Original Title: "Starting from Manus, Talking about Those Interns in the Crypto World"

Original Author: Lin Wanwan, Dongcha Beating

On the last day of 2025, the biggest news in the tech world came from Meta: Zuckerberg spent billions of dollars to acquire an AI company called Manus, which was founded less than a year ago. This is Meta's third-largest acquisition in history, following WhatsApp and Scale AI.

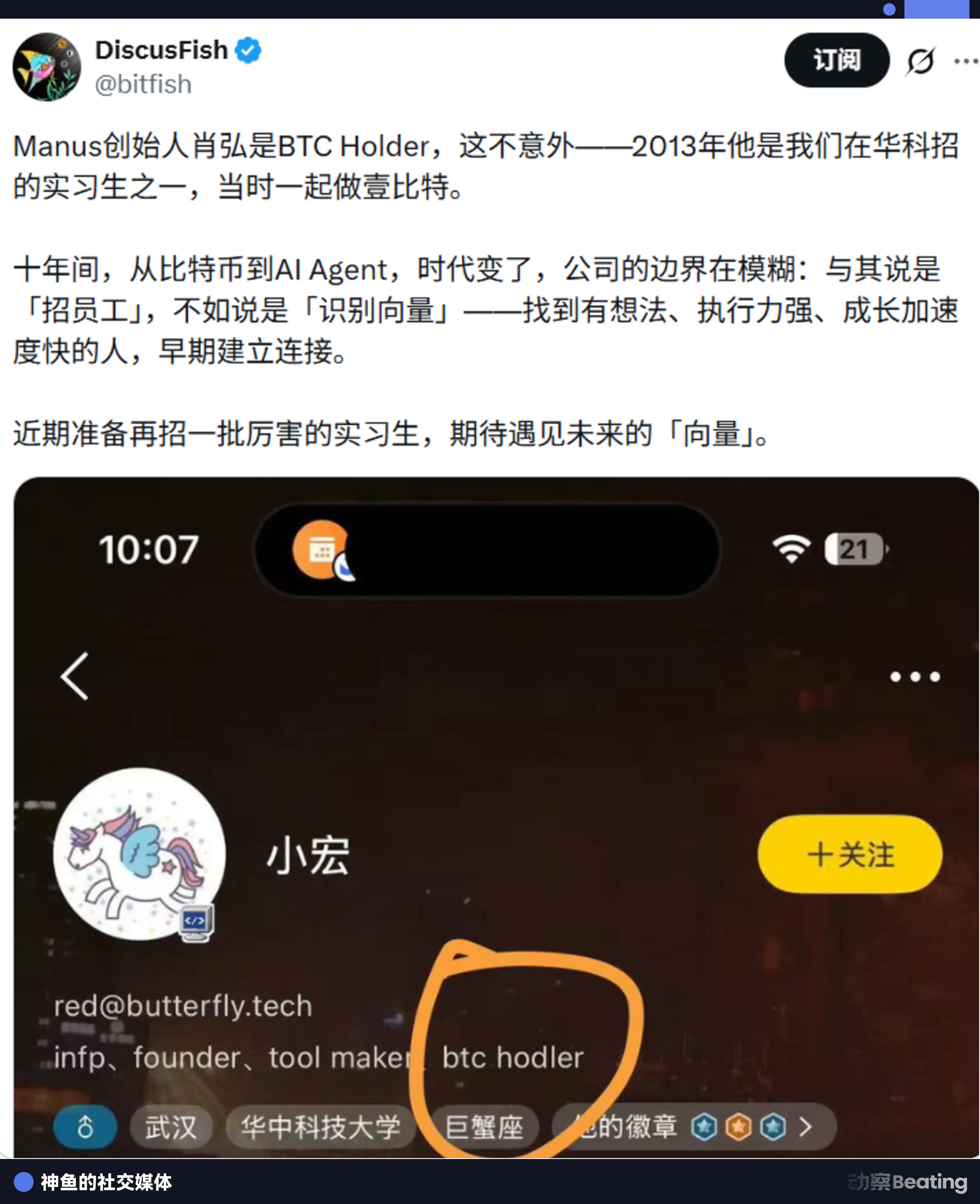

A few days after the announcement, people noticed that his self-introduction stated: BTC Holder.

A tweet appeared on Twitter. The user, known as "Shen Yu," whose real name is Mao Shihang, is one of China's earliest Bitcoin miners and has a fortune exceeding ten billion:

"Manus founder Xiao Hong is a BTC Holder, which is not surprising—he was one of the interns we recruited at Huazhong University of Science and Technology in 2013, working on Yi Bitcoin together."

