Introduction

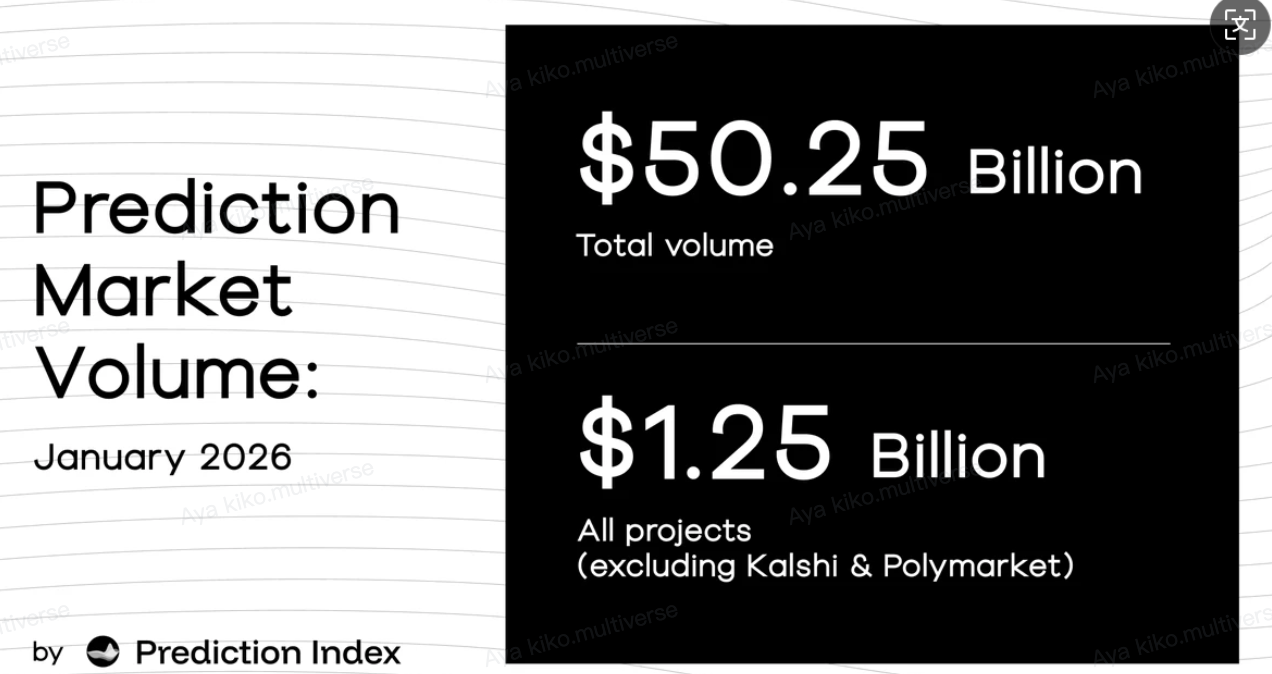

The cryptocurrency prediction market surged at an astonishing pace in 2025, reaching a new high of approximately $50.25 billion in total trading volume for the year. With the U.S. Commodity Futures Trading Commission (CFTC) gradually clarifying its compliance positioning, Wall Street giants entering the investment scene, and significant events occurring frequently, the prediction market has become one of the most anticipated Web3 tracks for 2026. On December 27, 2025, a trader placed a bet on Polymarket that "Venezuelan President Maduro will step down before January 31," with a return rate exceeding ten times. While it remains to be investigated whether this trade involved insider information, it sparked amplified discussions in the market regarding Polymarket and the entire prediction market sector. According to the CEO of Kalshi, the potential global scale of prediction markets could reach $150 billion. Major events such as the 2026 U.S. midterm elections and the World Cup are about to kick off, and the industry generally expects the market size to achieve another order-of-magnitude leap next year.

This article will focus on the hot topic of prediction markets, systematically sorting out its concepts, differences from gambling, reasons for the explosive growth in 2025, analyzing the current market landscape and data performance, reviewing the characteristics and models of representative platforms, and deeply exploring the risks and opportunities involved, concluding with a forecast of the trends and directions of the prediction market in 2026.

