In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

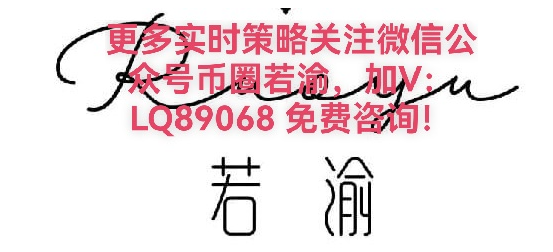

Last night's CPI data was neutral to slightly positive. U.S. stock index futures saw a short-term rise, with the December CPI year-on-year and month-on-month rates basically meeting expectations at 2.7% and 0.3%, respectively. The core CPI year-on-year and month-on-month rates were both 0.1% lower than expected, at 2.6% and 0.2%.

Although the inflation data did not exceed expectations, it was still decent. Both the CPI and core CPI year-on-year rates matched the previous values, and the core inflation month-on-month rate was lower than expected, indicating a downward trend in inflation. The inflation in November should not only be attributed to the shutdown. If inflation can continue to decline, it will be beneficial for interest rate cuts in 2026. Of course, although the December inflation data is good, it does not affect the Federal Reserve's decision not to cut rates in January. Many people cannot understand why the index would rise significantly when the data only met expectations. Lin Chao has previously explained that the cryptocurrency market itself is driven by speculative expectations. Currently, it is in a bearish phase, and as long as the data is not worse than expected, the market has already accepted this result. The risk-averse sentiment has already been priced in, and the news landing is merely the end of bad news. Moreover, better-than-expected inflation data indicates that the market has made room for significant interest rate cuts in the future, which is naturally positive news.

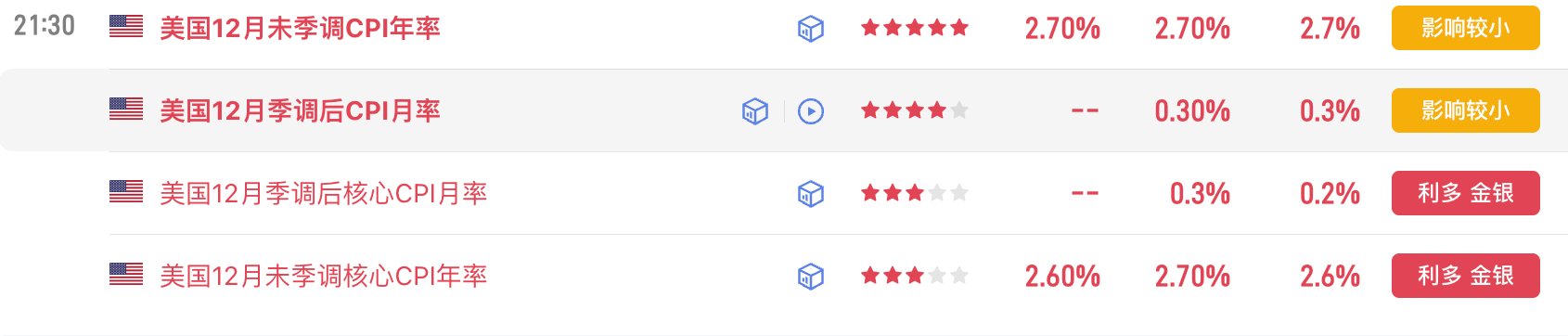

This is why we saw the price increase in the cryptocurrency market yesterday. Lin Chao suddenly noticed a significant increase in Bitcoin trading volume on Coinbase, while Binance did not see such an increase, indicating that more U.S. investors are buying in, and the trading volume increased during U.S. hours. We will need to look at the ETF data; although it is certainly good today, we must see if the trading volume and ETF continue to increase. If so, it is indeed possible that investors' investment preferences are starting to rise. However, it is still a bit early to confirm this, and we need to observe more, as the overall monetary policy and macro policy have not changed.

Lin Chao's Summary

Previously, Lin Chao mentioned that the cryptocurrency market in January is likely to rise (see the previous article "January Market Repeats, Welcoming the 2026 Bull Market"), but this does not mean that the bearish phase will end immediately. The entire cryptocurrency market will continue to experience wide fluctuations. Taking BTC's movement as an example, after breaking through the first range of $95,000, it completed a support-resistance swap, retracing to $94,000 to $95,000 as support and continuing to expand into the second fluctuation range (see the chart below). It will not suddenly enter a bull market as everyone hopes. Lin Chao estimates that this upward consolidation will continue until the end of the first quarter of 2026. The key point lies in the results of Trump's visit to China.

