From "Having Money" to "Having Strategy"

If you have ever opened a position on Hyperliquid, you may have encountered a problem:

It's easy to make small profits on Hyperliquid, but it's hard to figure out how to make big money.

Why?

Because Hyperliquid gives you:

✅ 0.07 seconds execution speed

✅ Zero gas transaction fees

✅ 50x leverage

✅ Completely on-chain transparent data

But it does not give you:

❌ A money-making strategy

❌ A data analysis tool

❌ A risk management framework

❌ Community guidance

This is why many people feel anxious after trading on Hyperliquid just once: how can they make more money faster!

They have the best DEX trading platform but lack the best methods.

1. Why is data-driven trading important?

Problem: The Consequences of Trading by Instinct

Suppose you see BTC drop from $95,000 to $94,000, and your intuition tells you, "This is the bottom; I should buy."

So you:

- Open Hyperliquid

- Open a 10x long position

- Buy 1 BTC

Then what?

BTC continues to drop to $93,000, and your account loses $10,000.

Your intuition was wrong.

Solution: Let Data Speak

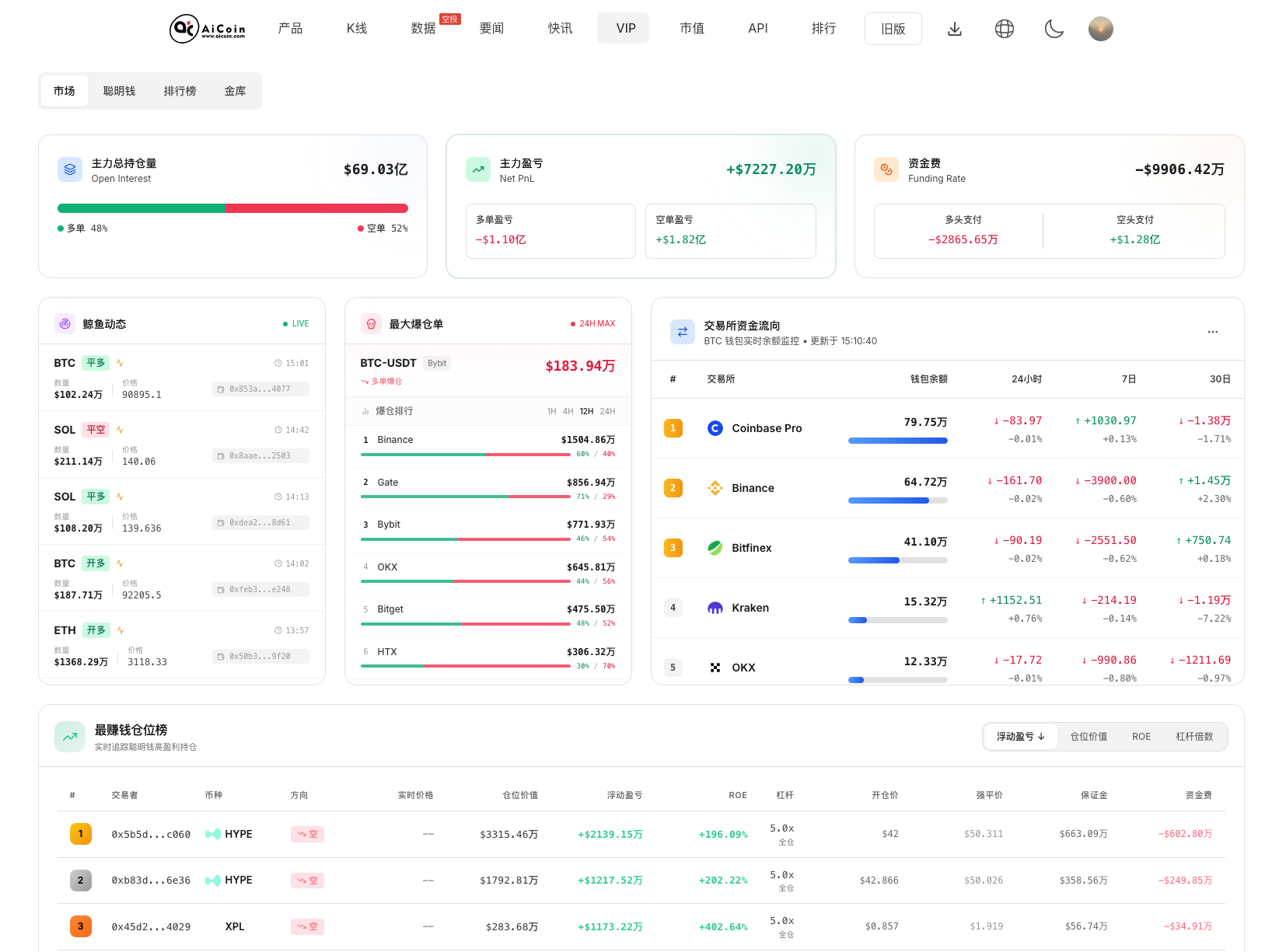

If you had checked AiCoin's data before placing the order, you would see:

- Large holders are continuously selling (capital flow is negative)

- The sentiment in the chatroom is panic (sentiment index is negative)

- The liquidation risk is very high (liquidation price levels are dense)

- Market bottom signals have not yet appeared (technical indicators have not reversed)

This way, you wouldn't place an order based on instinct but rather make decisions based on data.

The core of data-driven trading: Replace feelings with facts.

2. The Complete Loop of AiCoin Data + Hyperliquid Trading

The 4 Steps of the Loop

AiCoin Discovers Opportunities → Hyperliquid Executes Quickly → On-Chain Data Feedback → Optimize Strategy

Exclusive link for 4% trading cost reduction on Hyperliquid:

https://app.hyperliquid.xyz/join/AICOIN88

Step 1: AiCoin Discovers Opportunities

Key data provided by AiCoin:

1. Large Holder Movements

- Which coins large holders are buying

- Which coins large holders are selling

- Average holding cost of large holders

- Real-time profit and loss situation of large holders

2. Market Sentiment

- News alerts for whale data

- Real-time discussions in the chatroom

3. Capital Flow

- Market position situation

- Capital flow of exchanges

- Largest liquidation order data

- Whale dynamics

4. Technical Data

- Funding rates

- Distribution of profitable positions

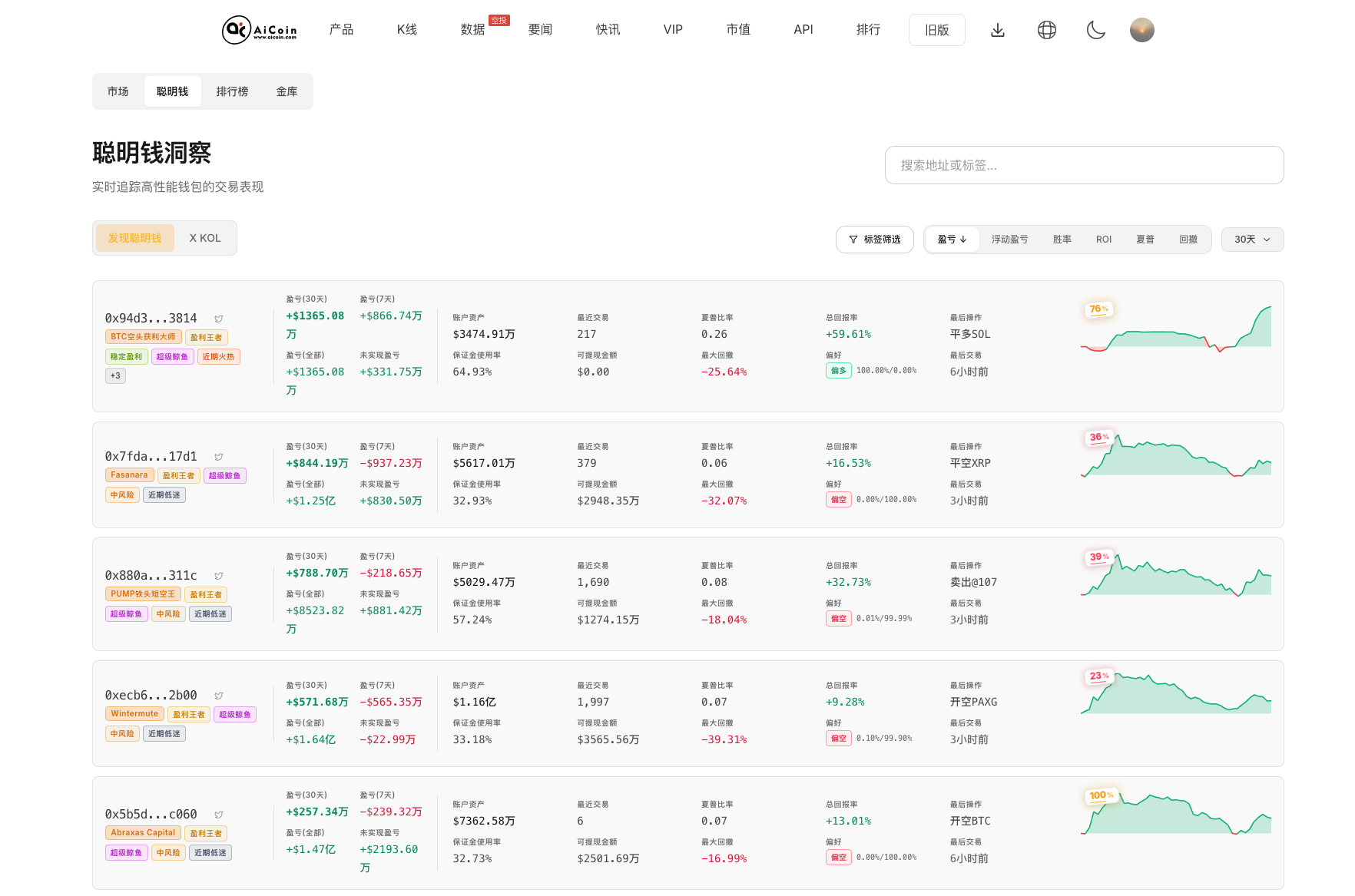

- Performance of smart money

How to Use This Data?

Scenario 1: Discover Arbitrage Opportunities

- AiCoin shows: BTC is $95,000 on Binance, $94,950 on Hyperliquid

- Your decision: Buy on Hyperliquid, sell on Binance

- Profit: $50 × leverage = profit earned in seconds

Scenario 2: Discover Trend Reversals

- AiCoin shows: Large holders start buying, sentiment index turns positive, technical indicators show reversal signals

- Your decision: Open a long position on Hyperliquid

- Profit: Follow the direction of large holders to gain trend profits

Scenario 3: Discover Risk Signals

- AiCoin shows: High liquidation risk, chatroom filled with panic, large holders are selling

- Your decision: Reduce leverage or close positions

- Profit: Avoid liquidation, protect principal

Step 2: Hyperliquid Executes Quickly

Once AiCoin discovers an opportunity, you need to execute quickly on Hyperliquid.

