Original|Odaily Planet Daily (@OdailyChina)

In 2026, survival is king.

In a previous article titled “2026, Survive: A Bear Market Survival and Counterattack Manual for Crypto Enthusiasts”, we systematically presented this year's "survival strategies," emphasizing the asset allocation of precious metals like gold as a key focus. For those looking to combat inflation, mitigate fiat currency depreciation, and address issues like the decline of the dollar exchange rate through gold, how to allocate gold-related assets has become the next challenge.

In this regard, based on my personal understanding, XAUT issued by Tether may be the best way for the crypto community to allocate gold assets. Coupled with the recent news that Tether has launched a new accounting unit “Scudo” for Tether Gold (XAU₮), the threshold for allocating gold tokens has also dropped sharply to just a few dollars.

Odaily Planet Daily will systematically analyze whether XAUT is worth position allocation in this article.

Potential Support for Rising Gold Prices: U.S. Policies, ETF Inflows, Bank Ratings

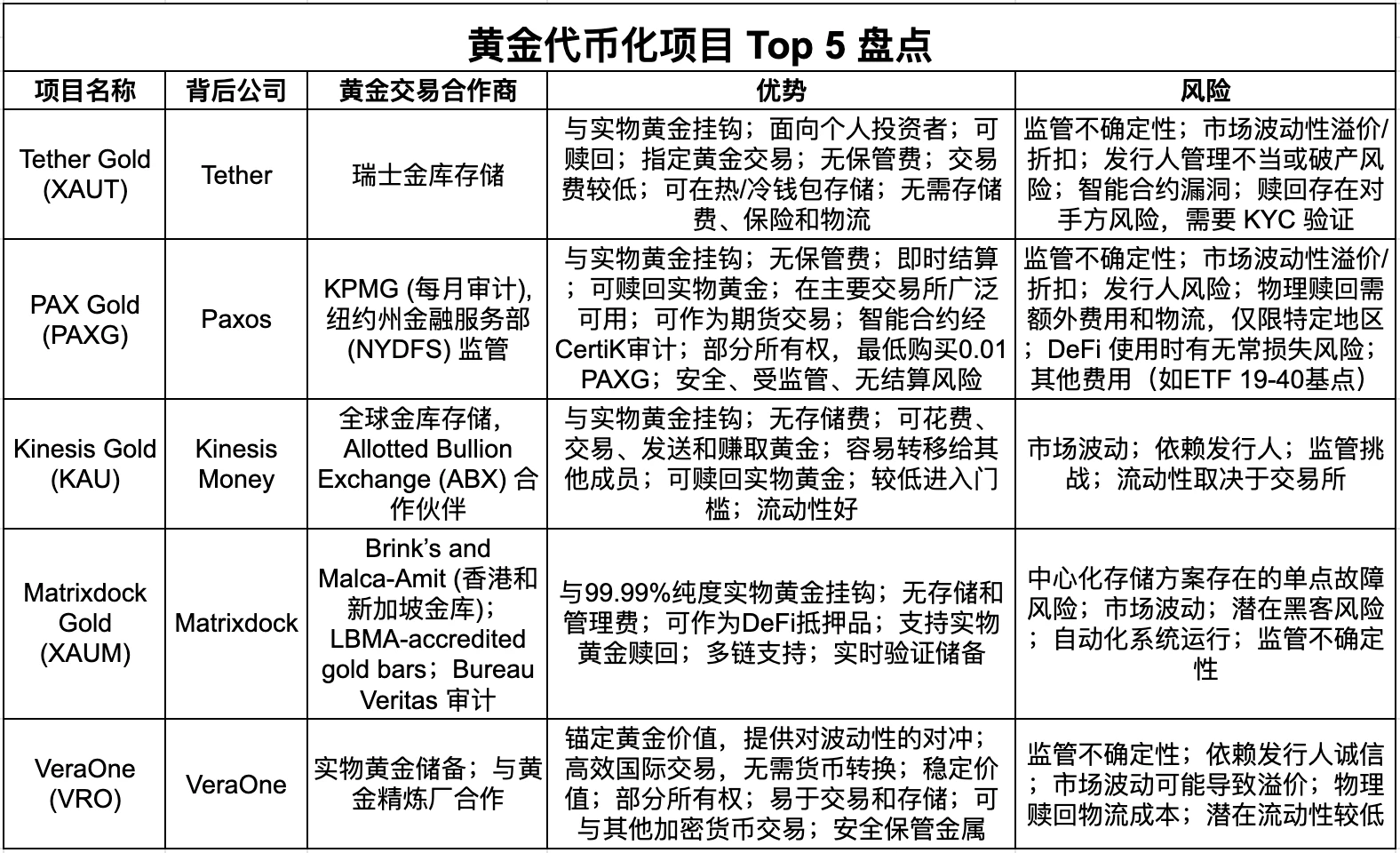

Last September, when the spot gold price was still hovering around $3,400-$3,500, we systematically introduced five major gold tokens in the article “Gold Prices Expected to Continue Rising to $3,900/oz: A Review of 5 Major Gold Tokens”, with XAUT among them. Looking back three months later, the spot gold price once surged to around $4,550 per ounce, which is quite astonishing.

