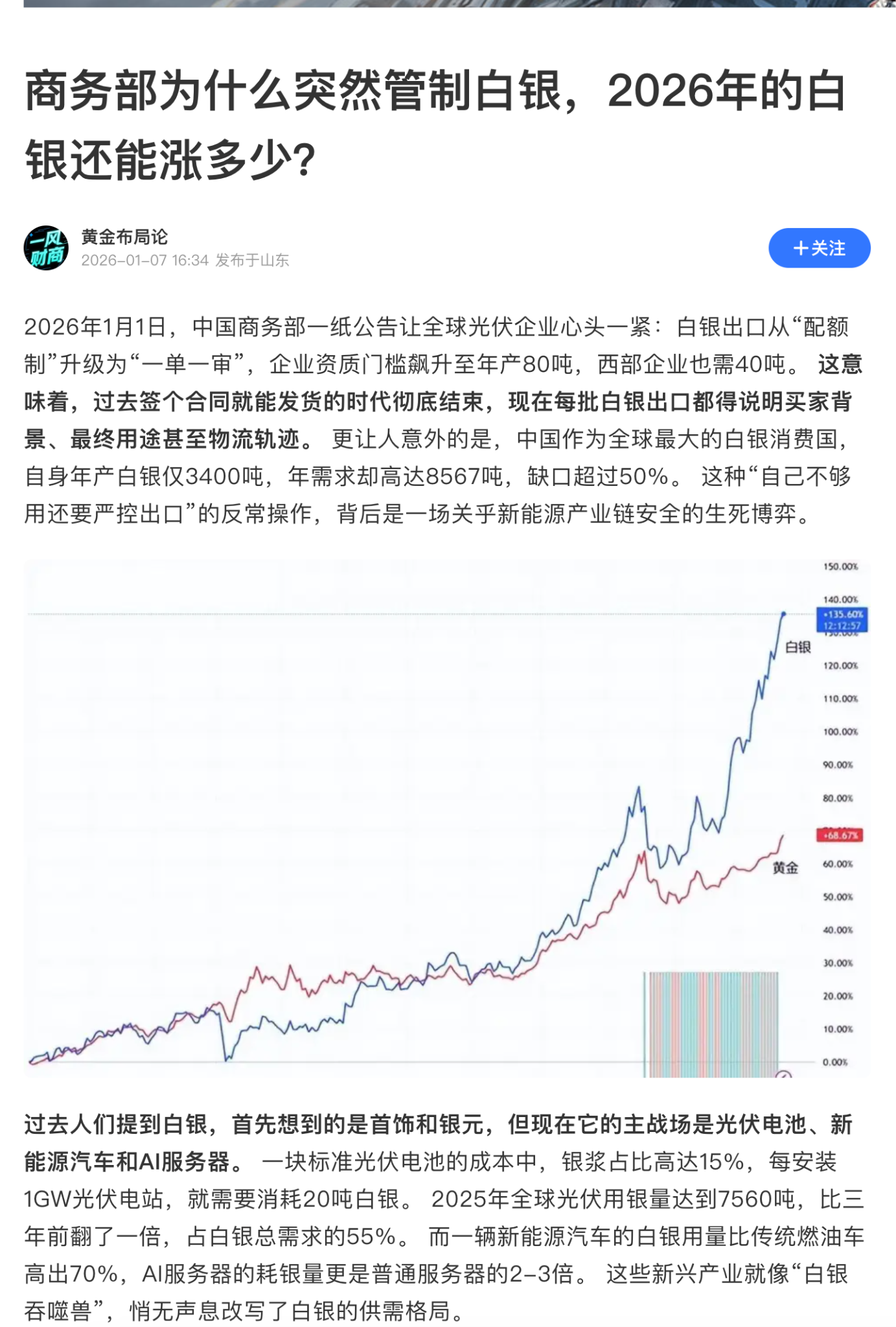

Recently, a silver frenzy has swept through global markets. Driven by high inflation expectations, surging industrial demand, and geopolitical uncertainties, silver prices have skyrocketed, breaking through multi-year highs and becoming a "star asset" in the eyes of investors. However, for the tech giants at the forefront of innovation, this silver feast is turning into a "nightmare" of production, potentially leaving the world's richest man, Elon Musk, in a state of panic, as even with vast wealth, he faces the dilemma of having no silver to buy.