Why is speed important?

Suppose AiCoin discovers an arbitrage opportunity (Binance $95,000 vs Hyperliquid $94,950).

If it takes you 5 seconds to execute (like on Binance), then:

- The price may have changed in those 5 seconds

- The arbitrage opportunity may have disappeared

- You may incur losses

But on Hyperliquid, you only need 0.07 seconds:

- The price remains virtually unchanged

- The arbitrage opportunity is fully captured

- You achieve the expected profit

This is why the speed of Hyperliquid is important.

Step 3: On-Chain Data Feedback

After executing the trade, Hyperliquid's on-chain data provides real-time feedback:

You can see:

- Whether your order was filled

- Your execution price

- Your slippage

- Your position status

- The market's real-time reaction

This data helps you:

- Validate whether your strategy is effective

- Adjust your risk management

- Optimize your next trade

- Learn the market's patterns

Step 4: Optimize Strategy

Based on the feedback from on-chain data, you can optimize your strategy:

If the strategy is effective:

- Scale up trading size

- Increase trading frequency

- Optimize entry and exit points

If the strategy is ineffective:

- Adjust trading logic

- Change risk parameters

- Try new strategies

3. 5 Advanced Trading Strategies

Strategy 1: Arbitrage Trading

Principle: Profit from price differences between different exchanges

Application on Hyperliquid:

1. CEX vs DEX Arbitrage

- Monitor prices on CEXs like Binance, OKX

- Compare with Hyperliquid's prices

- Execute arbitrage when price difference > fees

2. Trading Pair Arbitrage

- For example: Price difference between BTC-USDC and BTC-USDT

- Go long and short simultaneously on Hyperliquid

- Profit from the price difference

3. Futures and Spot Arbitrage

- Go long on Hyperliquid perpetual contracts

- Go short on the spot market (or vice versa)

- Profit from the basis

Specific Case (Theoretical Simulation):

Time: January 9, 2026, 10:00 AM

Binance BTC Price: $95,000

Hyperliquid BTC Price: $94,950

Price Difference: $50

Your actions:

- Buy 1 BTC on Hyperliquid (cost $94,950)

- Sell 1 BTC on Binance (revenue $95,000)

- Profit: $50 - fees = $40

Time Cost: 5 seconds

Capital Return Rate: 0.09% / 5 seconds = Annualized 5,700%

Risk Management:

- Only execute when price difference > fees

- Monitor liquidity on both exchanges

- Close positions quickly, do not hold overnight

Strategy 2: Market Making

Principle: Earn the bid-ask spread by placing buy and sell orders on the order book simultaneously

Application on Hyperliquid:

Hyperliquid's features are very suitable for market making:

✅ Zero gas fees (no fees for each order)

✅ Completely on-chain order book (can see all orders)

✅ High liquidity (good depth of trading pairs)

✅ Fast execution (orders filled immediately)

Specific Operations:

Assuming the current price of BTC is $95,000

Your actions:

- Place a buy order: $94,990 (price $10 lower)

- Place a sell order: $95,010 (price $10 higher)

- Wait for execution

When the buy order is filled:

- You buy 1 BTC at $94,990

- Wait for the sell order to be filled

- When the sell order is filled, you sell 1 BTC at $95,010

- Profit: $20 - fees = $15

If you execute 100 trades a day:

- Daily profit: $15 × 100 = $1,500

- Monthly profit: $1,500 × 30 = $45,000

- Annual profit: $45,000 × 12 = $540,000

Risk Management:

- Do not place orders too far away (insufficient liquidity)

- Monitor market volatility (quickly adjust prices)

- Set maximum position limits

- Regularly close positions, do not overhold

Strategy 3: Trend Following

Principle: Identify market trends and follow large holders and market sentiment

Application on Hyperliquid:

Step 1: Identify Trends with AiCoin

- Are large holders continuously buying or selling?

- Is market sentiment FOMO or panic?

- Have technical indicators shown reversal signals?

- Have key price levels been broken?

Step 2: Execute on Hyperliquid

- If the trend is upward: open a long position

- If the trend is downward: open a short position

- Use appropriate leverage (5-10x)

- Set stop-loss and take-profit

Specific Case (Theoretical Simulation):

Time: January 9, 2026

AiCoin data shows:

- Large holders are continuously buying BTC (capital flow is positive)

- Chatroom sentiment turns positive (sentiment index +60)

- BTC breaks the key price level of $94,000

- Technical indicators show reversal signals

Your decision:

- Open a 5x long position on Hyperliquid

- Buy 2 BTC (cost $94,500)

- Set stop-loss: $93,500

- Set take-profit: $96,000

Results:

- BTC rises to $96,000

- Your take-profit is triggered

- Profit: ($96,000 - $94,500) × 2 × 5 = $15,000

Risk Management:

- Only enter when the trend is clear

- Use stop-loss to protect principal

- Build positions in batches, do not go all in at once

- Regularly check stop-loss positions

Strategy 4: Hedging

Principle: Hedge risks by opening positions in different directions

Application on Hyperliquid:

Scenario 1: Protecting Spot Positions

Suppose you hold 10 BTC in spot on Binance, but you are worried about a short-term drop.

You can hedge with a short position on Hyperliquid:

Open a 10x short position on Hyperliquid (sell 1 BTC)

If BTC drops by $1,000:

Spot loss: $10,000

Short profit: $10,000

Total profit and loss: 0 (fully hedged)

Scenario 2: Locking in Profits

Suppose you have opened a 5x long position on Hyperliquid and have made a profit of $10,000.