I. Overview of Prediction Markets

Definition of Prediction Markets

A prediction market is a mechanism that aggregates dispersed information through financial incentives, transforming the collective knowledge and opinions of the public into a single probability data point. Participants place bets on the outcome of a certain event: if they are optimistic about a certain outcome, they buy the corresponding position; conversely, they sell or short it. As numerous participants engage in the game based on their information and judgments, market prices gradually converge to reflect the "collective probability of the event occurring."

Compared to traditional opinion polls or expert predictions, the advantage of prediction markets lies in their incentive mechanisms and accuracy. Only participants who bet on the correct outcome can profit, while incorrect predictions incur losses. This "money voting" model encourages people to think carefully and make full use of information, thereby enhancing prediction accuracy. Research has indicated that prediction markets often achieve a Brier score close to 0.09, with overall accuracy surpassing that of polls, experts, and even some weather models.

Differences Between Prediction Markets and Gambling

It is important to emphasize that prediction markets ≠ gambling; there are essential differences in their mechanisms.

Different Price Formation Mechanisms: Prediction markets use open order books or AMM for market-based pricing, where prices are generated through the game between trading parties. The platform does not preset odds or bear the risk of outcomes, only charging transaction fees. In contrast, traditional gambling has fixed odds set by the platform, ensuring profits through the "house edge," with odds adjustments aimed at controlling risk rather than reflecting true probabilities.

Different Functional Uses: The prices in prediction markets serve as a data product that can be referenced externally, useful for macro decision analysis, policy expectations, enterprise risk management, and even influencing media narratives and decision-making references. The odds in gambling are primarily for entertainment consumption, lacking information discovery value.

Different Participant Structures: The main participants in prediction markets are information-driven traders, including researchers, macro traders, data analysts, and institutions, whose core goal is to arbitrage and discover prices using information differentials; whereas gambling attracts more ordinary consumers, often driven by emotions and preferences, with participation motives less related to information accuracy.

In summary, prediction markets aggregate collective wisdom through financial incentives, generating probability information with spillover value, distinctly positioning themselves from traditional gambling. This is also one of the key reasons why U.S. regulatory authorities are willing to view them as a legitimate derivative market.

Reasons for the Explosive Growth of Prediction Markets

The explosive growth of prediction markets in 2025 can be attributed to the maturity of various conditions, including "timing, location, and human factors."

Regulatory Breakthrough: In 2025, the U.S. CFTC provided a clear positioning for prediction markets, recognizing them as legitimate commodity derivatives rather than gambling activities.

Inflow of Capital and Institutions: Progress in compliance has significantly boosted investor confidence, leading to continuous financing for prediction market projects in 2025. Reports indicate that Polymarket and Kalshi each completed multiple rounds of financing exceeding $1 billion in total. Additionally, the compliance advantage helped Kalshi attract liquidity support from the well-known Wall Street market maker SIG.

Expansion of Event Categories: Early prediction markets primarily focused on macro events like political elections, but now the sector has extended to broader fields such as economic indicators, hot topics in the cryptocurrency industry, and sports events. The continuous occurrence of various breaking news, political events, and major sports competitions in 2025 has provided a sustained catalyst for prediction markets.

Maturity of Technological Conditions: Advances in blockchain scaling solutions (such as Layer 2 reducing gas fees), the development of on-chain settlement and automated market-making tools, and the application of AI in information analysis and trading assistance have made it easier for ordinary users to participate in prediction markets. At the same time, improvements in wallet experiences, the opening of fiat deposit channels, and social distribution have simplified the onboarding process for new users.

II. Current Status of Prediction Markets: Market Landscape and Data Performance

1. Overall Scale and Duopoly Landscape

In 2025, the prediction market sector delivered an impressive performance: the total trading volume for the year reached approximately $50.25 billion, compared to only about $900 million in 2024. The user base expanded simultaneously, growing from around 4 million in 2024 to about 15 million in 2025. The market landscape formed a "duopoly" dominated by Kalshi and Polymarket, with the two platforms collectively holding over 90% of the market share. Specifically, Kalshi's nominal trading volume for the entire year of 2025 reached $23.8 billion, while Polymarket's trading volume was approximately $22 billion.

