/Whale Continuous Buying

- Practical: In the left filter area of the OKX wallet "Signal," select the "KOL" or "Whale" category. Closely monitor the continuous buying actions of these addresses. For example, when a certain KOL or whale address makes multiple large purchases of a new coin in a short period, it usually indicates they are actively building a position, signaling a rapid influx of short-term funds.

- Judgment: Such signals are typically precursors to price increases, warranting your immediate attention and research.

Scenario 2: Address Radar Monitoring Early Positions

Practical: Use the "Address Radar" feature to monitor the trading behavior of specific large holders on-chain. When you find a "smart money" address you have been tracking for a long time making large purchases of a new coin in its early stages, and the market cap and number of holding addresses are still low, this could be an excellent early entry signal.

Judgment: Early positions mean cost advantages; following such signals may yield higher potential returns.

Step 2: Multi-Dimensional Data Validation, Identifying Potential and Risk

Core: Combine token data to assess its market potential and risks.

Indicator 1: Price Trends and Increases

- Practical: Check the price trend chart in the central trend card. If the token is in the early rising stage, steadily increasing without severe pullbacks, it indicates a healthy trend.

- Case: A certain SOL chain token GM is in the early rising stage, with a maximum increase of 1 time, and the trend remains stable. This indicates that early investors still have room to position, making it worth continuous attention.

Indicator 2: Market Cap and Liquidity

- Practical: Pay attention to the current market cap and liquidity of the token. Tokens with very low market caps (e.g., less than $30K) are easily manipulated by whales, posing risks of price manipulation.

- Judgment: Choosing tokens with moderate market caps and good liquidity can effectively reduce the risk of manipulation, ensuring the freedom of fund entry and exit.

Indicator 3: Holding Address Heat

Practical: Observe changes in the number of holding addresses. If the number of holders increases rapidly in a short time, and the amount of each purchase is relatively small, it usually indicates that retail investors are gradually entering the market.

Judgment: The continuous influx of retail investors often creates a secondary upward trend, providing sustained upward momentum for the token.

Step 3: Risk Detection, Avoiding Fatal Traps

Core: Before buying, be sure to conduct contract safety checks to avoid fatal risks like "Piaoxiu" schemes.

Practical: The DEX market insight feature of the OKX wallet can perform real-time contract safety audits on on-chain tokens.

Focus: Pay special attention to "Piaoxiu detection," "minting permissions," and "freezing permissions."

- Non-Piaoxiu: Ensure that the project team cannot prevent you from selling the token.

- Minting Closed: Avoid the project team from infinitely minting tokens, diluting your holdings.

- Freezing Closed: Ensure that your assets cannot be frozen by the project team.

Important Note: Even tokens bought by "smart money" may carry contract risks. Always use the risk detection feature of the OKX wallet for secondary verification before purchasing; this is the last line of defense to protect your funds.

Don't forget: Immediately use the exclusive invitation code [AICOIN88] to register or bind the OKX wallet, enjoying a 20% reduction in trading costs, making each of your on-chain explorations more cost-effective!

The operation is very simple:

Click the exclusive link below (the invitation code has been automatically filled for you):

https://web3.okx.com/ul/joindex?ref=AICOIN88

In the wallet creation/import process, confirm that the invitation code AICOIN88 is bound.

Done! Start enjoying fee reductions immediately!

OKX App Download Link:

https://static.rmgvx.com/upgradeapp/okx-android_aicoin20.apk

How to Bind the App Invitation Code (AICOIN88):

Take action now, start your signal monitoring journey, and don't forget to bind the invitation code to further reduce your trading costs!

Conclusion: Use OKX Wallet to Become a "Smart Investor" in 2026

The "Signal" feature of the OKX wallet is not just a data tool; it is a complete on-chain practical guide. By mastering its interface information and following the three practical strategies of "observing buy signals," "multi-dimensional data validation," and "risk detection," you can accurately filter out quality "smart money" signals like a professional on-chain analyst and discover the potential of the next hundredfold coin.

In 2026, the Web3 market presents both opportunities and risks. Arm yourself with the OKX wallet to become a true "smart investor," seizing opportunities and avoiding risks.

Start taking action and unlock the freedom of decentralized assets!

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Exclusive 20% Fee Discount:

https://web3.okx.com/ul/joindex?ref=AICOIN88

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。