But you do not want to close the position (because you are optimistic about the future) and want to lock in profits.

You can:

- Open a reverse short position on Hyperliquid (1x)

- Lock in existing profits

- Continue holding the long position

Risk Management:

- The hedging ratio must be accurate

- Monitor the funding rates of both positions

- Regularly adjust the hedging ratio

- Do not over-hedge

Strategy 5: Grid Trading

Principle: Automatically buy and sell within a certain price range to earn multiple price differences

Application on Hyperliquid:

Setup:

- Price range: $94,000 - $96,000

- Number of grids: 10

- Price difference for each grid: $200

Operations:

- Buy 1 BTC at $94,000

- Sell 1 BTC at $94,200, buy 1 BTC

- Sell 1 BTC at $94,400, buy 1 BTC

- …and so on…

- Sell 1 BTC at $96,000

Profit Calculation:

- Profit for each grid: $200 - fees = $190

- Total number of grids: 10

- Total profit: $190 × 10 = $1,900

Advantages:

✅ Automated trading (no manual operation needed)

✅ Multiple profits (each grid earns)

✅ Risk diversification (spread entry and exit)

✅ Suitable for ranging markets

Risk Management:

- Use only in ranging markets

- Set reasonable grid ranges

- Monitor if the price breaks the range

- Regularly adjust grid parameters

4. How to Avoid Common Trading Mistakes

Mistake 1: Over-Leveraging

Problem: Trading with 50x leverage

Account balance: $10,000

Leverage: 50x

Trade amount: $500,000

If the price drops by 0.2%:

- Loss: $500,000 × 0.2% = $1,000

- Account remaining: $9,000

If the price drops by 2%:

- Loss: $500,000 × 2% = $10,000

- Account remaining: $0 (liquidation)

Solution:

- Beginners: 1-5x leverage

- Intermediate: 5-10x leverage

- Professional: 10-20x leverage

- Extreme: 20-50x leverage (for professional traders only)

Mistake 2: Ignoring Funding Rates

Problem: Holding positions overnight, profits eaten by funding rates

Your long position: 1 BTC

Holding time: 24 hours

Funding rate: 0.01% / hour

Funding cost: 1 BTC × $45,000 × 0.01% × 24 = $108

If your profit is only $100, then you actually lost $8

Solution:

- Monitor funding rates

- If rates are too high, consider closing positions

- Choose trading pairs with low rates

- Avoid long-term holdings

Mistake 3: No Stop-Loss

Problem: Hoping for a price rebound, ends up being liquidated

Your long position: 10x leverage, 1 BTC

Entry price: $95,000

Account balance: $10,000

If there is no stop-loss and the price drops to $94,500:

Loss: $500 × 10 = $5,000

Account remaining: $5,000

If it continues to drop to $94,000:

Loss: $1,000 × 10 = $10,000

Account remaining: $0 (liquidation)

Solution:

- Always set a stop-loss

- Stop-loss position = account risk ÷ leverage

- Do not move the stop-loss

- Regularly check stop-loss

Mistake 4: Chasing Highs and Selling Lows

Problem: Buying high when seeing prices rise, selling low when seeing prices drop

BTC rises from $94,000 to $95,000

You see the rise and chase to buy

Result: BTC drops back to $94,500

You incur a loss

Solution:

- Confirm trends with AiCoin data

- Do not chase highs based on feelings

- Wait for a pullback before entering

- Build positions in batches

Mistake 5: Over-Trading

Problem: Frequent trading, profits eaten by fees

You trade 100 times a day

Each trade fee: $95,000 × 0.025% = $11.25

Daily fees: $11.25 × 100 = $1,125

Monthly fees: $1,125 × 30 = $33,750

If your monthly profit is only $30,000, then you actually lost $3,750

Solution:

- Reduce trading frequency

- Focus on high win-rate trades

- Calculate the cost-benefit ratio of trades

- Do not over-trade

5. Optimize Trading with AiCoin Data

How to Use AiCoin's Large Holder Tracking

Function: Real-time display of large holder position changes

Application Scenarios:

1. Confirm Trends

- If large holders are continuously buying, the trend is upward

- If large holders are continuously selling, the trend is downward

2. Discover Opportunities

- Large holders starting to buy = possible bottom

- Large holders starting to sell = possible top

3. Risk Warnings

- Large holders selling = possible risk

- Large holders building positions = possible opportunity

Specific Usage:

Step 1: Open AiCoin's "Smart Money Tracking"

Step 2: Check the movements of large holders in the last 24 hours

Step 3: If large holders are buying, consider opening a long position on Hyperliquid

Step 4: If large holders are selling, consider opening a short position on Hyperliquid or closing positions

Step 5: Set stop-loss and take-profit

Step 6: Execute the trade

6. Case Analysis

Case 1: Earning $1,000 through Arbitrage

Background:

Time: January 8, 2026

Trader: Zhang San (Intermediate Trader)

Initial Capital: $50,000

Process:

10:00 AM

AiCoin shows: BTC at Binance $95,000, at Hyperliquid $94,950

Price difference: $50, greater than the fee of $10

Zhang San decides to execute the arbitrage

10:00:30 AM

Buys 2 BTC on Hyperliquid (cost $89,900)

Sells 2 BTC on Binance (revenue $90,000)

Profit: $100 - fee $20 = $80

10:01 AM

Arbitrage completed

Funds return to initial state

Pure profit: $80

Executing 10 similar arbitrages in a day:

Daily profit: $80 × 10 = $800

Monthly profit: $800 × 20 = $16,000

Annual profit: $16,000 × 12 = $192,000

Annualized return: 192,000 ÷ 50,000 = 384%

Key Points:

✅ Low risk (the price difference between the two exchanges is basically locked)

✅ Fast execution (Hyperliquid's speed advantage)

✅ Continuous profit (opportunities every day)

Case 2: Earning $5,000 through Trend Following

Background:

Time: January 1 to January 8, 2025

Trader: Li Si (Advanced Trader)

Initial Capital: $50,000

Process (Theoretical Example):

January 1, 10:00 AM

AiCoin shows: Large holders continuously buying, sentiment index +50

Technical indicators show reversal signals

BTC breaks the key price level of $93,000

Li Si decides to open a long position

January 1, 10:30 AM

Opens a 5x long position on Hyperliquid

Buys 5 BTC (cost $215,000)

Sets stop-loss: $92,000

Sets take-profit: $96,000

January 1 to January 8

BTC rises from $93,000 to $96,000

Li Si's take-profit is triggered

Profit: ($96,000 - $93,000) × 5 × 5 = $75,000

But Li Si only used $50,000 of principal:

Actual profit: $75,000 - Initial capital $50,000 = $25,000

But this is not the correct calculation method

Correct Calculation:

Initial capital: $50,000

Leverage: 5x

Trade amount: $250,000

Price change: $3,000

Profit: $250,000 × ($3,000 ÷ $43,000) = $17,442

Minus fees: $17,442 - $500 = $16,942

Annualized return: 16,942 ÷ 50,000 = 33.88% (7 days)

Key Points:

✅ Confirm trends with data

✅ Use leverage wisely

✅ Set stop-loss and take-profit

✅ Continuous profit

7. Daily Routine of Advanced Traders

8:00 AM - Market Analysis

1. Open AiCoin and check the data from the past 24 hours

Large holder movements: Are there any large buys/sells?

Funding rates: What is the sentiment index?

Liquidation data: What is the liquidation risk level?

Hot topics: What is the market discussing?

2. Check on-chain data from Hyperliquid

Position distribution: Where are large holders positioned?

Funding rates: Are the rates too high?

Order book depth: Is liquidity sufficient?

24h trading volume: How active is trading?

3. Develop today's trading plan

What is the main trend today?

What trading opportunities are there?

What is the risk level?

How much leverage should be used?

9:00 AM - Looking for Trading Opportunities

1. Monitor arbitrage opportunities

Regularly check the price difference between Binance and Hyperliquid

Execute immediately when the price difference > fees

2. Monitor trend signals

Are large holders starting to build positions?

Is sentiment starting to change?