Moreover, despite a recent phase of price correction, the upward momentum of spot gold has not been significantly interrupted. Specifically, the support for gold prices comes from the following aspects:

World Gold Council: Three Major Factors, Including U.S. Supreme Court Tariff Decisions, Only Cause Short-Term Fluctuations in Gold Prices

The World Gold Council released a report stating that the surge in precious metals (including silver and platinum) in December and the rebalancing of commodity indices may trigger market fluctuations in the short term. However, aside from short-term fluctuations, gold is expected to continue its operational logic. The upcoming ruling by the U.S. Supreme Court on tariff policies may have significant implications for U.S. trade policy. The impact on gold may be more complex but could provide potential support. Lastly, ongoing geopolitical conflicts (with recent U.S. actions in Venezuela as a prime example) also support gold prices.

Gold Prices Set to Break Historical Records 53 Times in 2025, Unprecedented ETF Inflows

The World Gold Council indicated that with gold prices breaking historical records 53 times in 2025, global investors injected unprecedented funds into gold ETFs. North American funds contributed the majority of global inflows in 2025. Meanwhile, gold holdings in Asia nearly doubled, and Europe also showed significant demand.

Gold Prices Rose About 65% in 2025, Setting Over 50 New Highs, Silver Rose About 150%

In 2025, precious metal market data showed that spot gold closed at $4,318.65 per ounce on December 31, down 0.46%. Against the backdrop of global "de-dollarization," the Federal Reserve restarting its rate-cutting cycle, and central banks continuing to purchase gold, gold became the most dazzling "star asset" of 2025, rising about 65% throughout the year and reaching a historical high of $4,549.96 per ounce, setting over 50 new highs within the year.

UBS Group: Raises Gold Price Targets for March, June, and September 2026 to $5,000 per Ounce

UBS Group stated that it remains bullish and has raised its gold price targets for March, June, and September 2026 to $5,000 per ounce (previously $4,500 per ounce). It is expected that by the end of 2026, gold prices will slightly decline to $4,800 per ounce.

Based on the above information, the outlook for gold prices remains optimistic for the coming year. Now, let's discuss why Tether's gold token XAUT is worth allocating.

Four Major Advantages of XAUT Allocation: High Market Value, Low Threshold, Good Liquidity, Leverage Available

First, it is supported by Tether's strong financial backing and the gold reserves and sufficient liquidity behind XAUT.

At the beginning of the month, Tether CEO Paolo Ardoino stated that Tether purchased 8,888 bitcoins worth about $780 million on New Year's Eve 2025. This transaction brought the publicly held bitcoin amount of the stablecoin issuer to over 96,000. Tether currently allocates 15% of its quarterly profits to bitcoin. Additionally, Tether purchased 26 tons of gold in the third quarter of 2025, bringing its total gold holdings to 116 tons, ranking it among the top 30 gold holders globally. The market value of around $2.3 billion also demonstrates the ample liquidity of XAUT.

Second, Tether recently launched a new accounting unit “Scudo” for XAUT.

According to official news, Tether officially introduced a new pricing unit Scudo for Tether Gold (XAUT). This unit aims to reintroduce gold as a means of payment, with 1 Scudo defined as one-thousandth of a troy ounce of gold or one-thousandth of an XAUT (approximately $4.4). This move simplifies the pricing method, addressing the issue of long decimal places that users need to handle during transactions or pricing, making gold more practical in everyday economic activities. Tether Gold is currently fully backed by physical gold in secure vaults, and the introduction of Scudo does not change the structure or support method of XAUT.

Third, XAUT is listed on major mainstream CEX and DEX platforms, supporting spot purchases or contract leverage operations.

According to Coingecko information, XAUT supports trading on CEX platforms like Bybit, OKX, Bitget, and DEX platforms like Uniswap, Fluid, and Curve.

Finally, Tether's dominant position in the stablecoin sector and its high profit margins also provide strong support for the growth and development of XAUT, with its industry application popularity expected to further increase in 2026.

According to Bloomberg citing data from Artemis Analytics reports, global stablecoin trading volume surged 72% year-on-year in 2025, reaching a record $33 trillion, with Circle's USDC trading volume reaching $18.3 trillion, ranking first; Tether's USDT trading volume was $13.3 trillion, also maintaining a high level. Together, they account for the vast majority of stablecoin trading activity.

Considering the ongoing decline of the USD to RMB exchange rate, for most ordinary people with relatively limited liquidity and a low risk appetite, converting part of their fiat currency into the gold token XAUT may be a relatively better solution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。