Source: https://predictionindex.xyz/

Kalshi and Polymarket exhibit significant differences in positioning and operational models, each reflecting different advantages. Kalshi, as the first prediction market to obtain regulatory approval in the U.S., resembles a traditional regulated exchange, employing centralized matching and off-chain settlement, primarily serving the U.S. market, with standardized contract designs and a user base predominantly consisting of institutions and professional traders. Polymarket, originating from the cryptocurrency community, is a decentralized, permissionless platform that uses on-chain smart contracts and trustless oracles to create and settle markets, allowing users to participate directly with Ethereum wallets, becoming synonymous with decentralized prediction markets.

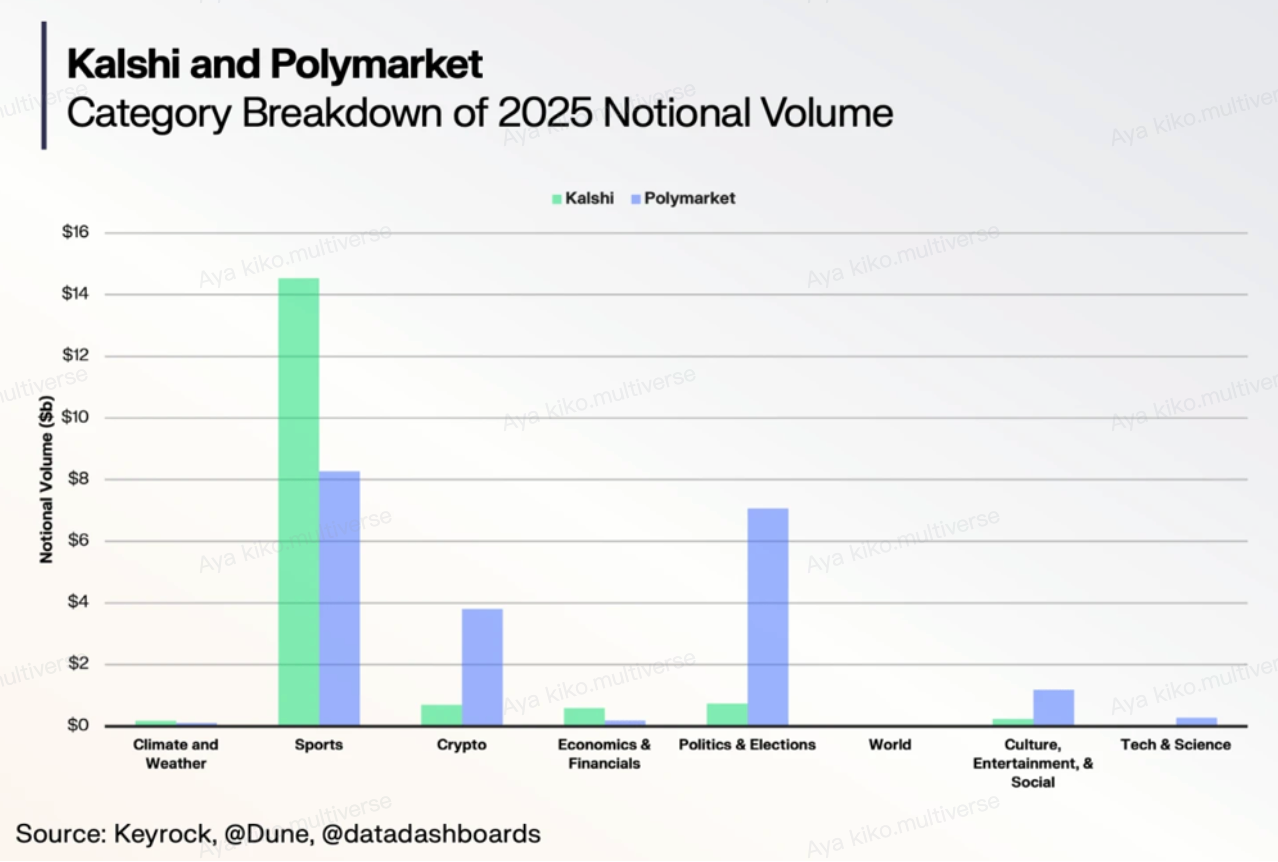

The distribution of topics also reflects the strategic focus of the two platforms. According to Dune data, Kalshi's predictions in 2025 were predominantly centered on sports events, with sports contracts accounting for about 85% of its nominal trading volume. Polymarket's market composition is more diverse, with sports (39%), politics (34%), and cryptocurrency (18%) being its three main pillars, collectively contributing over 90% of the trading volume. Additionally, some long-tail topics such as economic indicators, technological innovations, and social culture began to emerge in 2025.

