Good evening everyone, I am Xin Ya. In the last round, we took a small wave, and many people have solidified their positions a bit. Hmm.

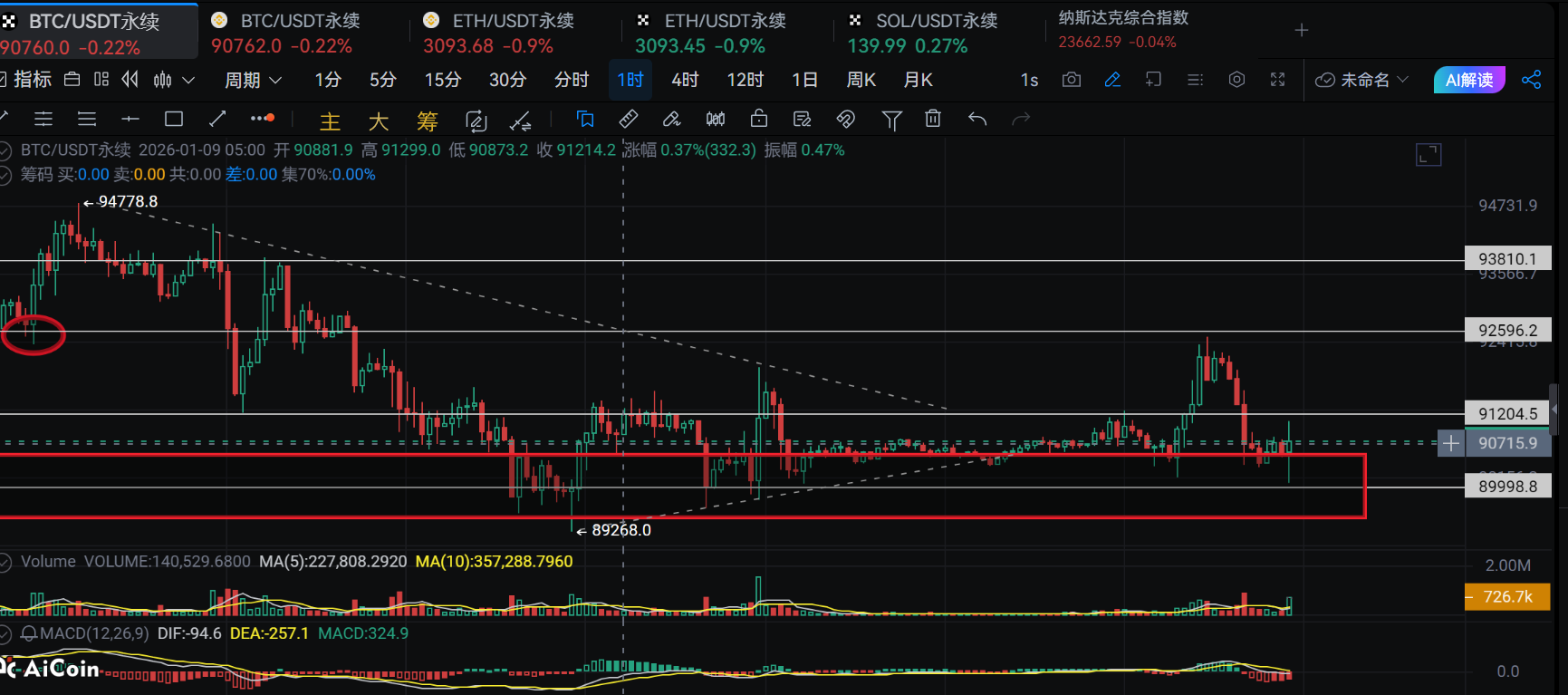

Let's briefly review the recent market situation. There isn't much value in the review. Last Friday, the market rallied, retraced, and consolidated for two days. In the early hours of today, after reaching 91200, it dropped to around 90200 at seven in the morning, then received buying support, and the market reached our previously set expectation of 92500. Consequently, this wave caused the buying positions that entered below 89500 before the 9th to miss out twice. If you have been paying attention to Xin Ya, you should recall that on the 9th, I mentioned that the long positions were being liquidated and the short positions were being taken for profit, and that we should look for a rebound entry in the 89500-90500 range. It seems to align with expectations.

In this market segment, the position of Bitcoin at 91200 has played a role in obstructing and accelerating the market multiple times. It is conceivable that this area will become a new point of divergence in the future. During the operation, buying support was established here, and we need to guard against the possibility of this becoming a turning point. However, the competition is evidently more reasonable.

