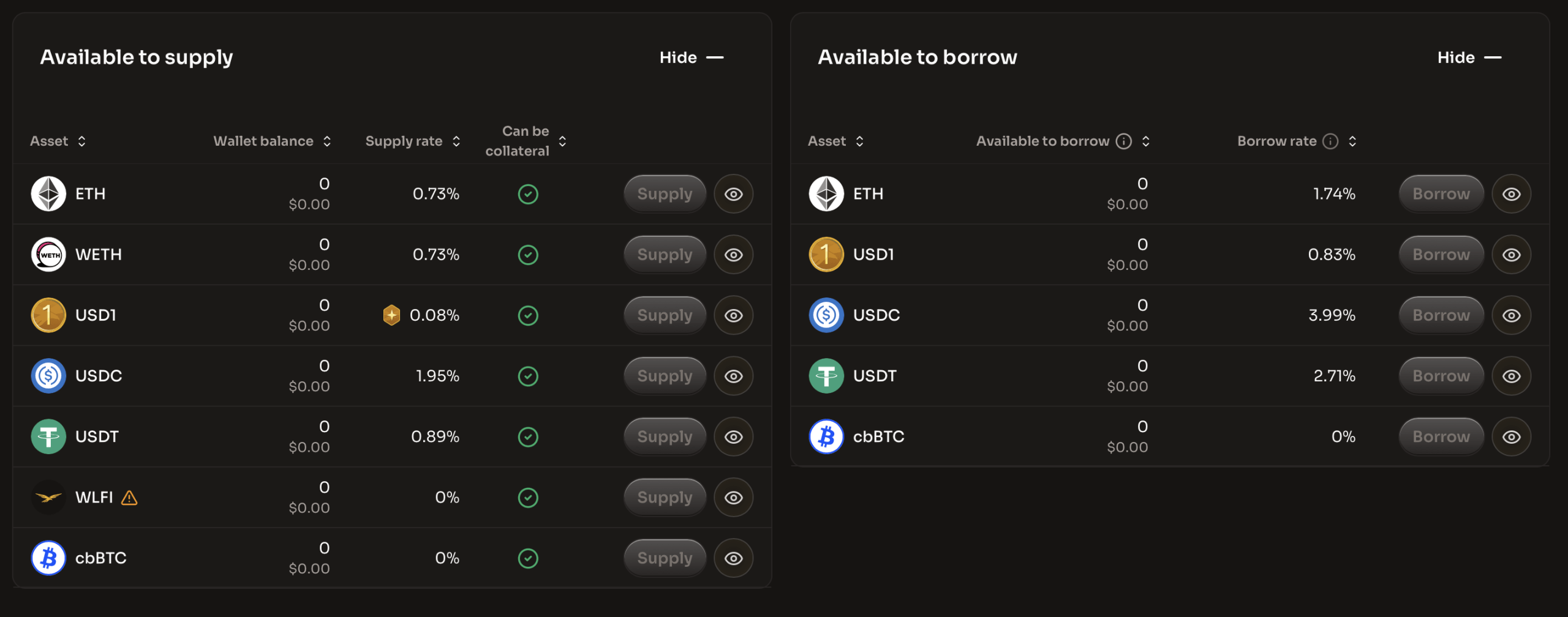

World Liberty Markets marks the second major product release from World Liberty Financial, positioning the platform as a new venue for users seeking onchain credit tools tied to USD1. The web-based application allows users to supply the stablecoin USD1 or post supported collateral to access borrowing services built on Dolomite’s infrastructure.

According to the company, supported collateral at launch includes WLFI, Ethereum’s ether, cbBTC, Circle’s USDC, and Tether’s USDT. The setup places USD1 alongside more established stablecoins in lending markets, a comparison the project appears comfortable inviting.

World Liberty Markets.

World Liberty Financial said USD1 recently passed $3 billion in circulating supply, with trading activity spreading across major exchanges. The launch of World Liberty Markets frames that growth less as a victory lap and more as a test: can the stablecoin hold up when users start putting it to work rather than just moving it around?

World Liberty Financial is led by co-founder Zach Witkoff and members of the Trump family.

The application is live through the company’s website, with a mobile version planned for a later date. World Liberty Markets also incorporates the USD1 Points Program, offering rewards to eligible users who supply the stablecoin, subject to stated terms.

Also read: Bitmine Expands Ethereum Treasury to 4.16M Tokens as Holdings Reach $14B

Company leadership described the rollout as the first step in a broader roadmap that includes tokenized real-world assets, expanded on- and off-ramps, and card-based spending options. Those ideas remain aspirational for now, but World Liberty Markets represents a concrete move from concept to functionality.

“A year ago, we set out to build a stablecoin that could compete with the biggest names in crypto, and USD1 has exceeded every expectation,” Zak Folkman, the co-founder and COO of World Liberty Financial remarked on Monday.

The executive added:

“Now we’re giving USD1 users access to even more ways to put their stablecoins to work. World Liberty Markets is a major step forward, and it’s just the first of many products we’re planning to roll out over the next 18 months.”

World Liberty Financial operates within decentralized finance ( defi), a sector known for fast iteration and even faster scrutiny. With World Liberty Markets now live, the focus shifts from announcements to execution—and whether USD1 can compete in the practical, less forgiving world of onchain credit.

- What is World Liberty Markets?

It is a web-based lending and borrowing platform launched by World Liberty Financial. - How does USD1 work on the platform?

USD1 can be supplied or borrowed using Dolomite’s lending infrastructure. - Which assets are supported as collateral?

Supported assets include WLFI, ETH, cbBTC, USDC, and USDT. - Is World Liberty Markets available now?

Yes, the platform is live as a web application.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。