Good evening everyone, I am Xin Ya. Today, whether it's Bitcoin or Ethereum, the volatility is not significant. I hope everyone has had a good rest.

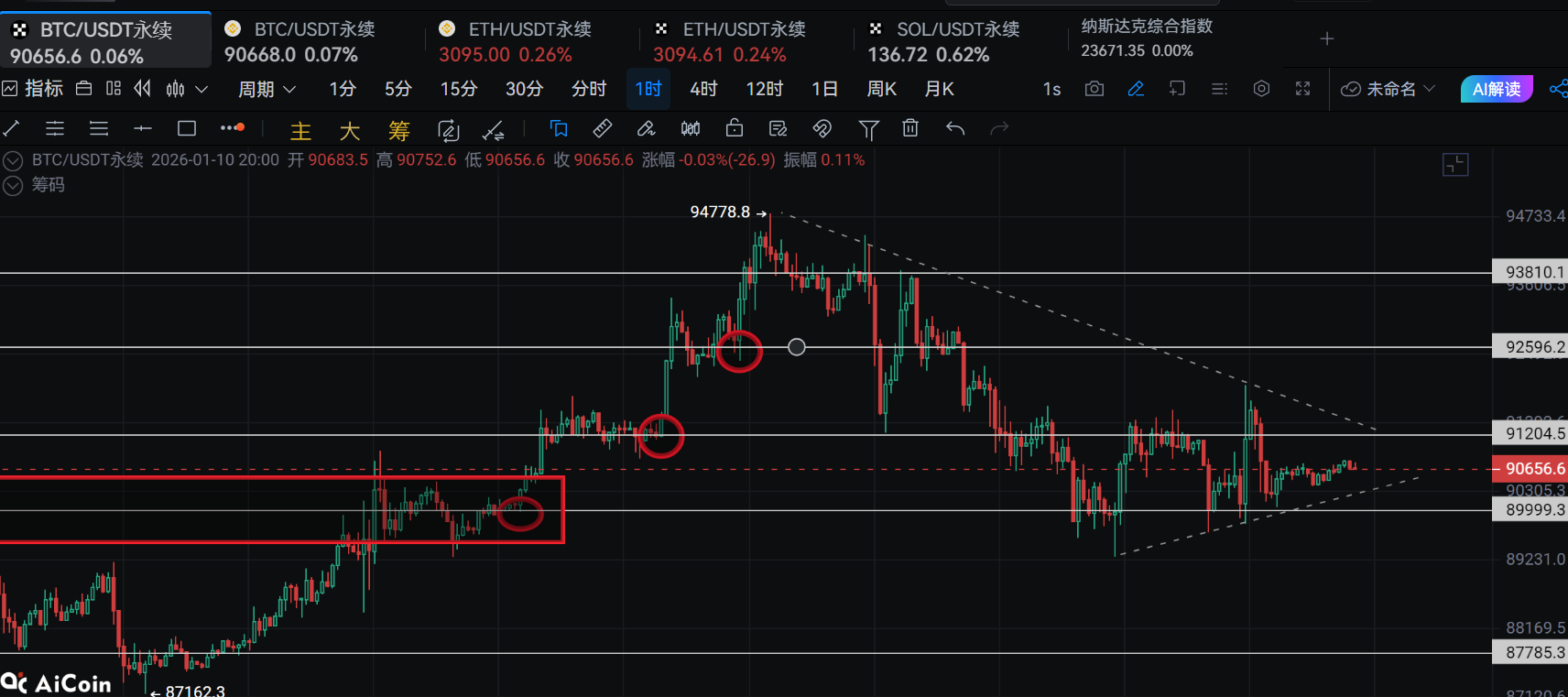

Let's take a brief look at the overall trend. Yesterday, Bitcoin briefly broke 90,000 at around eleven o'clock in the evening, and found support around 89,800. The bulls ignited, and the market spiked to around 92,000, liquidating 20 million dollars in short positions, while the spike at four o'clock in the afternoon on the ninth liquidated 15 million dollars in long positions. This is equivalent to a high-leverage position being established in both directions within the day. Looking at Bitcoin, after breaking above 91,800, it quickly retraced, with four consecutive hours of selling pressure bringing it down to 90,000, where divergence signs appeared. During the rebound process, trading volume was weak, and the recovery was relatively weak, indicating a tendency for correction. Throughout this period, the price movement, whether upward or downward, did not refresh the highs and lows, which shows that the market's opinions have not yet unified and still need to consolidate.

In a relatively weak market, neither retail investors nor major players are willing to engage in high-level follow-ups or low-level sell-offs. Therefore, we see that the market did not see a follow-up after the drop to 91,200, nor did it see selling pressure after breaking below 90,000; otherwise, the signals would be too obvious. The points of decline and the current operating range are controlled at the edges, playing at the limits of the former pressure zones.

Now let's look at Ethereum. Yesterday's night session first spiked to around 3,060 before rebounding back to 3,145. After a second round of selling pressure, it re-tested around 3,068 and naturally consolidated back to the current 3,100. The movement is indecisive, and the future market will still highly synchronize with Bitcoin's movements.

Yesterday, Bitcoin had the expected buying support to push it higher, breaking above 91,800, but did not follow through, instead oscillating to digest the differences. Ethereum, as expected, is contending around 3,100, but the continuation of upward movement and the extent of downward movement are much stronger than Bitcoin. In terms of future views, we can continue to go long, but the short-term approach should be relatively conservative. Good positions should be relatively heavy, and after reaching psychological expectations, reduce positions. Take the part that exceeds expectations with high frequency, while keeping the direction unchanged.

Key points of divergence and tug-of-war for Bitcoin to pay attention to are 89,500, 90,500, 91,200, 91,800, and 92,500. For Ethereum, they are 3,050, 3,080, 3,135, and 3,186.

It is recommended to go long around 90,000, and enter Ethereum at 3,050-3,080 for protection. The direction for Bitcoin and Ethereum in the future looks to refresh the highs reached yesterday, with stop-loss and position adjustments planned according to your positions and conditions. For rolling long positions, consider points at 91,200 and 3,120. Therefore, for those looking to short, do not consider entering before this position, but if you are trading against it, it’s fine.

Let’s move forward together. Official account: Xin Ya Talks About Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。