- Yi Bitcoin. Huazhong University intern.

Xiao Hong, born in 1993, hails from a small town in Ji'an, Jiangxi. Before becoming Meta's Vice President, he was best known as the founder of AI product Monica and Manus. However, few people know that his first serious internship was at a Bitcoin media company called Yi Bitcoin.

That year, he was just a sophomore, experimenting with various student projects at the Qiming College of Huazhong University of Science and Technology, such as WeChat drift bottles, WeChat walls, and a campus second-hand trading platform. As the deputy captain of the co-founding team, he was already somewhat well-known among his peers as a tech geek. But Bitcoin was still a whole new world for him.

Yi Bitcoin was one of the earliest vertical media outlets for Bitcoin in China, located in Beijing's Galaxy SOHO. The founding team included Shen Yu and several other young idealists, doing something very simple: translating foreign Bitcoin news, writing popular science articles, and trying to help more Chinese people understand this new thing that mainstream media at the time labeled as a "Ponzi scheme."

What Xiao Hong specifically did at Yi Bitcoin is hard to verify. But looking back twelve years later, the significance of this experience has long transcended the internship itself.

The Bitcoin circle in 2013 was a club of early participants in a large social experiment. There was no regulation, no pricing anchor, no mature business model—only a group of young people who believed that "code is law," huddling together for warmth amid mainstream society's ridicule. Those who could enter the market at that time were either gamblers or truly understood something.

Xiao Hong clearly belonged to the latter. Decentralization, permissionless, code autonomy. These concepts seemed like geeky self-indulgence at the time, but they formed a foundational framework for understanding the world. Twelve years later, as AI begins to reshape the boundaries of human-machine interaction, this framework may become traceable.

From Bitcoin to AI Agents, the technological forms are vastly different, but the underlying logic remains consistent: it's all about how to enable machines to operate autonomously, how to establish collaboration in an environment of distrust, and how to replace intermediaries with code. Those who understood Bitcoin in 2013 would require almost no additional cognitive effort to understand AI Agents in 2025.

Shen Yu used a term in that tweet: "recognition vector."

"In the past decade, from Bitcoin to AI Agents, the era has changed, and the boundaries of companies have blurred. Rather than hiring employees, it's more about recognizing vectors…"

What is a vector? Direction multiplied by speed. In 2013, Xiao Hong was a sophomore willing to bet his time on the "unreliable" field. This choice itself was a form of filtering—sifting out those who only saw immediate certainty and leaving those willing to invest in long-term possibilities.

Twelve years later, this vector pointed to the position of Vice President at Meta.

In the cryptocurrency industry, where the myth of wealth creation coexists with the risk of losing everything overnight, there is a hidden path to success: in your early twenties, follow the right person. Around 2013, a group of the smartest and most daring young people flooded into this wild-growing world. Some had just dropped out of school, while others had not yet graduated, working at the most grassroots levels in trading platforms, mining pools, and media companies alongside the most insane entrepreneurs of the time.

Their bets were on a certain understanding. This understanding allowed them to identify opportunities faster than their peers in every technological wave a decade later.

Warren Buffett once said, "Life is like a snowball; the important thing is finding wet snow and a long hill."

The cryptocurrency industry in 2013 was that long, wet hill. And those who stepped onto this slope in their early twenties have been rolling their snowballs for twelve years.

Xiao Hong is one of them. But he is not the only one.

Interns on a Shareholding Table

One day in 2013, in an office building in Zhongguancun, Beijing, two young men were discussing something crazy.

Wu Jihan, 27, with dual degrees in psychology and economics from Peking University, had just left a venture capital firm and had been investing in and promoting Bitcoin for the past two years—his translated version of Satoshi Nakamoto's white paper remains the most widely circulated.

The person sitting across from him was Zhan Ketu, 34, with a bachelor's degree from Shandong University and a master's from the Institute of Microelectronics at the Chinese Academy of Sciences, recognized in the industry as a chip design expert with over a decade of experience.

But there was a third protagonist in this story.

Ge Yuesheng, 21, had just graduated from Huzhou University a year earlier. Before joining Bitmain, he and Wu Jihan were colleagues at a private equity fund in Shanghai, where he was an intern, and both were doing investment analysis. Influenced by Wu Jihan, Ge Yuesheng began to get involved with Bitcoin.