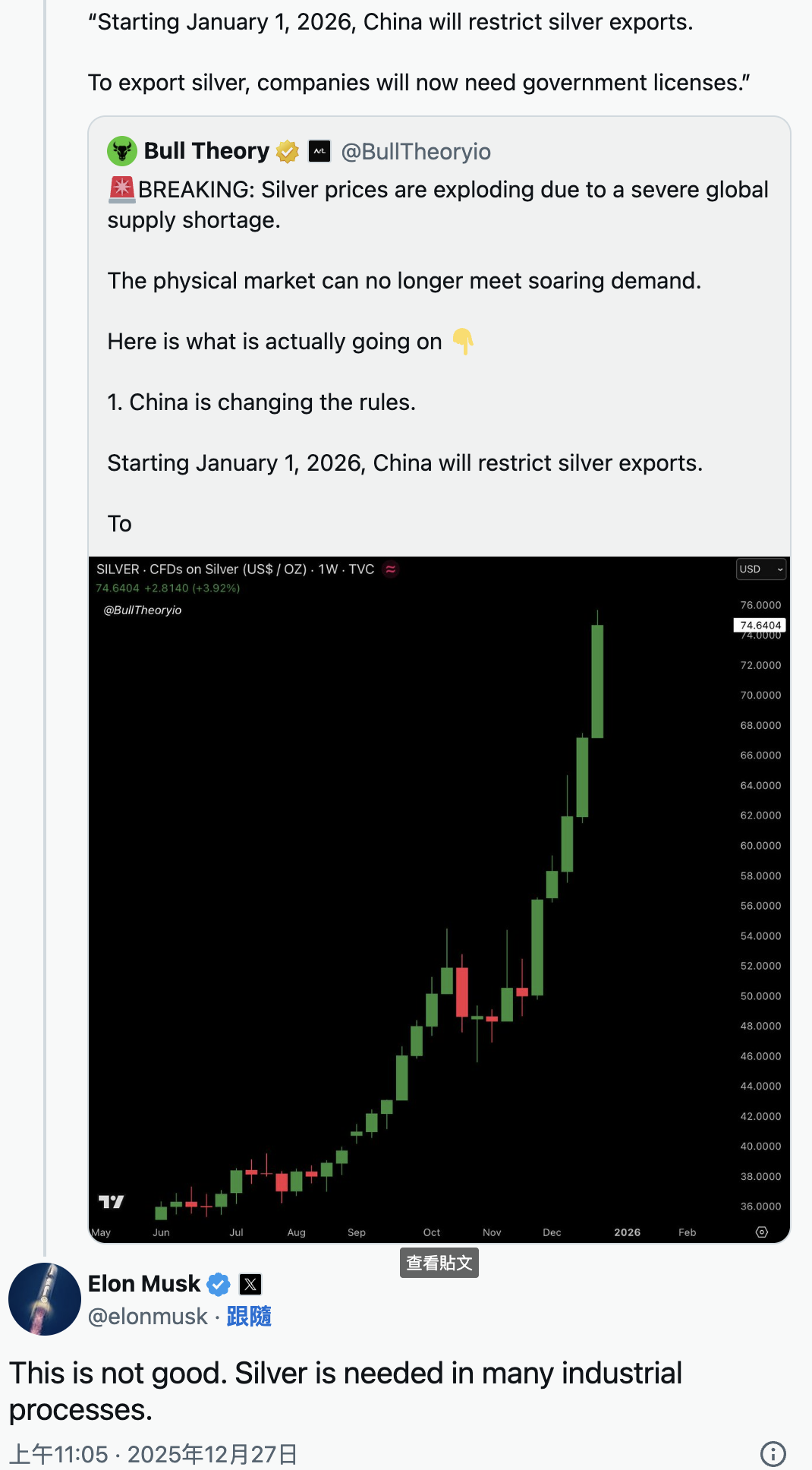

Silver Prices Break $80, Musk's "This is Bad" Alarm

When silver prices broke the $80 mark, Elon Musk's warning of "this is bad" revealed the deep-seated anxiety among tech giants. The core issue is not just rising costs, but extreme concern over a potential "physical meltdown" of the global silver supply chain. Particularly alarming are rumors that China may implement strict silver export controls in 2026, sending shivers through Western financial markets, as this could lead to "paper silver" in London and New York ultimately being unable to be redeemed for physical silver, directly impacting the global industrial chain.