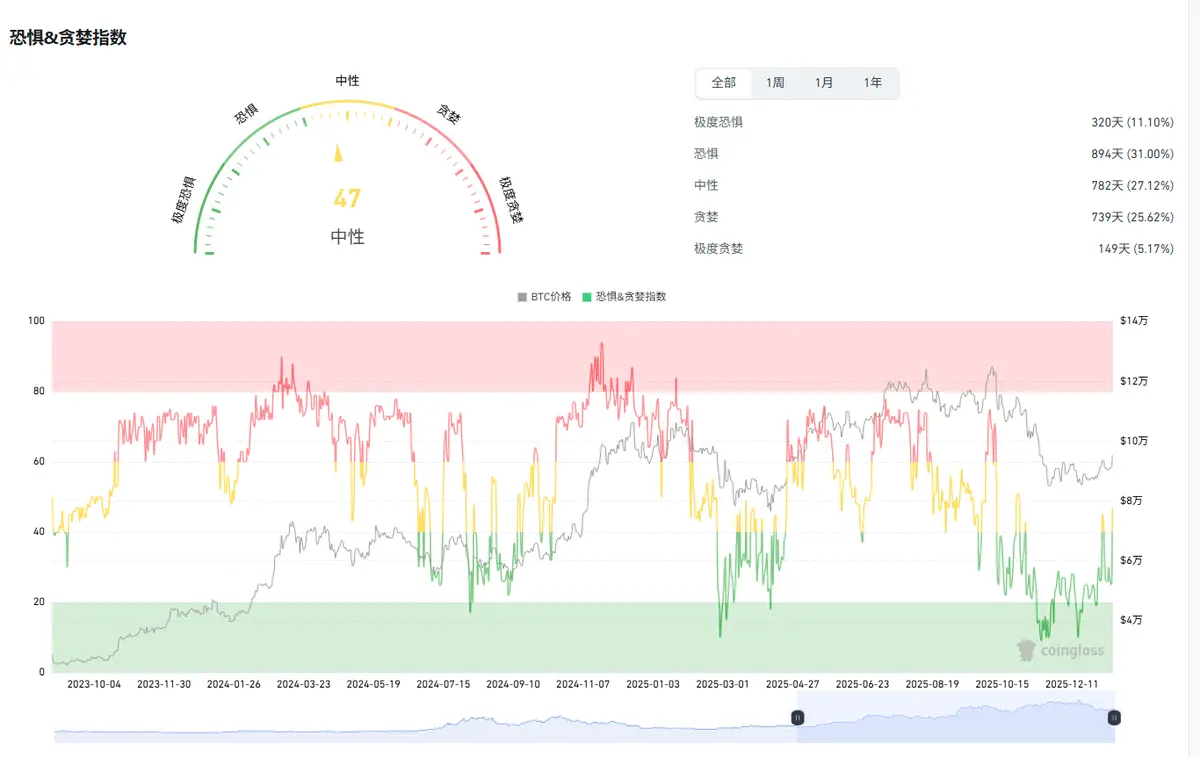

We can also see from the Fear and Greed Index that people are quite easily satisfied. A small rise, and confidence begins to recover. After a less than 10% bullish candle, people are already eager to act. This indicates that the overall market sentiment is extremely restless. Whether institutions or retail investors, after a long period of sideways movement, everyone is eager to try, ready to take action. However, Lin Chao wants to remind everyone that the more it is like this, the more we need to face it calmly. Whether in spot or contract trading, remember not to go all in at once, as it is not yet time for us to strike with full force. Patience is key.

If you are feeling lost—unable to understand the technology, unsure how to read the charts, not knowing when to enter the market, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits, missing out on market opportunities… these are common issues for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade speaks louder than a thousand words; repeated failures are not as good as finding the right direction. Instead of frequent operations, it is better to strike accurately, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never just the gains and losses of a single pass or moment, but rather a well-thought-out strategy before action, knowing when to stop and when to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market carries risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。