Source: https://keyrock.com/prediction-markets-the-next-frontier-of-financial-markets/

2. Market Heat and Capital Trends

In the second half of 2025, the heat of prediction markets reached unprecedented heights, with multiple indicators setting historical records. Statistics show that the total number of trades for the year soared to 97 million, a year-on-year increase of nearly 17.8 times, making the market a true real-time information engine. Another important indicator is Open Interest, which reflects the scale of bets on unresolved events. Kalshi's open interest reached $225 million in 2025, a year-on-year increase of 169%; among these, the open interest for economic and social events grew the fastest, reaching approximately $800 million and $700 million, respectively. This indicates that an increasing number of users are using prediction markets for medium- to long-term hedging and positioning, rather than just betting on short-term outcomes.

The capital market's enthusiasm for the prediction sector is equally fervent. In 2025, Polymarket and Kalshi announced substantial financing: Polymarket's valuation soared to the $8-9 billion range after an investment from ICE, and it is reportedly planning a new financing round with a valuation in the hundreds of billions; Kalshi also raised $300 million during the year, with a post-investment valuation of about $5 billion. The investment lineup behind the two giants is impressive, including top institutions such as the parent company of the New York Stock Exchange, Sequoia Capital, and SV Angel. According to CoinMarketCap, mainstream cryptocurrency companies like Coinbase, Gemini, Robinhood, and MetaMask also announced investments or new layouts in the prediction market sector at the end of 2024.

Kalshi's compliance model and Polymarket's on-chain model are beginning to permeate each other: Kalshi is exploring the tokenization of contracts on-chain (already piloted on Solana), introducing non-custodial trading and on-chain settlement; Polymarket is returning to the U.S. market with a compliant identity through regulatory approval. This "two-way integration" suggests that future prediction markets may simultaneously possess the credibility endorsement of traditional finance and the open innovation of decentralized networks.