Among these three, Ge Yuesheng was the least conspicuous. He had neither Wu Jihan's industry insight nor Zhan Ketu's technical background.

But he had one thing: money. More precisely, the resources of a family business—funding, mining sites, and electricity.

At that time, neither Wu Jihan nor Zhan Ketu had much money. According to later revelations from former Bitmain executives, Ge Yuesheng's family invested a lot of money early on, and several family members became shareholders. Wu Jihan founded Bitmain largely due to Ge Yuesheng's investment and support; this intern can be considered one of Bitmain's earliest angel investors.

The division of labor among the three was clear: Wu Jihan was responsible for industry judgment and market, Zhan Ketu was in charge of chip development, and Ge Yuesheng provided funding and resources.

To entice Zhan Ketu to join, Wu Jihan offered an astonishing condition: Zhan Ketu would not take a salary, but if he could develop an ASIC chip that could efficiently run Bitcoin's encryption algorithm in the shortest time possible, he would receive 60% of the shares.

Zhan Ketu took only six months to develop the 55nm Bitcoin mining chip BM1380 and the first generation of Antminer based on this chip.

In October 2013, Beijing Bitmain Technology Co., Ltd. was officially established. Business registration documents show that in the earliest shareholder structure, Zhan Ketu held 59.2% of the shares, Ge Yuesheng held 28%—and Wu Jihan's name was not even on the list of founding shareholders at that time.

This detail has been repeatedly interpreted. Why could 21-year-old Ge Yuesheng obtain 28% of the shares?

In 2013, Bitcoin was far from mainstream. In April of that year, the price of Bitcoin first broke $100; in November, it surged above $1,000; then in December, the price halved, beginning a two-year bear market.

Most people entered the market during the price surge and fled during the price drop. Many had money at home, but Ge Yuesheng chose to enter the market during its earliest and most chaotic phase and tied himself to that ship.

This required not only money but also a certain intuition for trends and the courage to bet in the face of uncertainty.

The later story is well-known: these three people built Bitmain into the world's largest mining machine company in less than five years, at one point accounting for over 70% of the global Bitcoin hash rate, with a valuation reaching as high as $15 billion. In the 2018 Hurun Blockchain Rich List, Wu Jihan became the "new rich man born after 1985" with a fortune of $16.5 billion, while Ge Yuesheng became the "new rich man born after 1990" with a fortune of $3.4 billion.

In 2019, he left Bitmain with Wu Jihan to co-found Matrixport, while Ge Yuesheng became the CEO of Matrixport and continues to this day.

A 27-year-old evangelist, a 34-year-old technical genius, and a 21-year-old intern angel investor were bound together by the same vision at the right moment.

The First Batch of Students from the "OKCoin Huangpu Military Academy"

If Ge Yuesheng's story is a classic case of an intern becoming a co-founder, then the next story showcases another possibility: from the first employee to being acquired at a high price by a competitor of the old employer.

One day in 2013, a young engineer named Wang Hui walked into an office in a Beijing office building.

The office was small and sparsely furnished, looking more like a temporary base for a startup. A whiteboard hung on the wall, filled with system architecture diagrams and flowcharts. A few desks were pushed together, accommodating fewer than ten people.

This was all of OKCoin's assets.

Founder Xu Mingxing was struggling to hire people. At that time, Bitcoin was still a gray area in China, with mainstream media either labeling it a Ponzi scheme or a "money laundering tool." It was nearly impossible to find engineers willing to give up offers from large companies to join a "coin trading company."

Wang Hui was the first person willing to take the risk.

As OKCoin's first employee, he needed to build the entire technical architecture from scratch. There were no ready-made solutions to copy, no mature open-source projects to use, and even very few competitors to reference. Everything was blank.

This meant huge challenges, but it also meant great opportunities: if he could make this work, he would become one of the most knowledgeable technical people in the industry.

After two years, Wang Hui almost single-handedly built OKCoin's core trading system. The performance of that matching engine was crushingly superior in the industry at the time. "Many trading platforms' systems couldn't even handle basic concurrency," he later recalled, "a few more people trading simultaneously would cause it to crash."

More importantly, he cultivated the entire technical team from scratch. Many of the core technical personnel at OKCoin (and later renamed OKEx, OKX) were trained by him.

But by 2016, Wang Hui chose to leave.

There are many rumors in the industry about the reasons for his departure: disagreements with the founder's philosophy, internal factional struggles, dissatisfaction with the company's direction… Wang Hui himself has never publicly responded to these claims.

