Original author: Frank, PANews

Previously, PANews conducted an in-depth study on the strategies of prediction markets, one important finding being that the biggest obstacle to the effectiveness of many arbitrage strategies may not be the mathematical formulas of the strategies themselves, but rather the liquidity depth of the prediction markets.

Recently, after Polymarket announced the launch of a U.S. real estate prediction market, this phenomenon seems to have become even more apparent. After its launch, the daily trading volume of this series of markets was only a few hundred dollars, far from the expected excitement. The actual market activity is much less than the discussions on social media. This seems both absurd and abnormal, leading us to consider a comprehensive investigation into the liquidity of prediction markets to reveal several truths about liquidity within these markets.

PANews retrieved historical data from Polymarket, covering a total of 295,000 markets, and derived the following results.

1. Short-term Markets: A PVP Battlefield Comparable to MEME Coins

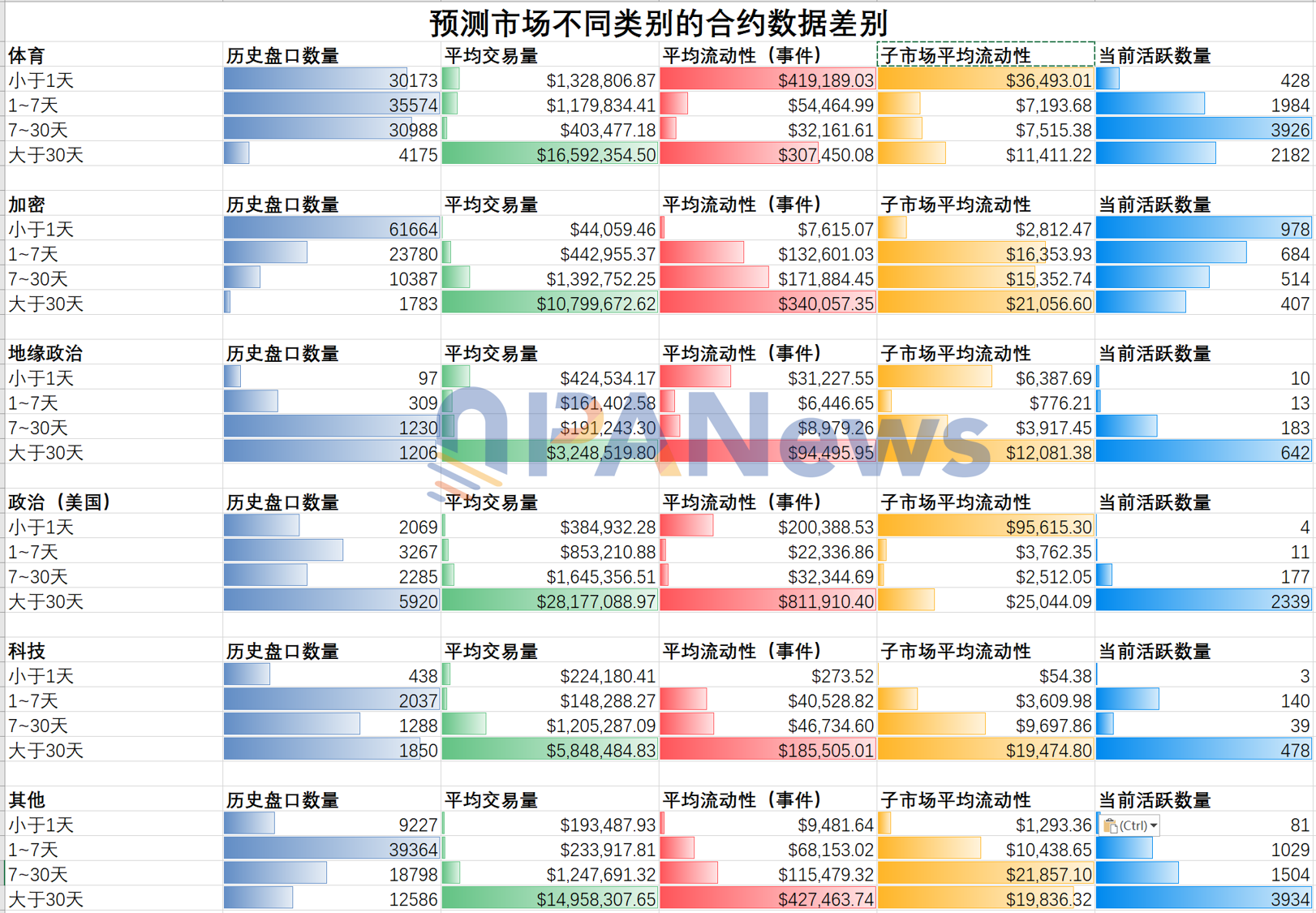

Among the 295,000 markets, 67,700 have a cycle of less than 1 day, accounting for 22.9%, while 198,000 cycles are less than 7 days, accounting for 67.7%.

In these ultra-short-term prediction events, there are 21,848 currently ongoing markets, of which 13,800 have a 24-hour trading volume of 0, accounting for about 63.16%. In other words, there are a large number of short-term markets on Polymarket that are in a state of no liquidity.

