Bybit has released its 2026 crypto outlook, outlining the key forces likely to influence digital asset markets over the coming year. The report centers on bitcoin and the broader crypto market, drawing on derivatives data, options-implied probabilities, volatility trends, and cross-asset correlations. It also considers macroeconomic conditions, regulatory developments, and institutional adoption to assess how market behavior may evolve through 2026.

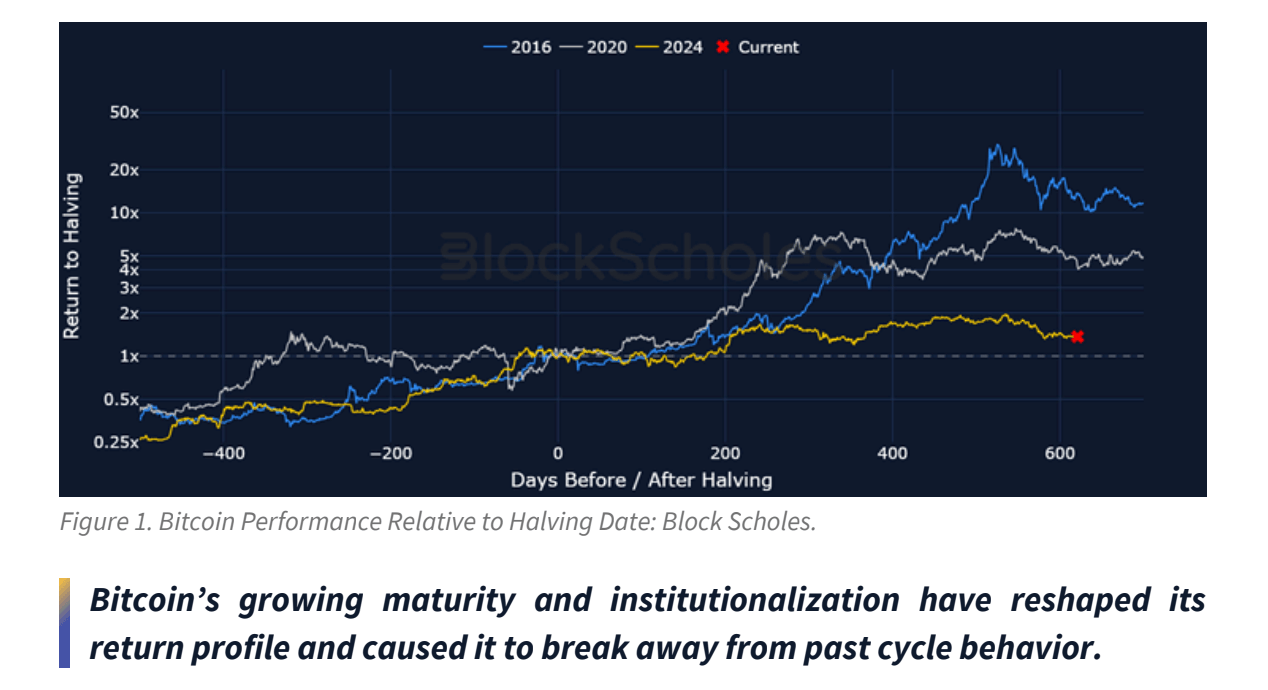

A core theme of the outlook is whether the traditional four-year crypto cycle, closely linked to bitcoin halving events and subsequent drawdowns, still provides a reliable framework. Bybit’s analysis suggests that while past cycles remain relevant, their influence may be weakening as macroeconomic policy, institutional participation, and market structure take on a larger role in price formation.

On the macro front, the report notes that markets are increasingly pricing in further monetary easing by the U.S. Federal Reserve. Such an environment could support risk assets broadly. Bitcoin has recently underperformed U.S. equities, but Bybit highlights the potential for a renewed positive correlation between bitcoin and major stock indices if accommodative conditions persist.

Derivatives data offers a more cautious signal. Based on current options pricing, the implied probability of bitcoin reaching $150,000 by the end of 2026 stands at 10.3%. The report stresses that this figure reflects market positioning rather than a price forecast, and suggests options markets may be conservatively aligned given the broader macro and regulatory backdrop.

Read more: Solana’s Ecosystem Hits $2.39 Billion Revenue High in 2025

Looking further ahead, Bybit points to real-world asset tokenization as a key structural theme, building on the expansion of stablecoin use by regulated institutions in 2025.

Overall, Bybit concludes that crypto markets are entering a more complex phase, where cycles still matter, but are increasingly shaped by macro forces, regulation, and institutional involvement.

- What is the main takeaway from Bybit’s 2026 crypto outlook?

Macro policy, regulation, and institutional flows may outweigh traditional crypto cycles in 2026. - Are Bitcoin halving cycles losing influence?

Bybit suggests the four-year cycle still matters but is becoming less dominant in price formation. - What do options markets imply for Bitcoin in 2026?

Options pricing shows a 10.3% implied chance of bitcoin reaching $150,000 by end-2026. - Which structural trends could shape crypto next year?

Real-world asset tokenization and stablecoin adoption are seen as key long-term drivers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。