Why Interest Rate Cuts Fail to Boost Bitcoin: Liquidity Channels Blocked

To understand why Bitcoin has reacted lukewarmly to interest rate cuts, it may be helpful to start with gold. Gold is a globally priced asset. While retail investors typically trade in grams, international pricing is done in troy ounces and tons. It is this global pricing structure that amplifies the impact of macroeconomic factors.

Bitcoin shares this characteristic. Additionally, its price is globally uniform, meaning that any serious analysis must begin with the macroeconomic conditions in the United States.

The puzzle is evident. The U.S. has entered a new round of interest rate cuts, yet Bitcoin's price remains around $80,000, while gold prices continue to rise. Traditional theory suggests that low interest rates should benefit risk assets like stocks and cryptocurrencies. However, so-called defensive assets are rising against the trend.

This contradiction can be explained by two structural factors.

The "Middle Layer Blockage" Problem

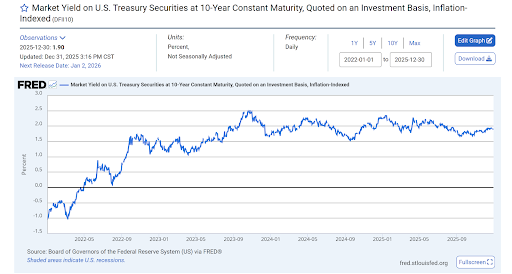

Market focus is not on nominal interest rates, but on real interest rates. With inflation remaining high, even if policy rates are cut, real rates are unlikely to break through high levels as long as inflation persists.

From the perspective of the real economy, interest rate cuts have not translated into a looser financial environment. Banks have not substantially relaxed lending standards. Companies remain reluctant to borrow. In other words, the middle layer between policy and capital allocation is still blocked.

Meanwhile, the U.S. Treasury continues to issue a large amount of new debt. In the second half of 2025, the pace of bond issuance for refinancing existing debt exceeds the liquidity released by interest rate cuts. The result, seemingly counterintuitive, is crucial: overall liquidity has not expanded but rather contracted.

Currently, there is not enough "available funds" to drive up Bitcoin prices.

This is a defensive interest rate cut cycle, not a growth cycle.

This round of interest rate cuts is fundamentally different from previous cut cycles that drove bull markets. The Federal Reserve is cutting rates not because of strong economic growth, but due to rising unemployment, increasing corporate default rates, and the government’s debt servicing costs becoming unsustainable.

This is a defensive rate cut, primarily influenced by concerns over economic recession and stagflation risks.

In this environment, the behavior of capital changes. Institutional investors prioritize survival over returns. Their first response is not to chase volatility but to reduce risk exposure and build cash buffers.

Despite Bitcoin's long lifecycle, it remains one of the most liquid high-risk assets in the world. When market pressures increase, it is seen as a source of liquidity—a financial ATM. Risk aversion begins with cryptocurrencies, not ends there.

This logic mirrors that of rising cryptocurrency prices. During price expansions, funds eventually flow into cryptocurrencies; during rising uncertainty, funds flow out of cryptocurrencies first.

In contrast, investors are waiting for a significant drop in real interest rates, while gold is used as a hedge against dollar depreciation.

Deeper Issue: The U.S. Debt Trilemma

U.S. interest payments have now exceeded defense spending, becoming the third-largest expenditure of the federal government after Social Security and Medicare.

Washington effectively has three choices left.

First, roll over old debt by issuing new bonds, thereby indefinitely rolling over debt. Given that the total federal debt has exceeded $38 trillion, this approach will only exacerbate the problem.

Second, shift to issuing short-term notes to suppress long-term yields and lower average financing costs, but this does not address the fundamental imbalance.

Third, and most importantly, allow implicit default through currency devaluation. When debt cannot be repaid at real value, it is repaid with devalued dollars.

This is the structural reason behind gold prices soaring to $4,500. Countries around the world are hedging against the risks of the later stages of the dollar credibility crisis.

Simply cutting interest rates is not enough. Many on Wall Street are now openly claiming that to avoid collapse, the financial system needs continuous monetary expansion and manageable inflation. This creates a deadly vicious cycle: either printing money leads to currency devaluation, or refusing to print money triggers defaults.

History shows that this choice is inevitable. The Federal Reserve is unlikely to tolerate a systemic collapse. Reimplementing quantitative easing and yield curve control now seems more a matter of timing than probability.

2026 Strategic Planning: From Liquid Darkness to Flood

Once this framework is understood, the current divergence between gold and cryptocurrencies becomes reasonable. Both assets can hedge against inflation, but timing is crucial.

Gold signals the trend of future monetary expansion, while Bitcoin is waiting for confirmation.

In my view, the path forward unfolds in two stages.

Act One: Economic Recession Shock and "Gold Peak"

When recession indicators are fully confirmed—such as the U.S. unemployment rate exceeding 5%—gold prices may remain high or even soar further. At that point, it will be seen as the safest asset.

However, Bitcoin may face one last round of decline. In the early stages of a recession, all assets will be sold off to raise cash. Margin calls and forced liquidations will dominate market behavior.

History has recorded this clearly. In 2008, gold prices fell nearly 30% before rebounding. In March 2020, gold prices dropped 12% in two weeks, while Bitcoin's price was halved.

Liquidity crises affect all assets. The difference lies in which asset recovers first. Gold typically stabilizes and rebounds faster, while Bitcoin takes more time to rebuild market confidence.

Act Two: The Federal Reserve's Yield and Bitcoin Liquidity Explosion

Ultimately, interest rate cuts will not be enough to address economic pressures. Economic strain will force the Federal Reserve to expand its balance sheet again.

This is the moment when the liquidity floodgates truly open.

Gold prices may consolidate or trade sideways. Funds will actively shift towards high beta assets. Bitcoin, as the purest manifestation of excess liquidity, will absorb this flow of funds.

In this scenario, price movements are rarely gradual. Once momentum builds, Bitcoin's price could change dramatically within months.

Explanation of Silver and Gold-Silver Ratio

The rise of silver in 2025 is driven by two main factors: its historical correlation with gold and its industrial demand. AI infrastructure, solar energy, and electric vehicles all heavily rely on silver.

By 2025, inventories at major exchanges, including the Shanghai Futures Exchange and the London Bullion Market Association, will have fallen to critical levels. In bull markets, silver typically outperforms gold, but in bear markets, silver also carries higher downside risks.

The gold-silver ratio remains a key indicator.

When silver prices are above $80, they are historically considered cheap. Below $60, silver is relatively expensive compared to gold. Below $50, speculative excess often dominates.

Currently priced around $59, this signal indicates that the market will shift towards gold rather than aggressively hoarding silver.

Long-Term Perspective: Different Leaders, Same Goal

Setting aside the specific time point of 2026, the long-term conclusion remains unchanged. Both gold and Bitcoin are on an upward trend against fiat currencies.

The only variable is leadership. This year belongs to gold, while the next phase belongs to Bitcoin.

As long as global debt continues to expand and monetary authorities rely on currency devaluation to relieve pressure, the performance of scarce assets will outperform other assets. In the long run, fiat currency remains the only consistently losing asset.

What matters now is patience, data, and discipline. The transition from gold dominance to Bitcoin dominance will not be publicly announced—it will manifest through liquidity indicators, policy changes, and capital rotations.

I will continue to monitor these signals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。