Bitcoin broke through the $96,000 mark in trading this morning, leading to the strongest rally in the cryptocurrency market since the beginning of 2026.

In this frenzy, privacy coins led by DASH surged by 45%, while Bitcoin ecosystem inscription tokens like ORDI and SATS saw increases of over 26%, becoming the most prominent sectors in this round of growth.

1. Market Overview

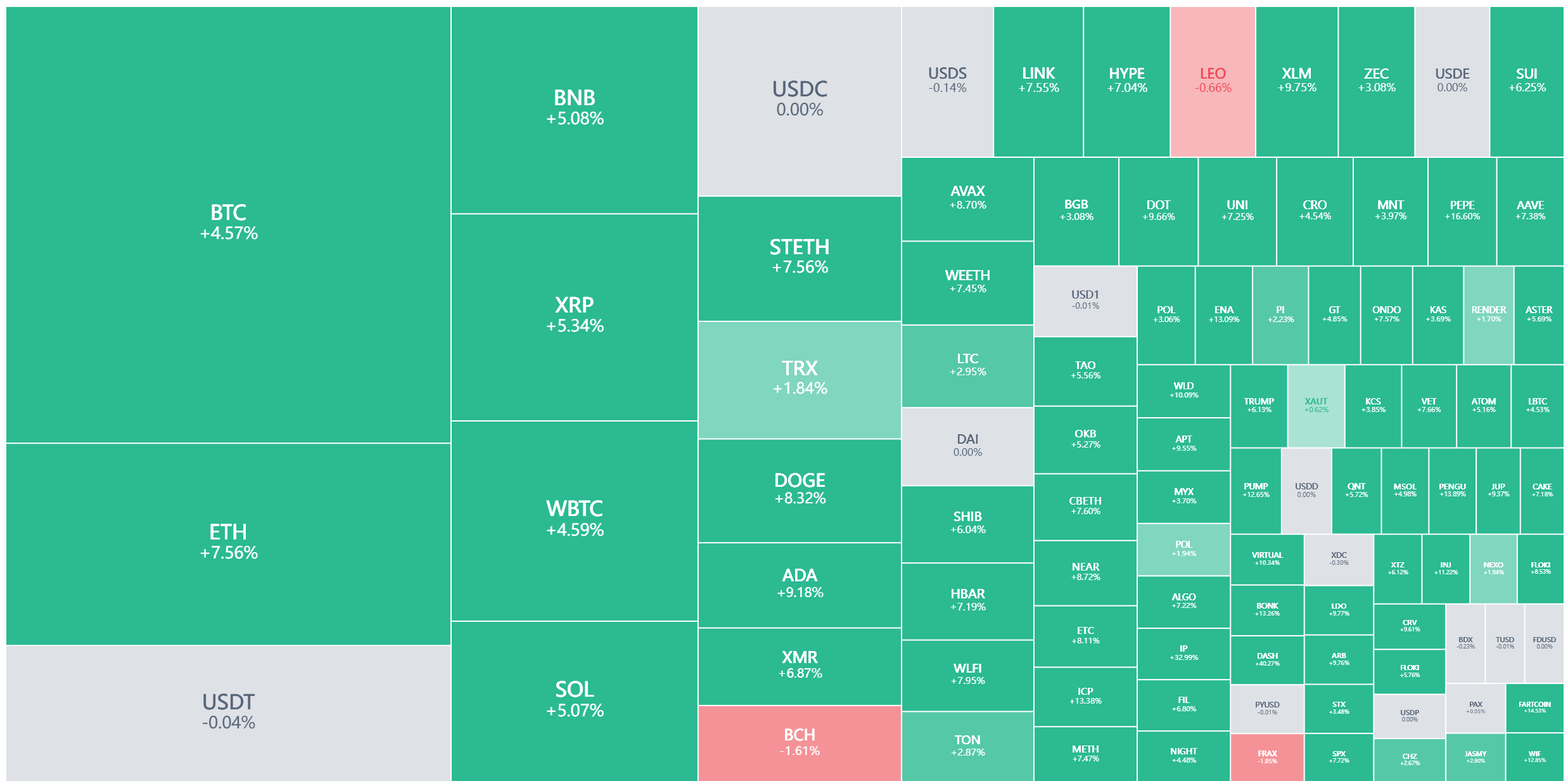

● In the early hours of today, the cryptocurrency market experienced a comprehensive rebound. Bitcoin's price briefly surpassed $96,000, with a 24-hour increase of 4.4%, and as of the time of writing, it was priced at $95,391.

● Meanwhile, Ethereum performed even stronger, breaking through the $3,300 mark, with a 24-hour increase of 7.45%, currently priced at $3,329.

● Mainstream cryptocurrencies rose in tandem, with Solana increasing by 4.5% to $145.3, and BNB rising by 4.24% to $944.

This round of growth exhibited a clear sector rotation characteristic, with privacy coins and Bitcoin ecosystem inscription assets leading the charge, while previously lagging altcoins also saw a rebound.

2. Leading Sector Analysis

Among the many rising cryptocurrencies, privacy coins and Bitcoin ecosystem inscription assets stood out, forming a clear market hotspot.