Does this state seem familiar?

During the peak frenzy of MEME coins, tens of thousands of MEME coins were issued on the Solana chain, most of which also went unnoticed or failed shortly after.

Currently, this state is also replicated in prediction markets, except that compared to MEME coins, the event lifecycle in prediction markets is defined, while the lifecycle of MEME coins is unknown.

In terms of liquidity, more than half of these short-term events have liquidity of less than $100.

In terms of categories, these short-term markets are almost entirely divided between sports and cryptocurrency predictions. The main reason is that the judgment mechanisms for these events are relatively simple and mature, usually involving questions like whether a certain token will rise or fall in 15 minutes or which team will win. However, possibly due to the significantly poor liquidity compared to crypto derivatives, the crypto category is not the most popular "short-term king."

Sports events dominate absolutely, with analysis showing that the average trading volume of sports events with a prediction cycle of less than 1 day on Polymarket reaches $1.32 million, while the crypto category only sees $44,000. This also means that if you hope to profit from predicting short-term trends in cryptocurrencies through prediction markets, there may not be enough liquidity to support it.

2. Long-term Markets: A Reservoir for Large Funds

Compared to the numerous event contracts in short-term markets, the number of long-term markets is much smaller.

On Polymarket, the number of markets with a cycle of 1 to 7 days reaches 141,000, while those greater than 30 days only number 28,700. However, these long-term markets have accumulated the most funds. The average liquidity of markets greater than 30 days reaches $450,000, while liquidity for those within 1 day is only about $10,000. This indicates that large funds prefer to position themselves in long-term predictions rather than participate in short-term games.

In long-term markets (greater than 30 days), aside from sports, other categories show higher average trading volumes and average liquidity. The market category most favored by funds is U.S. politics, with an average trading volume of $28.17 million and average liquidity of $810,000. The "other" category also performs well in attracting fund accumulation, with an average liquidity of $420,000 (this "other" category includes pop culture, social topics, etc.).

In the realm of cryptocurrency market predictions, funds also lean towards long-termism, such as predicting whether BTC will break $150,000 by the end of the year or whether a certain token's price will drop below a certain level within a few months. In prediction markets, crypto predictions resemble a simple options hedging tool rather than a short-term speculative tool.

3. Polarization in Sports Markets

Sports predictions are currently one of the main sources of daily active contributions on Polymarket, with the current active number reaching 8,698, about 40%. However, from the distribution of their trading volumes, there is a huge gap between different cycles of sports markets. On one hand, the average trading volume of ultra-short-term predictions of less than 1 day reaches $1.32 million; on the other hand, the average trading volume of mid-term (7 to 30 days) markets is only $400,000, while the average trading volume of long-term markets (greater than 30 days) is as high as $16.59 million.

From this data, it appears that users participating in sports predictions on Polymarket either pursue "immediate results" or engage in "seasonal gambling," while mid-term event contracts are not particularly popular.

4. Real Estate Predictions Face "Cultural Misfit"

After extensive data analysis, one apparent result is that the longer the prediction event, the better the liquidity seems to be. However, sometimes when this logic is applied to certain specific or more niche categories, this characteristic fails. For example, the real estate predictions mentioned earlier are relatively high in certainty and have a prediction cycle greater than 30 days. In contrast, predictions for the outcome of the U.S. 2028 election lead the entire market in both liquidity and trading volume.

This may reflect the "cold start dilemma" that new asset classes (especially those with strong niche characteristics) may face. Unlike simple and intuitive event predictions, the expertise and cognitive requirements for participants in the real estate market are higher. Currently, the market seems to be in a "strategy adjustment period," with retail participation enthusiasm limited to mere observation. Of course, the inherent low volatility of the real estate market exacerbates this cold start, as the lack of frequent event-driven fluctuations reduces speculative interest. Under these combined factors, such relatively niche markets face an awkward state where professional players have no counterpart, and amateur players are hesitant to enter.

5. "Short-term" or "Accumulation"?

