Family, the live stream sharing is officially starting! This week there are two major events that can directly shake the crypto world, let's first discuss the first one — the U.S. Supreme Court is about to make a ruling on Trump's tariff case, and this is crucial!

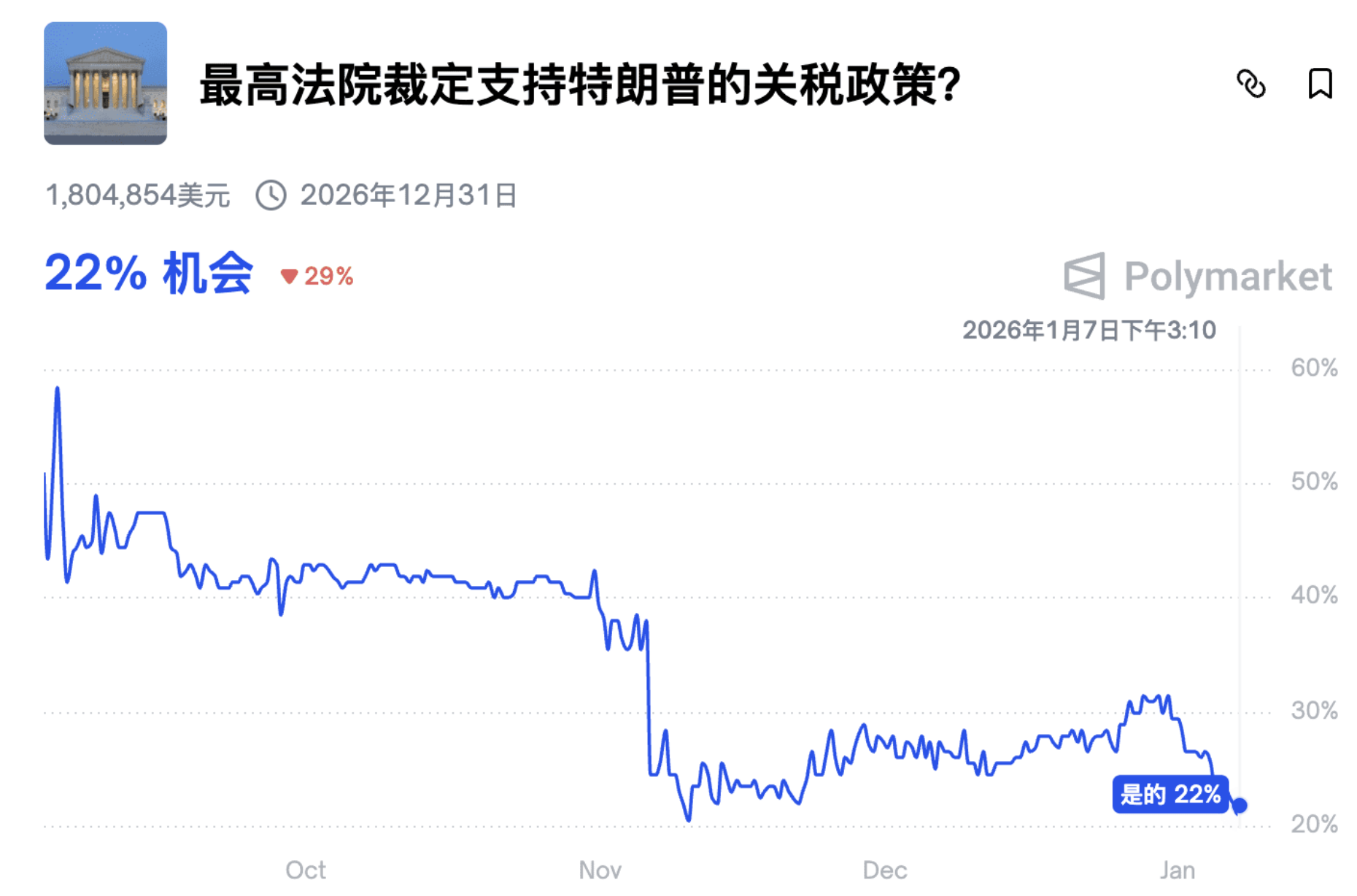

After Trump took office, he basically revolved around tariffs. Previously, he talked about distributing money to everyone and financial maneuvering, all relying on tariffs. But now the market predicts that the probability of these tariffs being ruled legal is only about 23% — which is like a slap in Trump's face!

If the court says these tariffs are illegal, or that Trump overstepped his authority, his policy credibility will be directly weakened, and it might even affect the upcoming midterm elections, but that's a distant matter. The positive side is that it could alleviate inflation, as tariffs ultimately come out of consumers' pockets. Previously, everyone was worried about inflation skyrocketing, but the CPI data hasn't been that exaggerated. Now the funds all recognize one principle: tariffs may affect employment, but they won't immediately drive up inflation, so the Federal Reserve won't rush to tighten in the short term, nor is there a reason to cut interest rates; they are likely to maintain the current interest rates.

What worries me is if Trump suddenly makes a surprise move, the market might not be able to handle it. By the way, there’s also the big non-farm payroll report on Friday! This will be the first normal non-farm data after the U.S. government shutdown. The impact of the small non-farm data will be brief, but the focus will be after the U.S. stock market opens; personally, I’m paying more attention to the big non-farm report. The U.S. midterm elections will have to wait until November, so in the short term, we’re still looking at the Federal Reserve. There’s also the matter of a new chairperson change mid-year. Recently, I’ve been taking a more laid-back approach to the market — although this wave of increase has seen an increase in positions, the volume hasn’t surged, and it still feels a bit lacking.

After discussing the U.S. situation, let’s talk about the recent turmoil in Venezuela. This country used to heavily rely on USDT and BTC, and in 2017, they even launched a petro cryptocurrency, mainly using BTC and USDT for oil transactions to circumvent sanctions, and also as reserves. But recently, an investigative journalist claimed that Venezuela sold gold for 600,000 BTC, worth over $60 billion — but this is an estimate, and there’s no on-chain data to back it up! Moreover, I’ve heard that the private keys are not held solely by the president.

If the U.S. were to seize these BTC, there are two possible outcomes: if frozen, 3% of BTC would be out of circulation, which would be a positive; if sold off, a concentrated sell-off could crash the market, which it likely wouldn’t be able to withstand. However, this is all on an emotional level; ultimately, it depends on how Trump deals with Maduro. Everyone should focus on the big non-farm report and the Supreme Court ruling on Friday, and also keep an eye on the prediction market — especially events related to the U.S. where large funds are betting. Last time when Maduro was caught, there were insider trading activities, so just observe and don’t rush into trading!

Having discussed the two major events, let’s pause the second round of benefits and return to the market to look at the trends!

First, let’s look at Bitcoin: I’ve analyzed the entire year of 2025’s chips, with resistance around 94,655, and higher pressure at 96,665, while support is at 90,000 and 87,445.

Next, looking at Ethereum, it has been pushing against the resistance at 3,275 these past two days. If it breaks through, it could reach 3,455 and 3,635, with support at 3,135 and 2,990.

Finally, looking at SOL, the blue in the chart represents buying volume, and the orange represents selling volume. Pay special attention to the chip peaks and the empty zones — the chip peaks are support and resistance points, while the empty zones can lead to rapid market movements.

SOL is now approaching the resistance at 145. There are fewer chips in the range from 145 to 175, but the trading volume is quite dense. If it breaks through, it’s likely to fluctuate in this range, with support looking at 135 to 125.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the stance or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。