Written by: Eric, Foresight News

Cangu, an automotive fintech service platform established in August 2010, went public on the New York Stock Exchange in July 2018 after raising hundreds of millions in Series B funding led by Tencent and Taikang Life.

Bitmain, a cryptocurrency mining chip and hardware design, manufacturing, and mining pool operator founded in 2013, completed three rounds of financing totaling nearly $800 million between 2017 and 2018, reaching a valuation of $15 billion at one point. However, it failed to list on the Hong Kong Stock Exchange by the end of the third quarter of 2018.

These two companies, which seem unrelated in terms of business, found their fates quietly intertwined by the end of 2024.

From Old Finance to New Finance

In the summer sixteen years ago, Cangu started in Shanghai by building a nationwide automotive finance channel network covering lower-tier cities and counties, entering the market with "automobile loan facilitation." Founder Zhang Xiaojun accumulated over a decade of experience at SAIC Group and served as the director and deputy general manager of SAIC General Motors Finance before resigning to establish Cangu.

Starting a business at the age of 43 gives a sense of late bloom. Relying on the founder's years of industry experience, Cangu initially targeted the long-tail market of solving the car loan difficulties faced by residents in small cities, quickly striking gold. Subsequently, Cangu shifted its focus to automotive sales and the after-sales market, establishing a comprehensive automotive transaction service platform that connects dealers, financial institutions, and consumers, forming a service system integrating finance, sales, and after-sales.

In 2018, while Uxin, Guazi, and Renrenche were frantically advertising and engaging in price wars, Cangu reported revenues of 430 million yuan and 1.05 billion yuan for 2016 and 2017, respectively, with net profits of 134 million yuan and 349 million yuan. However, in terms of fame, as PR&IR director Juliet Ye, who joined in 2018, put it, Cangu was "virtually unknown" outside the industry.

This seemingly overly low-profile company had connected 37,700 registered dealers, 11 third-party financial institutions, and 29 other industry participants, including OEMs, online advertising platforms, and insurance brokers, by the eve of its IPO, providing services to over 730,000 car buyers since its inception. In 2017, the automotive transaction volume facilitated by Cangu accounted for 3% of all automotive finance transactions in China, ranking first.

Looking back now, 2018 seems to have been Cangu's peak. Although it experienced a brief resurgence in early 2021 when its investment, Ideal Auto, went public in the U.S., the continuous decline in performance saw Cangu's market value plummet from an opening price of $11 to $0.50 by 2022, with losses exceeding 1.1 billion yuan that year. The reason lies in Cangu's shift in focus from finance to automotive transactions in 2020, which faced the dual blow of the rapid decline in traditional car sales and the expansion of direct sales models for new energy vehicles.

Seeing no way out, Cangu finally resolved to transform by the end of 2024, or at least, as they put it, to transform. The direction of this transformation is into Bitcoin mining.

In November 2024, Cangu officially announced its shift to a Bitcoin mining company, starting with a lavish $256 million cash purchase of mining machines from Bitmain, with a total computing power of 32 EH/s, and plans to invest an additional $144 million through issuing new shares to buy second-hand mining machines with a total computing power of 18 EH/s from sellers like Golden TechGen Limited. In total, with $400 million, Cangu directly became one of the top three companies in global computing power. The second-ranked CleanSpark had just achieved a computing power of 50 EH/s by the end of last year.

Previously bankrupt new energy vehicle brands like Hozon and Jidu have turned to Middle Eastern cryptocurrency companies, and Faraday Future's owner, Jia Huaiqing, has also boldly announced an entry into Web3. It's no wonder some jokes say: the endpoint for struggling car companies is cryptocurrency. For Cangu, starting from automotive finance and now stepping into a new financial field is not entirely a cross-industry move.

There are many U.S. listed companies that have transformed into Bitcoin mining companies, but few have dared to directly throw out $400 million to buy mining machines. Cangu is unprecedented in this regard, and it may be hard for others to follow. This blind gamble, while astonishing, has also raised some doubts: is this sudden shift a bit too smooth?

Transformation or Backdoor Listing?

By unraveling various subsequent actions, we can almost confirm that Cangu's sudden transformation is, in fact, a long-planned backdoor listing orchestrated by Bitmain.