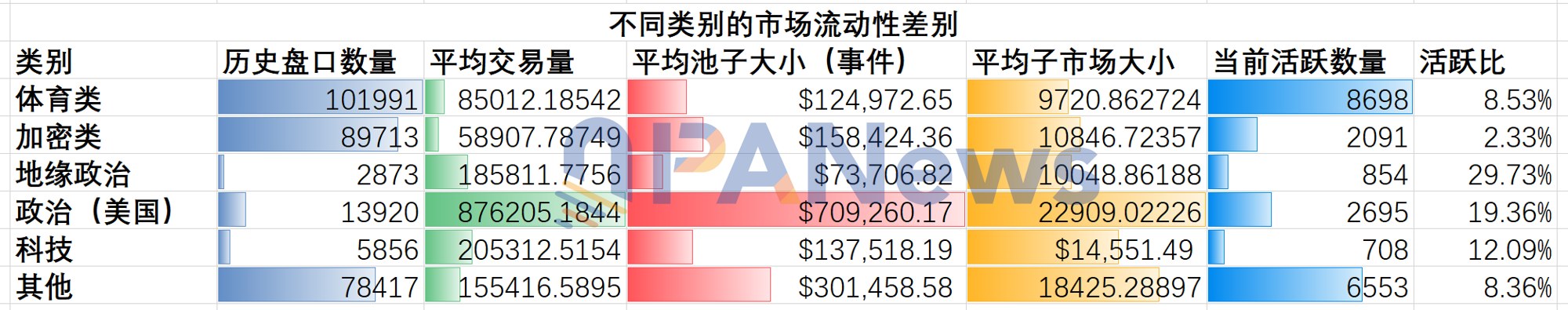

Through the above analysis, we can reclassify the different categories of prediction markets, with ultra-short-term markets like cryptocurrencies and sports being termed short-term markets, while categories like politics, geopolitics, and technology lean more towards long-term accumulation markets.

Behind these two types of markets correspond different investor groups. Short-term markets are clearly more suitable for those with smaller capital or who require a higher capital turnover rate. In contrast, "accumulation" markets are more suitable for those with larger capital and relatively higher certainty.

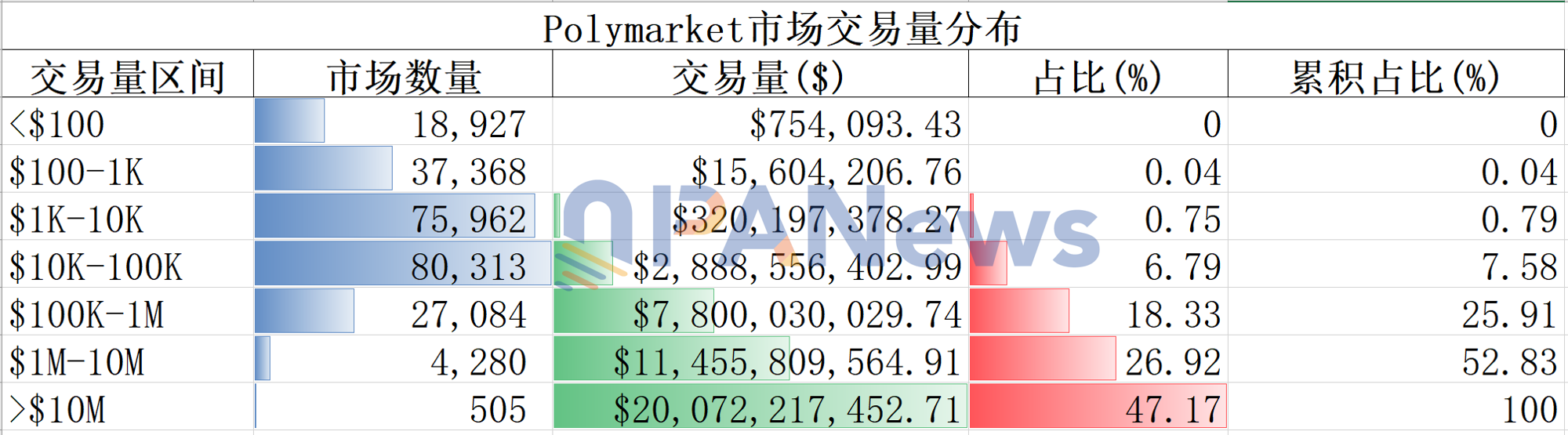

However, when markets are classified by trading amount, we see that markets with capital accumulation capability (greater than $10 million) account for 47% of the total trading volume, even though they have the fewest contracts, only 505. Markets with trading volumes between $1,000 and $100,000 dominate in number, totaling 156,000 contracts, but only account for 7.54% of trading volume. For the vast majority of prediction contracts lacking top-tier narrative capabilities, "launching and returning to zero" is the norm. Liquidity is not evenly distributed sunshine but rather a spotlight concentrated around a very few super events.

6. The "Geopolitical" Sector is Rising

From the "current active number / historical number," we can see the growth momentum of a category, and the currently most efficient growth sector is undoubtedly "geopolitics." The historical total of geopolitical event contracts is only 2,873, but there are currently 854 active, with an active ratio as high as 29.7%, the highest among all sectors.

This data indicates that the number of newly added contracts in the "geopolitical" category is rapidly increasing, making it one of the topics of greatest concern for current prediction market users. This is also evident from the recent frequent exposure of insider addresses related to several "geopolitical" contracts.

Overall, behind the analysis of liquidity in prediction markets, whether as a "high-frequency casino" in the sports sector or as a "macro hedge" in the political sector, their ability to capture liquidity lies in either providing immediate dopamine feedback or offering deep macro gaming space. In contrast, those "chicken rib" markets that lack narrative density, have overly long feedback cycles, and lack volatility are destined to struggle to survive in a decentralized order book.

For participants, Polymarket is evolving from a "predict everything" utopia into an extremely specialized financial tool. Recognizing this is more important than blindly searching for the next "hundredfold prediction." In this arena, only places with abundant liquidity will have their value discovered; whereas in places where liquidity is depleted, only traps remain.

This may be the greatest truth that data tells us about prediction markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。