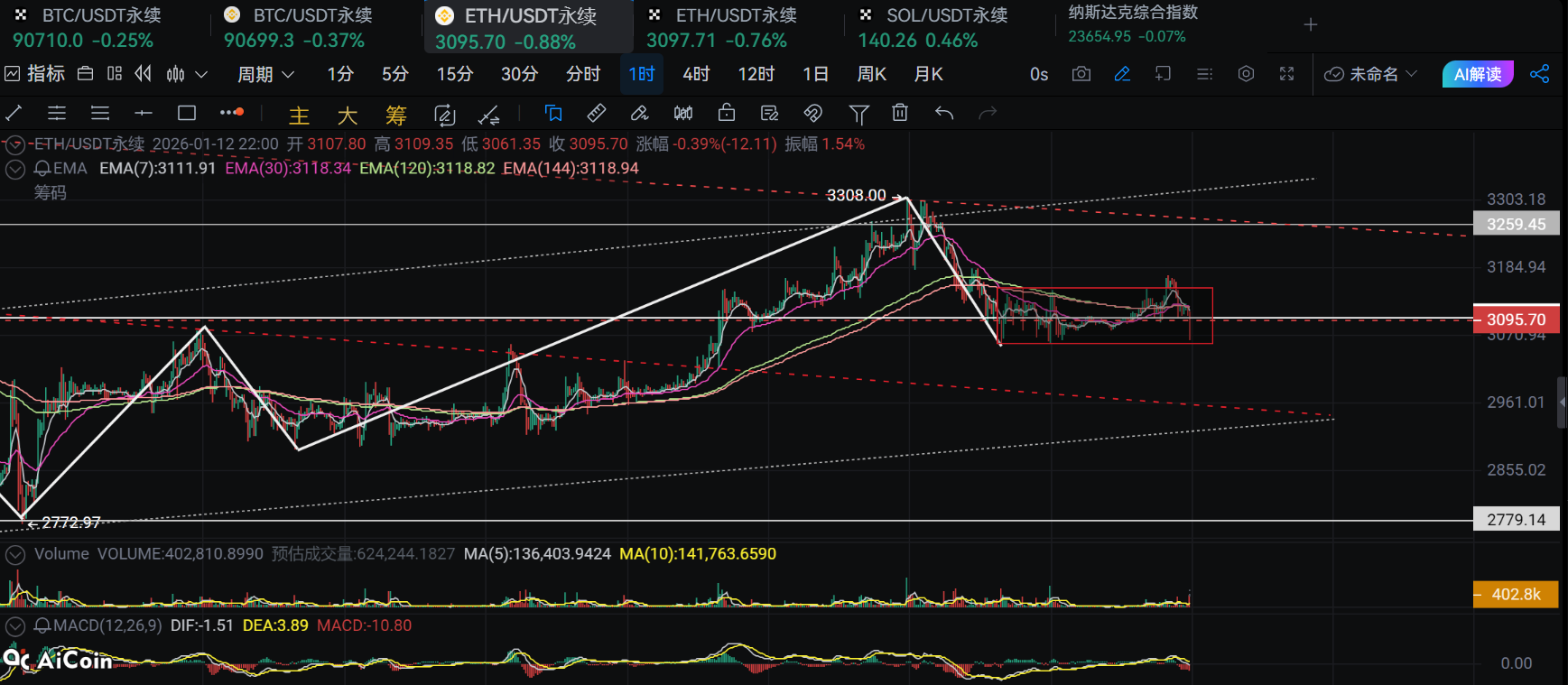

The trend of Ethereum has been consolidating around 3100 since the 9th, oscillating five times between the lower 3050 and upper 3150. There has been no buying support around 3100, indicating that short-term enthusiasts are using 3100 as a base for their trades. The long-term divergence is also present here. At eight o'clock today, the one-hour EMA7, EMA30, and EMA120 all converged at 3120, and after being broken, the selling pressure was amplified. Currently, the four-hour EMA120 and EMA144 are around 3080, and we need to see if the buying support in the 3050-3080 range is strong, as this will directly determine the market direction. During our analysis, Ethereum dipped to around 3065, and we have already taken a long position.

Currently, Bitcoin's one-hour EMA120 and EMA144 are around 91000, while the four-hour ones are around 90200, showing a significant divergence. We should focus on the three important levels of 89500, 90500, and 91200, as well as the market sentiment within this range. We can still look to enter long positions around 89500-90500. In the future, we will see if 92500 will be confirmed or broken again. As for Ethereum, we should focus on the lower range of 3050-3080, and the upper range around 3125. Due to the close proximity of the one-hour and four-hour EMAs, the short-term oscillation and volatility will be quite intense. The focus is on making waves, and conservatively, we can defend and go long at 3080. If it consolidates, we can operate within the already refreshed upper and lower ranges. Bitcoin is between 89500-92000, while Ethereum is between 3050-3150.

The fat year has been locked in. If we move forward together, follow the public account: Xin Ya Talks About Chan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。