III. Review of Representative Prediction Market Platforms

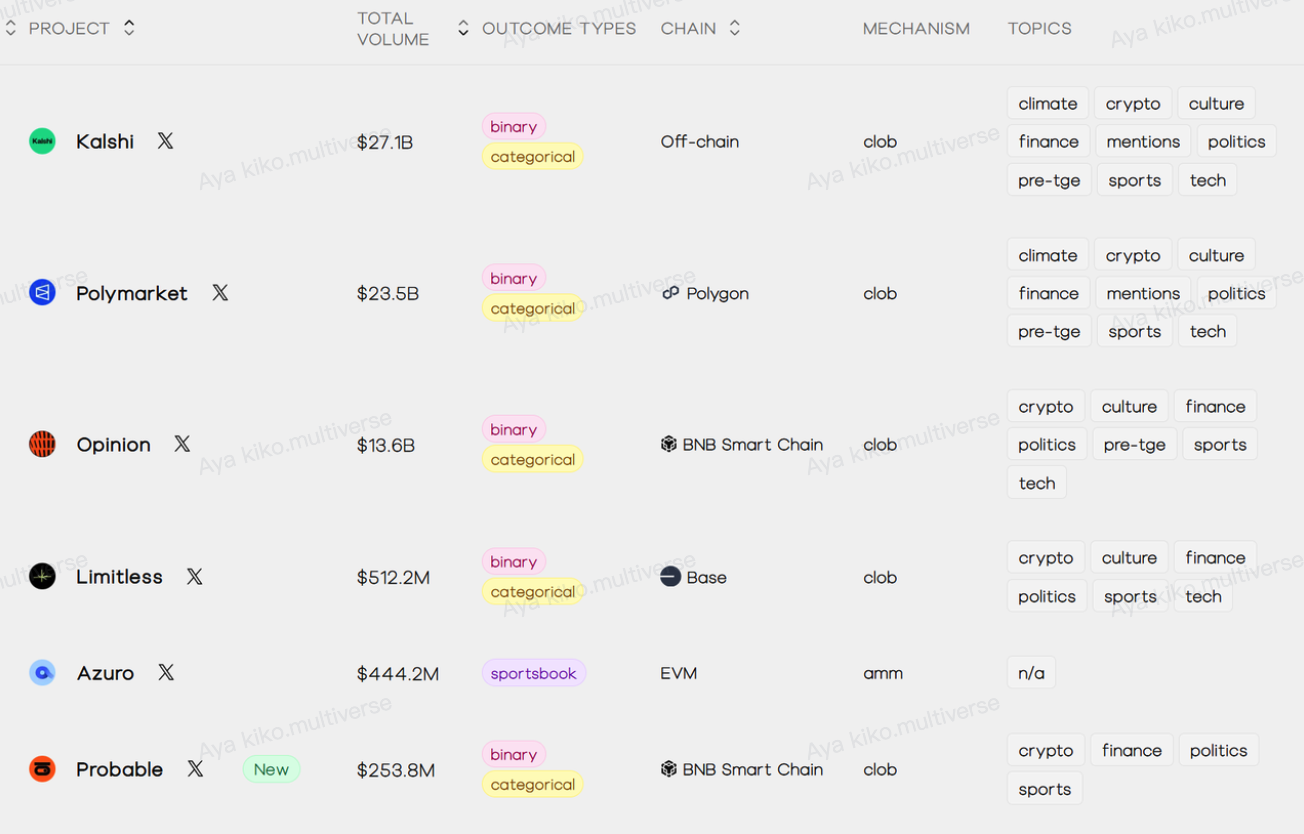

In the current prediction market sector, in addition to the two giants Kalshi and Polymarket, a number of emerging platforms are rising. According to historical trading volume rankings compiled by PredictionIndex, the Top 5 platforms are: Kalshi, Polymarket, Opinion, Limitless, and Azuro. Additionally, the recent project Probable, incubated by PancakeSwap, has also garnered significant attention.

Source: https://predictionindex.xyz/

1. Kalshi – Compliant American Prediction Exchange

Platform Overview: Kalshi launched in June 2021 and is the world's first prediction market exchange licensed by the CFTC. Headquartered in the United States, it employs a centralized matching trading mechanism and compliant settlement. Users must complete KYC to trade using fiat currencies like USD, primarily focusing on Yes/No binary contracts covering various categories such as politics, economic data, climate, cryptocurrency, and sports. With the launch of its sports market, Kalshi experienced explosive trading volume in the second half of the year. In 2025, Kalshi's transaction volume reached $23.8 billion, more than an 11-fold increase year-on-year; its historical cumulative trading volume is approximately $27.1 billion.

Event Types: Sports events are the platform's most significant feature, accounting for over 85% of trading volume. It also offers predictions on political and economic events (elections, macro indicators, etc.) and cryptocurrency market events, with plans to expand into new types of contracts such as predictions on publicly listed companies' earnings reports starting in 2025. The diversification of prediction topics enhances the practical value for hedging and speculation.

Mechanism and Revenue Model: Kalshi uses a Central Limit Order Book (CLOB) model for trade matching. It profits by charging transaction fees, which vary slightly based on contract types (e.g., $0.01 per contract). To enhance liquidity, Kalshi launched a market maker subsidy program in 2024-2025, investing at least $9 million to incentivize liquidity provision. Additionally, it collaborates with professional market makers like SIG to improve order depth. Currently, it has not issued tokens and primarily supports operations through equity financing and trading revenue.

2. Polymarket – Leading Decentralized Prediction Market

Platform Overview: Polymarket was launched in 2020 and is a representative decentralized prediction market platform on the Ethereum and Polygon networks. Users connect their crypto wallets through a web interface to participate, supporting binary and multiple-choice event markets. Polymarket employs a publicly shared order book and a mixed automated market-making mechanism, utilizing smart contracts to hold funds and decentralized methods like UMA oracles to determine outcomes. The operating team and server front end are relatively centralized, but settlement is completed on-chain. In 2025, Polymarket's transaction volume is estimated to be around $22 billion, with a historical cumulative trading volume of approximately $23.2 billion and over 314,000 active users. The frequent events in the second half of 2025 drove a surge in Polymarket's trading volume, with its market depth once leading other decentralized peers.

Event Types: The platform features a diverse range of topics, making it one of the most richly composed platforms in the industry. Sports, politics, and cryptocurrency are the three main pillars, accounting for approximately 39%, 34%, and 18%, respectively. Additionally, markets have been created in areas such as economic data, technological developments, and pop culture. Notably, Polymarket closely follows hot topics in the crypto space, such as "Will a certain coin price reach a new high?" and "Will a certain project be delivered on time?", providing unique hedging/speculation tools for cryptocurrency investors.