Are technical indicators showing reversals?

3. Monitor risk signals

Is the liquidation risk increasing?

Are large holders starting to sell?

Is sentiment becoming extreme?

2:00 PM - Trade Execution

1. Execute high-probability trades

Based on trades confirmed by AiCoin data

Set stop-loss and take-profit

Use reasonable leverage

2. Monitor positions

View profit and loss in real-time

Check if stop-loss has been triggered

Adjust take-profit position (if needed)

3. Record trades

Record entry points and reasons

Record exit points and results

Analyze the success and failure of trades

6:00 PM - Summary and Optimization

1. Review today's trades

Which trades were successful?

Which trades failed?

Why were they successful or failed?

2. Analyze the market

What was the main trend today?

What new opportunities have emerged?

What new risks have appeared?

3. Optimize strategies

Do you need to adjust leverage?

Do you need to change stop-loss positions?

Do you need to try new strategies?

4. Prepare for tomorrow

What are the main focuses for tomorrow?

What important economic data is there?

What important market events are there?

8. Progression Route from Novice to Professional

Month 1: Learn the Basics

Goal: Understand the basic operations and risks of Hyperliquid

Tasks:

✅ Complete your first trade (refer to AiCoin's guidance)

✅ Learn about leverage and risk management

✅ Experience different trading pairs

✅ Go through a loss (this is important!)

Key Metrics:

- Number of trades: > 50

- Win rate: > 40%

- Maximum drawdown: < 30%

Month 2: Learn Data Analysis

Goal: Learn to use AiCoin's data for trading decisions

Tasks:

✅ Learn AiCoin's smart tracking

✅ Learn AiCoin's market analysis

✅ Learn AiCoin's liquidation data analysis

✅ Make 10 trades using data

Key Metrics:

- Win rate: > 50%

- Average return: > 0.5%

- Maximum drawdown: < 20%

Month 3: Learn Trading Strategies

Goal: Master at least 2 trading strategies

Tasks:

✅ Learn arbitrage trading

✅ Learn trend following

✅ Learn risk management

✅ Practice 20 trades

Key Metrics:

- Win rate: > 55%

- Average return: > 1%

- Monthly return: > 5%

Month 4: Optimize and Scale

Goal: Stabilize profits and scale trading

Tasks:

✅ Optimize your best strategy

✅ Increase trading capital

✅ Try new trading pairs

✅ Build your own trading system

Key Metrics:

- Win rate: > 60%

- Average return: > 1.5%

- Monthly return: > 10%

Summary: 3 Key Points to Become an Advanced Trader on Hyperliquid

Key 1: Use Data Instead of Feelings

Do not trade based on intuition. Use AiCoin's data to confirm your trading decisions.

Key 2: Leverage Hyperliquid's Speed Advantage

Hyperliquid's 0.07-second execution speed is its greatest advantage. Use this advantage to capture opportunities that other exchanges cannot.

Key 3: Use Risk Management to Protect Capital

Even the best strategies can incur losses. Always set stop-losses and always control risk.

Next Steps: Start Your Advanced Trading Journey

Now that you understand Hyperliquid's advanced trading strategies.

It's time to start practicing.

Step 1: Register on Hyperliquid with the invitation code AICOIN88

Link:

https://app.hyperliquid.xyz/join/AICOIN88

Enjoy a 4% trading fee discount

Step 2: Join AiCoin's trader community

Telegram: t.me/aicoincn

Chatroom:

https://aicoin.com/link/chat?cid=l61eM4owQ

Exchange experiences with 1000+ traders

Step 3: Start your first data-driven trade

- Open AiCoin to view data

- Execute trades on Hyperliquid

- Record your results and learnings

Step 4: Continue learning and optimizing

- Analyze your trades daily

- Optimize your strategies weekly

- Improve your returns monthly

Most Important: Links!

Highlight 1: AiCoin's On-Chain Data Analysis Dashboard

Link:

https://www.aicoin.com/zh-Hans/hyperliquid

Highlight 2: Exclusive Benefit of 4% Trading Cost Reduction on Hyperliquid

Link:

https://app.hyperliquid.xyz/join/AICOIN88

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。