● In the privacy coin sector, DASH led with an astonishing increase of 45%, currently priced at $57.3. This performance continues the recent strength of privacy assets, with Monero having risen approximately 44% over the past eight days, briefly surpassing $640.

● Analysts believe the strength of privacy coins is related to the market's increasing narrative around censorship resistance and value storage, with privacy assets acting as a "safe haven" when mainstream assets are under pressure.

● The inscription sector saw collective unusual movements, with ORDI and SATS rising 28.4% and 26% respectively, currently priced at $5.44 and $0.00002 (1000 SATS).

These two tokens, as the core of the inscription sector, drove a simultaneous surge in trading volume and social engagement across the entire sector.

3. In-Depth Analysis of ORDI and SATS

Technical analysis of ORDI and SATS indicates that the current rise may be more of a technical rebound rather than the start of a new bull market.

● According to the latest data, ORDI's 24-hour increase reached 26.84%-27.12%, with trading prices in the range of $5.39-$5.40, and a market cap of approximately $113-$114 million.

● SATS saw a concurrent increase of 22.47%-22.91%, with trading prices between $0.00000001982 and $0.00000001987, and a market cap of approximately $4.16-$4.17 billion.

● From a technical indicator perspective, both have shown signs of short-term overbought conditions. ORDI's 4-hour RSI reached 75.18, indicating severe overbought territory; SATS's 4-hour RSI was 70.99, also showing overbought signals.

● The key risk point lies in rapid accumulation of leverage, with ORDI's open interest surging 41.09% in 24 hours to $7.941 billion, and SATS's open interest increasing by 38.56% to $453 million, presenting a high liquidation risk.

4. Exploration of Upward Drivers

The comprehensive market rise is driven by a resonance of macro environment, policy expectations, and technical factors.

● On the macro level, U.S. non-farm payroll data and unemployment rates for December were both below expectations, showing a dual slowdown in hiring and layoffs. As a result, traders increased their bets on the Federal Reserve pausing interest rate cuts.

● On the policy front, the U.S. Senate will review the CLARITY Act on January 15, and the progress of this bill is of great interest to the market. Although the review of the bill has been delayed, the market remains optimistic about the progress of cryptocurrency legislation.

● Standard Chartered's latest report predicts that 2026 will be the year of Ethereum, expecting ETH to outperform BTC. The bank has raised its long-term target price for ETH, proposing a new target of $40,000 by the end of 2030.

● Fidelity believes the cryptocurrency market may be entering a super cycle, with the bull market lasting for years. More governments and enterprises worldwide will incorporate digital assets into their balance sheets, and this new demand may have ended the traditional four-year cycle of cryptocurrencies.

5. Structural Changes in the Market

The current market exhibits clear structural characteristics, with significant differences between various sectors and ecosystems.

● In terms of capital flow, the rise of mainstream Bitcoin and Ethereum provides liquidity support for the entire market, while funds seeking higher risk returns naturally overflow into privacy coins, inscription assets, and other sectors.

● Ethereum's dominant position in stablecoins, tokenized real-world assets, and DeFi, along with ongoing network expansion upgrades, provides it with structural advantages that Bitcoin does not possess.

● The Solana ecosystem showcases a different development path, accelerating the terminalization of trading entry and gamification of growth, attracting a large number of developers and users.

● The Bitcoin ecosystem itself is also undergoing profound changes, shifting from the narrative of "Bitcoin as digital gold" to "Bitcoin as a programmable layer," leading to a revaluation of the asset issuance capabilities brought by the Ordinals protocol.

6. Risk Warnings and Market Outlook

Despite the high market sentiment, potential risks cannot be ignored, and investors should respond cautiously to possible market corrections.

● Technical indicators show that several leading assets are in overbought territory, with significant short-term correction pressure. In particular, the 4-hour RSI for both ORDI and SATS exceeds 70, and the rapid rise in leverage presents a risk of deleveraging.

● From on-chain activity, the overall performance of the inscription ecosystem remains stable, accounting for about one-third of Bitcoin transactions, consistent with levels in December 2025, with no significant spikes.

● Social sentiment assessments indicate that current market discussion intensity is below expectations, lacking viral spread and FOMO sentiment, with mainstream narratives still focused on technological upgrades rather than price speculation.

● While Standard Chartered is optimistic about Ethereum's long-term performance, it has revised down its recent price forecast, lowering the 2026 end target from $12,000 to $7,500. Looking ahead, market direction will be influenced by multiple factors. U.S. CPI data, Supreme Court tariff rulings, and the progress of the CLARITY Act may all impact market sentiment in the short term.

As Bitcoin reclaims the $96,000 mark, the entire market sees a simultaneous expansion in active addresses and holdings distribution. Trading volume for Bitcoin ecosystem asset ORDI has surged dramatically from daily levels, with prices rebounding from $3.80 to the $5.00 range, an increase of 40%.

Market funds are shifting from macro narratives to specific ecosystem competition, with the gradual clarification of regulatory frameworks and the acceleration of institutional trends together outlining a future where digital assets are rapidly integrated into the traditional financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。