In 2018, Bitmain submitted its prospectus to the Hong Kong Stock Exchange, planning for a maximum market value of $50 billion. According to the prospectus, Bitmain's net profit exceeded $1.1 billion in 2017, with an estimated net profit of $2.2 billion in 2018. Among many unprofitable new economy companies, Bitmain excited the capital circle.

However, coincidentally, 2018 coincided with a bear market in the cryptocurrency market, with Bitcoin prices plummeting, leading to a sharp decline in demand for mining machines and significant fluctuations in the company's performance. Investors and regulators expressed concerns about business sustainability and regulatory uncertainties in multiple countries, and the Hong Kong Stock Exchange also expressed a cautious attitude towards the cryptocurrency industry. Additionally, Bitmain's plan to "transform into AI chips" became another obstacle, with then-Hong Kong Stock Exchange president Li Xiaojia publicly stating that if a company previously made a fortune from mining machines but suddenly emphasized a transformation to AI chips without substantial performance, the original model lacked sustainability.

Most critically, in early 2019, a fierce power struggle erupted between Bitmain co-founders Wu Jihan and Zhan Ketuan, leading to a split in the company. Wu Jihan left to establish Bitdeer, causing Bitmain's valuation to plummet to $5 billion, completely losing the possibility of going public. Although rumors of an attempt to IPO in the U.S. surfaced later, even if there was some truth to it, it ultimately failed.

Perhaps from that moment on, going public became a thorn in Bitmain's side. In the recently concluded year of 2025, this largest cryptocurrency mining machine manufacturer finally found a new path to successfully enter the capital market.

In 2022, Antalpha, a company providing supply chain financing solutions for the digital asset industry, especially cryptocurrency mining, was born. The so-called supply chain financing essentially provides loans to miners to help them purchase mining machines, using mined Bitcoin as collateral to allow miners to hold Bitcoin long-term, and providing financing with computing power as collateral, essentially helping miners solve cash flow issues.

Antalpha was initially owned by Zhan Ketuan's parent company, along with its sister company Northstar, but after restructuring in 2024, it operated independently as "Bitmain's core financing partner" and went public on the Nasdaq Global Market on May 6 of last year at an IPO price of $12.8. On its first day of trading, Antalpha's stock price soared to nearly $28, with a total market value of $660 million, but the stock price has since fallen to around $9.3.

Just a month before Antalpha's bell-ringing, Cangu agreed to sell its automotive-related business in China to Ursalpha Digital Limited for $352 million, with this "buyer" introduced by another company, Enduring Wealth Capital Limited (EWCL).

These two seemingly unrelated companies are, in fact, intricately connected to Antalpha.

According to verification by TheMinerMag, Hong Kong company information records show that Ursalpha Digital, which took over Cangu's automotive business, shares the same company address as Antalpha Digital Limited, and its director, Qiu Changwei, founder of Taiwan Wanbao Securities, is also a director of Antalpha's Singapore company.

The "well-meaning introducer" EWCL appears somewhat mysterious, as its shareholder information cannot be verified due to its registration in the British Virgin Islands. However, a document submitted by Cangu to the SEC last March revealed the identities of EWCL's directors, namely Andrea Dal Mas, Peng Yu, and Anggun Mulia Fortunata. Among them, Andrea Dal Mas and Anggun Mulia Fortunata are two of the three actual controllers of Antalpha.

The submitted document indicates that EWCL intends to acquire 10 million shares of Class B common stock from Cangu's co-founders Zhang Xiaojun and Lin Jiayuan in cash. Each Class B share has 20 votes, suggesting that EWCL, or we could say Antalpha, or even Bitmain, is aiming to acquire control of Cangu.

Up to this point, we can roughly outline a picture: after the split between Bitmain's two founders, Zhan Ketuan launched Antalpha in 2022, later promoting Antalpha's independence in 2024, and last year using its "independence" to allow an affiliated company of Antalpha (Ursalpha Digital) to acquire Cangu's domestic automotive business, and then using another affiliated company (EWCL) to acquire control of Cangu.

This can indeed be described as a clever capital operation, but the story is far from simple, so let's continue to look deeper.

0.39% Restraint

If Bitmain's failure in the Hong Kong stock market was due to internal strife, then the rumored failure in the U.S. stock market may have been due to inadvertently entering the eye of the storm of great power competition.