The Lifeblood of Industry: The Irreplaceability of Silver and Cognitive Misconceptions

Silver, known as the best conductor of electricity on Earth, holds an irreplaceable position in the low-pressure, high-frequency miniaturized electronics field. Its excellent properties mean that in high-tech products such as electric vehicles (for example, the Tesla Model Y uses 25-50 grams of silver, double that of traditional gasoline vehicles) and AI servers (high-speed connectors require silver plating, using three times the amount of traditional servers), silver is an essential material. Although copper, aluminum, and others have attempted to replace it, they lead to increased resistance, signal delays, and other issues that severely affect product performance, resulting in a rigid demand for silver from tech giants.

"Byproduct Curse": Structural Dilemmas on the Supply Side

Unfortunately, over 70% of the world's silver is a byproduct of lead, zinc, copper, and gold mining. This means that silver production primarily depends on the prices of the main metals rather than the price of silver itself. When copper prices fall and mining companies reduce output, even if silver prices soar, it cannot stimulate a simultaneous increase in silver production, leading to extremely low supply elasticity. Compounding the issue, global copper ore grades are expected to continue declining by 2025, along with increasingly stringent environmental regulations, further limiting silver output.

Inventory Crisis: Huge Price Differences Between Eastern and Western Markets

The shortage of physical silver has become evident globally. Currently, the silver price on the Shanghai Gold Exchange is $5 higher than in London and New York, leading to a continuous flow of physical silver from the West to the East. The London Bullion Market Association (LBMA) silver leasing market has become illiquid, with reports that all requests for lease extensions expiring in the next two weeks have been denied. Meanwhile, New York's silver inventory also faces the risk of freezing due to national security reviews, further exacerbating the physical shortage crisis.

Wall Street's "Strangulation" Fails: Giants' "Cost No Object" Approach

In the face of soaring silver prices, Wall Street seems to be trying the same old tricks, attempting to suppress silver prices by raising margin requirements (such as at the Chicago Mercantile Exchange), mimicking the strategy used to strangle the Hunt brothers in 1980. However, this time is different. Wall Street's opponents are no longer speculators but industrial giants like Musk and Jensen Huang. These giants are not sensitive to margin costs; they are more concerned about supply chain security and the continuous operation of production lines. For them, a rise in silver prices from $30 to $80 has a negligible impact on final product costs; however, if silver supply is cut off, daily production losses could reach hundreds of millions of dollars. Therefore, they are willing to spend whatever it takes to stock up, further intensifying market panic and silver scarcity.

Retail Investors Enter the Scene: Physical Hoarding Intensifies Liquidity Crisis

In this silver frenzy, retail investors have also played a significant role. Faced with uncertainty in the financial markets, more and more ordinary investors are turning to hoarding physical silver bars. For instance, some truck drivers have sold their U.S. stocks and cryptocurrencies to buy silver bars, hiding them at home. Metal detectors on Amazon have sold out, and Canadian retail stores have even seen people using suitcases to carry silver bars, reflecting a trend of retail investors "de-financializing" and hoarding, leading to a significant amount of silver exiting the circulation market and further exacerbating liquidity depletion.

Investment Advice and Risk Warnings

In light of the complex situation in the silver market, investors should adopt a "fortress strategy": de-leverage, embrace physical silver bars or ETFs that are 100% backed by physical silver, to implement a hoarding strategy in response to long-term demand while ignoring short-term fluctuations. At the same time, they can also consider a "riding strategy," choosing mining stocks with real mines (such as Hecla Mining, Coeur Mining) to leverage profits from rising silver prices, but should avoid high leverage and exploration-stage mining companies.

However, risks still exist. Excessively high silver prices may force the accelerated research and application of de-silvering technologies (such as nano-copper and graphene alternatives), which could impact long-term silver demand. Additionally, silver prices are highly volatile (usually 2-3 times that of gold), and investors should be wary of technical backlash and the risk of leveraged liquidation.

This silver crisis not only tests the adaptability of tech giants but also serves as a reminder to the global economy that while pursuing cutting-edge technology, the strategic importance of basic raw materials must not be overlooked. Musk's "nightmare" reveals the deep vulnerabilities in the global industrial chain.

The above information is compiled from online sources and does not represent official investment advice.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。