Mechanism and Revenue Model: Polymarket's transactions are settled through on-chain smart contracts, using a shared order book to match prices, ensuring that the Yes and No prices always sum to 1 (Yes + No = $1). Initially, the platform charged zero fees to users to stimulate growth, but it actually maintains operations through spreads and liquidity subsidy mechanisms. Around 2025, Polymarket gradually began charging a small fee to winners for profit and plans to open more third-party front-end revenue-sharing models.

3. Opinion.trade – A Civilian Prediction Terminal Focused on Macroeconomics

Platform Overview: Opinion operates on the BNB Chain blockchain and is a prediction market platform focused on global macroeconomic and financial indicators. It is positioned as a "terminal for the masses," aiming to turn macro insights into tradable markets, allowing ordinary people to participate in macro information betting. The platform architecture integrates on-chain trading infrastructure, AI-assisted oracles, DeFi modules, etc., enabling users to create, trade, and resolve real economic event contracts through decentralized means. Opinion's historical total trading volume has reached $13.1 billion, ranking third among all prediction markets. Such high data may partly be attributed to aggressive liquidity mining or wash trading activities.

Event Types: It primarily focuses on economic and financial predictions, including macroeconomic indicators (inflation, employment, interest rates, etc.), changes in national policies, and market index trends. It also covers some political events and cryptocurrency market predictions, but unlike more entertainment-oriented platforms, Opinion emphasizes serious financial content. Its original design intention is to lower the threshold cost of traditional financial terminals, allowing users to participate in macro trading that would typically require significant capital, similar to what Bloomberg terminals offer.

Mechanism and Revenue Model: The platform utilizes AI-assisted oracles, leveraging artificial intelligence to obtain and assess event outcomes from authoritative data sources, enhancing the efficiency and accuracy of the oracles. Revenue models include transaction fees, market creation fees, etc. PredictionIndex labels Opinion as "pre-TGE," indicating potential plans for token issuance.

4. Limitless – High-Frequency Prediction Market Based on Base Chain

Platform Overview: Limitless is a decentralized prediction market platform deployed on Coinbase's Base chain, aiming to provide high-frequency, short-cycle prediction trading services. Limitless focuses on hourly and daily frequent markets, including various market judgments for both cryptocurrency and traditional assets, offering conditions for users to trade in natural language. The low fees and quick confirmations of the Base chain enable Limitless to support users in frequently adjusting positions and achieving near real-time price discovery. Limitless currently has a historical cumulative trading volume of approximately $512 million, ranking fourth in the prediction market sector. Thanks to user traffic from the Base ecosystem and Coinbase's endorsement, Limitless has seen steady trading volume growth since its launch in the second half of 2025.

Event Types: It focuses on short-cycle market trend predictions. Areas covered include cryptocurrency prices (e.g., "Will BTC's closing price today be above X?"), intraday trends in traditional stocks and commodities, and the immediate impact of specific macro events. Limitless tends to design binary contracts (Yes/No) or range contracts (e.g., which price range will it fall into) for users to trade in very short time frames. Additionally, the platform also provides real-time predictions for sports events, such as the outcome trends during a match, allowing users to continuously buy and sell positions during events.

Mechanism and Revenue Model: Limitless operates entirely on the Base chain, issuing collateralized Outcome Shares through smart contracts. Users buy Yes or No shares, and the correct side's shares are redeemed at $1 after the event concludes, while the incorrect side's shares become worthless. The trading employs a mixed AMM + order book model, ensuring continuous liquidity while allowing users to place orders. The platform's revenue primarily comes from transaction fees and market-making spreads. Its advantages lie in leveraging the low-fee Base chain for a better user experience and potential collaborations within the Coinbase ecosystem.

5. Azuro – Decentralized Prediction Market Infrastructure Protocol

Platform Overview: Azuro is a decentralized protocol focused on providing prediction market infrastructure. Unlike trading platforms directly aimed at users, Azuro offers a toolkit for developers, DApps, and operators to quickly build various prediction applications. Azuro is deployed on multiple EVM-compatible chains (Ethereum mainnet, Base, BNB chain, etc.) and uses a vAMM (virtual automated market maker) + "Liquidity Tree" funding management model to support liquidity for large-scale markets. Its goal is to become the Uniswap of the prediction market space, providing general infrastructure for others to build front ends and customize gameplay. Azuro's self-reported total "processed" prediction trading volume is approximately $444 million, ranking fifth in the industry.