But one thing is certain: he took all the experience and connections he accumulated at OKCoin with him.

His first stop after leaving was a brief collaboration with another former OKCoin executive. That person was Zhao Changpeng, who later founded Binance and became the world's richest person in cryptocurrency.

In early 2018, Wang Hui, along with two former colleagues, co-founded JEX to engage in cryptocurrency options trading. This timing was quite delicate. In January 2018, the price of Bitcoin had just begun to plummet from its historical high of $20,000, and the entire industry was in despair. While most people were fleeing, Wang Hui chose to enter the market against the trend.

JEX received investments from Huobi and Jinse Finance. Just a year later, in 2019, Binance announced the full acquisition of JEX, with the transaction amount reportedly reaching hundreds of millions of RMB.

This is a rather dramatic conclusion: the first employee of OKCoin saw his company acquired by Binance.

In a roundabout way, these individuals all came from the same place.

Thus, there is a saying in the crypto world: OKCoin is the "Huangpu Military Academy of the cryptocurrency industry."

Vectors, Windows, and Survivors

Now, let’s return to Xiao Hong.

In 2013, he was just a sophomore intern at Yi Bitcoin. This internship might occupy only a small part of his life resume—after all, his main trajectory later was in the WeChat ecosystem, with companies like Yiban, Weibian, and Nightingale Technology, which was eventually sold to Minglue Technology.

But some things leave a mark.

Xiao Hong introduces himself as a "BTC Holder." This means that from 2013 to today, he has at least maintained his attention and participation in cryptocurrency. In a market where price fluctuations are measured in hundreds of times, being able to hold on for twelve years is itself a capability, or rather, a belief.

More importantly, that brief internship in 2013 may have shaped a certain methodology for him: not pursuing a technological disruption from zero to one, but rather being adept at finding gaps on existing large platforms and creating value through product capabilities.

From Yi Bitcoin to the WeChat ecosystem's Yiban and Weibian, then to the AI browser plugin Monica, and finally to the general AI Manus, the underlying logic of this path may be consistent: find a large platform that is exploding and create the best tool on that platform.

The stories of these three interns reveal some common patterns:

First, timing is more important than effort. They all entered the cryptocurrency industry between 2013 and 2017, during the "chaotic period" of the industry. They entered early enough that most people had not yet realized the existence of opportunities, but not so early that the infrastructure was completely undeveloped. Those who entered during this window gained disproportionate growth space. By 2020, the industry had matured, making it much more difficult for newcomers to replicate the same path.

Second, choosing whom to follow is more important than choosing what to do. Ge Yuesheng followed Wu Jihan, Wang Hui followed Xu Mingxing, and Xiao Hong followed Shen Yu. These big names may not be the most famous, but they were among the most discerning and execution-oriented individuals at the time.

The benefits of following the right people go beyond just learning; more importantly, it allows entry into a high-quality network. Wang Hui's ability to quickly secure investment and be acquired by Binance after leaving OKCoin was largely due to the reputation and connections he accumulated in the circle.

Third, the ability to bet in the face of uncertainty is rare. Joining a Bitcoin company in 2013, sticking with a DEX project during the bear market in 2018, and abandoning a stable job to start a business in 2020—these choices all seemed full of risk at the time.

But risk and reward are symmetrical. Those willing to bear uncertainty ultimately received returns commensurate with the risks they took.

Of course, these are all stories of survivor bias.

Most young people who entered the crypto world around 2013 did not become billionaires. Many of them exited during the bear market, missed out during the bull market, or went to zero amid the volatility. But this does not prevent us from extracting valuable insights from the stories of survivors.

On the last day of 2025, Xiao Hong tweeted: "To do well in products in a globalized market, there are many troubles that do not come from the business itself and user value itself. All of this is worth it."

From the Yi Bitcoin intern in 2013 to the Meta Vice President in 2025, Xiao Hong took 12 years.

In these 12 years, his former boss Shen Yu transformed from a 23-year-old dropout entrepreneur into a billionaire industry patriarch. Shen Yu's former partner Wu Jihan evolved from an evangelist into the creator of a mining empire, then left amid internal strife, started anew, and rose again.

The pace of this industry is too fast. Fast enough for a person to transform from an intern to a billionaire in just ten years, and fast enough for a giant to fall from the peak and rise again in the same span.

So, treat every intern around you well. Because you never know who you will need to take to dinner in ten years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。