The core technology of Bitcoin mining machines comes from chips. During the previous term of "Tariff Emperor" Trump, the U.S. government harbored deep hostility towards a Chinese tech company hoping to go public in the U.S. Although Bitcoin mining machine chips simply hard-code the mining algorithm onto the chip, it was still enough to trigger some American politicians' anxiety. Over the past few years, voices from across the ocean in North America have often suggested that Bitmain's Antminer has backdoors, with intentions clearly revealed.

So if Bitmain indeed missed out on the U.S. stock market for this reason, and as we suspected, hoped to use Cangu as a backdoor to at least list its mining business, it requires a prerequisite: Cangu can no longer be a Chinese concept stock.

Three weeks after Antalpha went public, Cangu announced that it had completed personnel adjustments to its board following the sale of its automotive business and would apply to the China Securities Regulatory Commission to cancel its "Chinese concept stock" status. Cangu stated that its core business had shifted to Bitcoin mining, with operations covering North America, the Middle East, South America, and East Africa. On October 15, Cangu decided to terminate its plan to list via American Depositary Receipts and instead directly list Class A shares on the New York Stock Exchange. Less than a month later, on November 6, Cangu officially announced that it would offer Class A share trading directly on the NYSE starting November 17. Additionally, the company is actively seeking to enter the field of high-performance computing for artificial intelligence.

What may have prompted all this could be pre-planned, or it might be due to the investigation by Republican Congressman Zachary Nunn into Bitmain and Cangu in early September. Zachary Nunn stated that Bitmain and Cangu "seem to be expanding their business in the U.S. through complex ownership structures and financing arrangements, which regulators and the public may not fully understand in terms of transparency." In response, representatives from Bitmain and Cangu stated that they strictly comply with all U.S. laws and have no connections with any government or state-owned enterprises.

See? We are not the only ones aware of this matter.

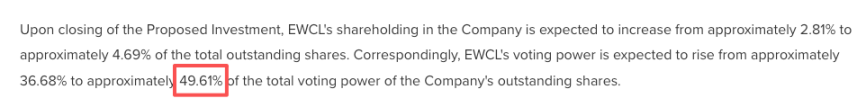

However, even though it seems that compliance risks have been eliminated, Bitmain still did not act rashly. On December 29, Cangu announced that EWCL would subscribe to 7 million Class B shares to be issued by Cangu for $10.5 million. After the transaction is completed, EWCL's shareholding in Cangu will increase from approximately 2.81% to 4.69%, and its voting rights will correspondingly rise from about 36.68% to 49.61%, with the transaction expected to be completed in January of this year.

49.61%, just 0.39% away from actual control. And this 0.39% may be Bitmain's test of the U.S. regulatory attitude.

At this point in the story, all the clues have been connected. The hardware products that include chips, such as mining machines, may make it impossible for the mining machine sales business to enter the U.S. capital market in the foreseeable future, but the mining business still has a chance. These interconnected operations, if not for a backdoor listing, can only be described as an incredible coincidence.

In fact, signs of this had already emerged in March of last year. Cangu mined 530 Bitcoins that month, which, based on the total network computing power, required at least 29 EH/s of computing power. Having just paid for 32 EH/s of computing power in November 2024, and nearly all of it operational by March 2025, indicates that the mining machines purchased from Bitmain for over $250 million were indeed spot purchases, with no need for finding mining sites, connecting power, or setting up; they were already on the shelves.

The Final Savior: Providing Computing Power for AI

The second-largest Bitcoin mining machine manufacturer, Canaan Creative, currently has a total market value of around $550 million. Therefore, even if Bitmain successfully goes public, it is almost impossible for its market value to return to the $15 billion of 2018. However, if it can leverage its mining and power resources to provide computing power for major AI companies, the situation could be different.

Daisy, a U.S. stock analyst at MSX, pointed out that if Bitmain goes public purely as a mining operation, the outcome will not be favorable, and it will have to choose to transform and sell its existing power and computing resources. But this story cannot just be empty talk; it must have actual orders. Daisy noted that MARA is a typical example; although it aims to transform into AI computing services, it has no actual orders, so no one is buying. In contrast, companies with power resources and real orders, such as Applied Digital and IREN Ltd, are performing much better, with current market values of approximately $9 billion and $15.45 billion, respectively.

If Cangu can secure real orders, perhaps Bitmain can provide its former investors with a long-overdue explanation, eight years late, thanks to the tailwind brought by the AI arms race. Currently, Cangu's market value is about $500 million, and this 30-fold uphill journey still requires gradual climbing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。