Event Types: Azuro initially focused on sports betting/prediction, providing markets for betting on outcomes of events such as football, basketball, and esports. Subsequently, through community governance, the protocol expanded to support other categories like politics and cryptocurrency prices, but most application scenarios still concentrate on sports and gaming predictions. Azuro's design allows for diverse odds structures, not limited to simple binary markets, such as supporting scores, spreads, and other complex gameplay to attract traditional betting users.

Mechanism and Revenue Model: Azuro's uniqueness lies in its virtual AMM + liquidity tree model. Liquidity providers deposit funds into Azuro's pool, and the protocol algorithmically allocates funds among different odds options, effectively automating market-making for all options. Thus, even if certain options do not have active orders, there is still liquidity for users to place bets. Azuro collects fees through smart contracts and periodically settles them to LPs and the protocol treasury. Revenue sources include marginal fees from player bets and profit-sharing for LPs providing liquidity. The Azuro protocol has issued a governance token, AZUR, allowing holders to participate in DAO governance and receive a share of platform fees. However, the low price of AZUR indicates market skepticism regarding its tokenomics and profit prospects.

Additionally, Probable is an upcoming new on-chain prediction market platform jointly incubated by the BNB chain DEX protocol PancakeSwap and YZi Labs. Probable will be exclusively deployed on the BNB Chain, focusing on zero fees and an extremely user-friendly experience to attract widespread user participation. Currently, Probable is still in the preparation stage for launch and is expected to open for public testing soon. The prediction market sector continues to see the emergence of new projects such as Myriad, Predict, TrendleFi, and Hyperstrike.

IV. Risks and Challenges Facing Prediction Markets

Despite the rapid development of prediction markets, as an emerging and unique sector, it still faces numerous risks and challenges:

Regulatory Compliance Risks: The legal gray area is an unavoidable threshold for prediction markets. Even with federal CFTC licensing in the United States, some states and countries still view prediction markets as illegal gambling. For example, although Kalshi has a license, it has faced scrutiny from prosecutors in some states regarding its event contracts violating local anti-gambling regulations. A shift in regulatory direction in the future could significantly impact platform operations. For decentralized platforms, meeting regulatory requirements (such as KYC and restrictions on sensitive event types) without sacrificing trust characteristics is also a challenge.

Insider Trading and Manipulation: Since prediction markets are directly linked to real-world events, there is a risk of being exploited by insider information. Those with undisclosed information can profit by betting in prediction markets, leading to distorted market pricing and unfairness. This poses not only legal risks but also undermines the confidence of ordinary participants. Additionally, the risk of manipulation by large players must be monitored: theoretically, those with substantial funds can create false probabilities by continuously driving up or down contract prices, influencing others' decisions and even media interpretations.

Liquidity Building Challenges: Compared to ordinary token trading with AMM automated market-making, prediction markets are closer to an order book model, requiring active order management and having high volatility in price jumps, which places high demands on market makers. New platforms often struggle to attract sufficient market-making funds, leading to a poor user experience; without liquidity, there is no sustained trading, and consequently, no user retention. The liquidity barrier results in a significant Matthew effect in the industry: leading platforms have ample funds, creating a virtuous cycle, while smaller platforms fall into a vicious cycle of "no liquidity → no users → even less liquidity."

Market Mechanism and Technical Risks: On-chain prediction markets also face technical risks such as smart contract vulnerabilities and oracle attacks. Historically, Augur has encountered market abuse (users creating meaningless markets for arbitrage) and issues with low participation leading to inaccurate oracle results. Nowadays, some platforms use centralized oracles or manual arbitration for results, introducing trust issues that could lead to asset disputes and user losses. Furthermore, high-frequency prediction markets require high-performance support on-chain; if the underlying public chain experiences congestion or failure, it will also impact trading continuity.

Homogeneous Competition and Profit Models: Currently, many new projects essentially replicate the Polymarket or Kalshi model, lacking differentiated selling points, making it easy to fall into homogeneous competition when vying for users. Intense competition forces platforms to offer high subsidies and zero fees, attracting traffic in the short term but not conducive to long-term profitability. In fact, most prediction market platforms are still not profitable, relying on financing to sustain operations. Finding a sustainable profit model without compromising user experience remains a challenge.

V. Outlook for Prediction Markets in 2026: Opportunities and Trends

Despite numerous challenges, the prediction market sector still holds immense opportunities. Looking ahead to 2026, we can foresee the following trends and development directions:

Continued Rapid Growth in Scale, Major Events Catalyzing Markets. The explosion in 2025 may just be the beginning, with the sector expected to continue expanding several times or even tenfold in 2026. This year coincides with several globally significant events: the U.S. midterm elections will take place in November, expected to attract massive betting funds; the 2026 World Cup will be held in the summer, a major global sports event, with platforms like Kalshi already planning related markets, anticipating a surge in sports trading volume at that time. Additionally, the ever-changing global economic situation, Federal Reserve interest rate policies, and breakthroughs in popular technologies could all become focal events, continuously injecting trading momentum into prediction markets.

Increased Industry Consolidation, Oligopolistic Positions Further Solidified. "The strong get stronger" may be the main theme of 2026. Kalshi and Polymarket are likely to continue dominating the market and leverage their resource advantages to expand their moats: Kalshi may seek more traditional financial collaborations, such as launching data products or derivatives based on prediction markets in conjunction with brokerages and asset management institutions; Polymarket may embrace more Web3 ecosystems, such as deep integration with decentralized social platforms and information oracle networks, increasing user stickiness and traffic entry points. Among emerging platforms, Opinion is expected to solidify its position in macro predictions, Limitless to establish a foothold in high-frequency markets, and Probable to rise with traffic from the BNB chain. However, overall, the vast majority of trading volume will still be concentrated in a few leading platforms.

More Mainstream Participants Entering, Cross-Industry Integration Deepening. In 2026, we may see traditional financial and tech giants more actively participating in prediction markets. Coinbase, Robinhood, and others announced their foray into prediction markets in 2025. Some large hedge funds may also attempt to use prediction markets for strategic trading or hedging. Meanwhile, media and data agencies will more frequently cite prediction market data. This cross-industry integration enhances the exposure and credibility of prediction markets while providing platforms with new monetization channels, such as licensing data for third-party use.

Emergence of Innovative Products and Derivatives, Enriching Market Layers. As the industry matures, prediction markets are expected to give rise to various innovative products. For example, data derivatives based on prediction market prices: certain platforms or financial institutions may issue prediction index ETFs, event options, etc., securitizing prediction market results for easier public investment. There are also conceptual information futures and policy-based predictions. In the DeFi space, prediction market result tokens may be used for collateralized lending, yield aggregation, etc., becoming new financial Lego components. In the sports entertainment sector, NFTs or fan tokens may also combine with prediction markets to create new social betting gameplay. These derivative innovations will attract investors with different preferences, further expanding market size.

Deep Integration of AI and Prediction Markets, Enhancing Efficiency. Artificial intelligence technology is expected to be more deeply applied in all aspects of prediction markets in 2026. On one hand, AI can be used for information collection and analysis, helping prediction participants make better decisions. For example, AI bots can gather relevant news and social sentiment online, providing suggestions on the probability of event occurrences for traders' reference. On the other hand, AI will participate more in market making and arbitrage. High-frequency algorithms based on machine learning models can identify pricing discrepancies between prediction markets and traditional markets in real-time for arbitrage, making prices reflect true probabilities more efficiently. Additionally, AI can help improve oracle systems, such as using natural language processing to automatically interpret news event outcomes or detect subtle differences in outcome statements, reducing the need for manual arbitration.

Conclusion

From a marginal academic experiment to a burgeoning market worth hundreds of billions of dollars, the prediction market sector has undergone a remarkable transformation in just a few years. The explosion in 2025 demonstrated the allure of "converging wisdom with money" and revealed the immense potential of financializing information. When thousands of people trade based on their information and judgments, the market prices reflect not just cold numbers but a collective consensus on future realities.

Looking ahead to 2026, with more mature participants and stronger capital driving the sector, prediction markets are poised to reach new heights. Perhaps in the near future, "trading the future with probabilities" will become a common aspect of public investment portfolios. In this sense, prediction markets are not only a hot topic in the crypto world but may also become a significant pillar of future financial markets.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。